Hated Bonds As U.S. Economy Out-Surprises Eurozone

This is an abridged version of our Daily Report.

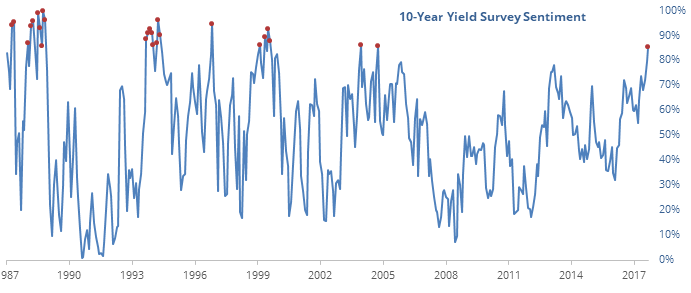

Survey says: sell bonds

Recent surveys of diverse investor groups show nearly universal expectations for higher rates (lower bond prices). An average of different surveys is the most extreme since 2005.

Other extremes mostly led to lower interest rates.

USA! USA! USA!

Economic surprises in the U.S. have been stronger than in the eurozone where they just dipped into negative territory. When that’s happened before, the S&P 500 outperformed the Euro Stoxx 50 index. The U.S. dollar also did well, while commodities suffered, and bonds rallied.

Back-to-back followed by back-to-back

This is the first time since December 2015 that the S&P 500 rose more than 1% on consecutive days followed by 1% losses on consecutive days. There have been 23 of these patterns since 1928, and all but 3 of them occurred during bear markets.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.