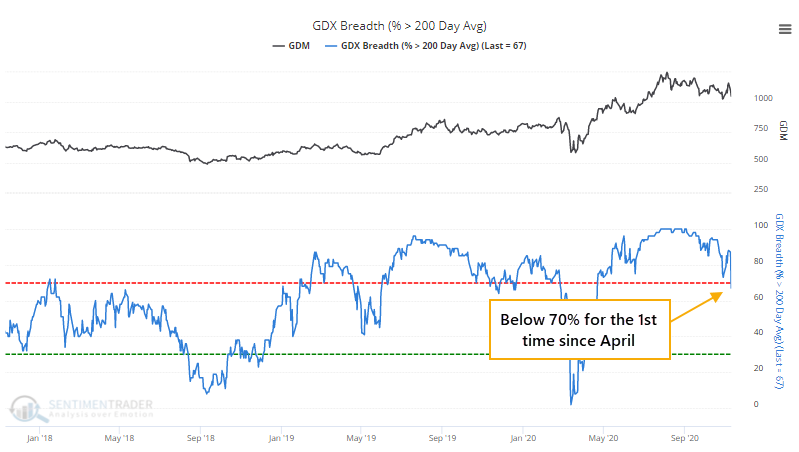

Gold miners haven't had this few uptrends in months

The relief rally this week, while historically broad, certainly didn't bring along all comers. Gold stocks have been looked at as a potential safe haven this year, even though their record on that score is mixed at best. Even so, investors saw no need for them this week.

As a result of the selling pressure, fewer than 70% of gold miners have managed to hold above their 200-day moving averages, the fewest since April.

This ends a long streak with more than 70% of miners being in long-term uptrends. Going back to 1986, there have only been a few times when more than 70% of mining stocks held above their 200-day averages for more than 6 months. The most recent one was the 4th-longest ever.

In most markets, when we see an end to a protracted streak of momentum, there is often some shorter-term weakness, but longer-term strength. Momentum does not die easily, but commodity-related markets are different beasts.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Forward returns in gold miners after ending a long streak of momentum

- Seasonality in GDX

- Fund flows and Social Sentiment for gold mining stocks

- Sentiment on the Hang Seng and Nikkei 225 has become quite frothy

| Stat Box According to the Investment Company Institute, investors pulled more than $3.3 billion from bond mutual funds and ETFs in the week ending November 4. Remarkably, that's the first outflow in more than 6 months, ending one of the longest streaks of inflows in 23 years. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

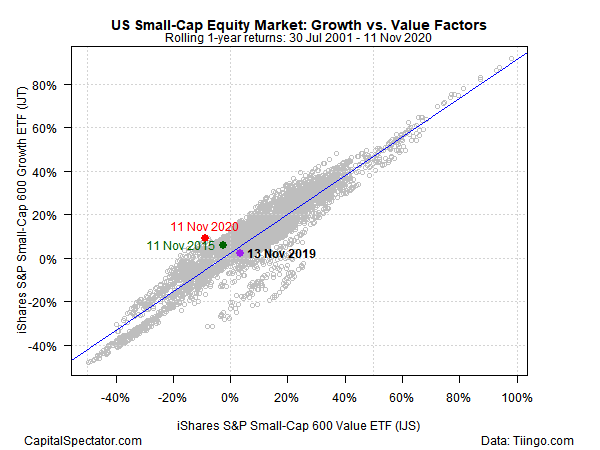

1. Investors had really shunned small-cap value vs small-cap growth stocks (until this week) - Capital Spectator

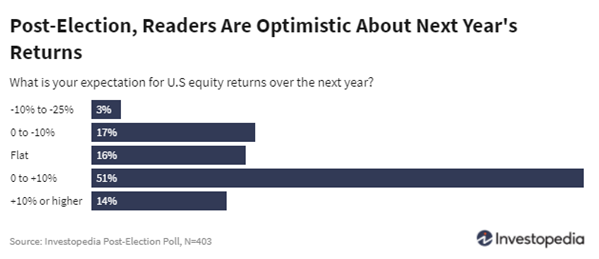

2. Readers of a popular investment website think stocks (stonks!) are going to jump in 2021 - Investopedia

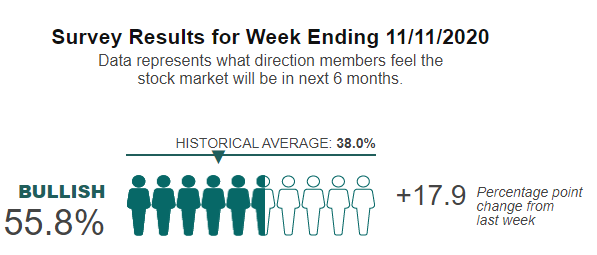

3. Mom and pop got really excited bout the vaccine news this week (it doesn't mean what you might think it does) - AAII