Dollar Index (DXY) Surge on Fed Decision Day

The Dollar Index (DXY) surged 95 bps on the Fed decision day on Wednesday. As one can see, it's following through today by tacking on additional 55 bps as I type this note. The commodity complex and stocks that are highly correlated to commodities are having a rough day.

Let's assess potential forward returns for the Dollar Index (DXY) as a possible trend change could have a meaningful impact on commodities and stocks.

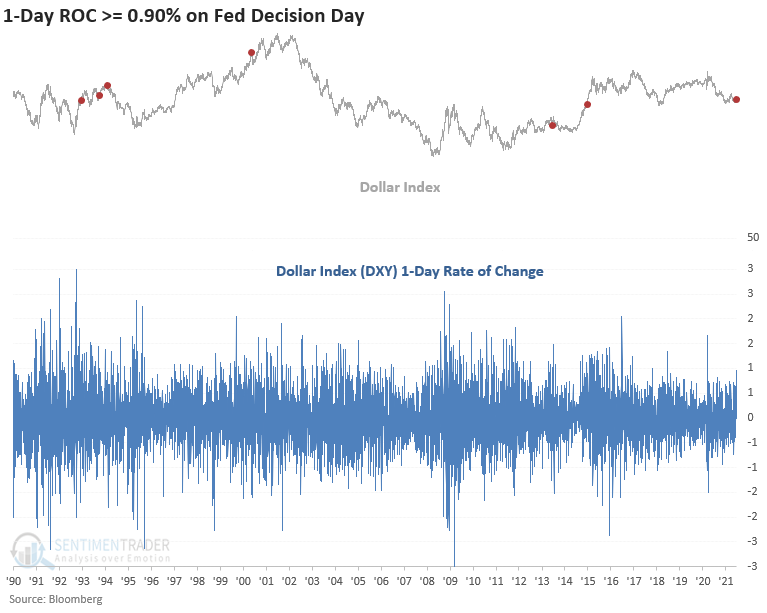

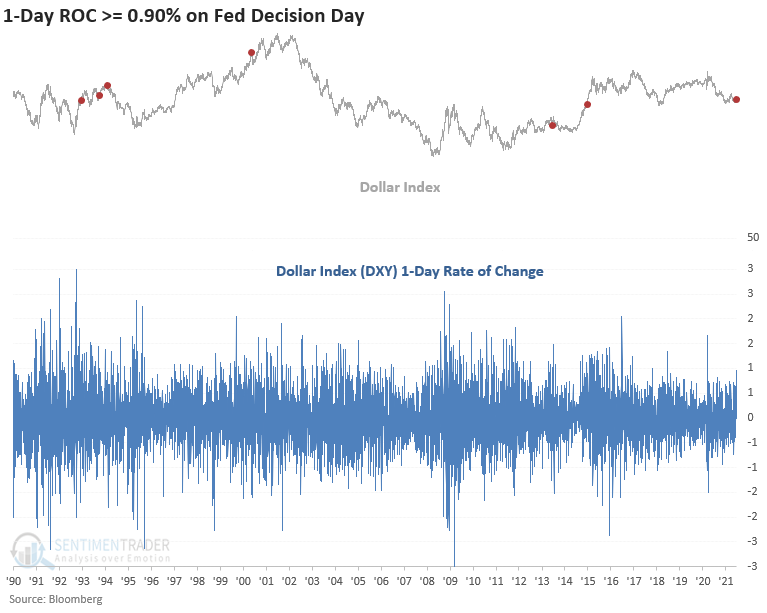

I will conduct a study that buys the DXY when the 1-day rate of change increases by 90 bps or more on a Fed decision day.

HISTORICAL CHART

A surge of 90 bps or more on a Fed decision day is rare. I think it's important to note that the other signals occurred within the context of a DXY uptrend. The DXY has been in a downtrend since March 2020.

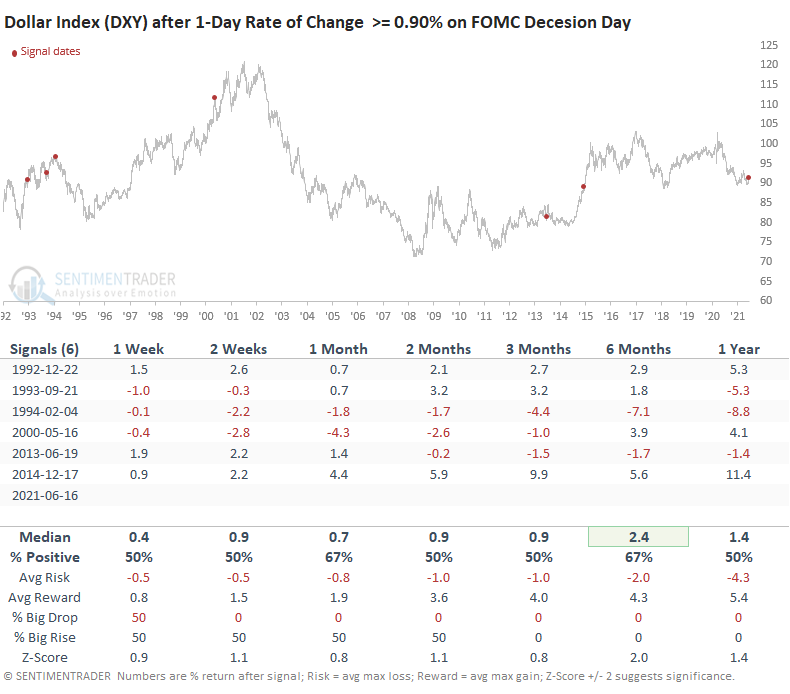

HOW THE SIGNALS PERFORMED

The results are a coin flip on most timeframes.

Let's lower the threshold for the 1-day rate of change to 50 bps and see if we can examine a larger sample size.

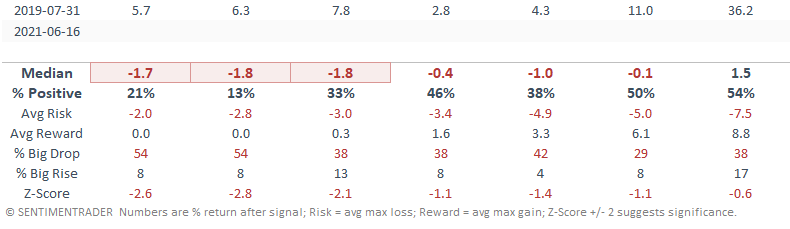

HOW THE SIGNALS PERFORMED

The results suggest that the Dollar Index (DXY) could be on the cusp of a potential trend change.

Let's see what happens to Gold when we use the 50 bps threshold.

HOW THE SIGNALS PERFORMED - GOLD

As expected, Gold's results are abysmal.