GLD and SLV premium to NAV

NOTE: I (Jason) am dealing with some family health issues, so I'm re-publishing Troy's note with some quick notes from myself, noted with [Jason]

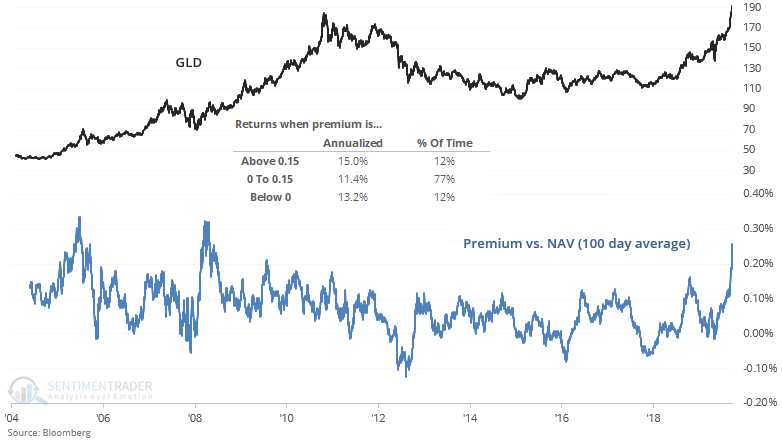

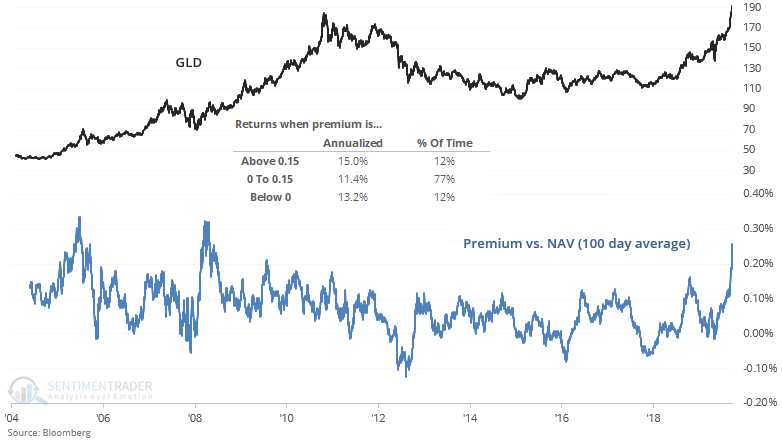

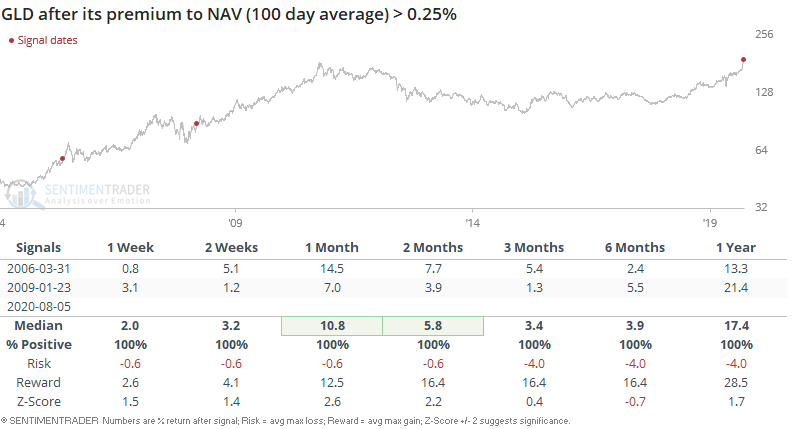

As The Market Ear noted, GLD and SLV are trading at a significant premium to net asset value. This is to be expected given investors' and traders' headlong rush towards precious metals. Looking at a longer term version of this indicator, GLD premium to Net Asset Value (NAV)'s 100 day average is at the 3rd highest level of all time. The last 2 spikes occurred during the previous 2 precious metals bull markets:

Those 2 historical cases saw gold climb further in the short term (animal spirits!) before a multi-month pullback/correction began.

[Jason]: The annualized return for GLD is actually higher when the premium is above .15% than it is when the fund is trading at a persistent discount. While some of the extremes in premium/discount preceded peaks/troughs in gold, respectively, trying to identify those peaks/troughs in real-time proved inconsistent. GLD's premium is higher than any over the past decade, lending more credence to the idea that we'll probably have more success using precedents from the 2000s bull market rather than the last decade, the potential for which we started noting last July. Some of the shorter-term extremes in gold are definitely worrying from a risk/reward perspective, but longer-term it is hard to ignore the fact that the metal itself has ignored some extremes in recent months.

Similarly, SLV premium to Net Asset Value's 100 day average is at the 2nd highest level of all time:

The record in early-2009 occurred as silver began a multi-year bull market. Back then, silver made a sharp correction before trending higher:

[Jason]: Like GLD, SLV actually showed better annualized returns when it had been at a persistent premium than a discount. Again, extremes in the premium/discount highlighted some extremes in SLV, but they were relatively short-term in effectiveness.