Emerging Market Central Bank Policy Rates

Central banks around the globe have begun the process of normalizing interest rates after one of the most profound easing cycles in history. Emerging markets are leading the charge as inflationary pressures are driving the shift in monetary policy. Remember, inflation acts as a tax on the poor and impacts corporate margins for specific industries that have no pricing power.

Let's review the outlook for emerging markets when inflation rises and central banks tighten monetary policy.

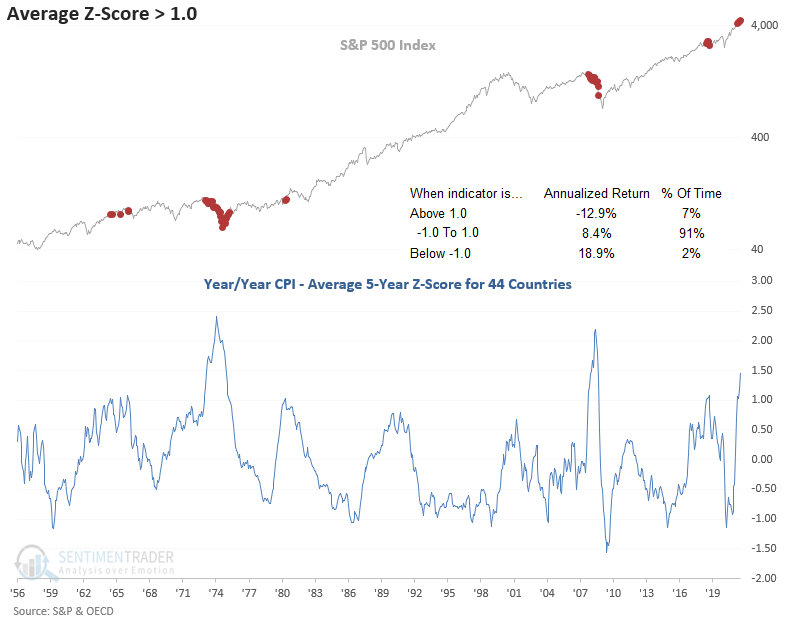

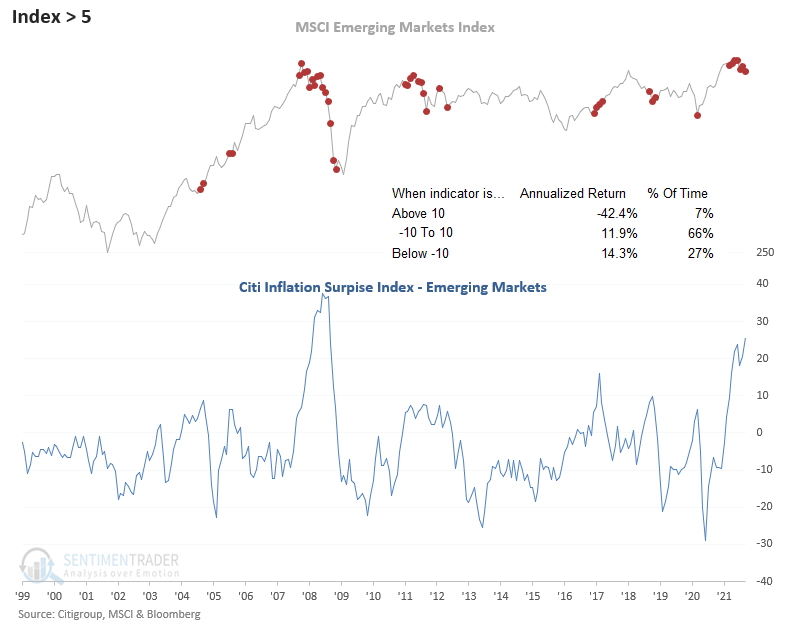

HISTORICAL INFLATION CHART

The following indicator applies a rolling 5-year z-score to the Y/Y change in CPI for 44 countries and measures the average for all countries. When the average z-score surpasses 1.0, stocks suffer.

Inflation is a global phenomenon.

