Hong Kong triggers an IBD power trend sell signal

Key points:

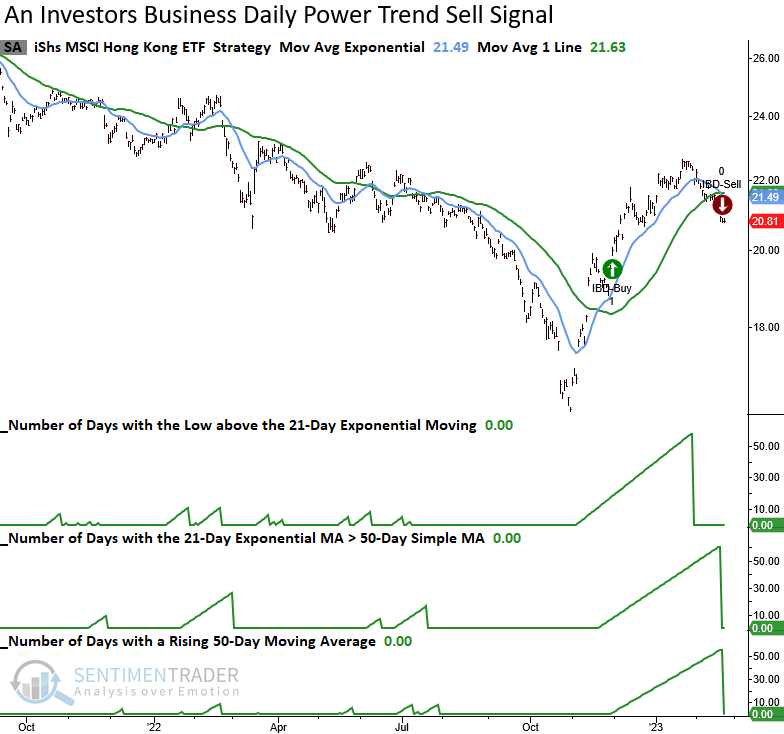

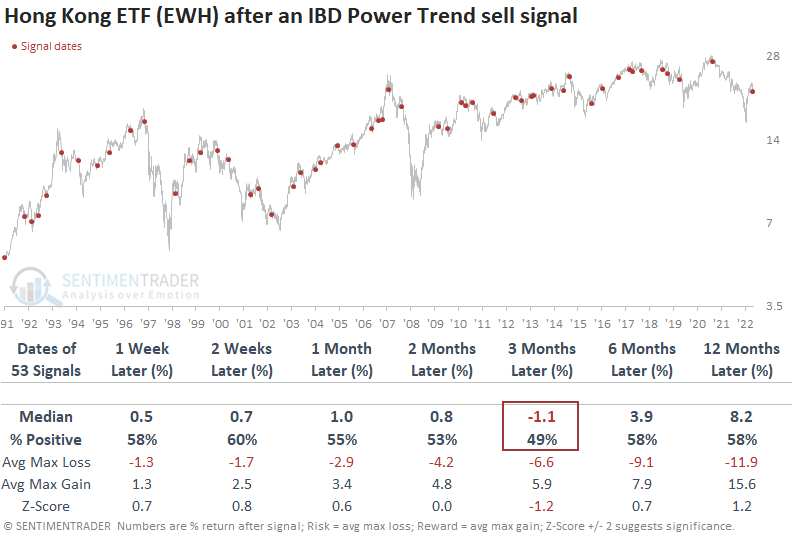

- The Investors Business Daily Power Trend strategy triggered a new sell signal for Hong Kong

