Gold's triangle pattern will be key tell for miners

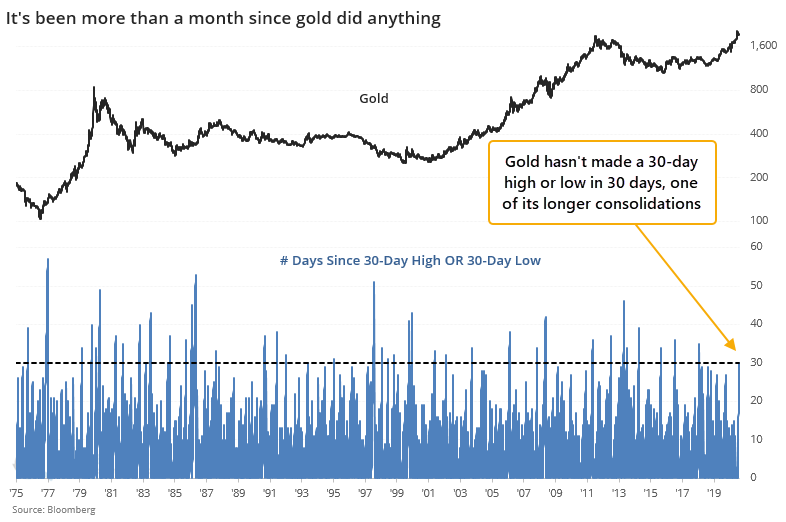

Gold hasn't done anything for more than a month. It gets derided as a "pet rock" because it has limited use for most investors, doesn't have any earnings, and doesn't pay any interest. For the past 30 days, it's lived up to its name.

Since peaking on August 6, gold has gone into consolidation mode. It hasn't set a 30-day high OR a 30-day low in 30 sessions now.

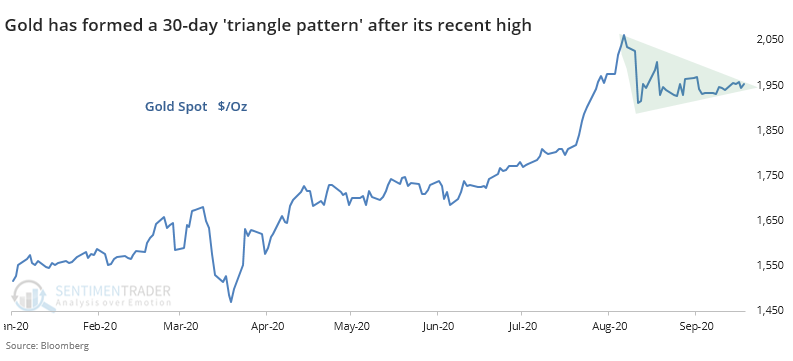

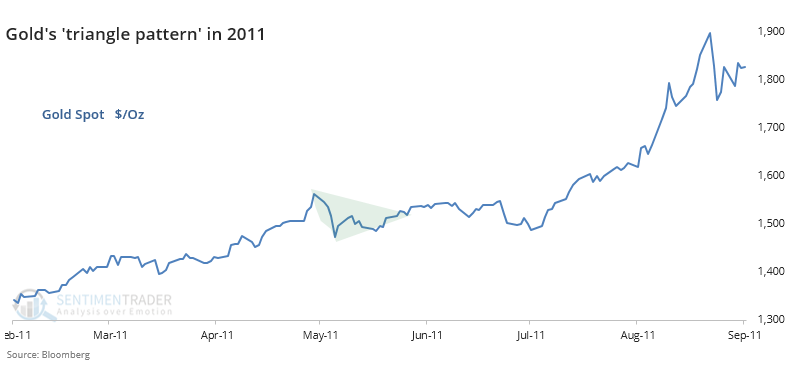

This is what's commonly referred to as a "triangle pattern" because, well, it looks like a triangle.

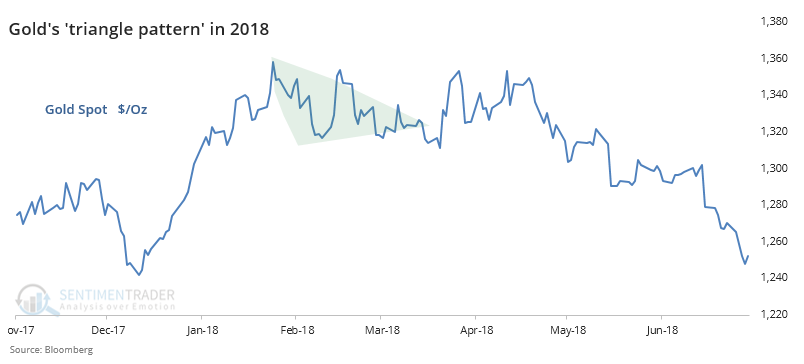

This happened in 2018 after a run-up in gold, too, and that didn't work out so well.

