Gapping To A New High

Some Monday morning optimism is pushing the futures to new heights. While backing off a bit, the S&P 500 contract is at or close opening above its prior all-time record high close.

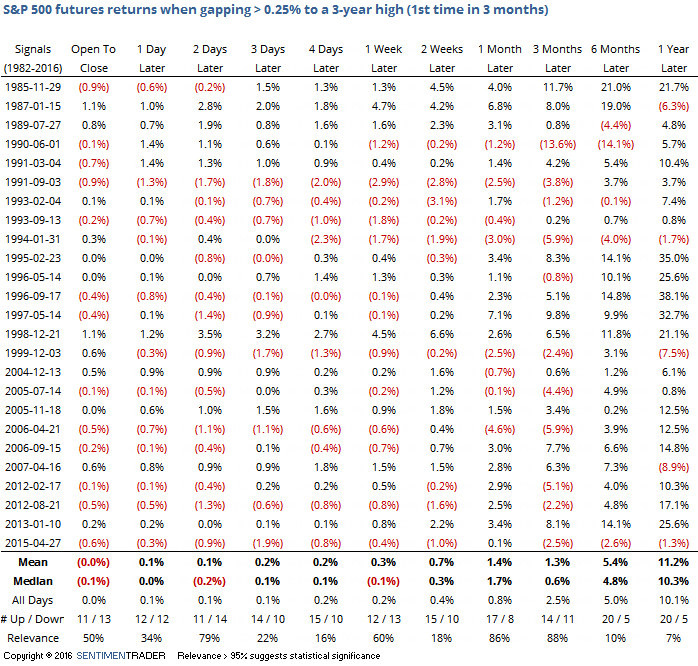

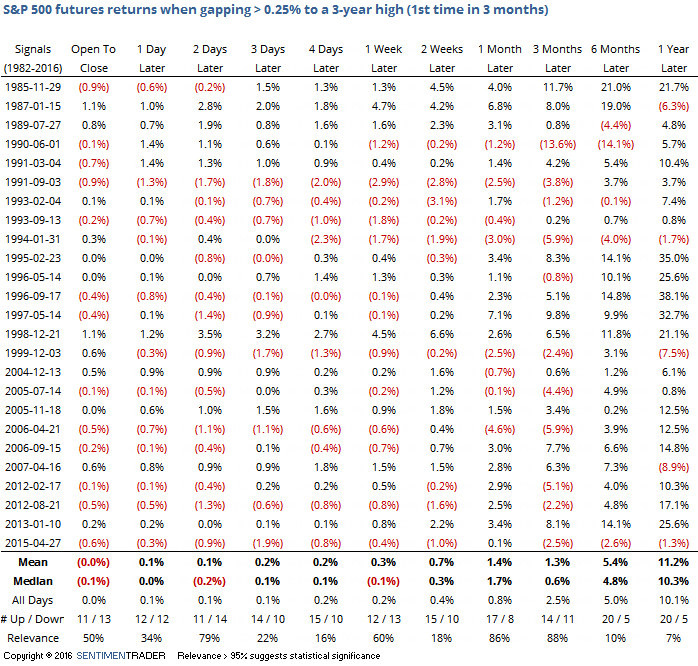

Let's go back to the inception of the futures and look at what happened the other times it opened up at least 0.25% to a new multi-year high, using only the first instance in at least three months since clustered instances don't generate as much emotion as the first instance in months. All returns are from the open of the day that gapped up (i.e. today's open).

Returns were a bit weak in the short-term. Up to a week later, there were more negative than positive returns and the median return was negative, with the worst being two days later (that would equate to today's open through Wednesday's close). By a month later, it turned quite a bit more positive and by six months later, the S&P was higher 20 out of 25 times, including every instance in the past 20 years other than the last from April 2015.

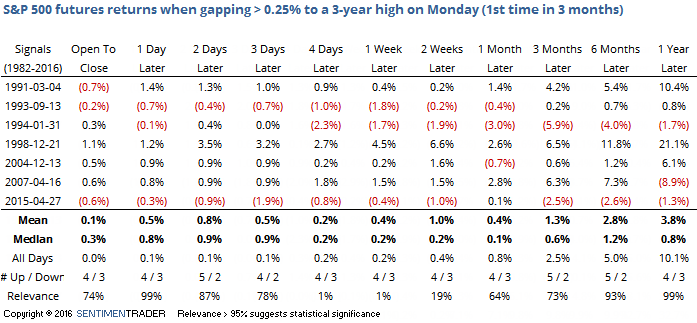

Let's take a look to see if it made any difference if the gap to new highs occurred on a Monday:

Not really. Returns improved a bit but the sample size is awfully small. Through the end of the week, the S&P gained 4 out of 7 times but its return was in line with random.

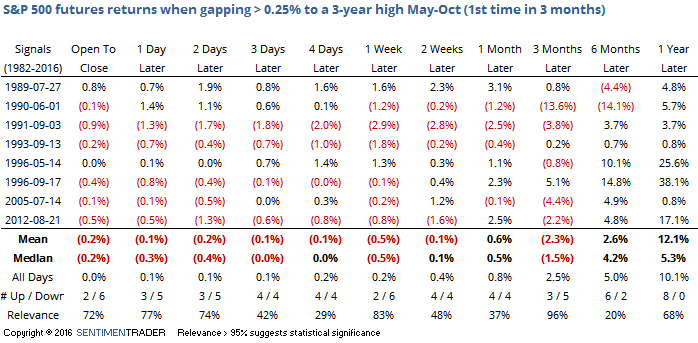

Taking a different tack, let's look at returns when this gap occurred during the summer months, May through October:

A bit more negative here. A week later, the S&P was higher only 2 out of 8 times, and both of those positive instances gave back the gains during subsequent months. Again, the sample size is small.

There is always the risk when we trade to a new high that late buyers will come in and send us on a runaway move higher. With short-term optimism at the highest level in a year, though, that scenario is unlikely. Most likely is perhaps another day of smallish gains but then some backing-and-filling. Most of what we looked at did not indicate a high likelihood of a large decline at any point, but rather small gains or (more likely) smallish losses over a multi-day period.