Internet sentiment

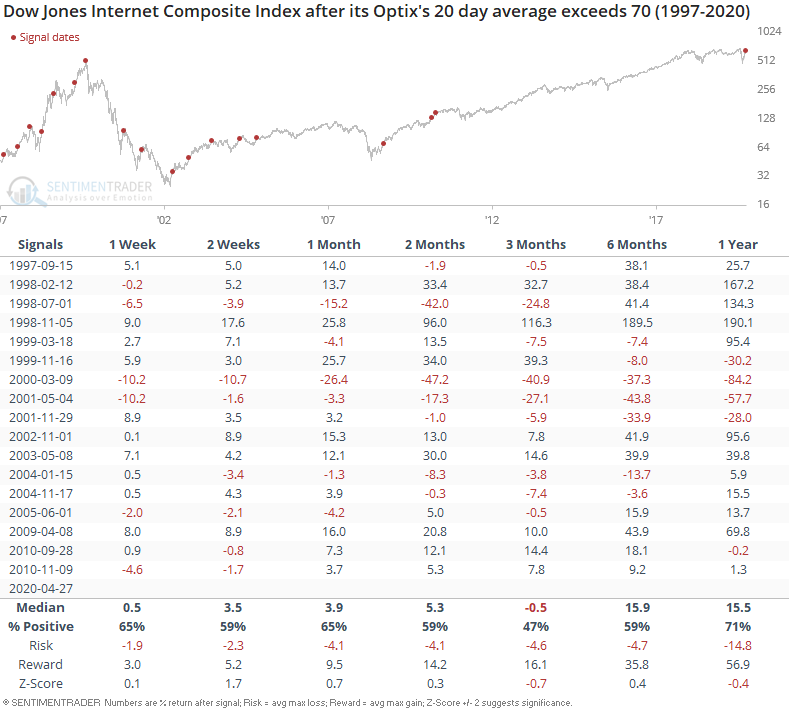

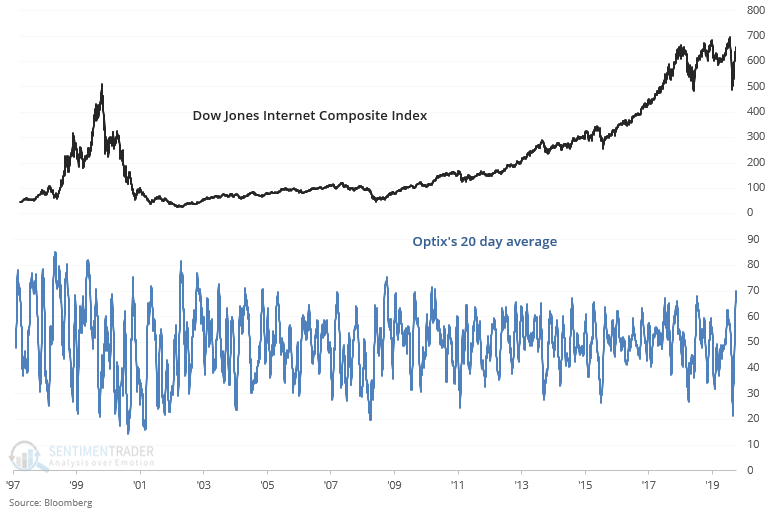

As I've noted over the past few days, internet stocks are extremely popular these days. With a similar formula to the one we use to calculate Optix for other ETFs, we calculated an Optix for the Dow Jones Internet Composite Index. As you can see in the following chart, a 20 day average for Optix is at its highest level in a decade. It doesn't help that this index has essentially made a flat top since January 2018:

Historically, such optimistic sentiment towards internet stocks has led to mixed/bearish historical returns. This was clearly bearish during the 2000-2002 dot-com bust since it occurred at the top of counter-trend rallies. It wasn't necessarily bearish during a bull market.

Overall, I think the rally in tech stocks is overdone. HOWEVER, I would caution readers to not confuse "tech stocks are overstretched, hence they should fall" vs. "tech is overrated". Valuations might be stretched and stock prices might come down. But the fundamental trend that supports tech is not going to end, even if tech stocks crash. So from a trading perspective, long tech is not a good idea. But if you are an entrepreneur, "long tech" by moving your business towards being more reliant on tech is a great idea. The 3 biggest trends right now - AI, 3D-printing, and nanotechnology will continue to revolutionize countless industries. Companies that are slow to adapt to new innovations will die off, whereas companies that infuse their business with these technologies will do well.