Economists have become too negative

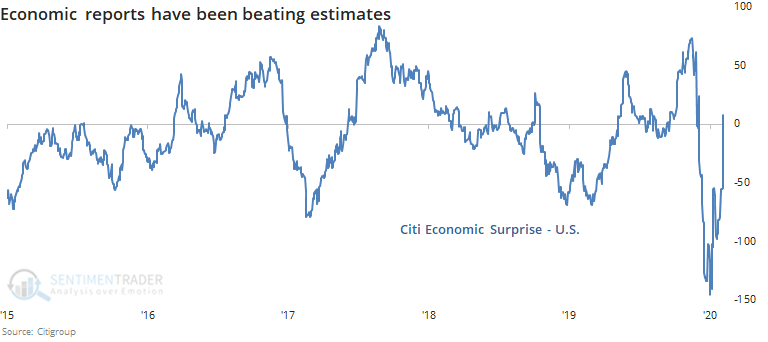

Despite the gloomy headlines, economic reports have been better than expected. Thanks in large part to reports that were much better than economists' guesses on the labor market (which continued on Friday in a massive way), the overall tone of economic surprises have turned positive after the worst reading in history just a few weeks ago.

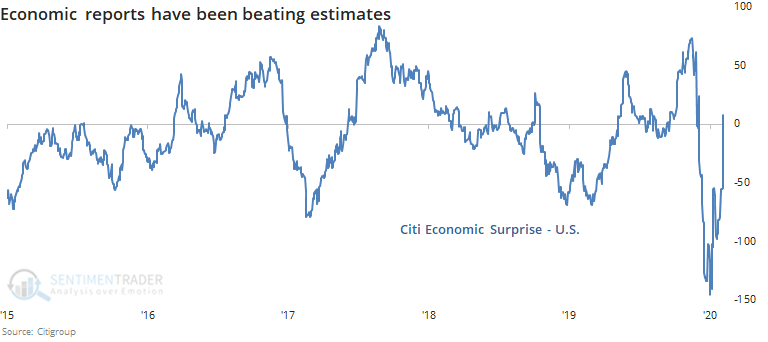

Bloomberg's version of economic surprises generally tracks well with Citigroup's, and we can see that among individual components, labor market surprises have helped push up the overall indicator.

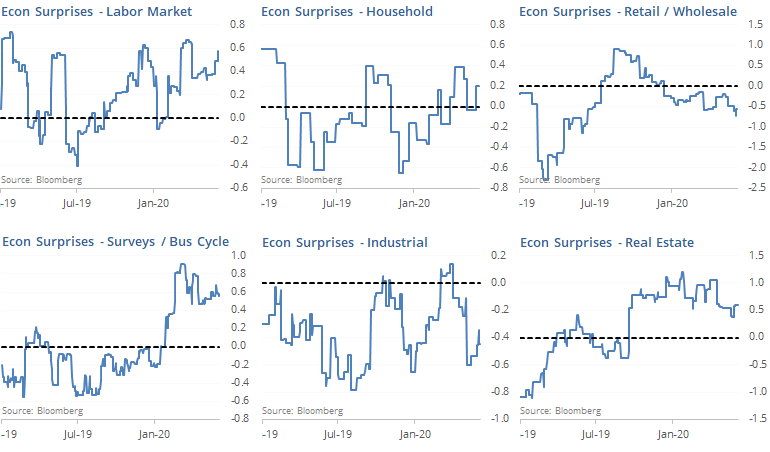

There is a strong tendency to link economics and markets, which is usually a mistake. While it sounds good in theory that improving economics, relative to expectations, should drive stocks higher, it was inconsistent as a driver of forward returns for the S&P 500.

