IPO Index - The Balloon Popped

After a multi-month bounce and consolidation phase, the Renaissance IPO Index formed a significant intermediate-term top this week.

I've been monitoring the IPO group closely and even shared a big picture chart in a note on March 26th. IPOs represent one of the more speculative areas of the market, especially in the last few decades as the percentage of unprofitable companies coming public has surged.

One has to wonder what, if any, message can we gain from the balloon popping. Are the speculative pockets of the market like IPOs starting to discount peak liquidity as the fiscal and monetary accommodation can't last forever?

Let's take a look at an update to my IPO chart and a trading signal that suggests one should avoid the group in the near term.

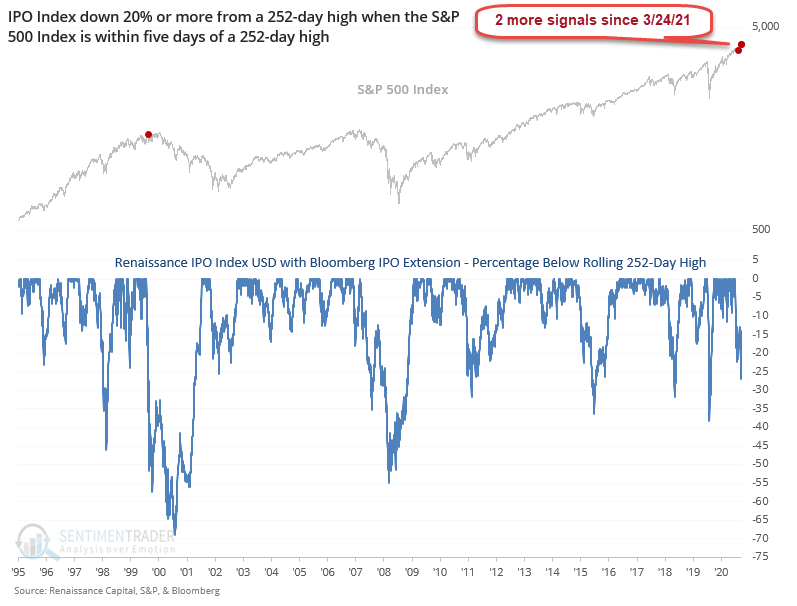

IPO DIVERGENCE CHART

Since the first signal on 3/24/21, the IPO index has now registered two more divergence alerts, both this week. Even at the height of the internet bubble in March 2000, the down 20% within five days of an S&P 500 high setup only occurred one time. In case you were wondering, the date was 3/30/2000.

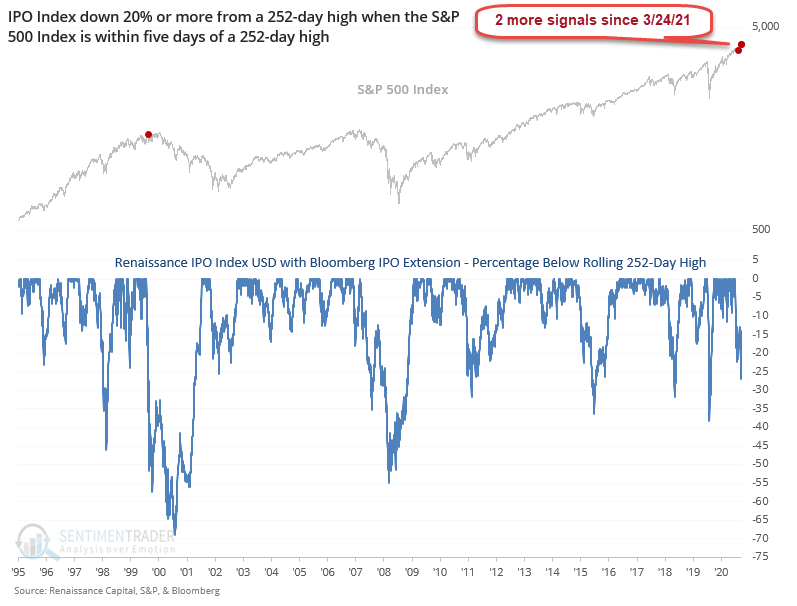

IPO MARKET

While one can make an educated guess as to why a market does what it does on any given day, I suspect this chart helps explain some of the narratives in IPO underperformance. Thanks to Jason for sharing this chart.

