Extremely high volume

Volume tends to explode whenever markets are extremely volatile. Good news from the Fed today? Lots of buyers, stocks up 3%. Bad news on the coronavirus front tomorrow? Lots of sellers, stocks down -5%. The fight between government intervention and a pandemic-driven recession has caused many investors and traders to panic.

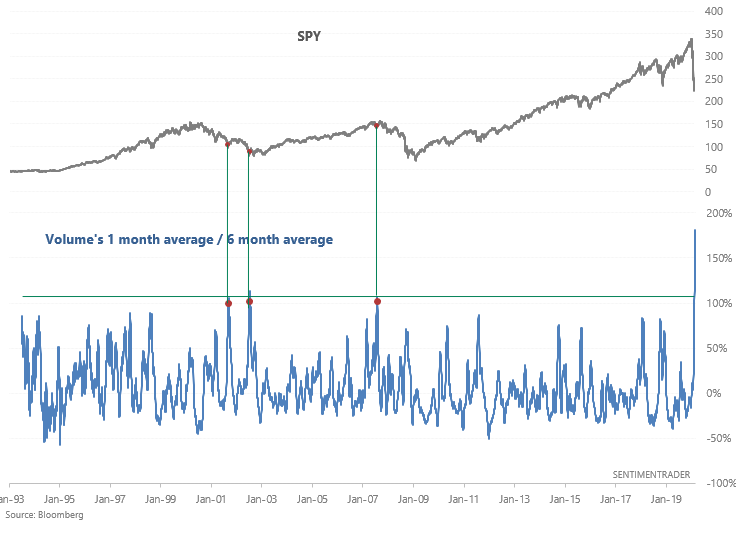

Volume in SPY over the past month has been 180% more than its 6 month average. This is the most rapid volume spike in history.

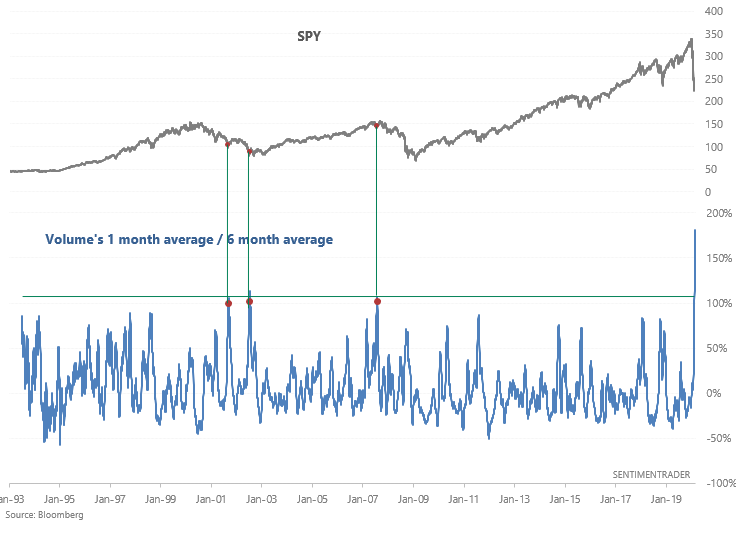

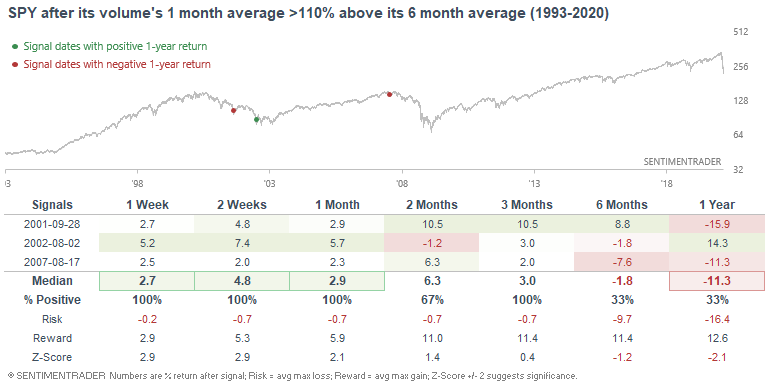

There are only 3 similar historical cases, and none of them even come close to the kind of sudden frantic activity we've seen recently. 2 of them marked major medium term bottoms in the 2000-2002 bear market, and 1 of them marked the last correction's bottom in a bull market before stocks rallied to marginal new highs and then slide into a bear market.

