In an optimistic market, the yen stands out

In a market that's sloshing with money and financial assets are soaring, it's hard to find anything that's hated.

Looking at the Market Sentiment Overview, the Japanese yen is currently the only major market with a low Optimism Index, and even that isn't too terribly extreme.

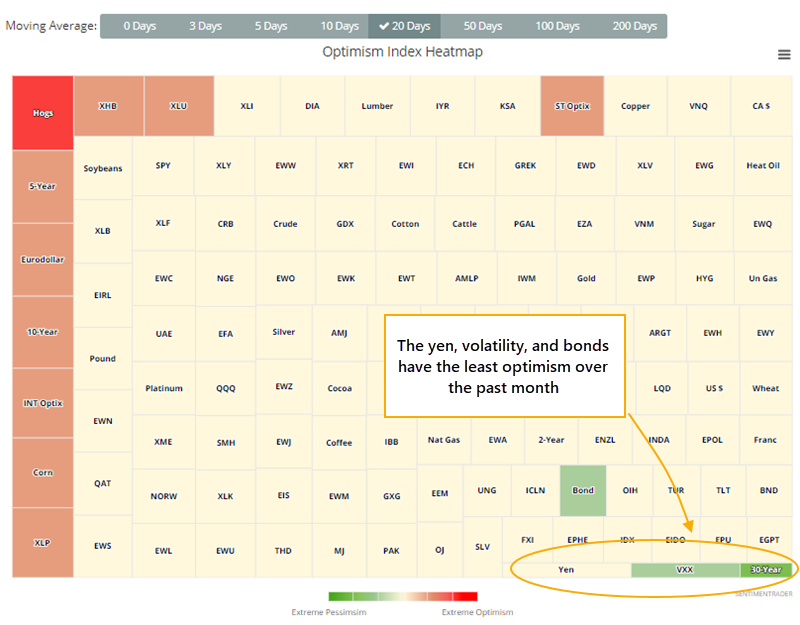

The Optimism Index Heatmap shows that the 20-day average Optix among markets and ETFs has only a few markets in the lower-right corner, where we see pessimism. That's the yen, volatility, and bonds.

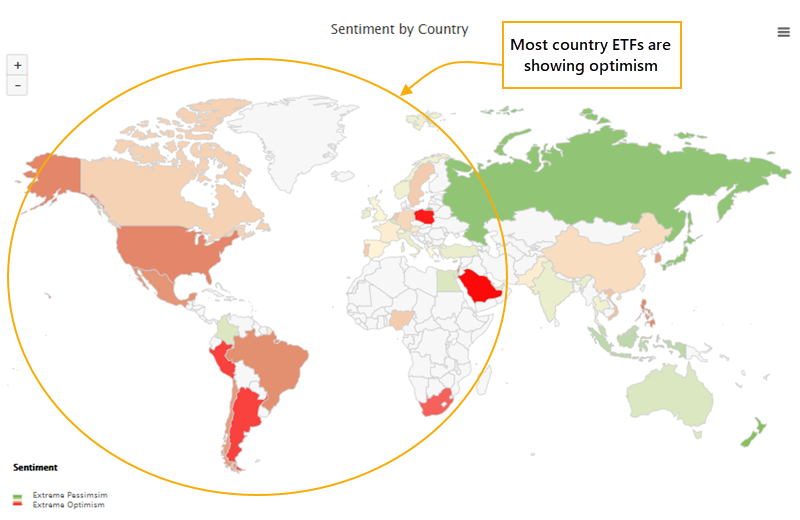

And the Geo-Map shows that around the world, there are few pockets of even minor pessimism (green countries).