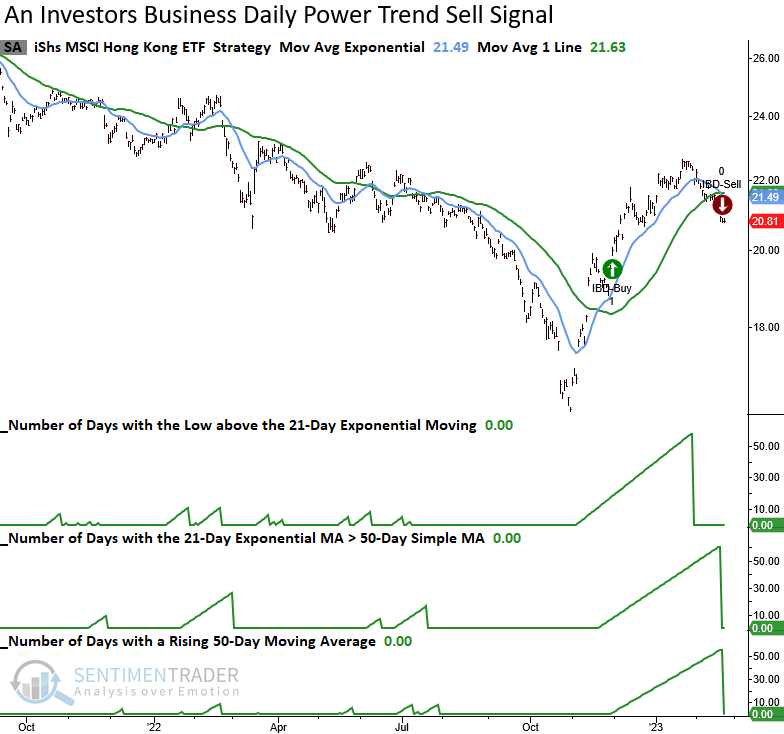

- After similar trend changes, the ETF showed flat to slightly negative returns over the next three months

- The Power Trend system registered several other sell signals for Chinese-based ETFs and stocks

A short to medium trend-following strategy turns unfavorable for Chinese stocks

In a recent note, I shared the details of the Investors Business Daily Power Trend strategy.

I like the system, so I'm now following signals for stocks and ETFs around the globe. One country I've been monitoring is China, as the reopening of the economy was supposed to be bullish for stocks and commodities. Commodities have been anything but bullish, as I highlighted in a recent note, and now we're starting to see sell signals for Chinese-based stocks and ETFs.

We may have experienced a buy the rumor, sell the news type of trade.

On Tuesday, the Hong Kong ETF (EWH) triggered an IBD Power Trend sell signal.

Similar IBD Power Trend sell signals preceded flat to slightly negative returns

When an IBD Power Trend sell signal occurs, the Hong Kong ETF (EWH) struggles on a short to medium-term basis, especially three months later. After a 40% trough-to-peak rally since last October, a consolidation in Hong Kong stocks seems appropriate.

