Gold and the 4-Year Cycle

A lot of investors are familiar with the 4-year cycle - or "Election Cycle" - for the stock market. But does it apply to precious metals as well?

The answer appears to be, "Yes, but differently." Whereas the stock market tends to exhibit strength or weakness during specific times within each 4-year cycle, gold seems to treat each alternating 4-year period differently.

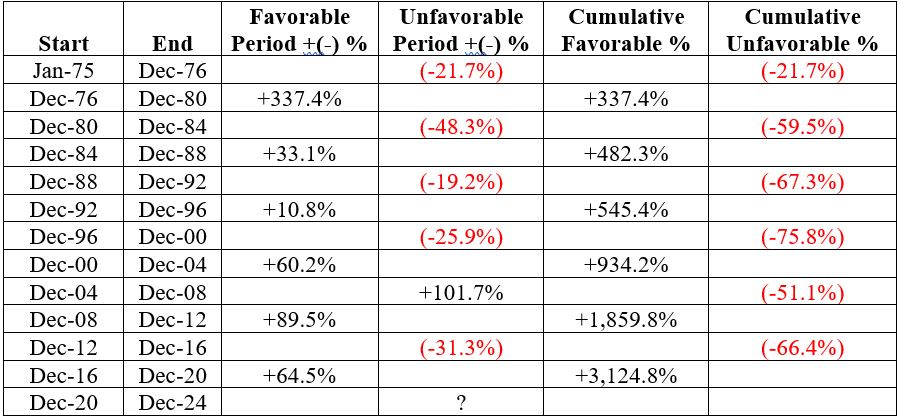

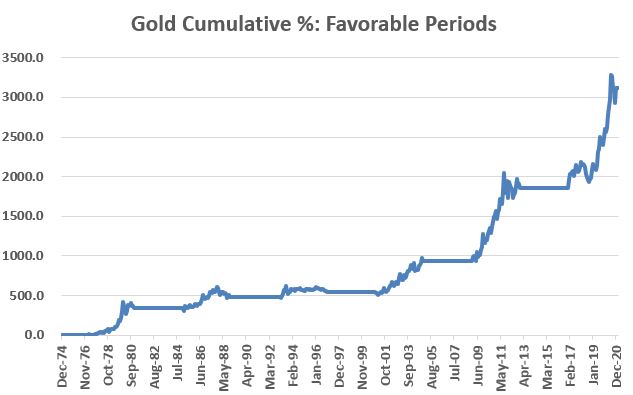

For our purposes, we will designate each successive 4-year period as "Favorable" and then "Unfavorable." So 12/31/1976 to 12/31/1980 is deemed "favorable" and 12/31/1980 to 12/31/1984 is deemed "unfavorable." And so on and so forth.

Data Note: We have monthly return data for gold bullion starting in January 1975. For testing purposes, we will deem the 2-year period of January 1975 through December 1976 as "unfavorable."

The table below displays the cumulative return for gold during each alternating "favorable" and "unfavorable" 4-year period.

As you can see, the favorable 4-year periods have seen gold exhibit strength consistently. During the unfavorable period of 2004 to 2008 gold did gain over 100% (hence the reason we deem this period as unfavorable and not outright bearish), but overall the returns have been negative during unfavorable periods.

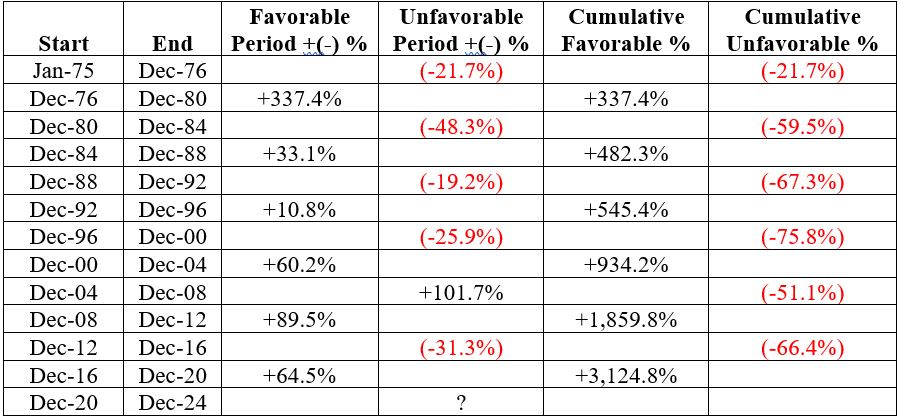

The chart below shows the cumulative price gain/loss for gold during the "favorable" 4-year periods.

The chart below shows the cumulative price gain/loss for gold during the "unfavorable" 4-year periods.

Gold entered a seasonally unfavorable period on January 1, 2021. Since then, gold has lost roughly -9%. Will the shiny metal bounce back? It certainly could (remember it gained over 100% from 2004 through 2008).

But for the next four years, any gains may have to come "against the wind" of an unfavorable 4-year cycle.