Investors getting more and more comfortable with leverage

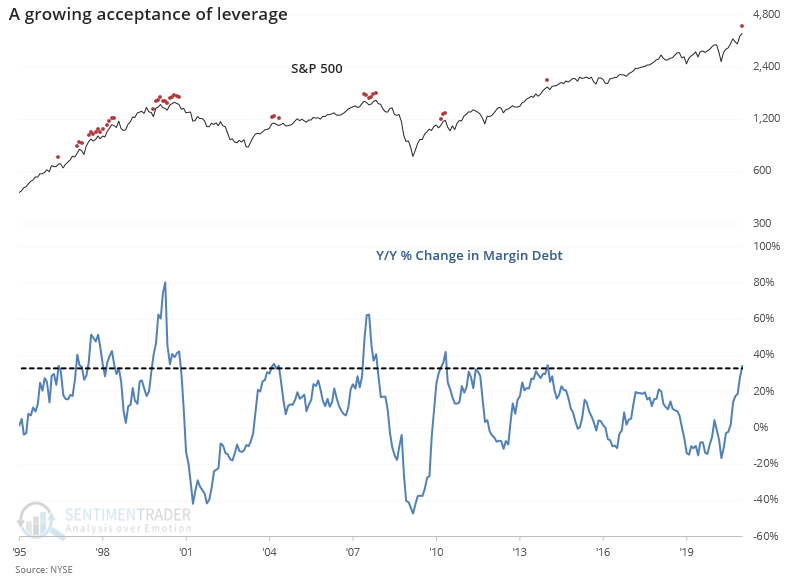

A month ago, we saw that margin debt was picking up. Investors had quickly been becoming more comfortable borrowing funds against their stock holdings, and debt was rising quickly from its low. It kept going.

The latest figures show that debt has jumped more than 33% from a year ago, the fastest pace in about 7 years. It's still below the 60% gains seen at the prior two major peaks, though.

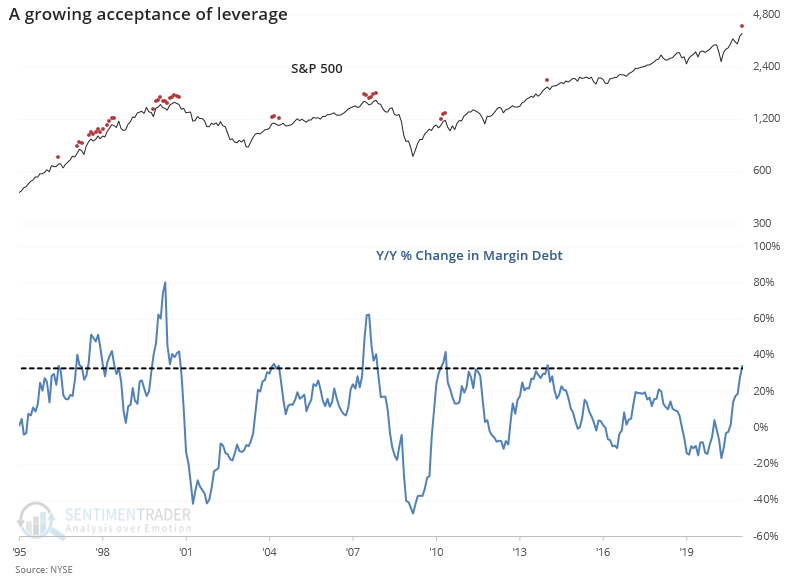

Zooming out to 1950, it's still among the higher rates of change.