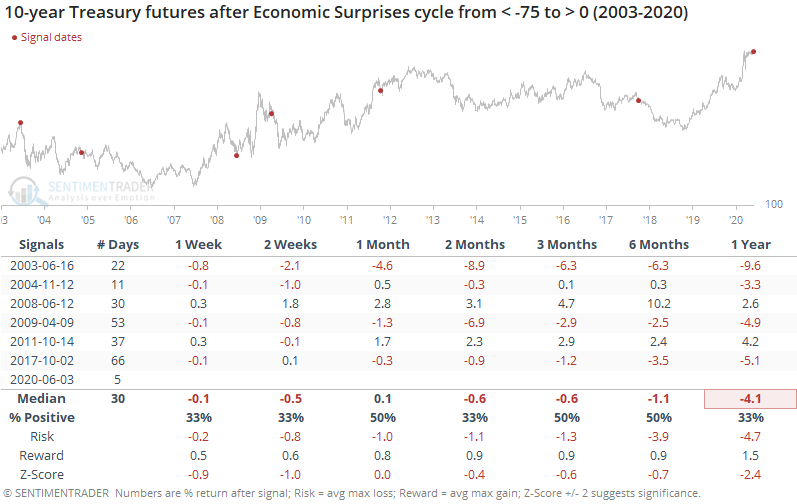

It was not so great for bonds. 10-year Treasury futures often got slammed after these reversals.

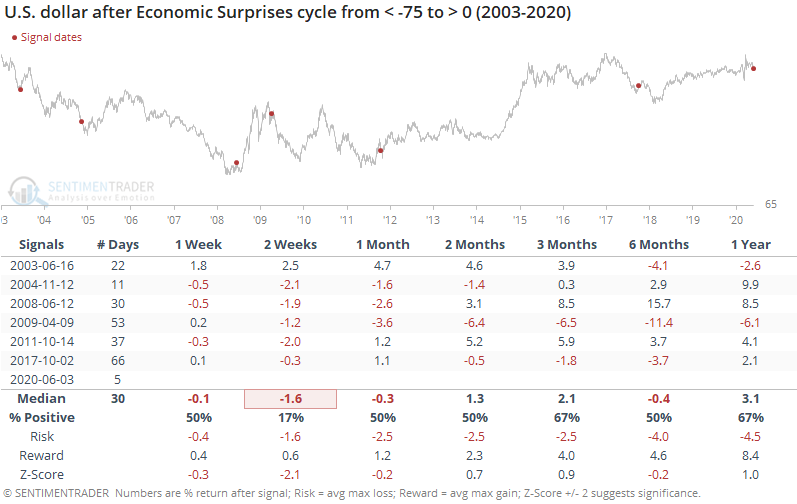

The dollar tended to sink right away, then was mixed.

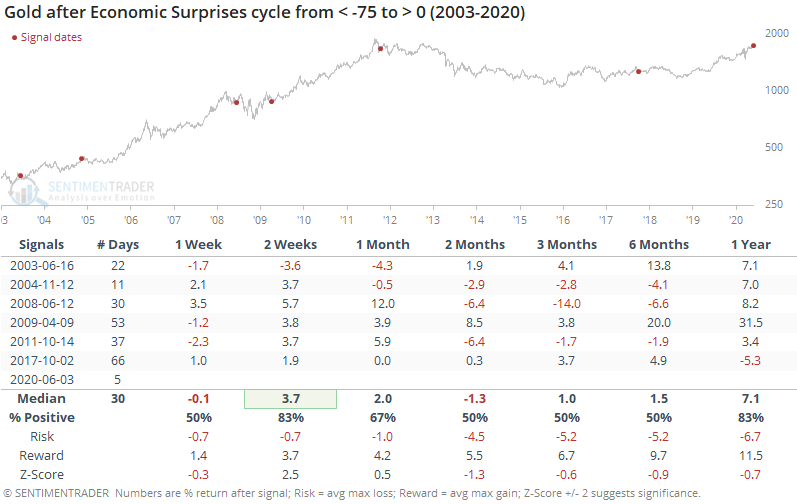

Because the dollar tended to sink shorter-term, it benefited gold, but after that, there was no clear pattern.

With continued improvement in the labor indicators, we'll likely see the various economic surprise indicators jump in the days ahead. They will be shared far and wide, and assumed to be continued good news for stocks. For the most part, it is a positive, but a minor one only.