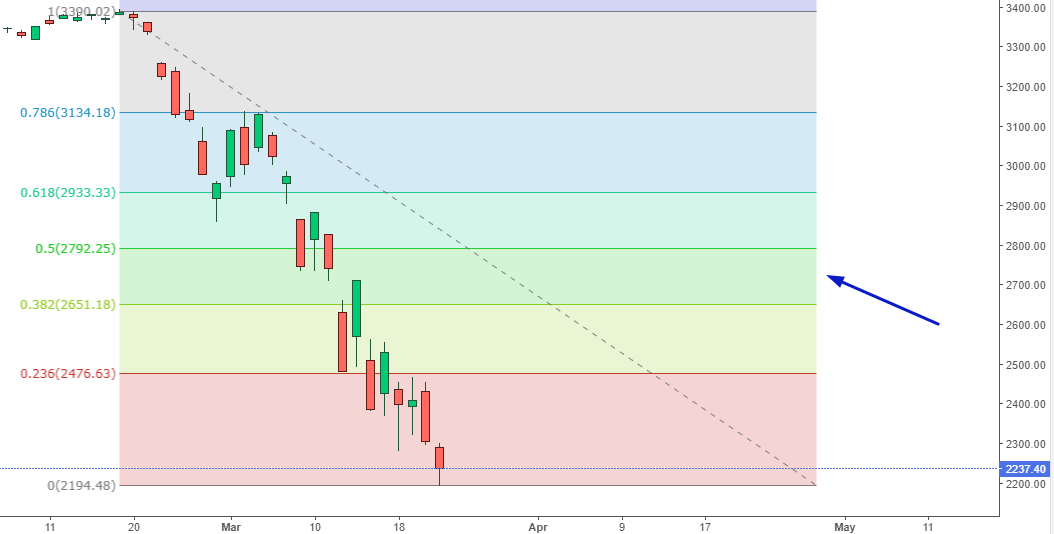

As you can expect, all 3 historical cases saw large rallies over the next 2-3 months. A fib retracement of 38.2%-50% is entirely in the cards:

