If the Nasdaq is peaking, it should look like this

On Thursday, we saw that the consistency of gains and their magnitude in the Nasdaq Composite over several time frames can be matched by only two other times in its history.

After Thursday's rout, one of the most popular questions has been whether this is "it", the final pricking of what could be considered bubbly behavior. If so, what would a peak look like?

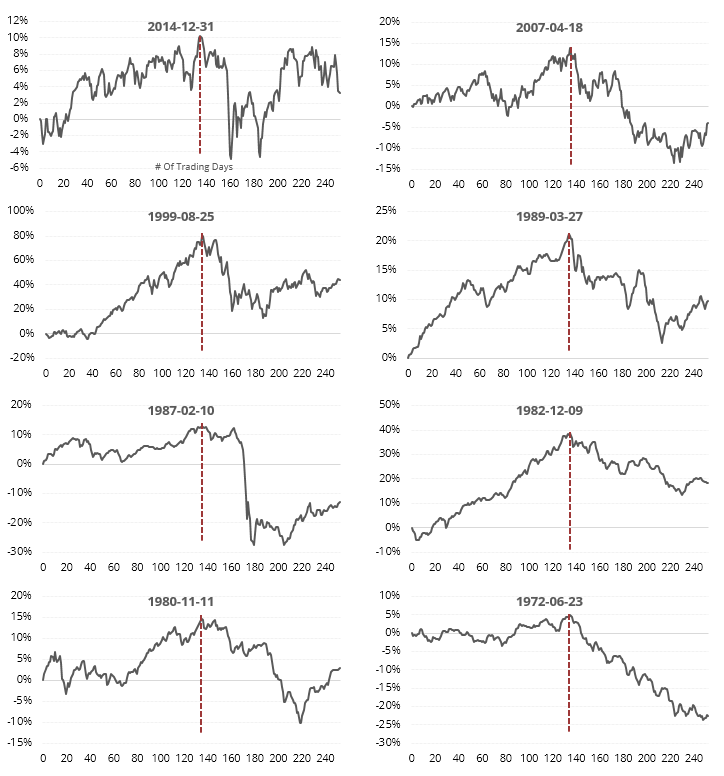

The go-to analog is 1999. While there are some fair comparisons to that period, while others wildly miss the mark. The assumption out there seems to be that if this is, indeed, a 1999-2000 type pricking of a bubble, then we'll see wild back-and-forth swings in the weeks ahead, with big drops then dramatic rallies. If we rely solely upon n=1 then maybe that's the case. But when it comes to analogs, we'd prefer to cast a wider net.

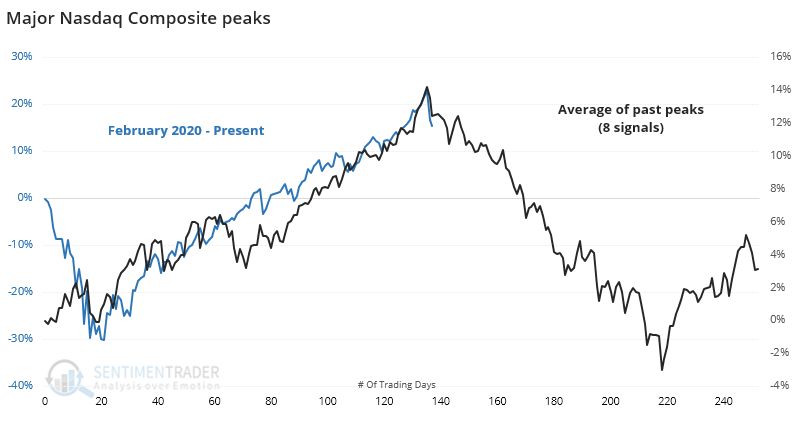

Below, we can see an average of the 8 other times the Nasdaq hit a 3-year peak that wasn't surpassed for at least the next year.

That average is v-toppy, meaning there wasn't a lot of back-and-forth activity surrounding the peak. The Nasdaq soared higher, then...did not. The individual signals show that when the Nasdaq peaked, it PEAKED, underlined and with all-caps. There wasn't much dickering around.

The suggestion from this is that if the Nasdaq is finally peaking, and if it looks anything like its past major peaks, then we're more likely to see an almost straight-down move in the weeks ahead. If we instead see a bunch of back-and-forth volatility with a subsequent move to new highs, then it would violate pretty much all the historical peak precedents (unless it peaks then plunges again, which would reset the analogs).

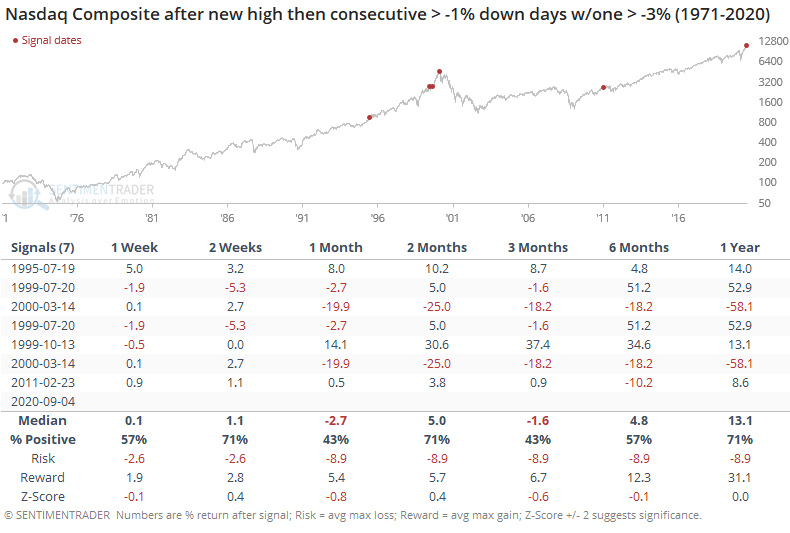

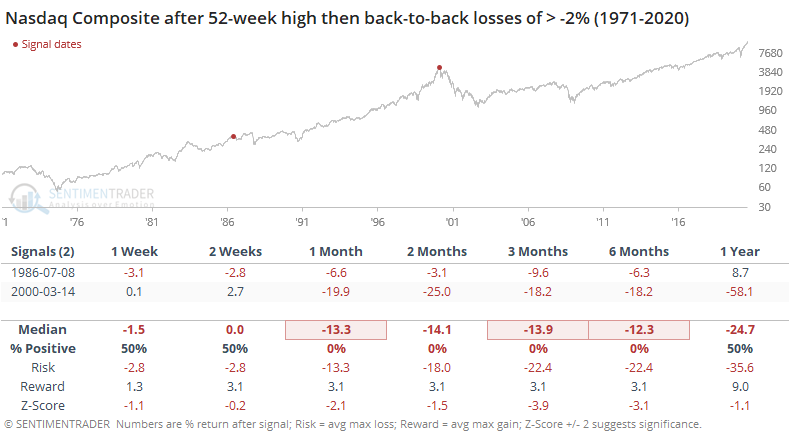

As this is published, the Nasdaq is down again. It has never hit a 52-week high then suffered back-to-back losses of greater than 3%. It has dropped more than 2% on consecutive sessions twice.

There is time for the index to recover. If not, it helps to confirm what has already been some troubling precedents.

EDIT: After this was published, the Nasdaq rose enough avoid another 2% loss. Its precedents got a little less scary as a result.