Homebuilding Buy Signal Update

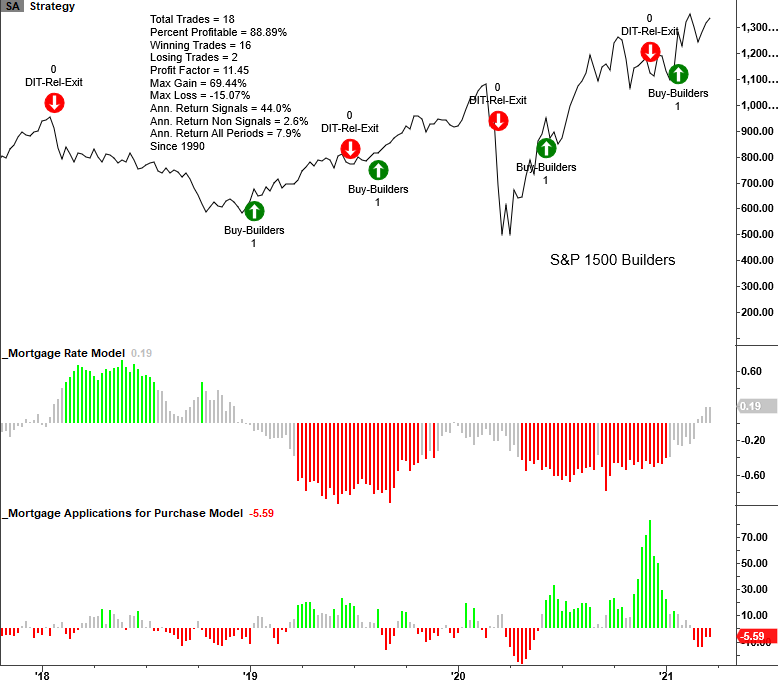

With interest rates on the rise, I thought it would be a good time to update performance for the 1/22/21 buy signal in the homebuilding group. Please see my note from 1/25/21 for model details.

Let's review the current signal details and an interest rate model that seeks to identify a change in rates that impact stocks in the homebuilding group.

Homebuilding Buy Signal on 1/22/21

The rate and purchase components in the model have subsequently moved to a level that would preclude any new signals. Remember, a signal can only be generated when rates are down, and mortgage applications for purchase are up.

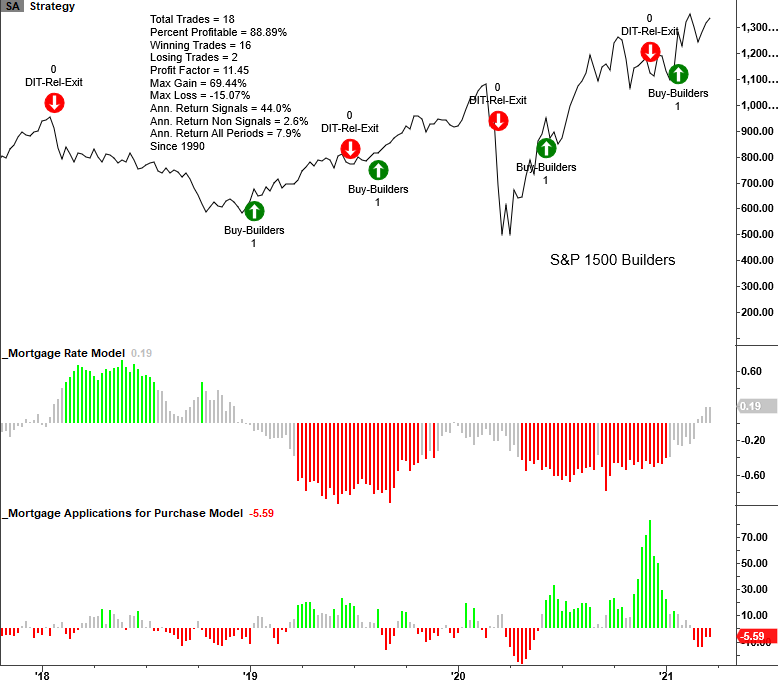

Homebuilding Signal Performance

Since the 1/22/21 buy signal, relative performance for builders has been strong. As I write this note, interest rates are up on the day, and homebuilders are among the best performing groups.

