For the First Time in a Year, Speculators Bet on the Dollar

The U.S. is the place to be. Investors have been betting on domestic stocks and bonds to continue soaring. Might as well bet on the dollar, too.

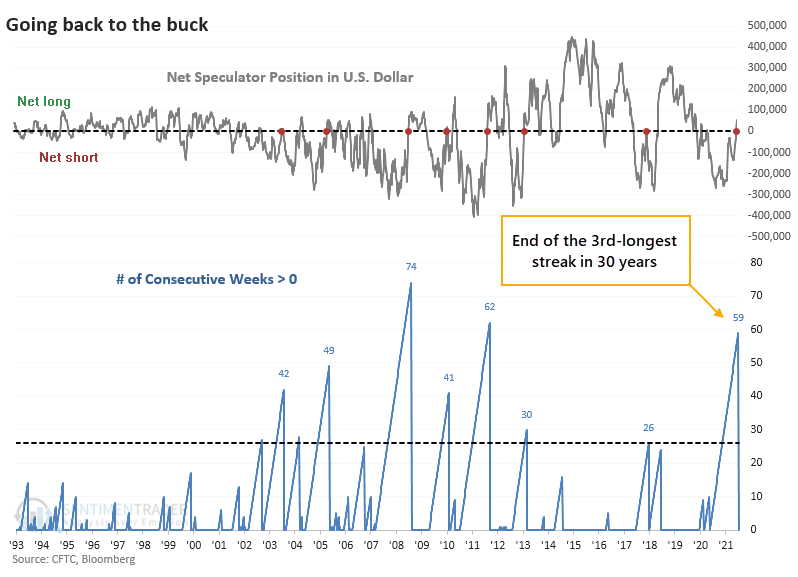

Bloomberg notes that speculators in the dollar versus its major peers have flipped to a net long position for the first time in months, meaning they're shorting other currencies against the buck. This just ended the 3rd-longest streak of shorting the dollar in 30 years.

For 59 consecutive weeks, well over a year, speculators had been short the dollar. That's just below the streak of 62 weeks that ended in September 2011, which happened to mark the end of a long period of a declining dollar.

BETTING ON THE BUCK WAS A GOOD SIGN

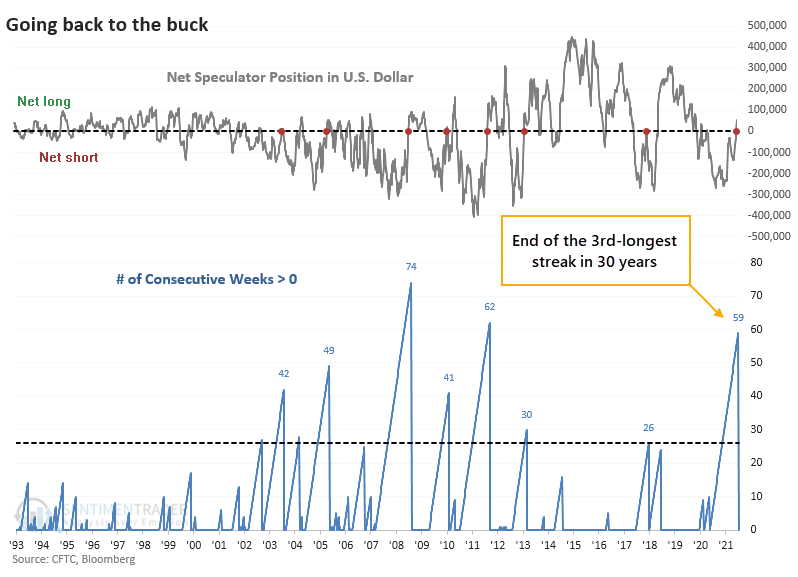

For the dollar, it was a good sign when speculators decided to start betting on the currency again after a long period of shorting it. All of the signals triggered in the past 20 years.

Over all time frames up to six months later, the dollar performed well on average. There were a few losing periods, including the most recent one. But generally, the return of these trend-following traders tended to keep pushing the buck higher in the months ahead.

