Insiders are bullish Materials...and Seasonals will soon align

Key points

- The S&P 500 Materials sector bounced sharply off its April 2025 low but has struggled since early July

- Corporate insider activity in the materials sector is flashing some very favorable signals

- Likewise, this sector will soon enter a most favorable seasonal period

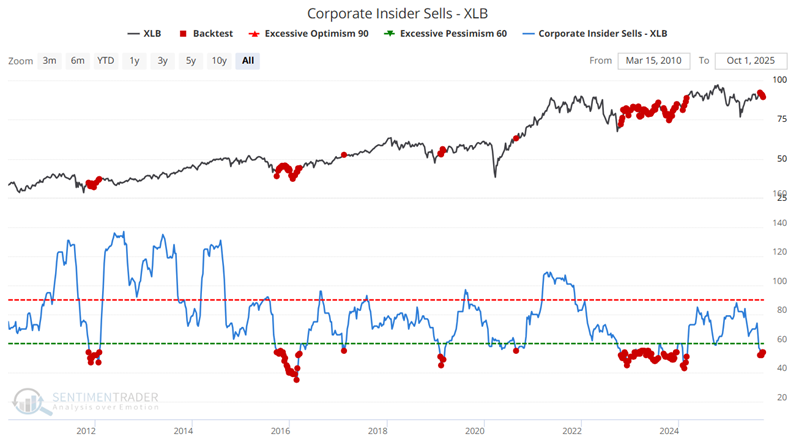

Materials sector insider activity remains bullish despite a strong rally

The chart below shows that the Materials Select Sector SPDR Fund (XLB) has rebounded significantly off its April 2025 low and re-established an uptrend above its 200-day moving average. XLB recently retested the 200-day moving average and bounced off of it.

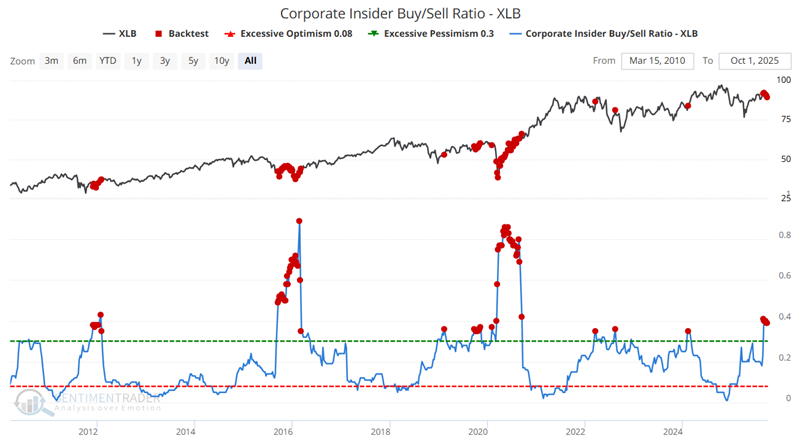

Although XLB has already rallied 25%, corporate sector insiders have only recently started to exhibit some bullish activity. The chart below highlights all weeks when the Corporate Insider Buy/Sell Ratio-XLB indicator was above 0.35.

The table below summarizes subsequent XLB performance following the dates highlighted in the chart above.

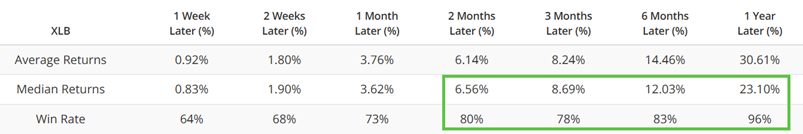

Insider buying is presently in bullish territory as seen below.

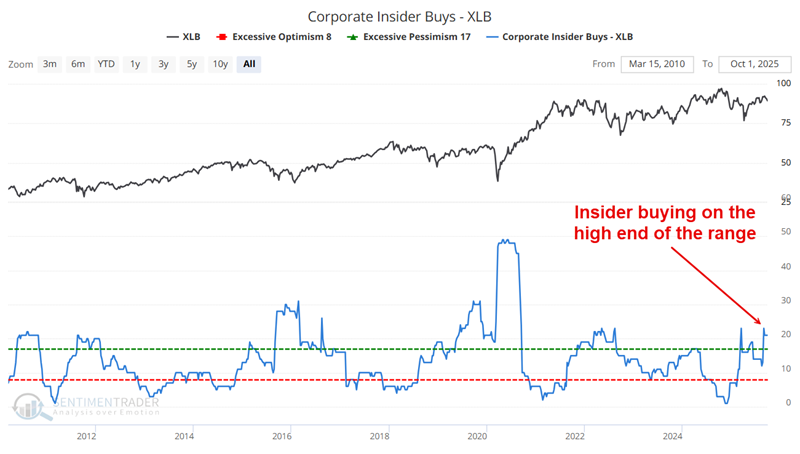

Still, the most notable aspect of recent activity is the plunge in sector insider selling. The chart below highlights all weeks when our Corporate Insider Sells - XLB indicator was below 56. Historically, this has been a good time to accumulate shares in this sector. The most recent signal occurred in late September.

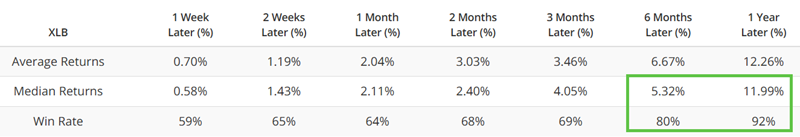

The table below summarizes subsequent XLB performance.

The good news is that recent insider activity strongly suggests higher prices for stocks in this sector over the coming twelve months.