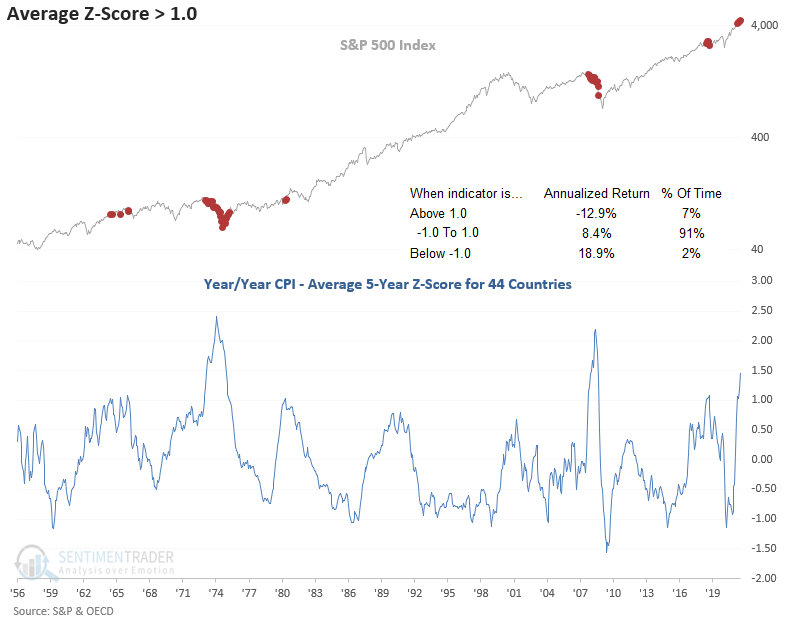

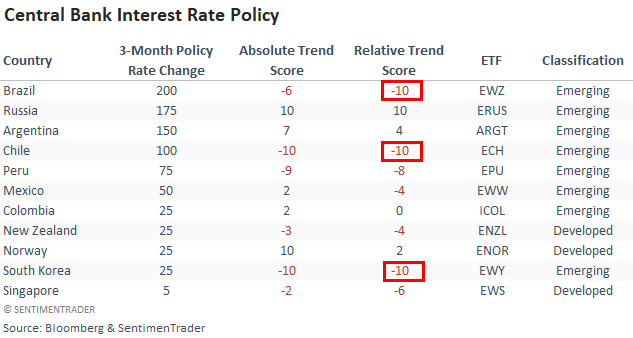

The following table contains countries with a positive 3-month change in central bank policy rates. I selected the countries from a Bloomberg policy rate table that includes 53 countries.

Emerging market economies are dominating the list of countries with a tighter interest rate policy.

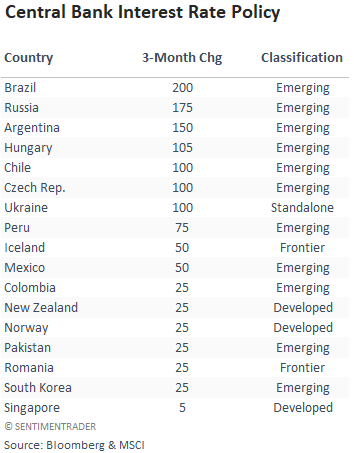

EMERGING MARKET INFLATION

The Citi Inflation Surprise Index for emerging markets has now risen to the highest level since 2008. The index measures price surprises relative to market expectations. As the table shows, a level above 10 is unfavorable for the MSCI Emerging market Index.

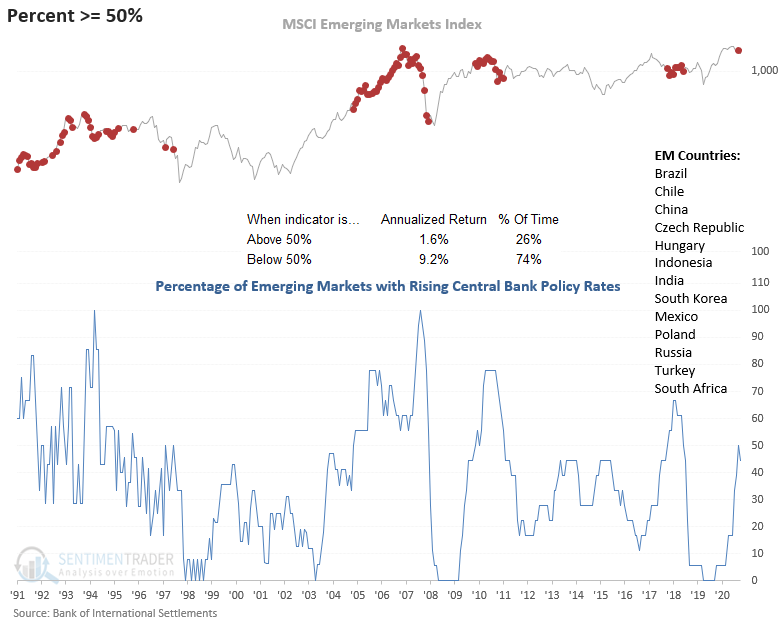

The following chart contains an indicator that measures the percentage of emerging market countries with increasing policy rates. The calculation uses 13 essential economies, including the BRICs. The indicator touched 50% in August before dropping in September due to a rate cut in Turkey. Annualized returns diminish when the percentage increases above 50% and turn markedly negative when above 60%.

Let's look at central bank policy for countries with a USD-based ETF and include the absolute and relative trend score indicators from my Monday morning ETF Update. As the table shows, several ETFs maintain weak comparable profiles versus the S&P 500, especially Brazil, Chile, and South Korea. Russia is bucking the trend as the country is heavily tied to energy resources.

Scores range from 10 highest to -10 lowest.

Never fight the fed is one of the golden rules of investing. When central banks act, take note. As the data shows, a broad-based allocation to emerging market stocks looks unfavorable until EM central banks decide to change course.