Everyone wants out of U.S. stocks

Key points:

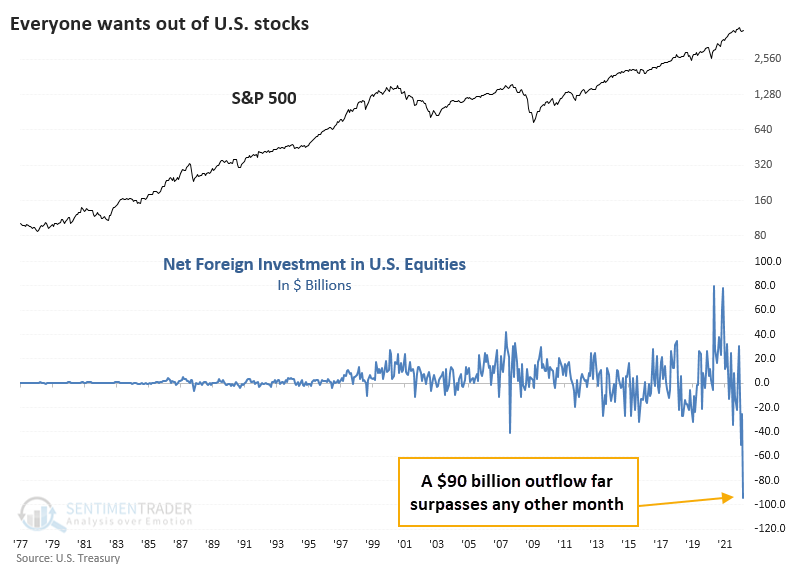

- Foreign investors pulled more than $90 billion from U.S stocks in March, following a massive outflow in January

- At extremes, foreign investors are no better market timers than domestic ones

- S&P 500 returns tend to be positive following large outflows relative to the market cap of stocks

A record outflow from stocks

Everyone wants out of the U.S. Despite claims that the U.S. is the only relatively safe place to be, and despite a rising dollar, sentiment toward U.S. stocks is horrid. That's true among people that live here and people that don't.

According to the U.S. Treasury in a just-released report, foreign investors pulled a stunning $90 billion from U.S. equities in March. That's more than double the previous record outflow...and that was just in January of this year. It's likely gotten worse since then.

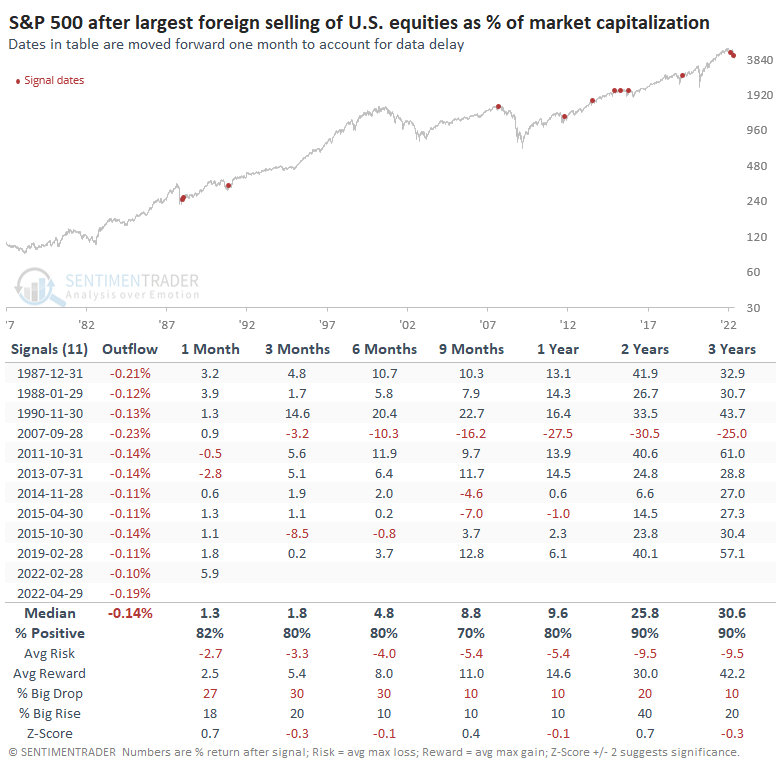

We've covered this report in the past, concluding that foreign investors are no better market timers than domestic investors. At extremes, they're pretty terrible.