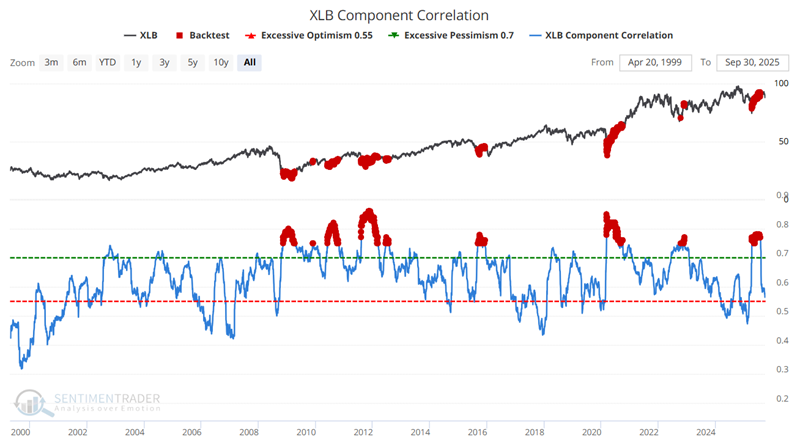

Component correlation is another favorable factor for Materials

Our component correlation indicator measures the degree to which the sector index component stocks trade similarly. Typically, it is favorable when there is a high degree of correlation. The chart below highlights all dates when the XLB Component Correlation indicator was above 0.75.

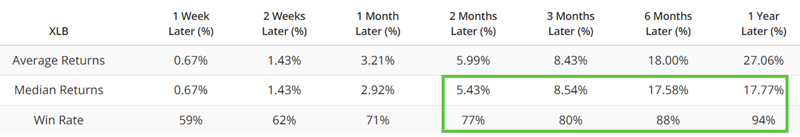

The table below summarizes XLB performance following the dates highlighted in the chart above. Most notable is the high Win Rates two months and out. This dovetails nicely with the insider action highlighted above.

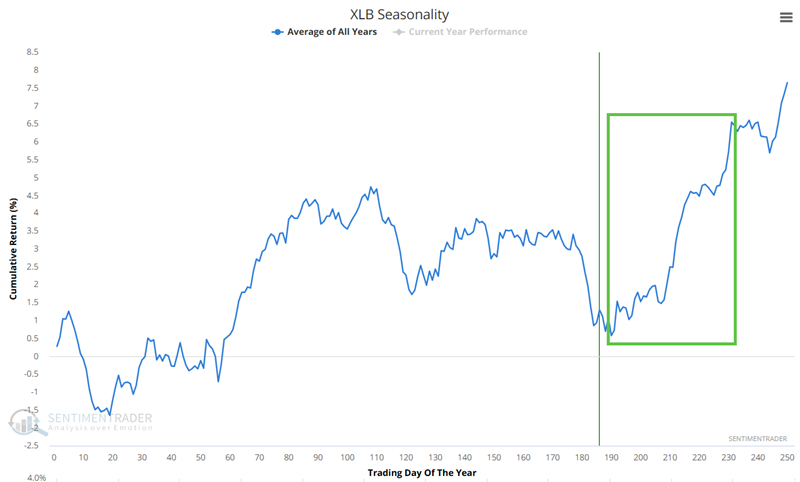

Seasonality will soon be a favorable factor

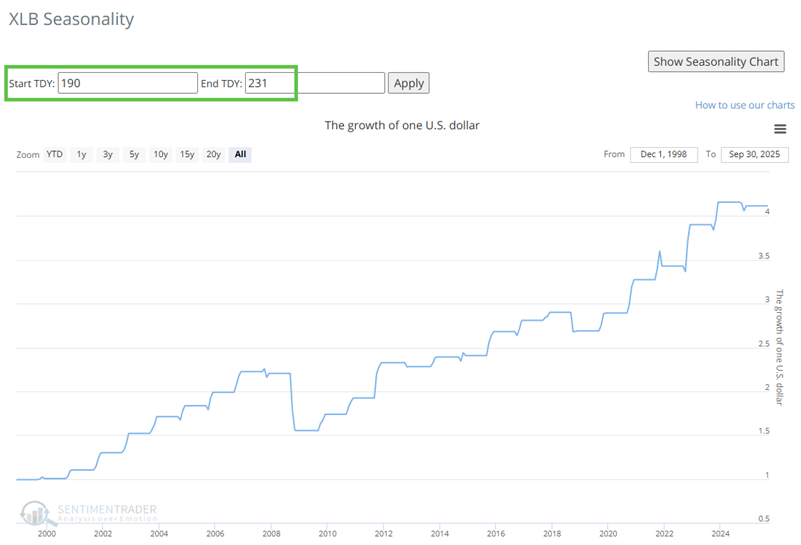

The chart below displays the Annual Seasonal Trend for ticker XLB. A strong seasonal period will begin soon, extending from Trading Day of Year (TDY) #190 through #231. For 2025, this period extends from the close on October 6th through December 3rd.,

The chart below shows the hypothetical growth of $1 invested in ticker XLB only during this period every year since 1999.

As always, seasonality is merely an average of the past and not a roadmap for the future. Nevertheless, it will soon rank as a favorable factor for the materials sector.

What the research tells us...

Corporate insiders are typically not precision market timers and often buy in too early or too late relative to a bottom in price. Nevertheless, they are rarely wrong over a one-to-three-year period when they act en masse. The recent insider activity in the materials sector, combined with the recent high correlation among materials sector stocks and an impending favorable seasonal period, suggests that investors give this sector the benefit of the bullish doubt in the year ahead.