OTHER MARKETS MIXED, EXCEPT FOR BONDS

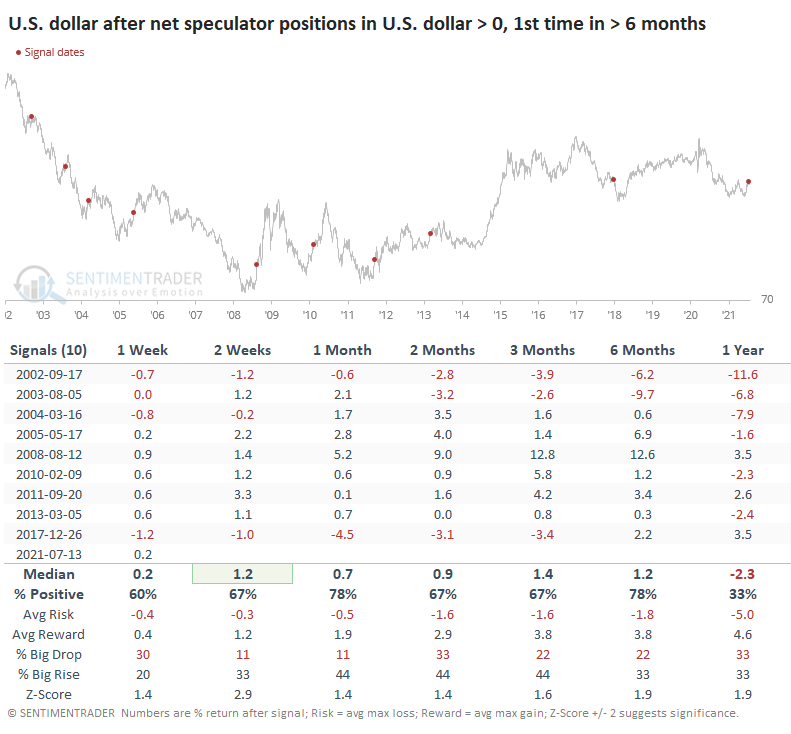

Gold did okay despite the mostly rising dollar. Thanks to most of these signals triggering during the mid-2000 run-up in gold, it did not suffer consistent losses. There were some big ones in there, and it's not like this was a good buy signal for gold, it's just that it didn't consistently plunge due to a rising dollar.

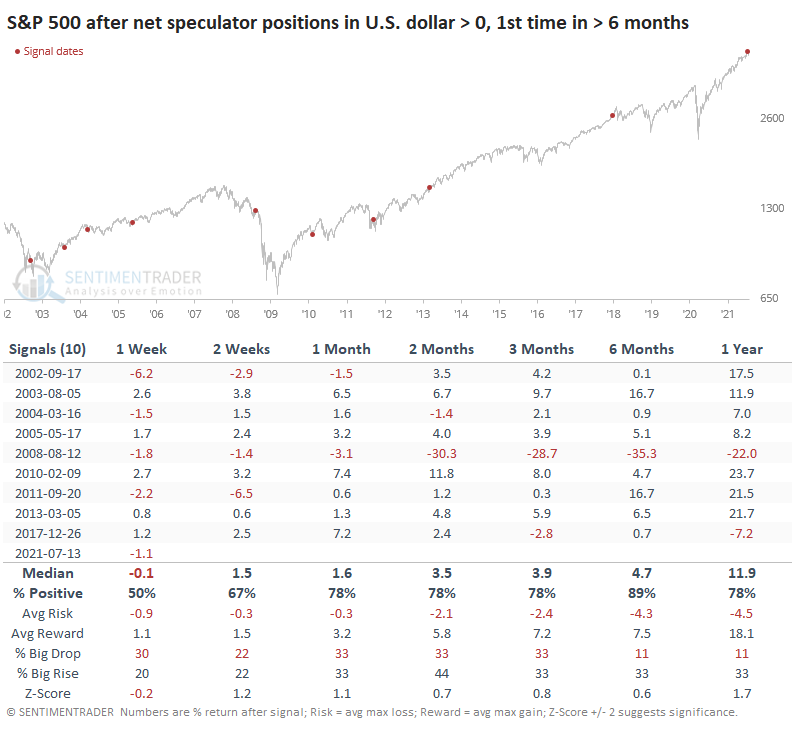

For U.S.-based large-cap stocks, the rising dollar mostly preceded higher returns. The last 20 years have been overwhelmingly dominated by bull markets, so we should fully expect positive returns. Even so, the ones after these signals were better than random, with the glaring exception of August 2008.