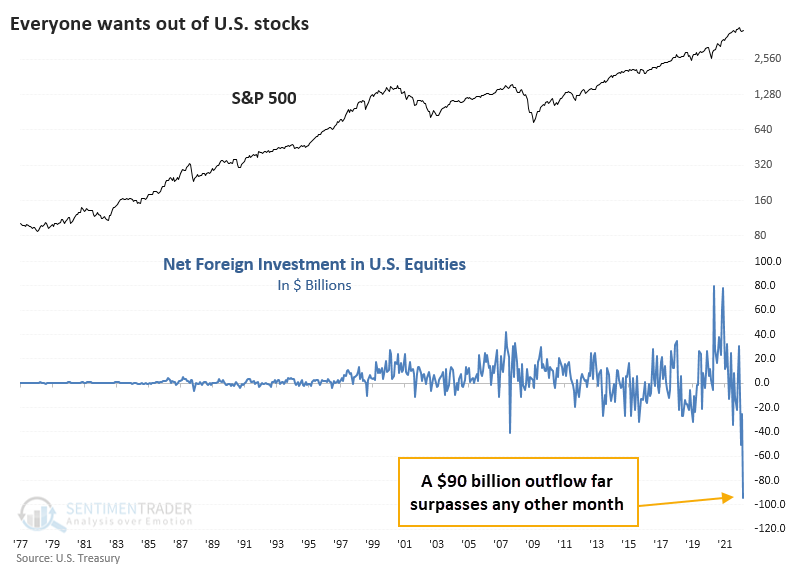

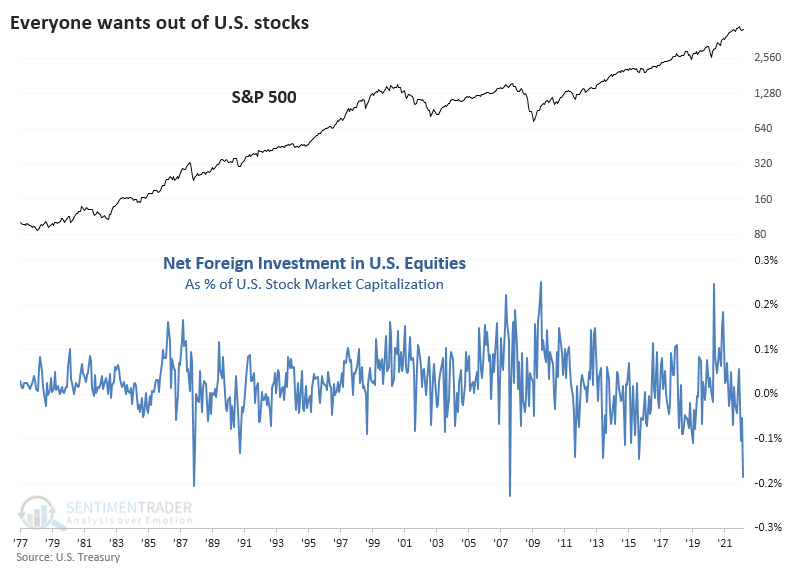

Hopefully, the chart above sets off alarm bells because it's misleading. The gigantic outflow was that in absolute terms, but the value of U.S. stocks has risen dramatically over the past 40+ years. Even when expressed relative to that value, the recent outflow still ranks as the 3rd-largest since 1977.

After the most significant outflows, the S&P 500 tended to rebound. The dates in the table are moved forward one month to account for the delay in reporting from the Treasury.

The only time foreign investors nailed the move and presciently yanked massive amounts of money out of stocks was in the late summer of 2007. Unfortunately for them, they quickly reversed course. From September 2007 through March 2008, they were net buyers of more than $100 billion.

What the research tells us...

It's hard to find a group of investors, or increasingly even a single investor, who believes that prospects for U.S. stocks are excellent over the next year or so. Maybe some are looking for a temporary relief bounce, but the media is filled with reports of pessimism and the idea that "we're not there yet because investors haven't capitulated." That idea is getting a lot of play, confirmed by quite a few objective measures. And it would be rare for stocks to see a sustainable bottom without a bout of true capitulation in this kind of environment. But more and more behavioral measures show that sentiment is so dour that it would be rare not to see that potential rebound, even if it's only temporary.