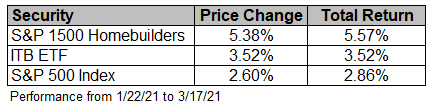

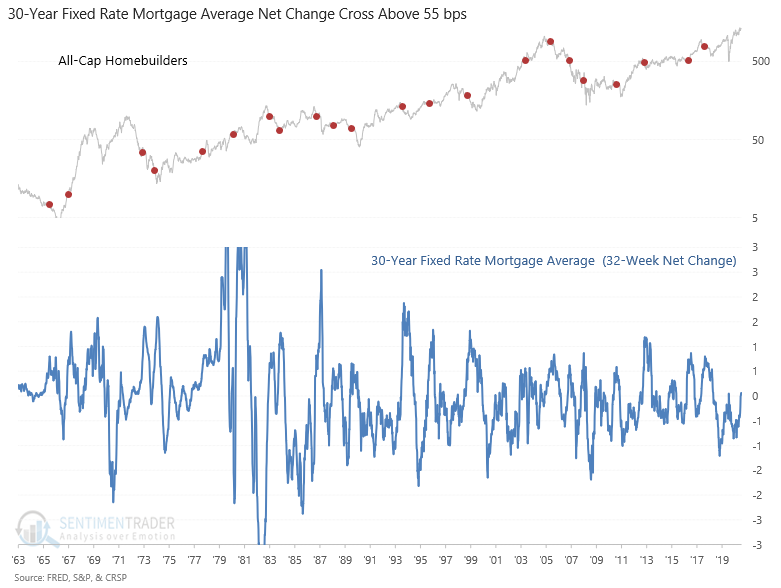

Mortgage Rate Change Chart

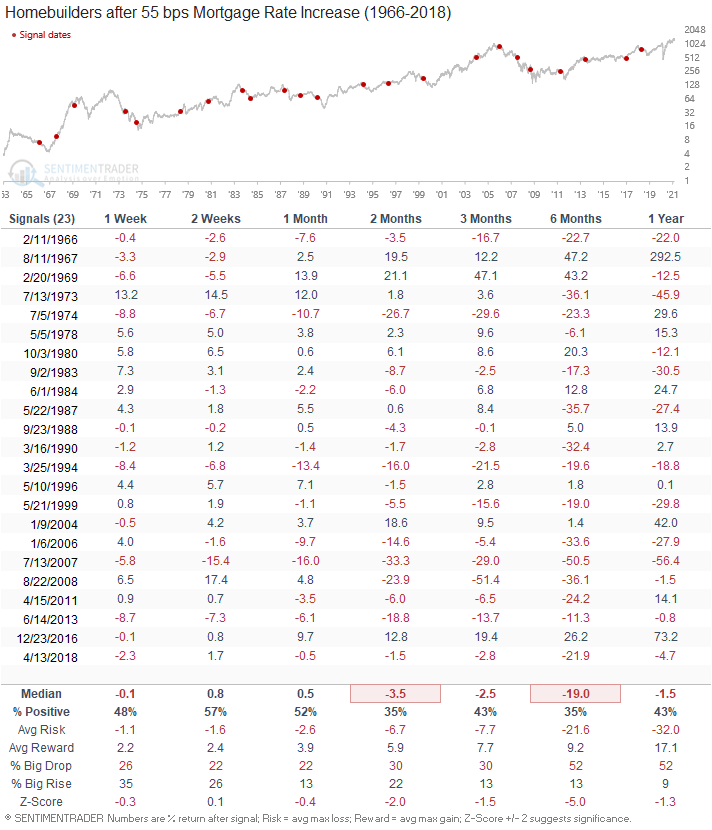

When I built my housing model several years ago, I also decided to create a standalone interest rate signal to assess the impact of rising rates on homebuilding stock performance. The optimization showed that when the 30-year fixed-rate mortgage rate rose by 55 bps over a 32-week period, stocks underperformed.

Mortgage Rate Change Signal Performance

As the table below shows, a 55 bps increase in mortgage rates impacts homebuilders across all time frames.

Conclusion: Interest rates are on the rise but have not reached a level that would impact homebuilders' performance. If rates reach an unfavorable level, I fully expect my relative strength condition to trigger an exit signal.