High Beta vs. Quality Risk-On Signal

A trading model that compares the performance of high beta stocks to quality stocks registered a new risk-on buy signal for the S&P 500 at the close of trading on 11/1/21.

According to S&P Dow Jones, the S&P 500 high beta index contains stocks that are more sensitive to changes in market returns. In contrast, the S&P 500 quality index seeks to isolate stocks using a quality score based on return on equity, accruals, and financial leverage.

In simple terms, we call this factor investing.

Let's assess the outlook for the S&P 500 when investors make a directional bet on the market by favoring high beta over quality.

RELATIVE RATIO RANGE SIGNAL CONCEPT

The concept I use to identify relative ratio range signals is simple. I calculate the ratio for two securities and measure the range over a lookback period in percentage terms. The range rank methodology allows one to test threshold levels between 0 and 100%. I then optimized the signal to determine the most favorable lookback period, reset and buy level thresholds.

PARAMETERS FOR HIGH BETA VS QUALITY RATIO RANGE SIGNALS

Ratio = S&P 500 High Beta Index/S&P 500 Quality Index. The range rank for the relative ratio utilizes an 84-day lookback period.

- If the relative ratio range rank crosses below 10%, the reset condition is true.

- If the reset condition is true and the relative ratio range rank crosses above 90.5%, buy the S&P 500 index.

CURRENT DAY CHART

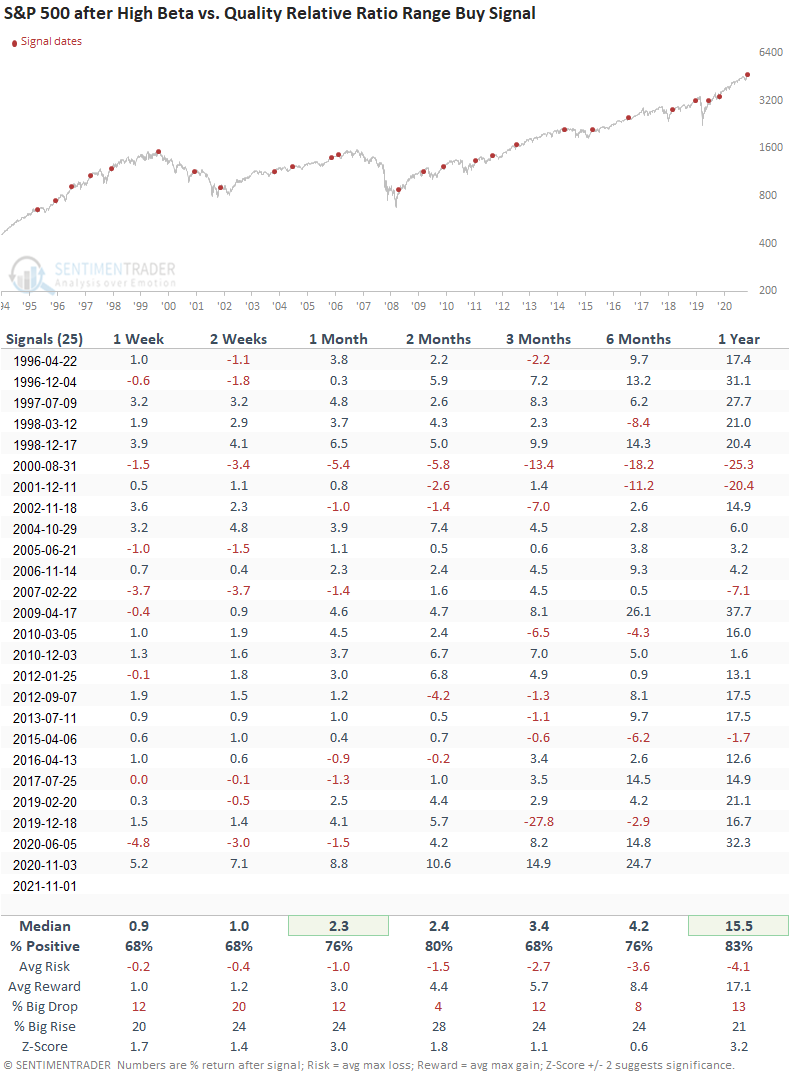

HOW THE SIGNALS PERFORMED

Results look good across all time frames, especially the 1-month window. And, if we exclude the 2000-02 bear market period, the 1-year performance and risk/reward profile is outstanding.

