Investors are back in risk-on mode

Investors move back to risk-on

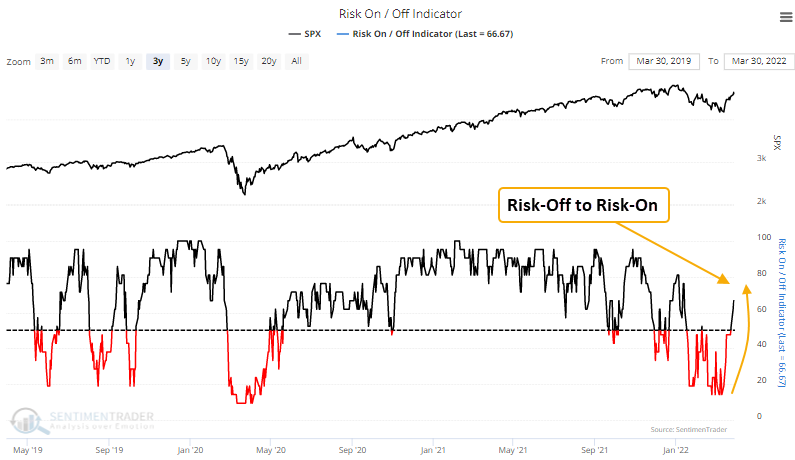

The SentimenTrader risk-on/off indicator has now cycled from risk-off to risk-on. Dean showed that the indicator utilizes a weight-of-the-evidence approach by combining 21 diverse components into a single model to assess the current market environment. A level above 50% is considered risk-on.

A trading model that applies a range rank to the indicator to identify a bearish to bullish reversal has now triggered.

This signal was triggered 49 other times over the past 22 years. After the others, SPY future returns, win rates, and risk/reward profiles were excellent across all time frames. Since 2006, the 4-week time frame has registered 32 out of 38 winners.

When to own homebuilders

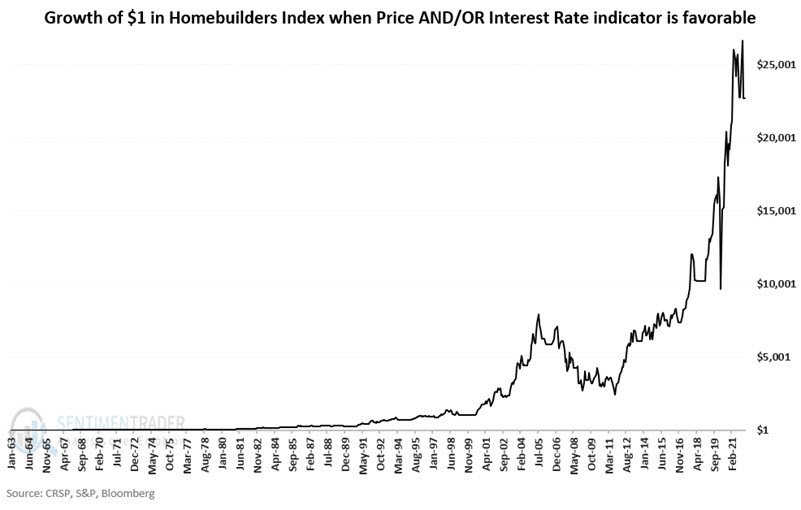

The recent uptick in interest rates has many investors wondering what effect this will have on the stocks of home builders. Jay looked at a system that uses the trend in homebuilders and interest rates to determine when to hold those stocks (or not).

The chart below displays the hypothetical growth of $1 invested in our Homebuilders Index only when at least one of the indicators closed the previous month with a favorable reading (i.e., either Price > Moving Average or interest rates < moving aveage).

The results are inarguably positive but are also quite volatile. The converse is also true - when trends are negative, returns in these stocks were horrid. Jay discussed what this might mean for this sector right now.