Chart from TradingView

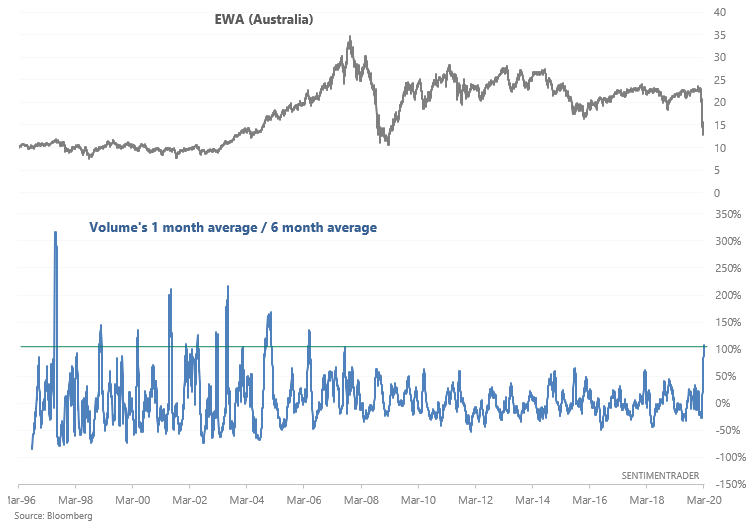

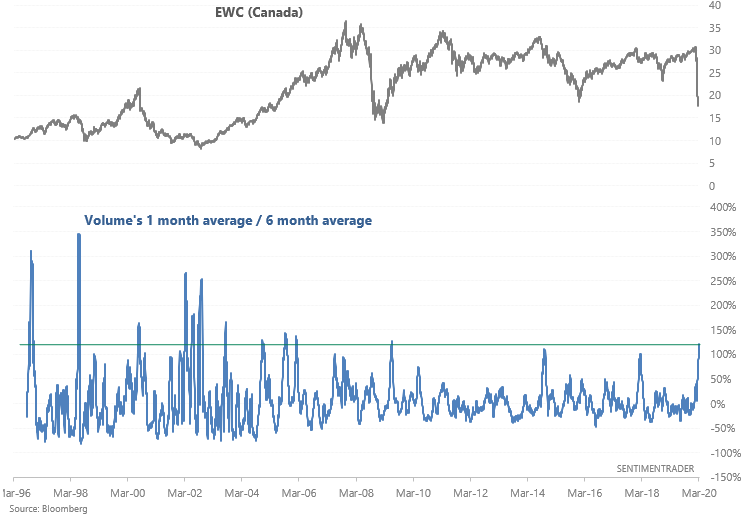

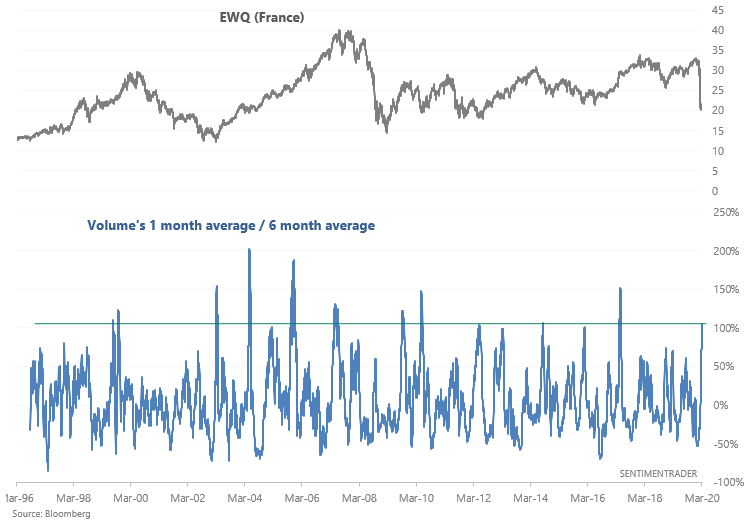

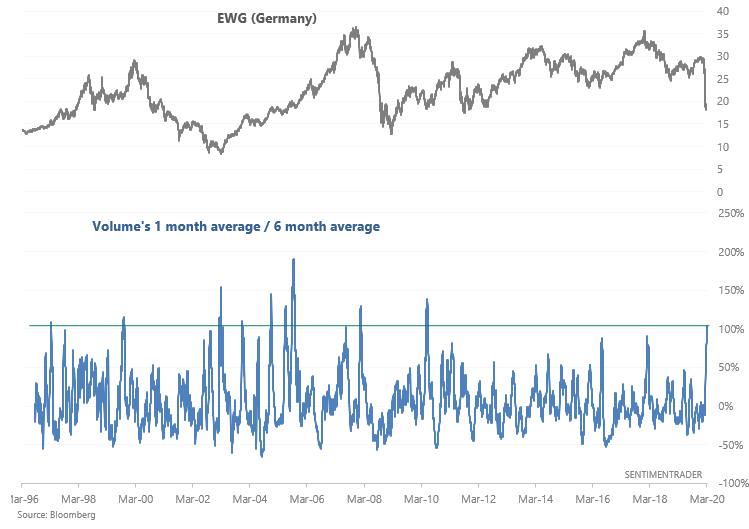

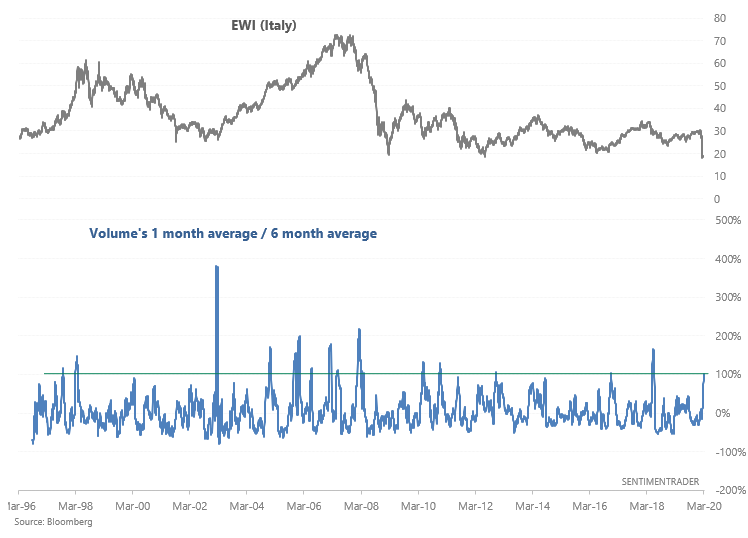

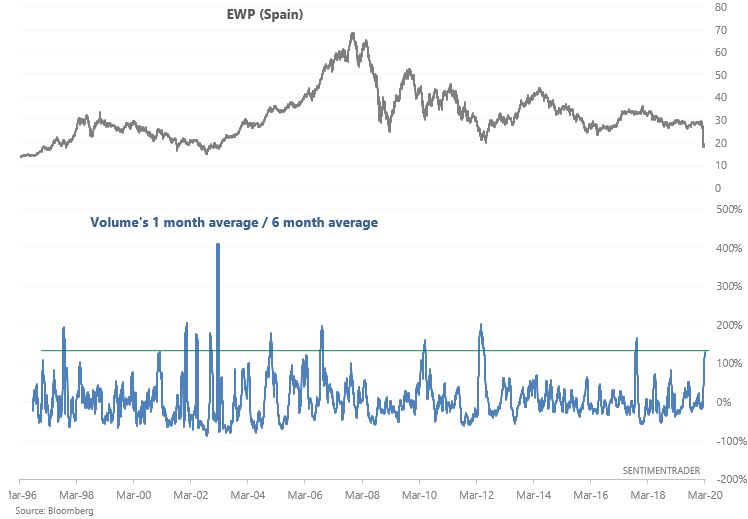

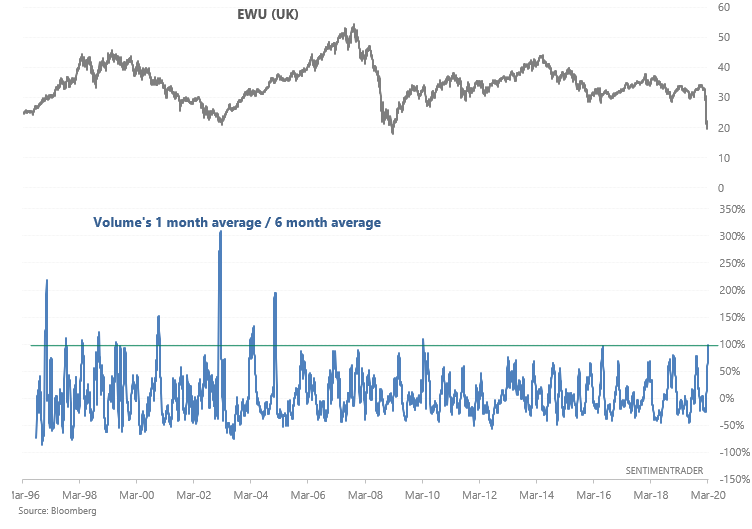

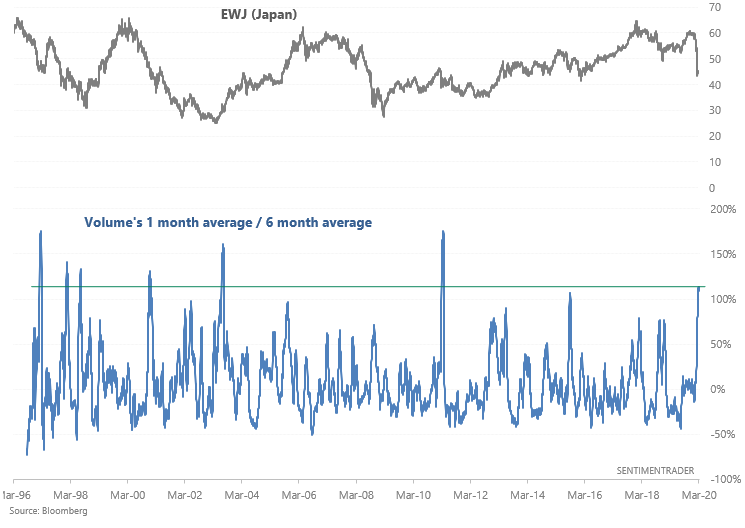

It's not just volume in the U.S. that's exploding. Volume in other countries' ETFs has exploded to the highest level in years as well.

Australia:

Canada:

France:

Germany:

Italy:

Spain:

UK:

Japan:

Volume will probably recede once the stock market rallies. That isn't bearish or bullish - it's normal. Volume expands on a declining stock market and recedes on a post-crash rally.