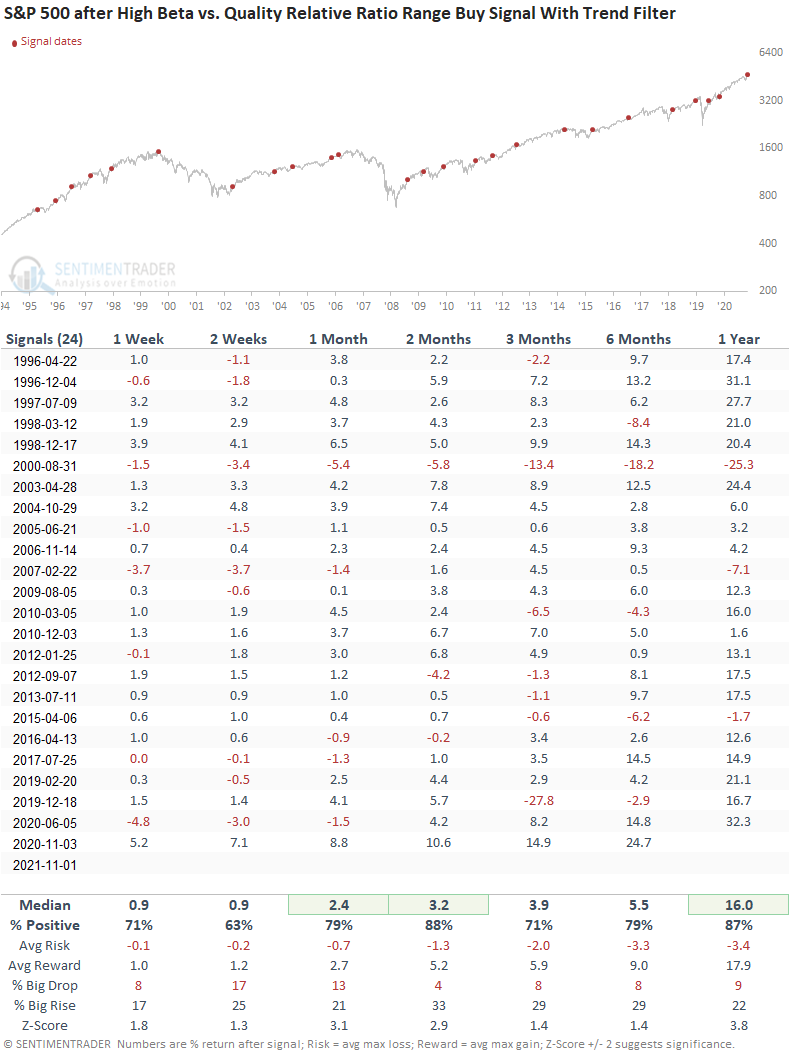

Let's add a trend filter to the study to isolate instances similar to the current one. I will keep the original study parameters but now include a condition that requires the S&P 500 Index to be trading above its respective 200-day moving average.

HOW THE SIGNALS PERFORMED

Results look solid across all time frames with several notable risk/reward profiles. The consistency and risk/reward profile in the 2-month window suggests smooth sailing for a year-end rally.

KEY TAKEAWAYS:

- A signal occurs when high beta stocks outperform quality stocks

- The model has a 88% win rate over the next two months when the S&P 500 is trading above its 200-day average

- The signal suggests the year-end rally can continue