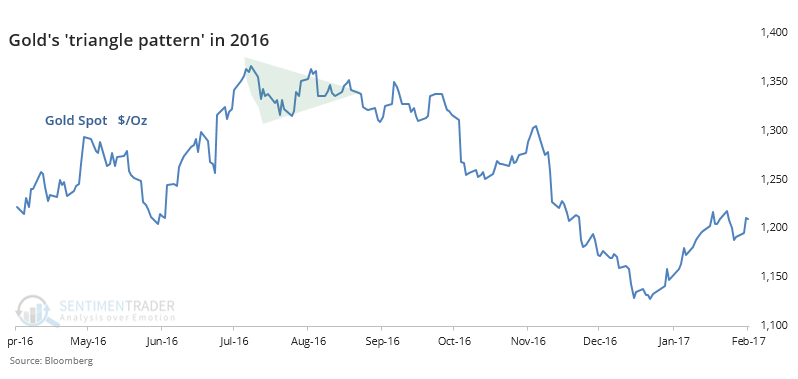

Neither did the one prior to that, in 2016.

We'd have to go back to 2011 to see that last positive resolution of this pattern for the yellow metal.

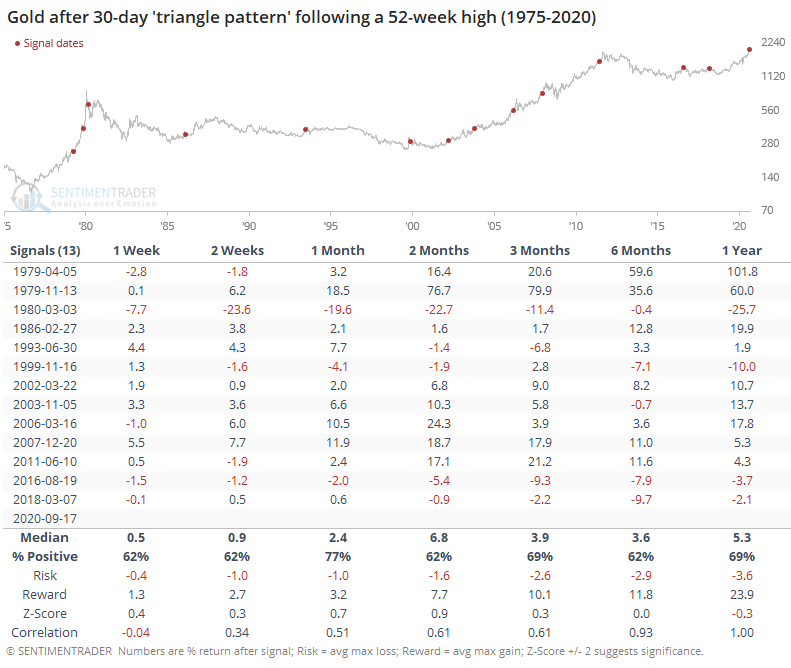

Instead of subjectively eyeballing chart patterns, let's go back to 1975 and look for every time when gold hit a 52-week high, then failed to set either a 30-day high or a 30-day low for 30 days. It rallied to a new high, then just sat there.

Mostly, gold resolved these patterns by breaking out to the upside. Over the next 3 months, it was higher 69% of the time, with an excellent risk/reward ratio.

The last row in the table, titled "Correlation", shows the relationship between that time frame's median return and the median return 1 year later. It shows us there was a slight tendency to see a fakeout over the next week, but gold's returns over the next 2-4 weeks gave us a decent hint at what returns over the next year would look like.

In an earlier premium note, Troy looked at this in a different way, using the expansion and contraction in gold's Bollinger Bands, a measure of volatility. Those future returns were poor, mainly because most of the signals triggered during bear markets. That's a bit of a concern, and it would be as well if gold breaks down out of this triangle pattern in the weeks ahead. History suggests it has a decent probability of heading higher, but buyers need to prove they have enough optimism to push it outside its recent consolidation zone.

