Gold miners show perfect breadth

Even as "everything" rallies, the biggest standout is gold. Whatever the reasons behind the move, it has been stunning.

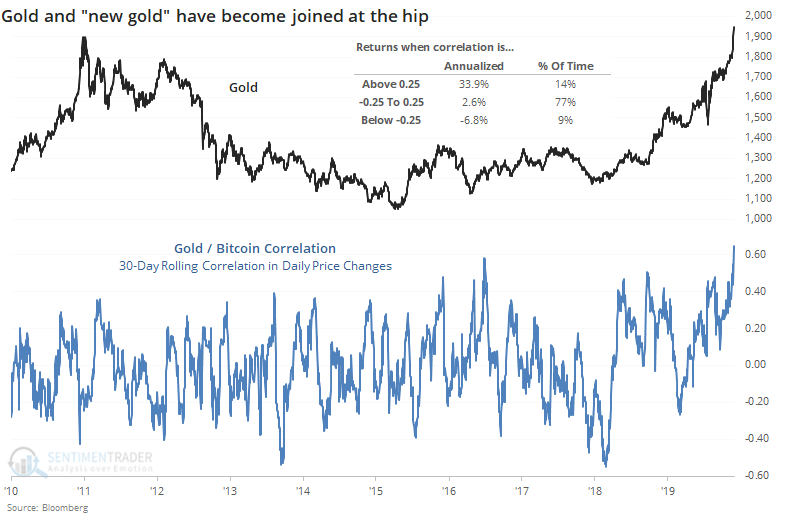

The worry among some is that it's only speculative activity, as judged by the fact that bitcoin, dubbed the "new gold", has also started to spike. As the Daily Shot notes, the correlation between the two alternative stores of value has jumped.

In the relatively short history of bitcoin, high correlations between it and gold haven't been a bad sign for the latter, as its annualized returns were significantly higher during regimes of high positive correlation than high negative correlation.

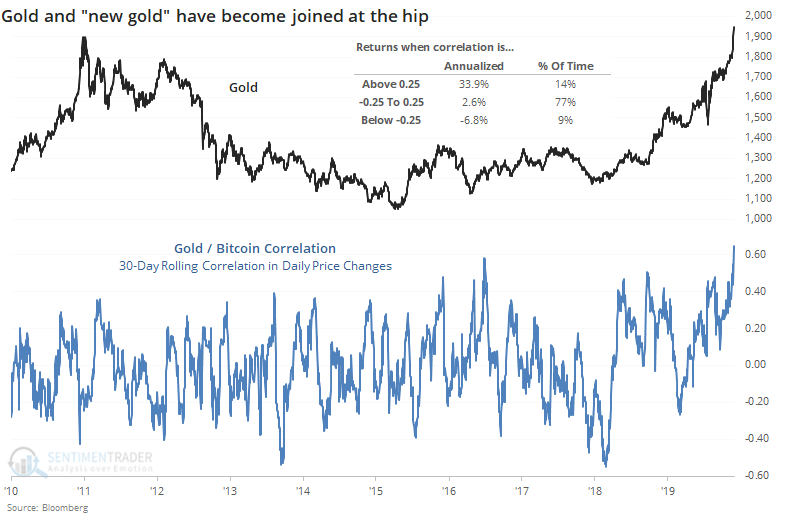

Because of the surge in gold, gold mining companies have taken off as well. The NYSE Arca Gold Miners Index (GDM), the basis for popular exchange-traded funds like GDX, has skyrocketed 34% in just the past 30 days.

That has helped to push every gold mining stock above their 50- and 200-day moving averages, a feat rarely achieved. Almost all of them are even above their shortest-term averages, and a near-record percentage of them have ticked at a 52-week high. That's astoundingly widespread buying interest in this group.

