Investors are getting more anxious on smaller declines

Investors are getting more anxious on smaller declines

There have been some worrying signs lately. Rallies are being met with less and less enthusiasm, while declines, even tiny ones, are greeted with high anxiety.

On the surface, this could be a good thing and sometimes is. Knee-jerk contrarianism can work, especially in solid trends. But we've seen an extended period now where good news is being met with a collective yawn, or even aggressive selling pressure, while bad news is being exaggerated and extrapolated.

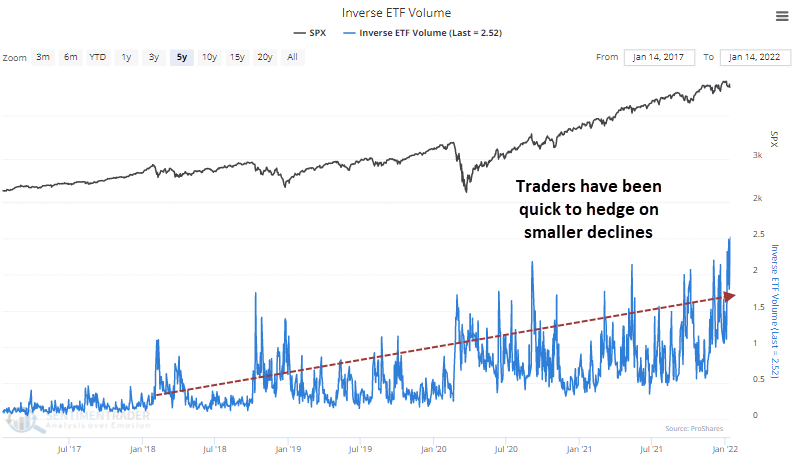

The anxiety has reached a point where inverse ETF volume, funds that profit when stocks decline, reached a record high on Friday. The 5-day average is now 20% higher than the previous peak from October 2021. Each successive dip has coincided with higher and higher anxiety. We can blame the new cadre of retail traders, but it's deeper than that.

Corporate insiders have not been interested in buying stock in their own companies, more stocks are falling into bear markets, fewer are holding above their long-term trendlines, and more are hitting 52-week lows.

All of this can be seen in the increasingly hesitant amount of risk behavior. Since September, our Risk-On / Risk-Off Indicator has had a series of lower highs and lower lows and the spread between Smart Money and Dumb Money Confidence has been diverging from the S&P 500.

| Stat box The Nasdaq Composite fell below its 200-day moving average for the first time in more than 400 days, ending the 3rd-longest streak above its 200-day average in its history. |

An option setup in semis

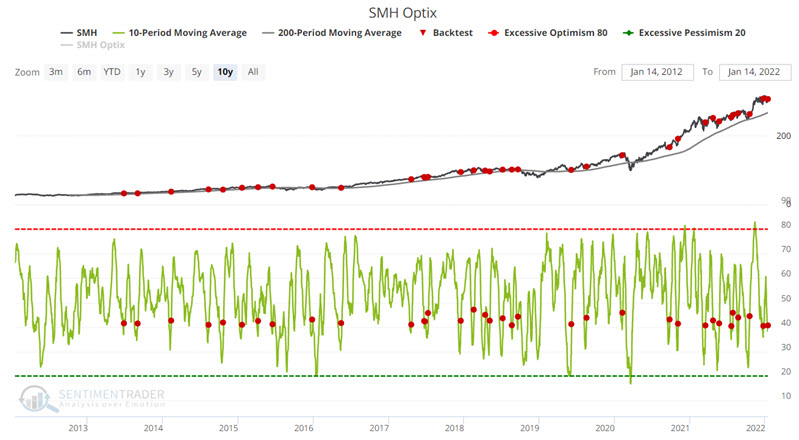

In addition to a favorable seasonal trend, Jay noted that the SMH semiconductor fund Optimism Index has flashed a favorable sign recently. The red dots in the chart below display each time the 10-day average for SMH Optix has crossed above 40 while SMH was above its 200-day moving average.

After the other signals, SMH has been higher 1-month later 79% of the time with an average gain of 3.44%. Based on these two favorable indications, a trader might consider a bullish position on semiconductors, so Jay outlined the risks and rewards of a potential option position in the fun.