Gold is sinking, even against other metals

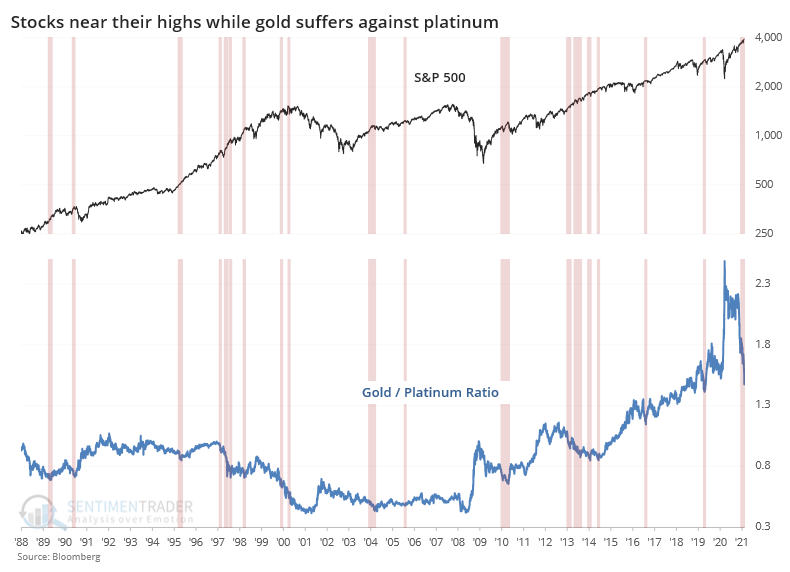

Gold has had a tough 2021, even when measured against some other metals. So much so that the ratio of gold to platinum has plunged to its lowest level in years.

Marketwatch noted that this hasn't been a great sign for stocks.

Consider a 2019 academic study in the Journal of Financial Economics: It showed that a declining gold-platinum ratio forecasts lower stock market returns over the subsequent 12 months - not higher.

A 2016 research paper by Huang and Kilic points out that:

High [gold / platinum ratio] is associated with more negative risk-neutral skewness.

In other words, gold rises against platinum during times of economic distress, and options traders price in a higher probability of adverse outcomes.

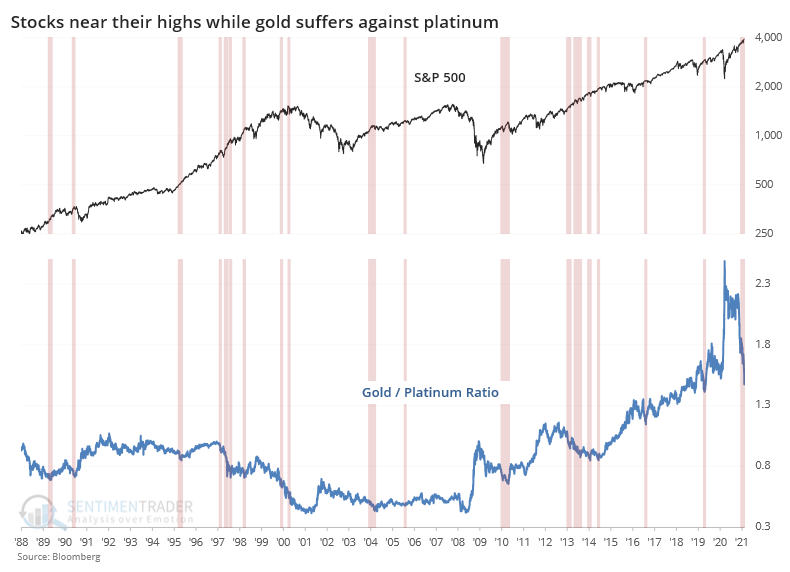

We can see the ratio below superimposed against the S&P 500. The red highlights show dates when the S&P 500 was at or near a 1-year high while the gold/platinum ratio was at or near a low.

Out of 175 days that met these criteria, forward returns in the S&P were subpar but not consistently so, especially after the first couple of months. Up to 3 months later, risk was higher than reward, which is fairly unusual given the uptrend in stocks since 1988. So, there's a bit of support for the argument that this is negative, or at least "not positive," for stocks.

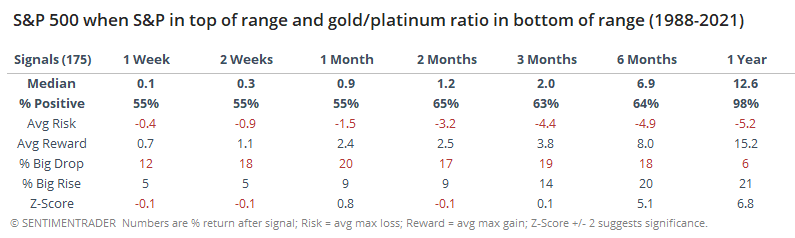

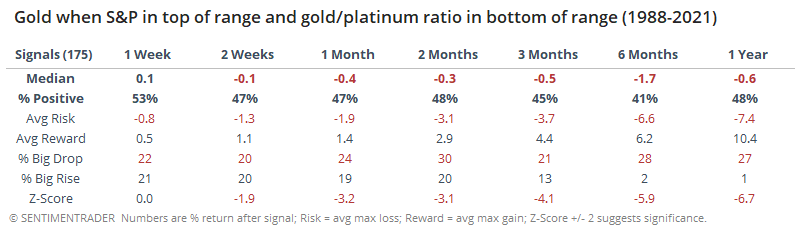

It wasn't a great sign for gold, despite the idea that it might indicate oversold conditions.

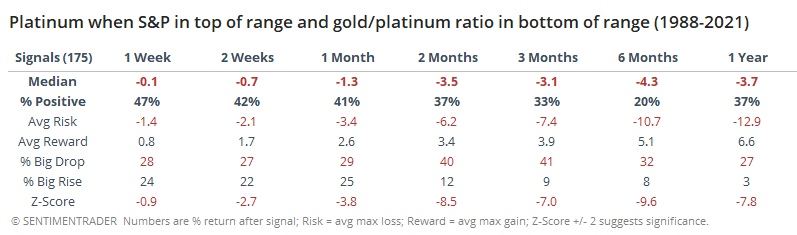

Curiously, it was an even worse sign for platinum.

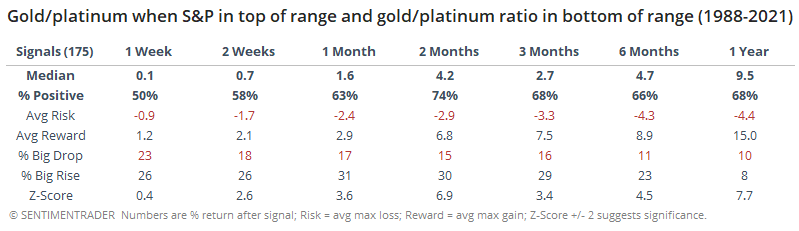

That means that between the two metals, forward returns favored gold over platinum. The ratio of gold to platinum rose over the next 2 months 74% of the time, with an abnormally positive average return.

These kinds of ratios often go in and out of fashion depending on their recent record. It's like intermarket relationships - they work great for a while, then don't. Most of them are too inconsistent to rely on, and we'd probably lump this mostly into that category. If anything, it might be a bit of a positive for gold over platinum, and kinda-sorta a shorter-term negative for stocks, but we wouldn't put too much weight on it beyond that.