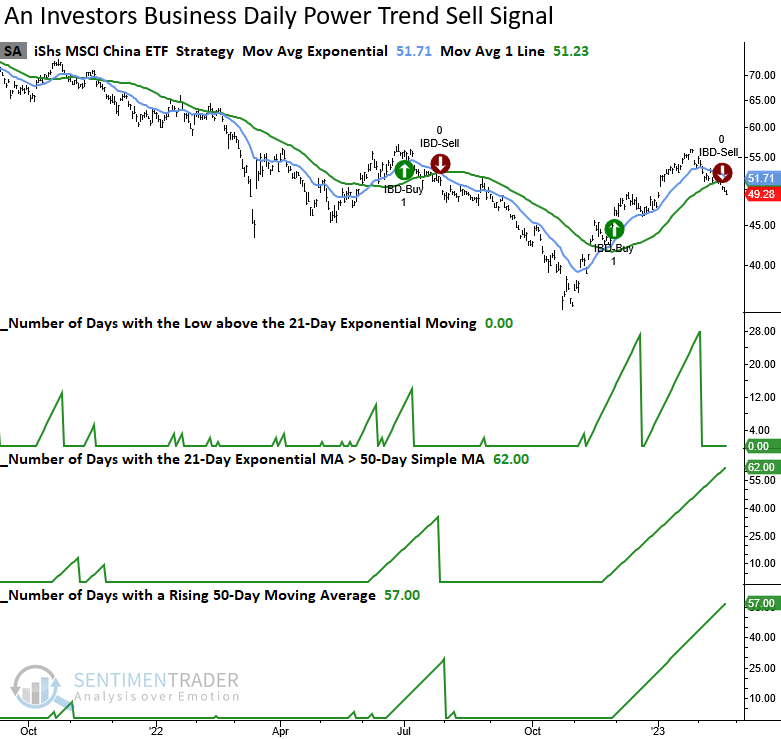

Some other Chinese-based sell signals

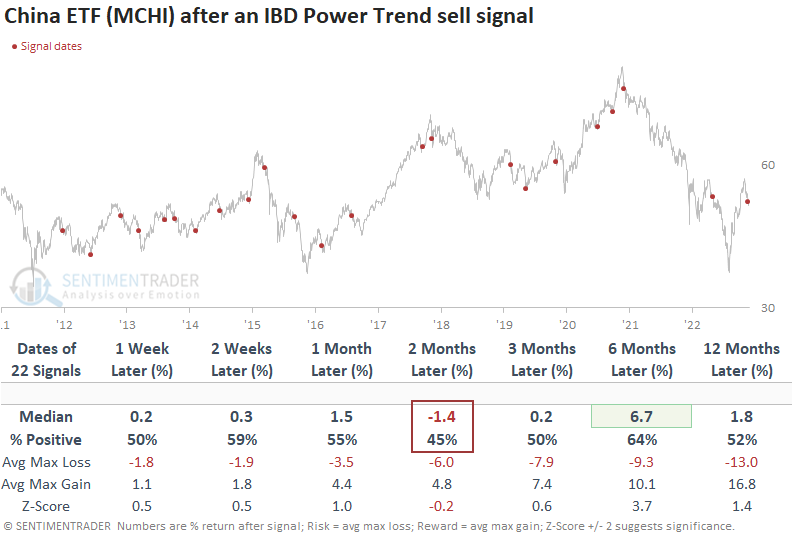

A Chinese ETF with over 600 stocks triggered a sell signal on 2023-02-17.

The China ETF (MCHI), which holds a significant weighting in Tencent and Alibaba, could underwhelm in the next few months. Like the Hong Kong ETF, it must work off the overbought condition.

A potential driving force behind the Chinese-based Power Trend sell signals

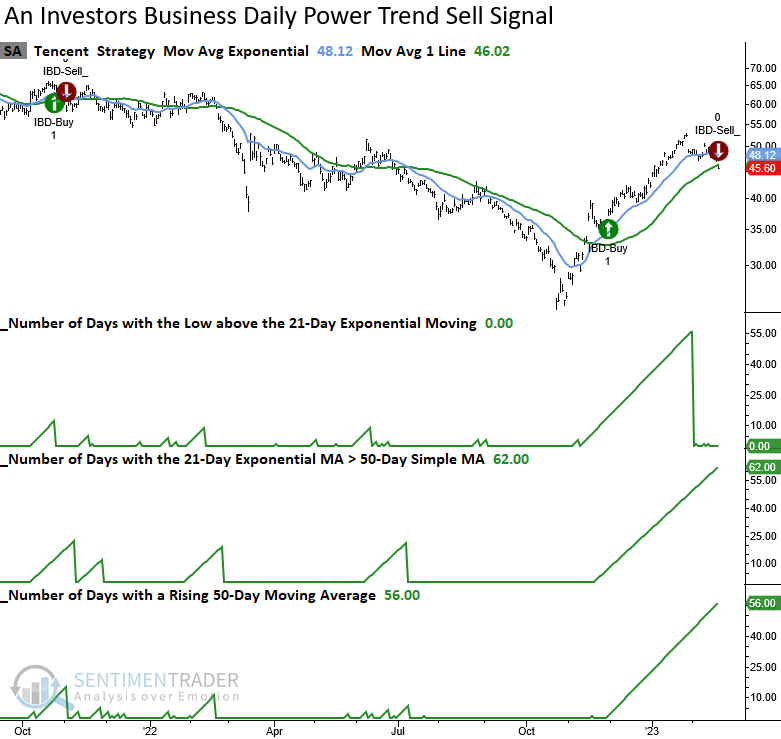

Tencent Holdings triggered a new IBD Power Trend sell signal on 2023-02-21.

