Growth vs. value around the world

The ratio between growth vs. value stocks has gone truly parabolic. This has caused value investors like Warren Buffett to significantly underperform the broad S&P 500 over the past month (and it's also why Buffett has underperformed buy and hold over the past decade).

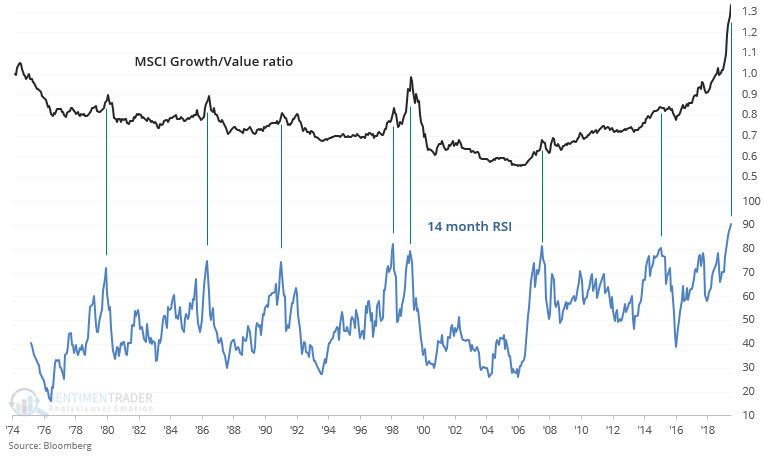

The MSCI World Growth/Value ratio continues to soar, pushing its 14 month RSI to the highest level ever!

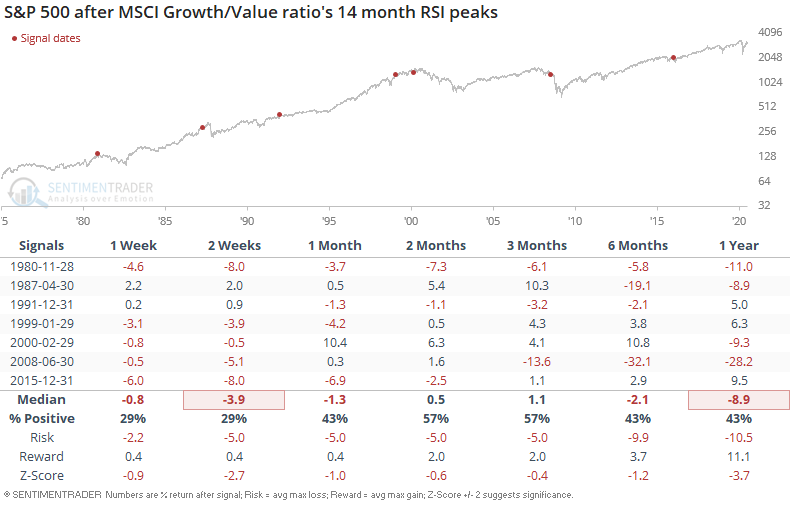

While it's probably premature to assume that the Growth/Value ratio has peaked (extreme can always get more extreme), let's assume that this is the peak. In the past, peaks in the MSCI Growth/Value ratio's 14 month RSI typically led to major problems for the S&P 500 sometime over the next year. For example:

- December 2015: stocks crashed next month

- June 2008: worst of the bear market was about to begin

- February 2000: bull market top

- January 1999: not a problem

- December 1991: no major correction over the next year, but the stock market didn't rally much further

- April 1987: the infamous 1987 crash

- November 1980: major 2 year bear market and recession ensued.