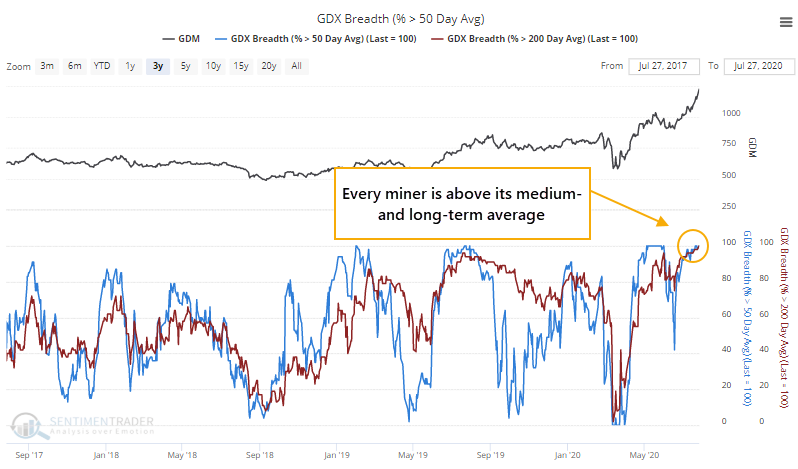

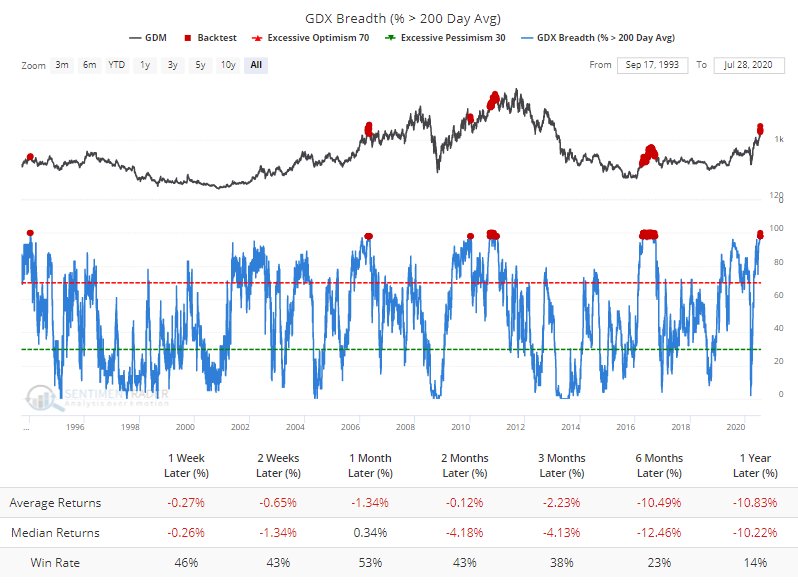

When all but a few of the stocks were above even just their 200-day averages, the index had trouble holding onto its gains per the Backtest Engine.

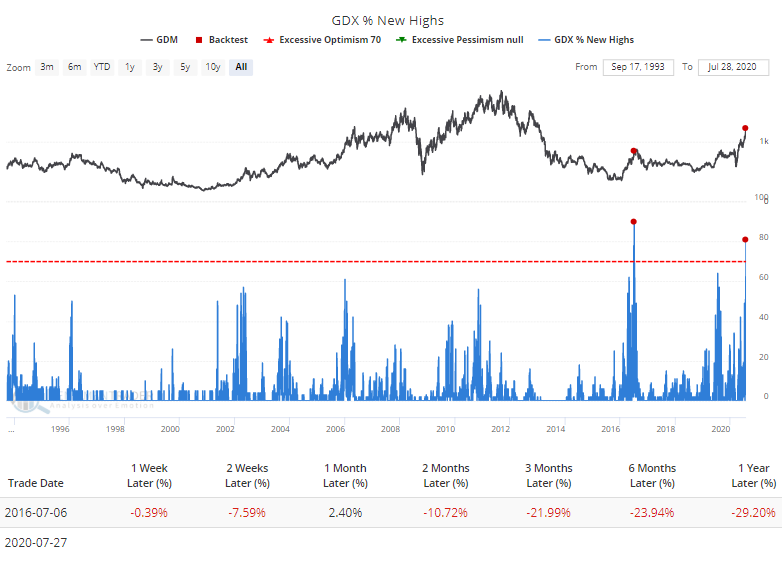

The Backest Engine also shows that there has only been one other day with more of these stocks hitting a 52-week high at the same time.

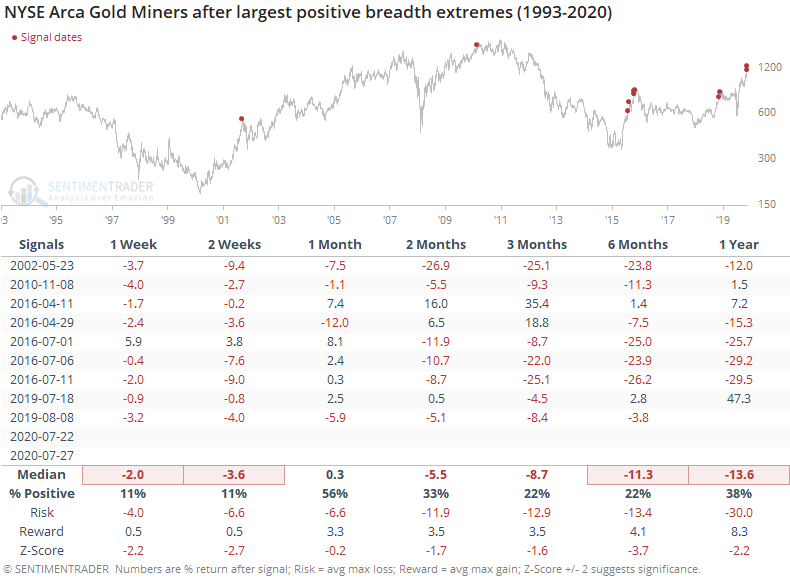

Below, we can see every time since the inception of GDM when more than 90% of the stocks were above all three moving averages, and more than half of them were at a 52-week high.

Only one date showed a gain over the next couple of weeks, and that one ended up giving those gains back. All but one of the signals showed a loss between 1-3 months after these breadth surges.

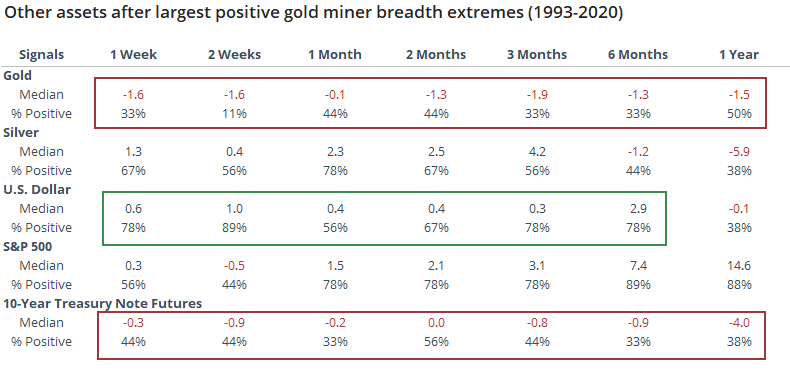

For other assets, there was less of a pattern. Weakness in miners tended to coincide with a drop in gold and a bounce in the buck, neither one being a big surprise given the returns in the table above.

We'd rate this kind of push as a fairly strong negative for gold miners here.