Insiders Buy; A Selling Climax; Small Traders Panic

The weekly indicators that just came out show some interesting extremes.

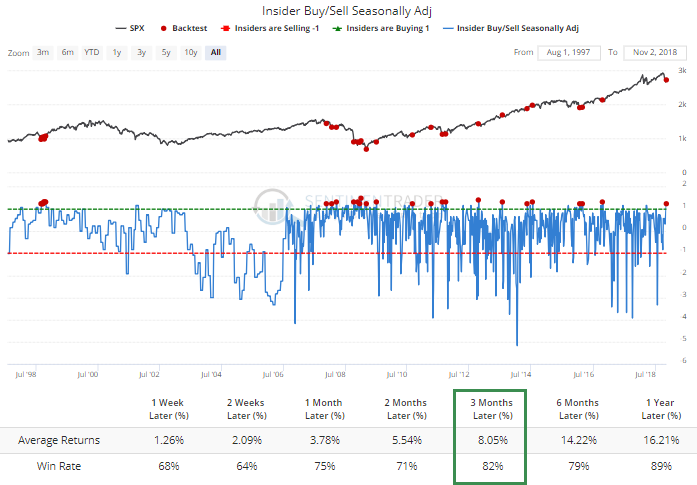

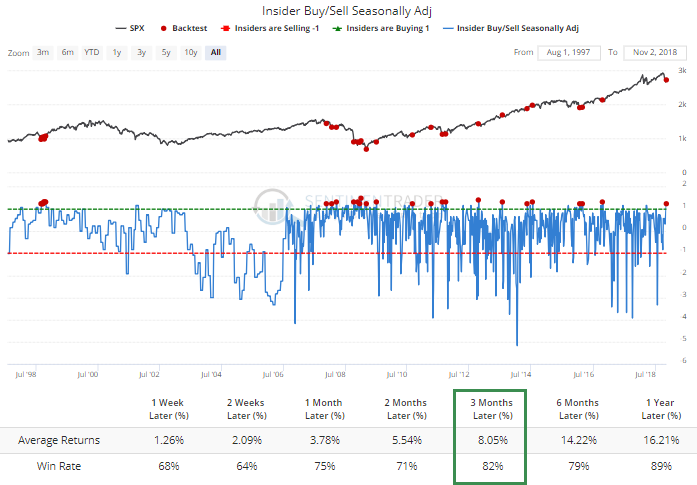

Corporate insiders picked up their buying interest, now that an increasing number of companies are outside of their restriction window during earnings season. This isn't my favorite indicator, especially when it shows selling (it's too inconsistent) but buying interest among insiders is more reliable. When it happens to the degree it did this week, it's been a good sign.

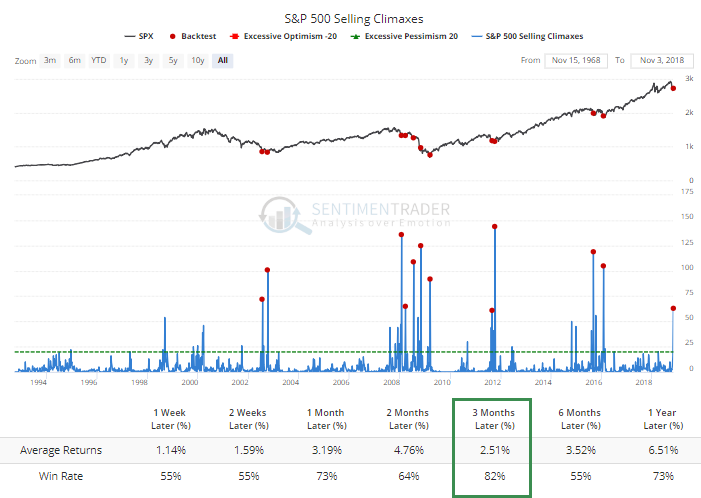

They picked a decent week to pick up their buying, at least earlier in the week. The buying pressure that started midweek was enough to trigger a large number of selling climaxes among S&P 500 stocks. A selling climax occurs when a stock trades down to a 52-week low, then reverses enough to close up for the week. Last week, there were more than 60 stocks in the S&P that triggered the pattern, the most since January 2106.

According to the Backtest Engine, more than 60 selling climaxes in a single week led to some consistent rebounds over the next few months.

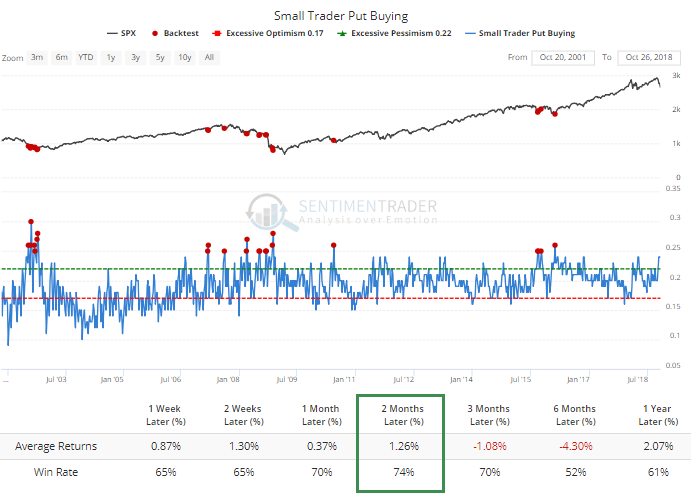

If stocks hadn't reversed during the week, it's kind of scary to think about just how many protective puts the smallest of options traders would have bought. As it stands, they spent 25% of their options volume on buying puts, the most since February 2016 and tied for 3rd most since the end of the financial crisis.

In 2008, their pessimism was warranted right before the big collapse in October, but other than that, it paid to fade their scramble for protection.

A lot of what we've seen in the past two weeks have strongly suggested at least a bear market bounce over the next 2-12 weeks, and those indications continue to pile up. There are definite concerns longer-term given the break in momentum, but we've seen time and again that the types of readings that have been recorded lately consistently tend to lead to multi-week relief even during bear market environments.