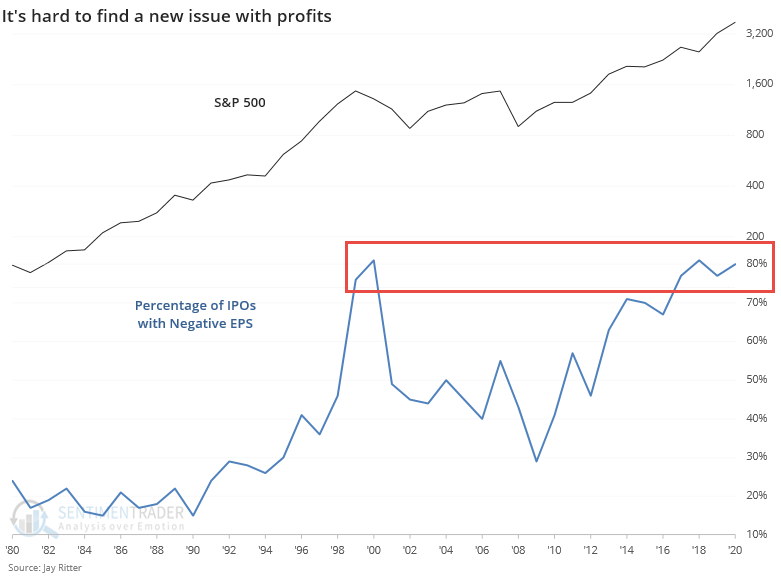

RELATIVE LOWS CHART

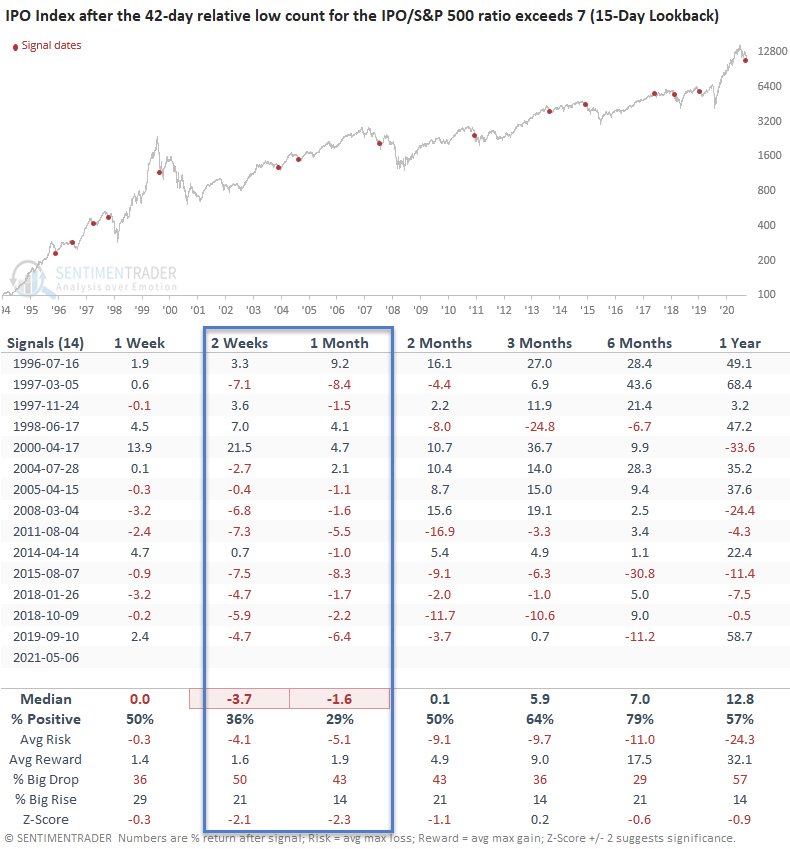

Given the limited sample size in the down 20% divergence set up in the first chart, I thought I would apply one of my relative strength indicators to the IPO/S&P 500 ratio to assess the underperformance. The indicator in the chart below counts the number of IPO Index 42-day relative lows versus the S&P 500 index in the last 15 days. A high count reflects severe underperformance. The current count reached 7 on Thursday.

Let's see what happens if we buy the IPO Index when the relative low count reaches 7. I also included a condition that requires the IPO Index to register a 252-day high to identify the first signal after a peak.

HOW THE SIGNALS PERFORMED

Performance is weak in the 2-4 week timeframe with z-scores that show significance. I would also add that the 1-month timeframe shows eight consecutive down periods starting in 2005.

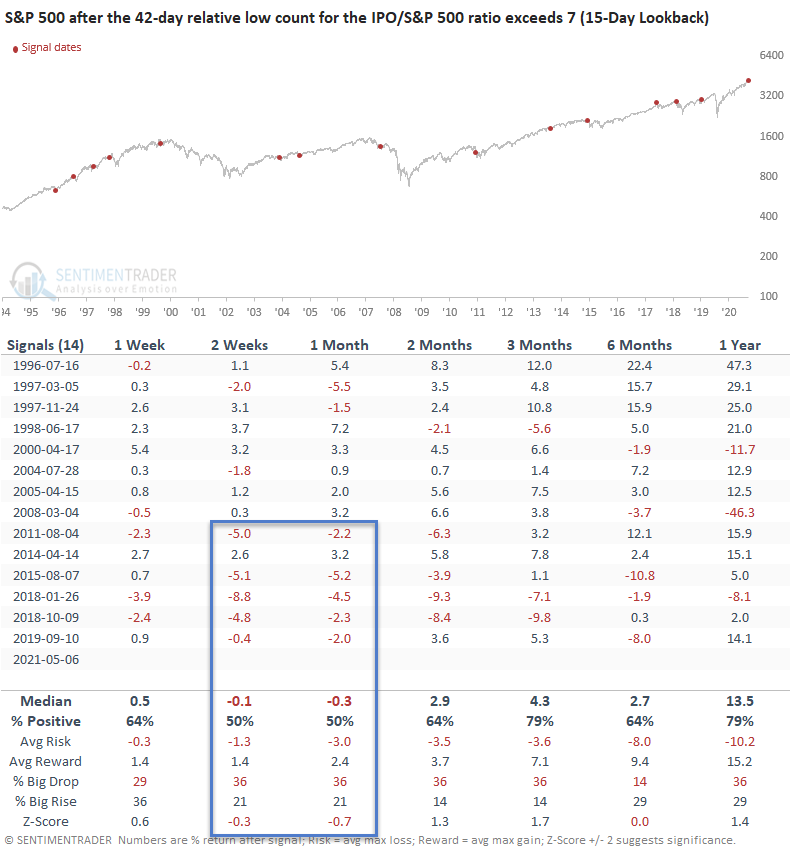

Let's look at what happens to the broad market if we apply the signals to the S&P 500 index.

HOW THE SIGNALS PERFORMED - S&P 500

While not as weak as the IPO results, I would note that the 2-4 week timeframe was somewhat soft, and more so with recent signals. It would appear that severe IPO underperformance is not a significant risk for the broad market on a long-term basis.

IPO ETF CONSOLIDATION BREAKDOWN CHART