How the U.S. Dollar could impact Gold

Key Points

- Price movements in Gold and the U.S. Dollar tend to be inversely correlated

- U.S. Dollar Hedgers positions have risen to a significant level (indicating the smart money has been buying), and the Dollar is entering a favorable seasonal period

- Traders should be alert for any sign of an upside reversal in the Dollar, which could serve as a brake for the runaway movement in metals

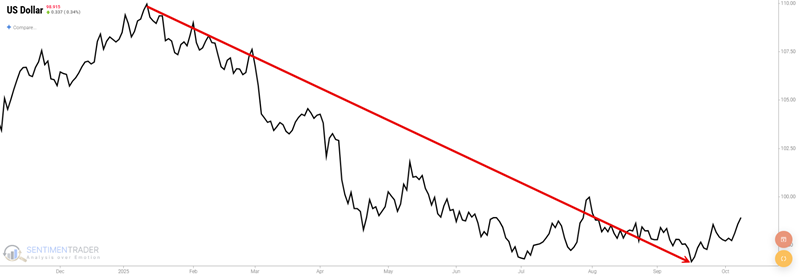

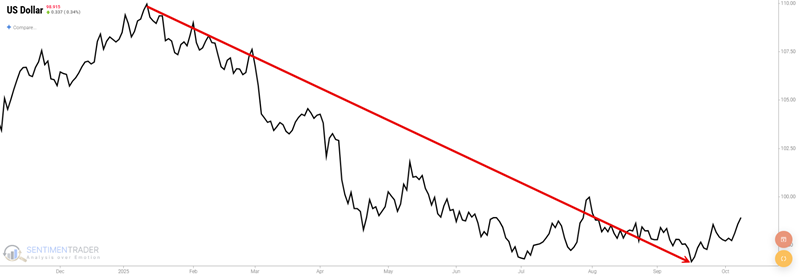

The Dollar has plunged while Gold has soared

Gold and the U.S. Dollar have long had an inverse relationship. Over the past five years, the correlation coefficient has been roughly -0.36. The charts below show that the Dollar experienced significant weakness in the last year, while Gold has soared.

The critical implication here is that if the Dollar were to reverse and rally, it would likely signal a period of weakness for Gold. How likely is such a move? Several factors are presently flashing important alert signals.

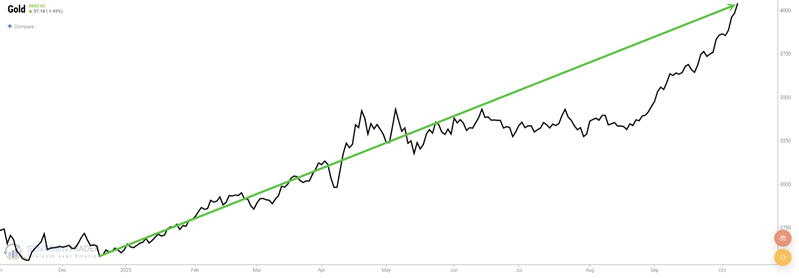

The Dollar is entering a potentially favorable seasonal period

The purpose of this discussion is not to try to convince you to enter a bullish position on the U.S. Dollar. It merely offers one piece of evidence suggesting the potential for at least a short-term upside reversal in the Dollar.

The chart below shows the annual seasonal trend chart for the Dollar. Note the favorable period that extends from Trading Day of the Year (TDY) #203 through #233. For 2025, this period extends from the close on October 13th through November 24th.

Again, this is not a call to action to buy the Dollar or to sell short Gold. The point is to highlight the potential for a Dollar bounce and to remind us that such a bounce would likely negatively impact Gold and other metals.

Dollar Hedgers are long the buck

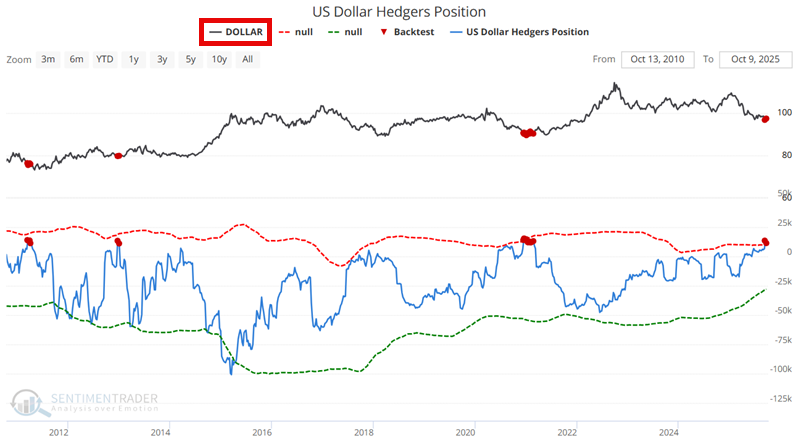

Commercial Hedgers are considered smart money. When hedgers become net long to an extreme degree, we should expect the commodity's price to rise. The opposite is true when they become so hedged that their cumulative position falls to a very low level. Lately, the exposure of U.S. Dollar Hedgers has been on the rise.

The chart below highlights all weeks in the past 15 years when the US Dollar Hedgers Position indicator was above 10,000.

The table below summarizes Dollar performance following these highlighted dates.

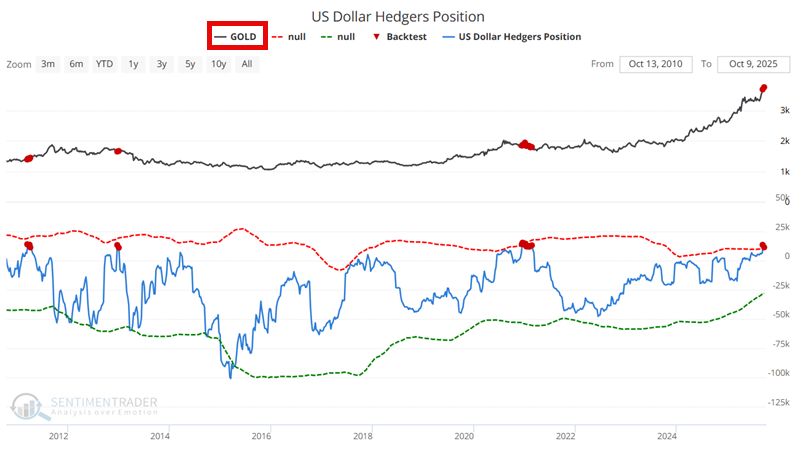

More to the point, the chart below highlights all weeks in the past 15 years when the US Dollar Hedgers Position indicator was above 10,000, with Gold as the underlying index instead of the Dollar.

The table below summarizes gold performance following the highlighted dates. The bottom line is that Gold has a history of subpar performance after U.S. Dollar Hedgers turn bullish on the Dollar.

What the research tells us…

Note that this article is labeled as "Informational" and not "Actionable Signal." The goal is not to try to pick a top in Gold. If metals want to continue to run, we don't wish to stand in the way. But, as the saying goes, trees don't grow to the sky. Eventually, the Gold rally will run out of steam. And one factor that could hasten that day more than most would be a bullish reversal in the Dollar. With seasonality and smart money now turning bullish for the Dollar, gold traders should be on high alert.

Bottom line: The detailed information does not necessarily constitute a "Call to action." It is more of a "Call to pay close attention." While the data suggest the potential for a Dollar rally, it does not constitute an immediate "buy" signal in the Dollar nor a "sell short" signal in Gold. The primary focus here is the potential for even a short-term bounce in the Dollar to cause a reversal in gold and other metal markets.

Go forward, forewarned.