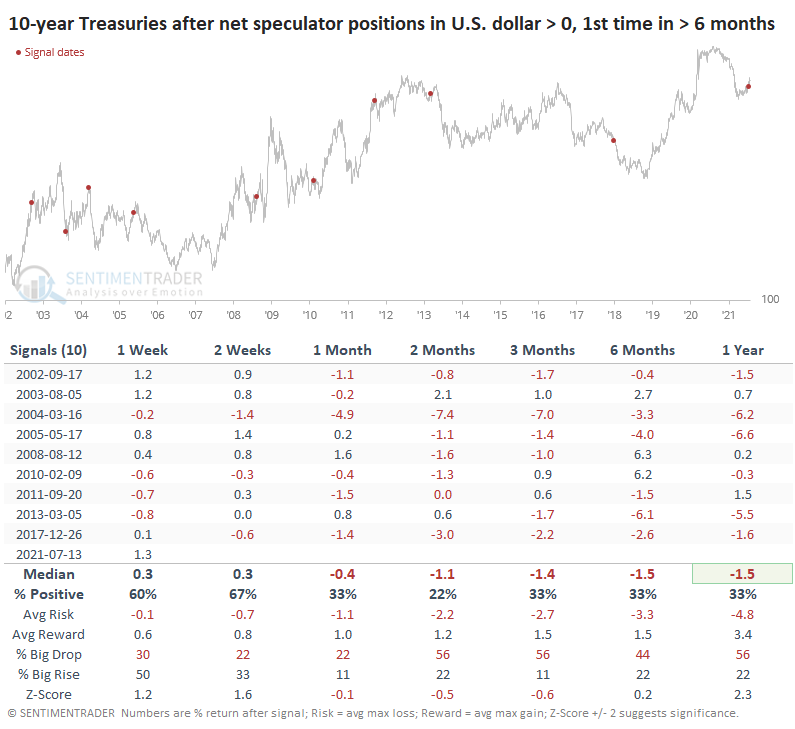

Bond futures did not react well to speculators returning to the dollar. Every signal showed a loss in 10-year Treasury note futures at some point between one and three months later.

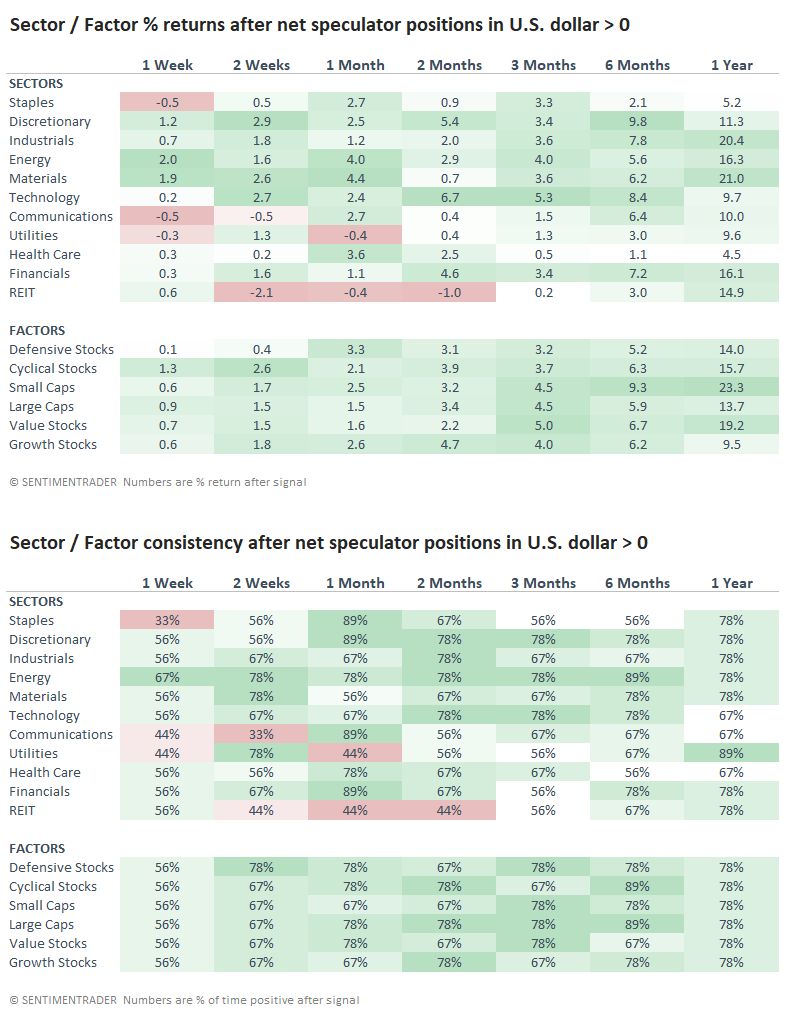

For sectors and factors, the tendency for bonds to decline (and interest rates rise) meant that rate-sensitive sectors like Utilities and REITs struggled over the short- to medium-term.

The dollar is trying to overcome a long-term downtrend, and a persistent tendency for speculators to short every rally doesn't help. That behavior has been changing lately, however, and if these traders now have the mentality of buying dips, it could be enough to at least temporarily change the risk/reward in the dollar back to the positive side.