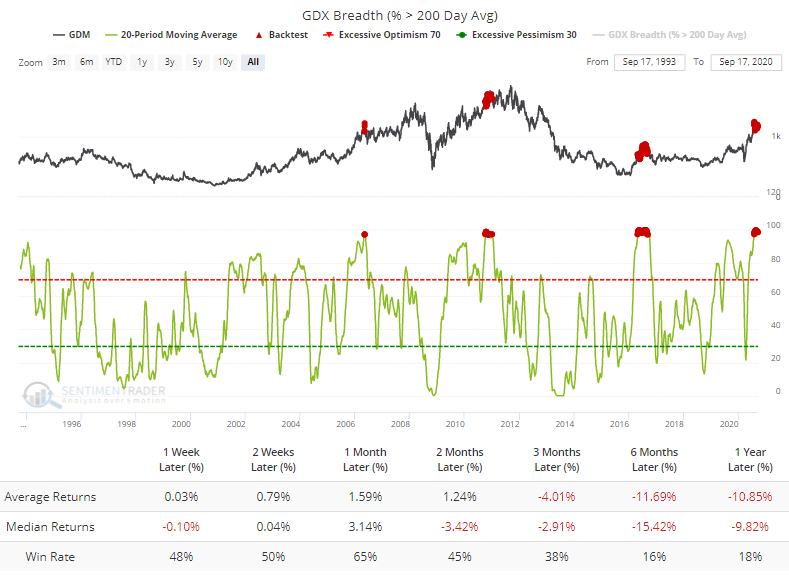

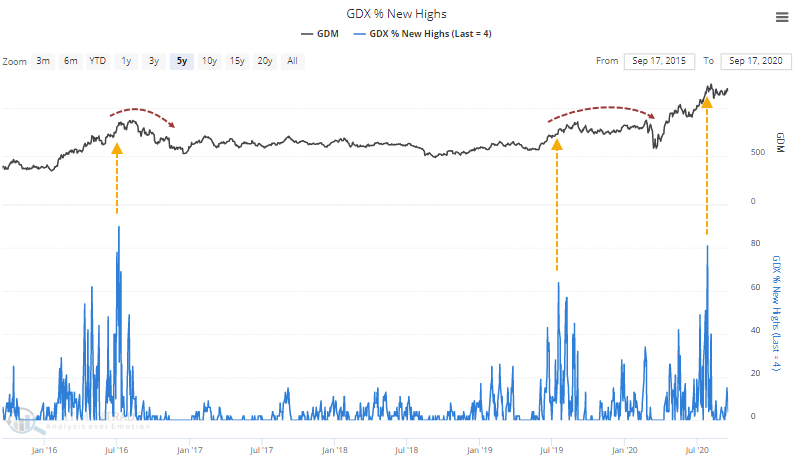

Because gold had been doing well, miners were as well. Over the past 20 days, an average of more than 97% of gold mining stocks have held above their 200-day moving averages. That's among the best performances in nearly 30 years. The problem for the miners is they've never really been able to sustain this kind of momentum.

The Backtest Engine shows that miners have not been able to tack on many gains following these signals. Over the next 6 months, their returns were horrid.

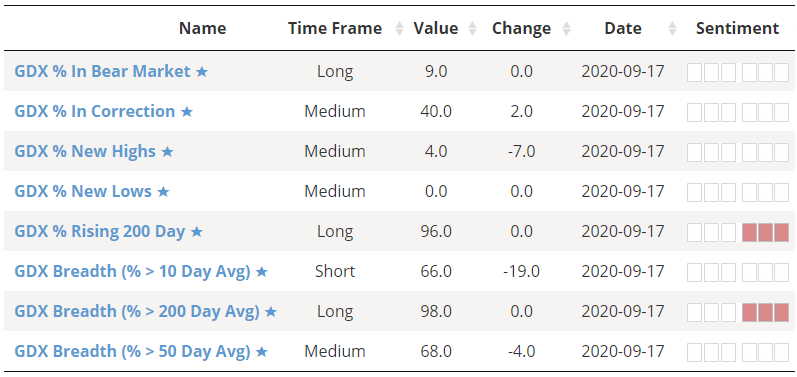

The other breadth metrics we follow for the miners are mostly good and not necessarily extreme.

While only 4% of them just hit a 52-week high, recently that had been more than 80%, a rarely-achieved feat of coordinated buying interest in the sector. Like we saw with how many of them were above their 200-day averages, though, these companies have not had much success at maintaining this kind of upside momentum as a group.

Whichever way gold breaks from its triangle pattern in the weeks ahead will almost certainly determine the fate of the miners as well. History hasn't been very kind after showing the kinds of moves they've enjoyed in recent months, so bulls have to hope that this time is different.