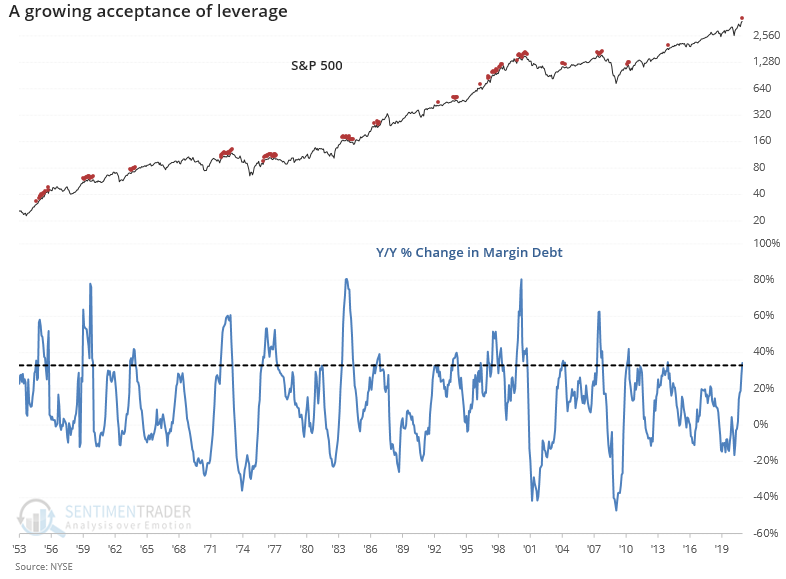

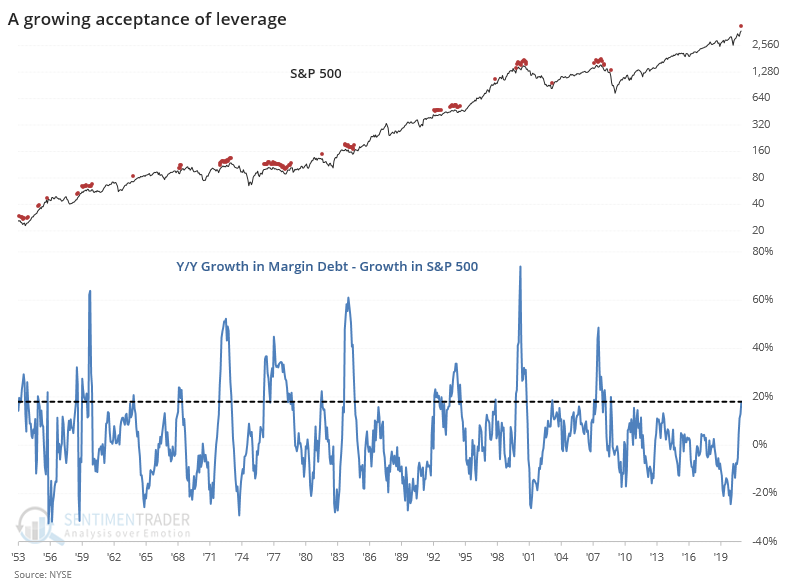

One of the things we've been pointing out since 2015 or so is that even though debt was growing, it was only about in line with the growth in stock prices. We should expect that. It wasn't anything like 2000 and 2007 when debt ballooned "irrationally" more than stock prices.

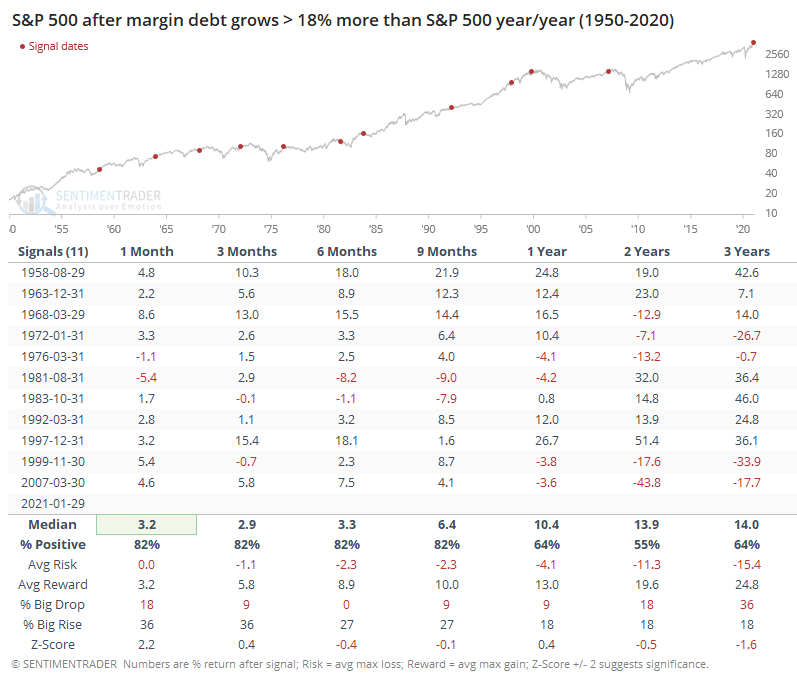

Lately, we're starting to see the very beginning that this is changing. The jump in debt has outpaced the rise in the S&P 500 by nearly 20%.

These increases in debt didn't necessarily lead to imminent doom. Note that the dates in the table are moved forward one month to account for the delay in reporting.

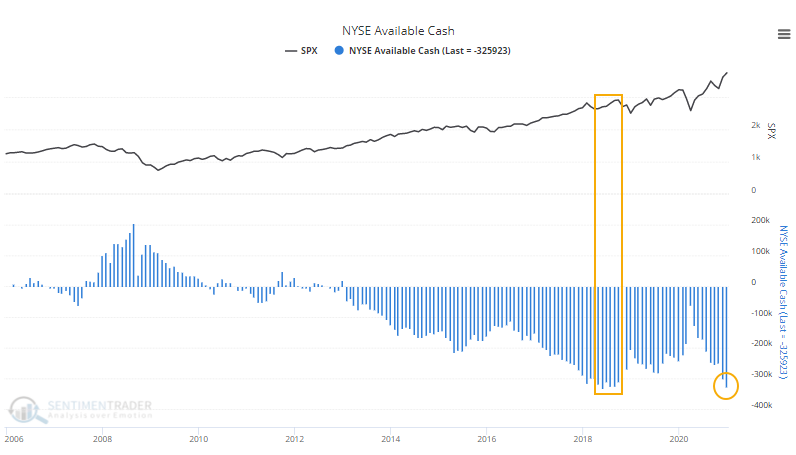

At the same time that debt is growing, free credits (cash) isn't keeping up, so NYSE Available Cash, the net difference between debt and cash, is nearing a record low.

This can remain low for a long time, and there isn't necessarily any lower bound, but the pace of its shrinkage is alarming.

Margin debt tends to get quite a bit of attention, and it can be an effective indicator at true extremes, which might come around once a decade or so. It seems like we're on our way to a signal that could be a true point of concern, and maybe it's already on track to trigger in January, we just won't know for another month.