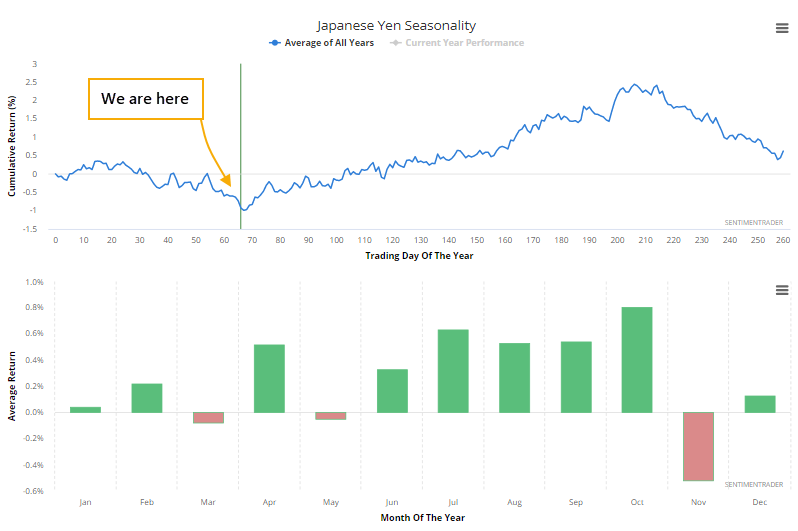

We'll get to sentiment on the yen in a moment, because the yen is about to bottom, if the calendar is any indication. Today marks the start of the best seasonal window in that market.

We would never suggest taking seasonal biases that literally. This is an average yearly price path over decades, and any individual year can deviate wildly from the average. It simply shows us whether there are times when trends tend to have a certain bias, and for the yen, that bias has been positive from early April through mid-October.

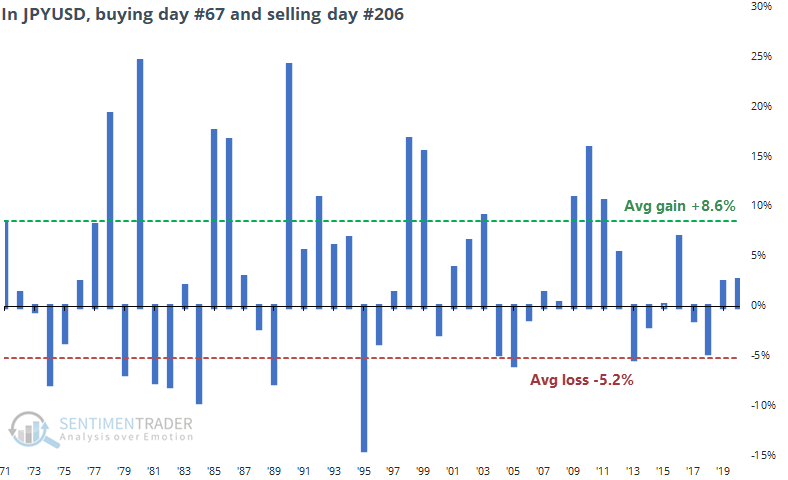

Over the past 50 years in the JPYUSD cross, buying day #67 (early April) and selling day #26 (mid-October) has been a decent trade. The win rate was 62%, but the average win was quite a bit higher than the average loss.

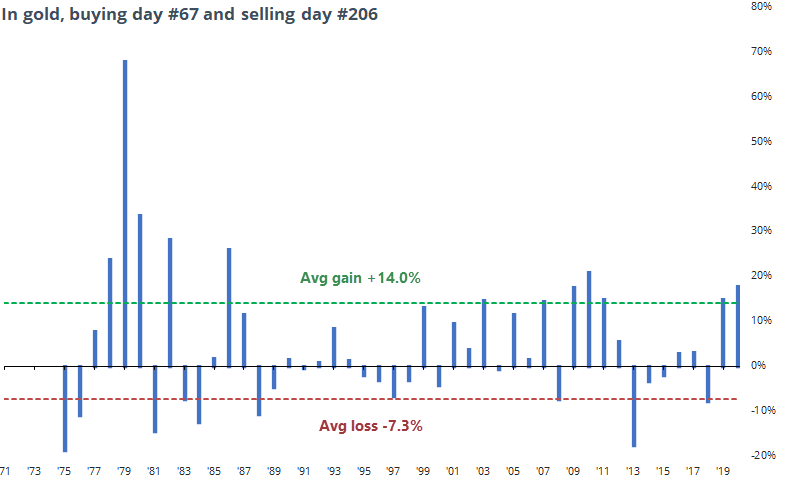

The seasonality chart for gold looks similar to that of the yen, and it's not by mistake. The dollar, and its performance against the yen, has a high correlation to gold returns.

