Energy sector surge suggests higher prices

Key points:

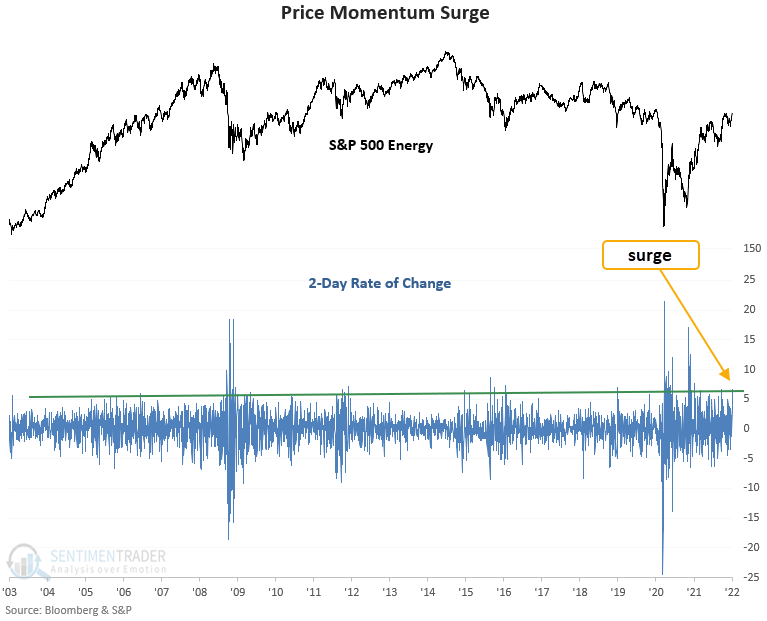

- The 2-day rate of change for the energy sector surged by 6.6%

- The sector rallied 83% of the time over the next 6 months after other signals

Momentum begets more momentum

The S&P 500 energy sector has risen by 6.66% over the previous 2 trading sessions. This is the best start to a new year for energy stocks in history.

Let's conduct a study to assess the outlook for the sector when the 2-day rate of change increases by 6.5%. I will screen out repeats by only including the first occurrence in the previous 2 months, which is the case now.