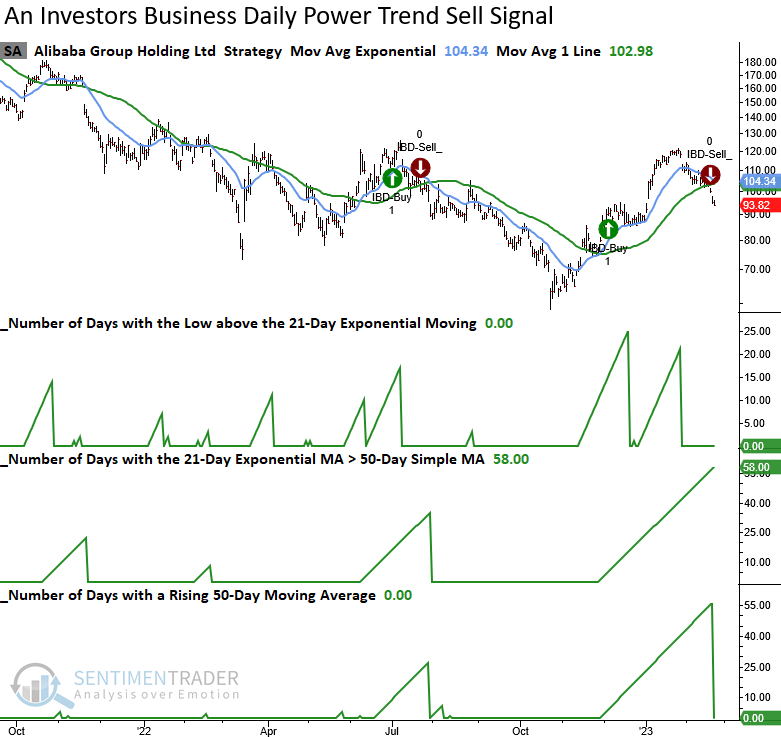

Alibaba Group Holdings triggered a new IBD Power Trend sell signal on 2023-02-17.

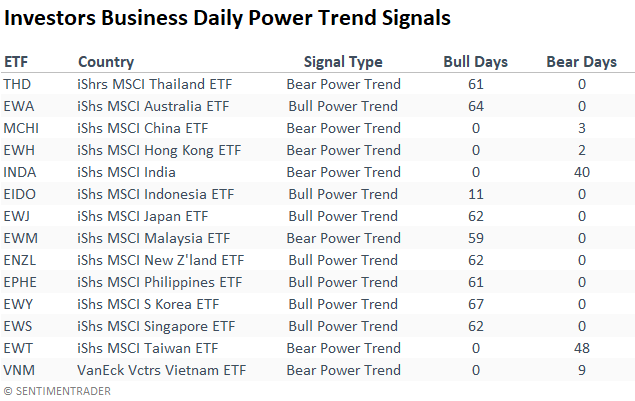

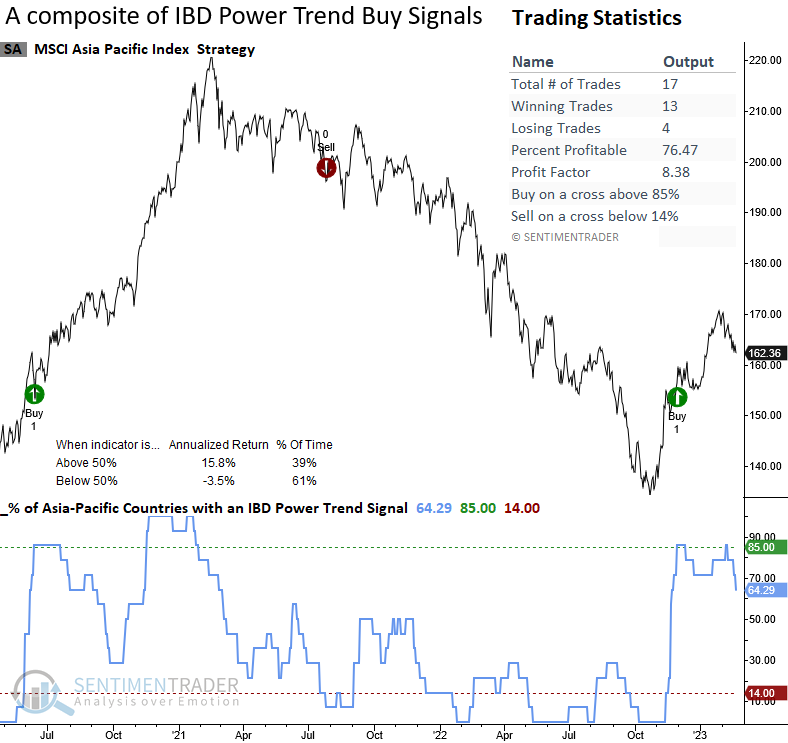

The rest of the Asia-Pacific region still looks healthy

When I measure the percentage of Asia-Pacific countries on an IBD Power Trend buy signal, the composite shows 64% with a bullish trend. So, the recent sell signals in China don't appear to be a regional problem for a manufacturing-heavy area.

While the percentage of Asia-Pacific countries on an IBD Power Trend buy signal has declined from a high level, the composite remains bullish. However, should it fall below 14%, a risk-off sell signal for the region would trigger.

What the research tells us...

The Hong Kong ETF (EWH) and several other Chinese-based stocks and ETFs triggered IBD Power Trend sell signals. After massive multi-month runs, a consolidation that works off the overbought conditions seems appropriate. So far, the sell signals in the Asia-Pacific region are somewhat limited to China and a few other countries.