Insiders are buying Materials and Tech

Key Points

- Corporate insider buying is typically a favorable sign, primarily when concentrated within a particular sector

- Insiders in Materials and Technology have bought at a level that led to favorable forward returns

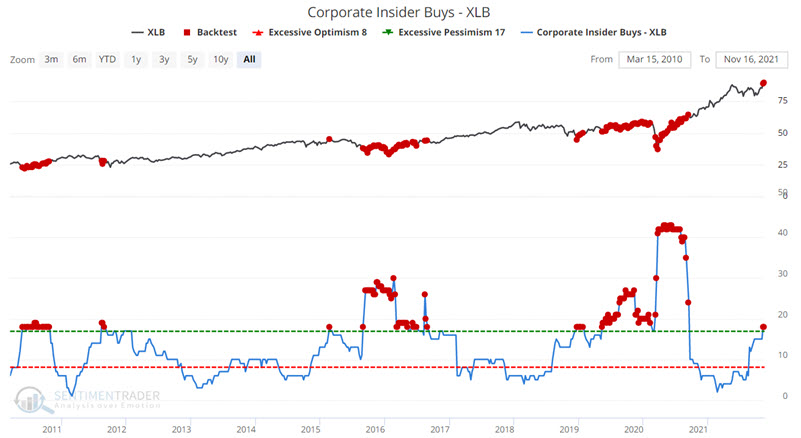

Insider buying in Materials stocks is the highest in a year

Corporate insiders are considered to be "smart money" because they have the most direct knowledge and influence on a public company's shares. While they sell for many reasons, they typically buy because they have confidence in their companies and think prices will rise as their good performance is recognized by the market.

Among stocks in the Materials sectors, these insiders apparently see some value. The number of insider buying transactions in these shares over the past six months has risen to the highest level in a year.

Insiders often tend to accumulate shares over several months. So, it will be interesting to see if the latest reading is a one-off event (like late 2011 and early 2015) or if it develops into another period of accumulation.

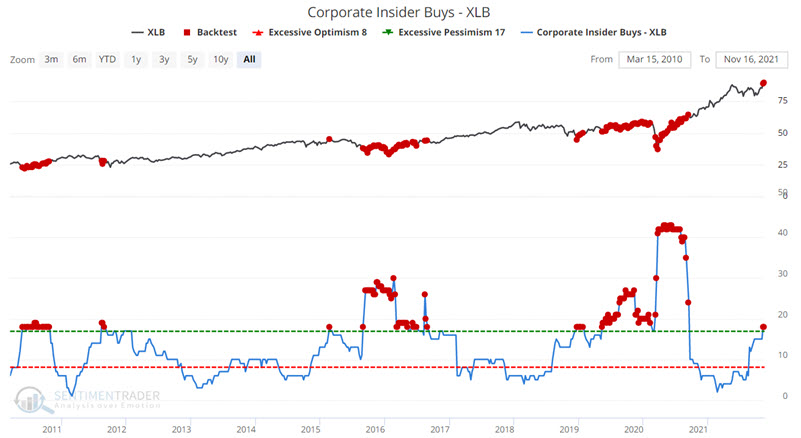

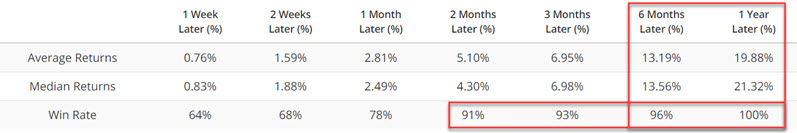

The table below displays the performance figures for XLB following all readings above 17 according to the Backtest Engine.

The next 6- and 12-month returns showed high Win Rates and robust Average and Median returns.

At the same time that insiders have been buying, their interest in selling has waned, pushing the Buy/Sell Ratio closer to (but not quite into) a bullish extreme.

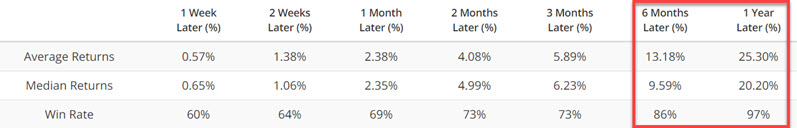

Insiders are buying Technology, too

Stocks in the Technology sector are also seeing renewed, and heavy, buying interest among insiders.

Despite the substantial advance since the Covid-19 bottom, Technology company insiders have continued to accumulate shares throughout most of 2021. Did they know something we don't? Well, that's the reason for tracking insider buying in the first place.

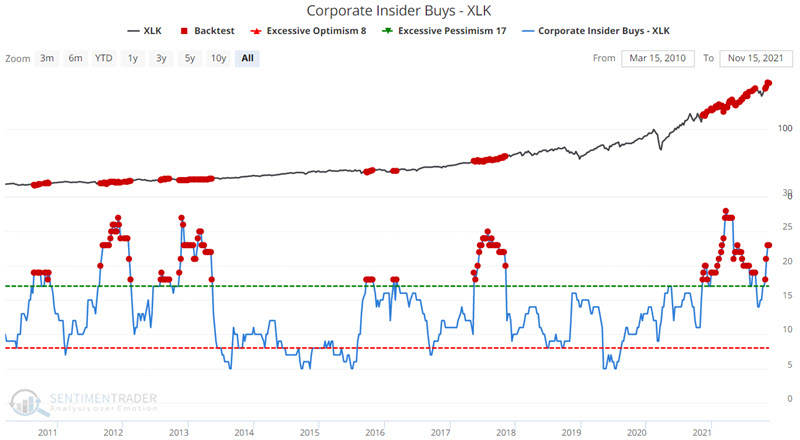

The Backtest Engine shows that XLK returned an average of nearly 7% over the next 3 months once buying interest became extreme.

Every time frame from 2 months out to 12 months has shown a Win Rate over 90%. The 6- and 12-month returns were particularly impressive.

Among these companies, insider selling interest has also waned, and the Buy/Sell Ratio is above its bullish threshold.

What the research tells us…

Insiders in Materials and Technology companies are doing the most bullish thing they can - buying shares of their own firms. Historically, this has tended to highlight good opportunities for non-insiders. Outside forces can always overwhelm these indicators, but when insiders have been this confident in their shares, the sectors have a strong track record of rising.