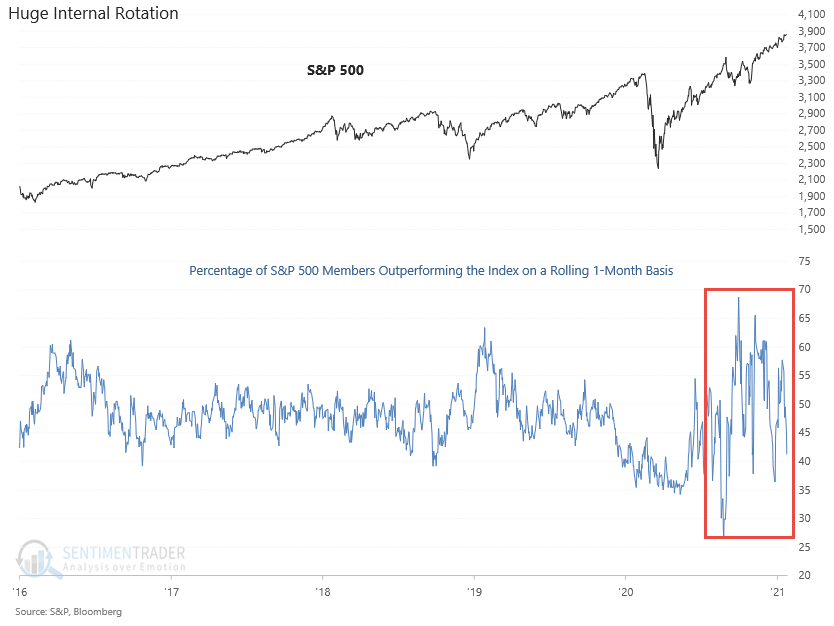

Huge Internal Rotation

Jason and I have highlighted some oddities in short-term breadth measures of late. The indicators run counter to several long-term studies that remain constructive. We can add one more item to the list of oddities. The percentage of S&P 500 members outperforming the Index on a rolling 1-month basis contracted in a significant way over the last six trading days. The indicator experienced a decline of 16.44%. Significant gyrations up and down in this indicator are a sign of internal rotation.

Let's take a look at some historical chart examples of the indicator.

Current Chart for Members Outperforming Index

As one can see, the gyrations up and down since late July have been significant. It's not uncommon to see this type of internal rotation around market transition periods. i.e., bear to bull or bull to bear. What makes this period different from others is the duration. The process is occurring in a brief period.

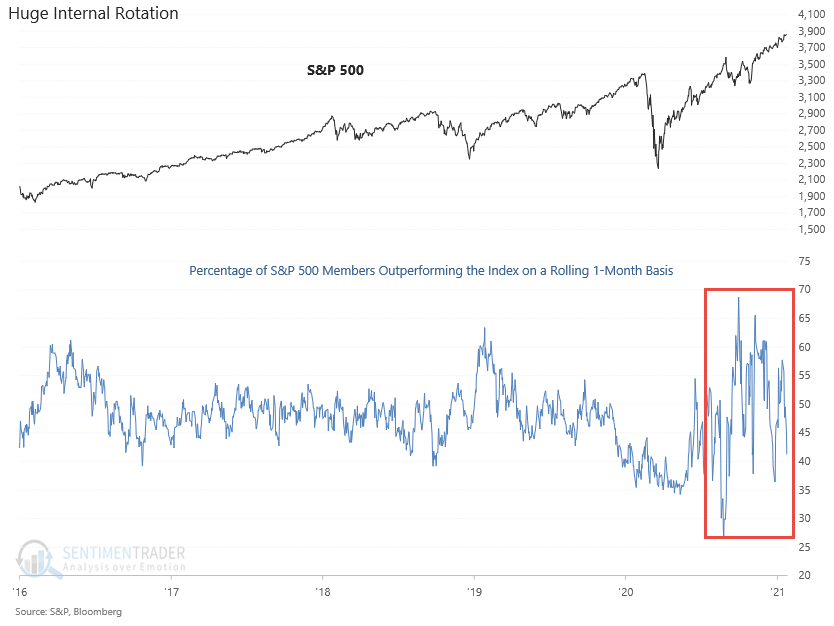

1999-2002 Example

If we zoom out to include the 1990's in our chart, we can see the internal rotation in the 1999-2002 period. While the gyrations were more significant than the current day, they occurred over a much longer timeframe.

