ETF Traders Not Buying The Rally; Nasdaq Is First "Big Four" Above Average

This is an abridged version of our Daily Report.

Not buying it

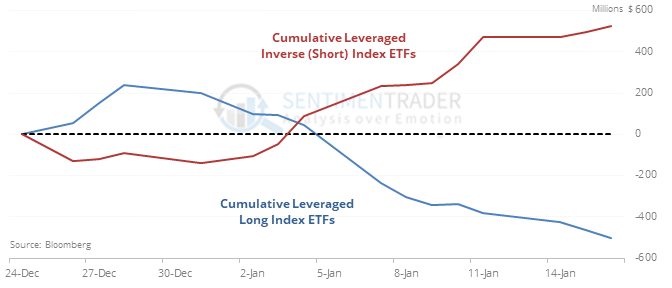

In the three weeks following the December low, leveraged ETF traders have abandoned long funds while flowing into inverse (short) funds, suggesting they’re betting against the rally. When we look at the largest leveraged index ETFs with at least five years of history, we see that since the December 24 low, the long funds have lost a cumulative $501 million. At the same time, leverage inverse funds have seen a cumulative inflow of $523 million. It seems like ETF traders are showing extreme skepticism about this rally.

This is typical behavior, and the past few weeks have been about average for rallies when these traders were not embracing a rally. It led to better shorter-term returns than when they flowed into long funds and out of inverse ones.

Tech first

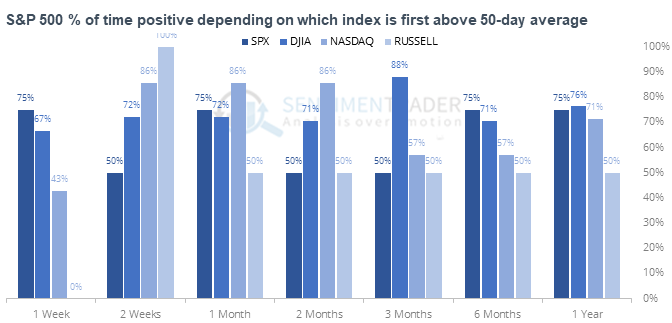

Out of the “big four” indexes, the Nasdaq Composite was the first to climb above its 50-day moving average. This is considered a good sign of returning risk appetite, but it has been better for future returns when the S&P 500 or DJIA were the first to close above their averages, and worse for forward returns when the Nasdaq or Russell 2000 was the leader.

Challenging

According to the sector ranks later on in this report, Financials are the most-loved sector after Wednesday’s jump. The Optimism Index for the XLF financials fund has soared above 90. According to the Backtest Engine, there have been 47 days when it was above 90 and the fund was below its 200-day average. It added to its gains over the next week 15 times (a 32% win rate).