Gold miners enter the danger zone

Key points:

- Gold miners have collapsed by over -40% in the last five months

- While many traders are looking for an oversold bounce, history suggests that caution remains in order

- The weakest period of the year for this sector begins in late September and will last until late November

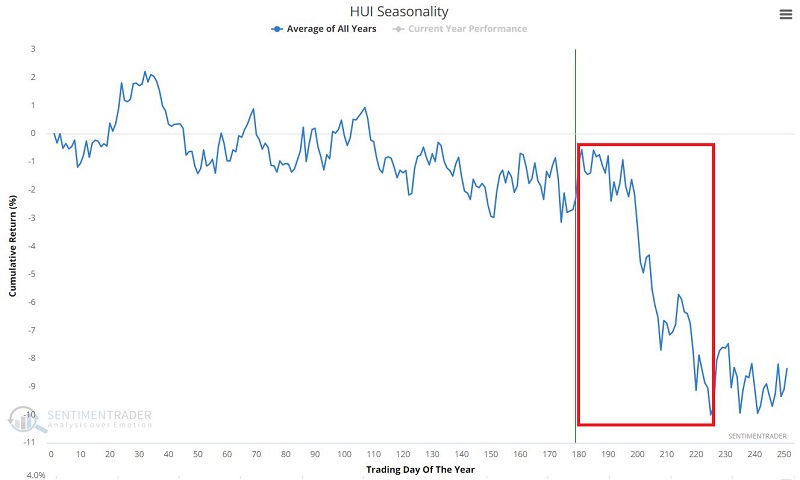

Gold miner seasonality

The chart below displays the annual seasonal trend for The NYSE Arca Gold Bugs Index (HUI). The red box highlights a period of typical seasonal weakness. The current unfavorable period begins at the close on September 21 and ends on November 22.

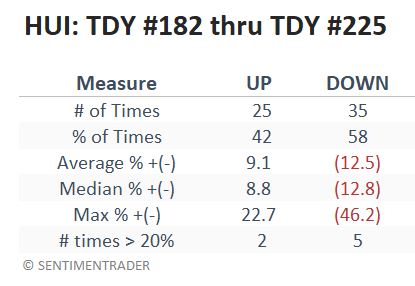

HUI unfavorable period performance

The chart below displays the hypothetical return achieved by holding HUI only during the unfavorable period marked by the red box in the chart above.

From 1962 through the present, the cumulative return during the TDY #181 through TDY #225 period was -93%. It is important to note that results can vary significantly from year-to-year. The table below summarizes HUI's performance during this unfavorable fall period.

Note that 42% of the time, gold miners showed a gain during this period. Likewise, on two occasions, HUI registered gains over +20% during the supposedly bearish period (+22.7% in 1989 and +20.7% in 1993).

Still, before trying to pick the bottom in this fast-falling sector, remember that when this particular period is bad, it is awful. Extreme caution is urged if you play the long side of gold miners from late September into late November. HUI has declined by -20% five times and by -10% or more nineteen times, or almost one out of every three years.

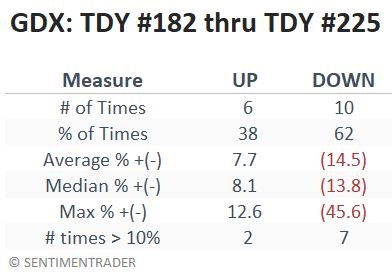

Looking at VanEck Gold Miners ETF (GDX)

The NYSE Gold Bugs is an index and cannot be traded directly. VanEck Gold Miners ETF (GDX), on the other hand, is an ETF that holds a basket of companies in the precious metals mining industry. Let's look at GDX performance during this same seasonally weak window.

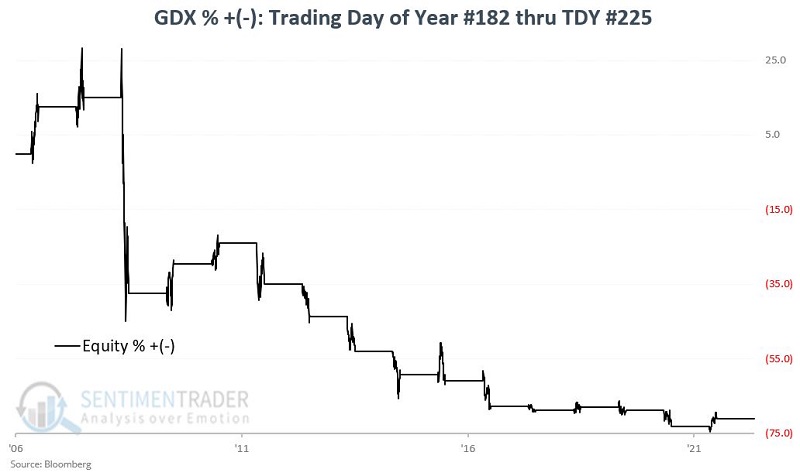

The chart below shows the hypothetical return achieved by holding GDX only during the unfavorable period marked by the red box in the chart above.

Since its 2006 inception, the cumulative return during the TDY #181 through TDY #225 period was dreadful at -71%. Once again, it is important to note that results can vary significantly yearly. The table below summarizes GDX's performance during this unfavorable fall period.

What the research tells us…

Gold stocks have taken a beating of late, plunging over -40% in the last five months. This deeply oversold condition has many traders looking for a buying opportunity and an oversold bounce. And there is certainly a chance that things may play out that way. But caution is in order for those looking to play the long side of gold miners in the months ahead as swift and severe price declines are highly common in this sector between late September and late November.