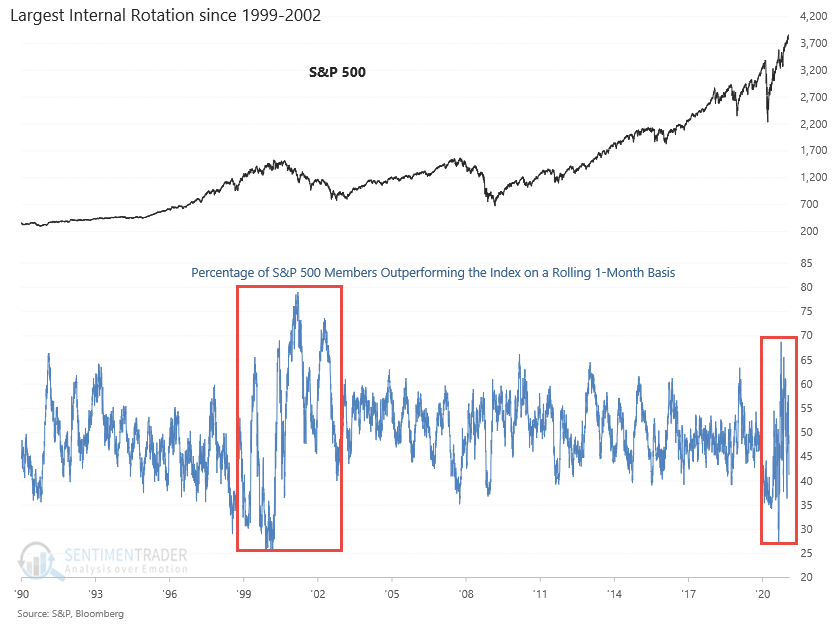

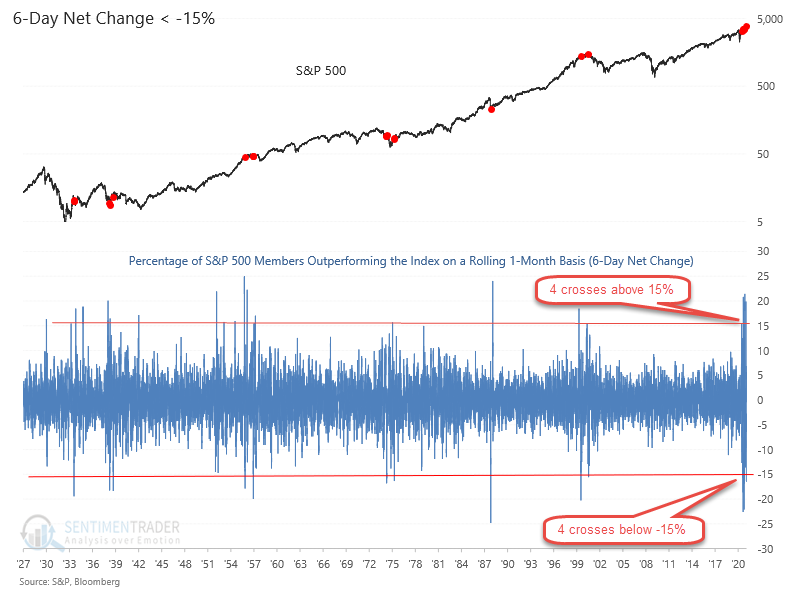

If we zoom out further and look at the 6-day net change in the percentage of members outperforming, one can see the large up and down swings from a historical perspective. I count four instances where the 6-day net change crossed above 15% and four where it crossed below -15% since July 2020. That's the most in history in such a brief period. Please note, the red dots in the chart represent readings of -15% or less.

Conclusion: I suspect the extreme internal rotation in such a brief period is a sign of investor uncertainty around the disconnect between some segments of the economy and the stock market. Investors are struggling with the growth versus value conundrum.