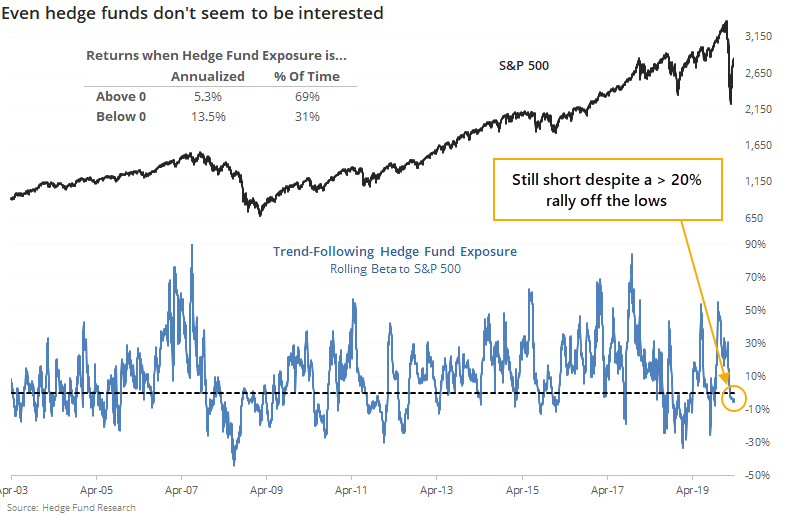

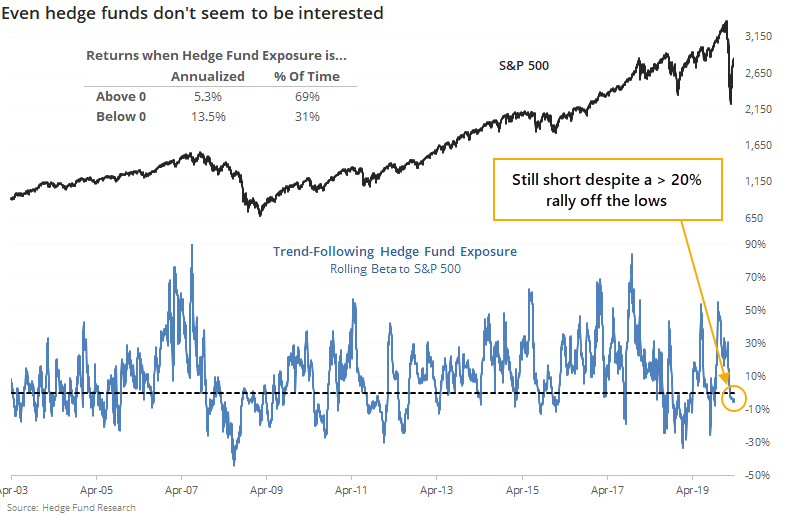

Hedge funds remain short despite rally

Like individual investors and some other survey-based sentiment measures, trend-following hedge funds don't seem to have much faith that this has been anything but a bear market rally.

This is a gross simplification, to be sure, but if we approximate the positioning of hedge funds according to their rolling beta to the S&P 500, then it's apparent that they haven't ramped up along with the S&P in recent weeks.

Despite more than a 20% gain in the S&P, Hedge Fund Exposure has actually decreased a bit and remains negative. All this means is that an index of hedge fund returns from Hedge Fund Research, Inc. has shown a negative beta to returns in the S&P 500 index over the past month.

Just eyeballing the chart above, it's apparent that this is unusual. When stocks rally, trend followers tend to add to their positions. That's the whole point of being a trend follower. This suggests that the quantitative models that many of them use have not yet triggered long entries, which are sometimes based on fairly basic triggers like multiple closes above the 200-day average, 50-day highs, etc.

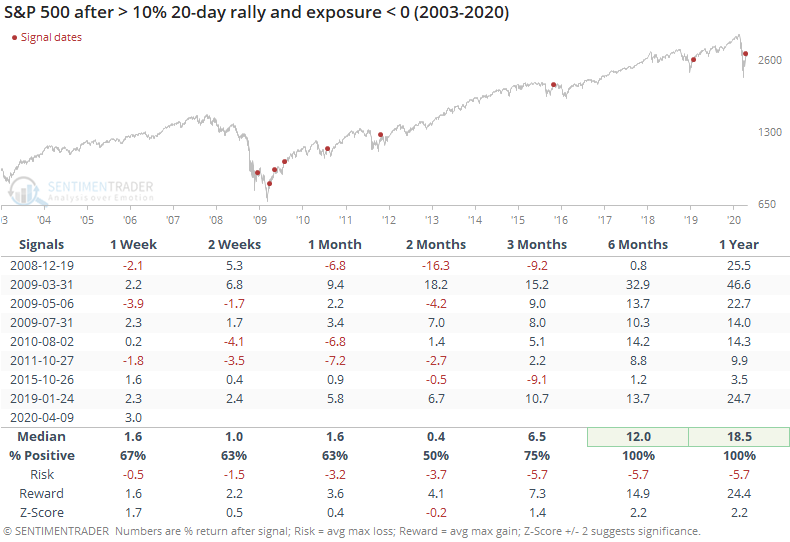

While history is limited, if stocks rally hard but Exposure suggests a net short position, then stocks have shown above-average returns in the medium- to long-term. This is less meaningful given the nearly one-sided market over the past decade.

It's easy to suggest that everybody's bullish just because prices have rallied, but they're not. Many surveys, and even hard data, suggest that there are only pockets of buyers. This isn't necessarily a good thing, but so far the evidence suggests that it mostly is, at least longer-term.

It does raise the question of exactly who is buying, and we don't know. The usual culprits seem to be holding back.