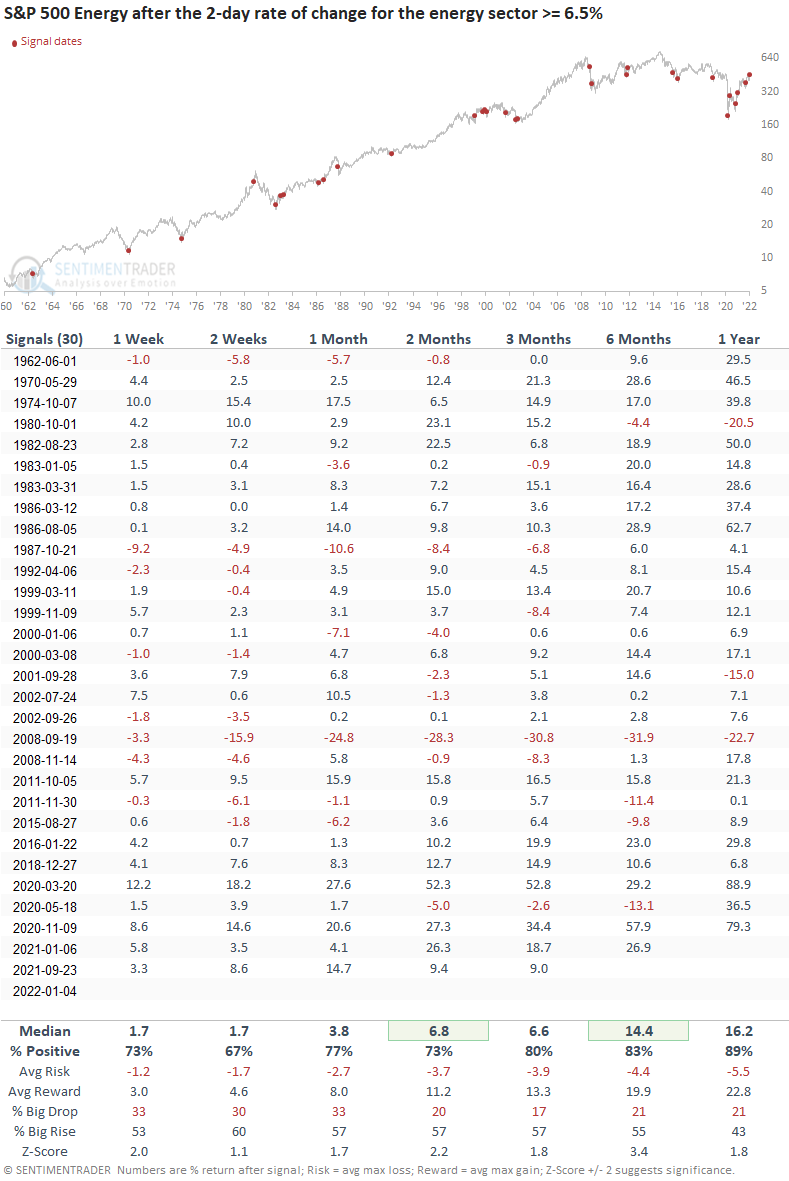

Energy stocks rallied 83% of the time after other signals

This signal has triggered 30 other times over the past 60 years. After the others, energy sector future returns, win rates, and risk/reward profiles were solid across all time frames, especially the 6-month window. A year later, the energy sector was higher 89% of the time. And, the drawdowns in that time frame were all associated with recession/bear market environments.

Most instances occurred after a significant correction or bear market phase. That condition provided a solid backdrop for future returns.

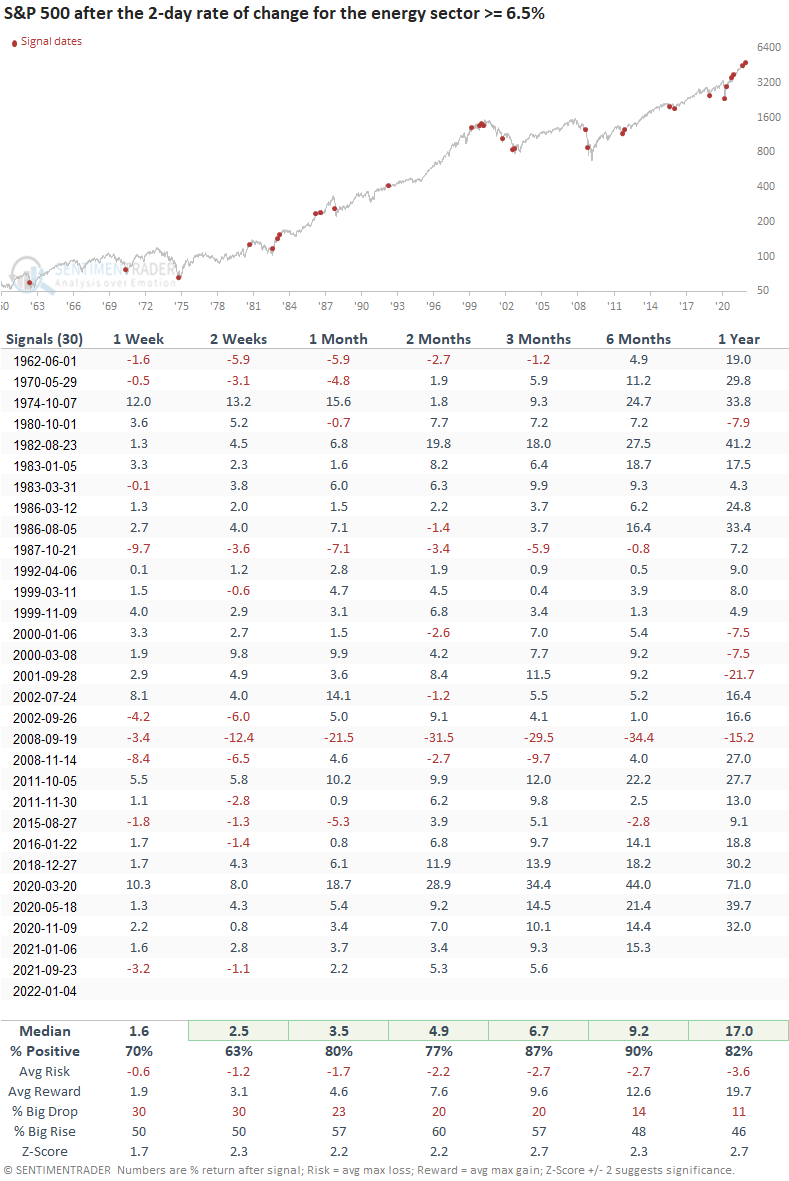

The S&P 500 performs well after the energy sector surges

The broad market shows excellent results, win rates, and risk/reward profiles when the energy sector surges. However, as was the case with the energy sector, we need to remember that most signals occurred after a correction or bear market.

What the research tells us...

When energy stocks surge over a trailing 2-day period, the price momentum begets more momentum. Similar setups to what we're seeing now have preceded rising energy sector prices across all time frames.