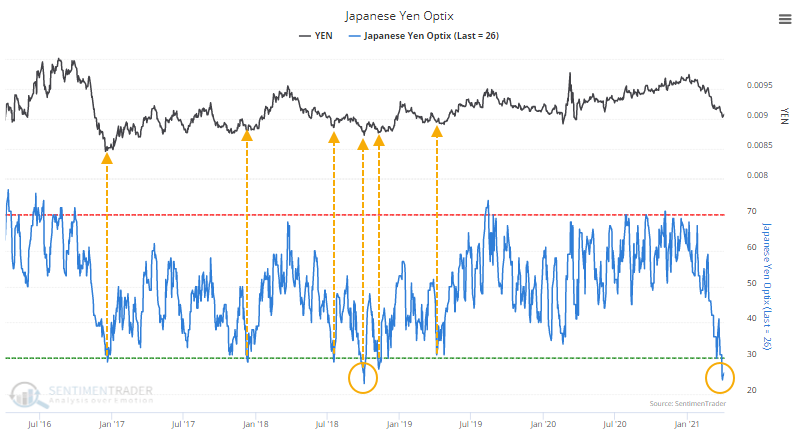

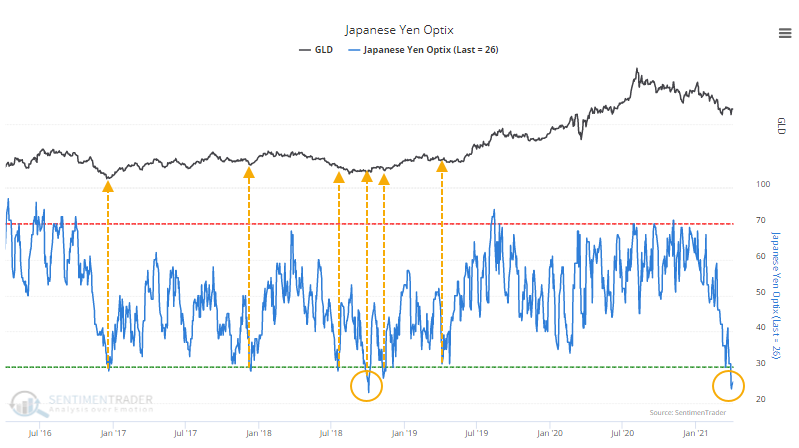

This is particularly interesting now because sentiment on the yen is about as depressed as it has been at any point in over 5 years. The Optimism Index recently dropped below 25 for only the 2nd time since 2015. The other was early October 2018, marking a major low for the currency.

And, again, if we use gold as a substitute, the pessimism in the yen tended to coincide roughly with troughs in the precious metal. After that pessimism in the yen, gold took off to the upside.

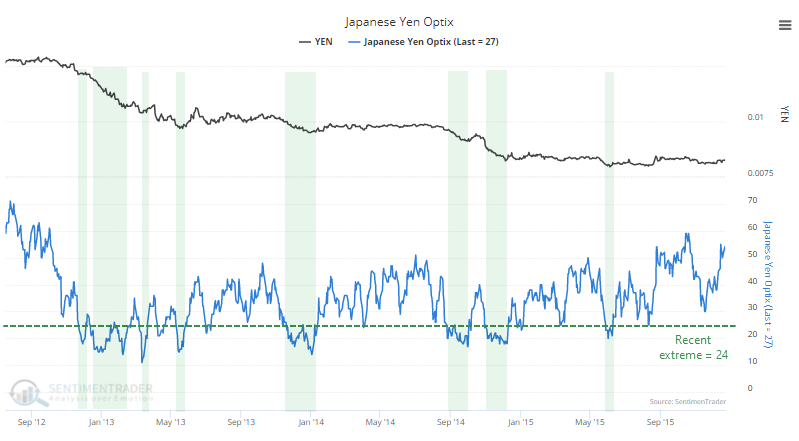

Here's the biggest caveat - optimism in the yen is low only by bull market or trading range standards. In a structural bear market, optimism this low has not been a reason to buy. If anything, it's been a better signal to sell.

The bear market from 2013 - 2015 is a prime example. When the Optimism Index dropped to its recent extreme of 24%, then yen showed an inconsistent, and temporary, tendency to rebound.

If the currency is going to recover from its recent bout of pessimism, then now is as good a time as any.

As always, when a market doesn't do what it should, then it tells us a lot about the market environment. And if the yen can't stem its losses soon, then we'd have a very good clue that the longer-term environment is poor, and rallies should be used for selling. For buyers, an Optimism Index below 20 would be a more reliable buy signal, and even that would be shorter-term and speculative.