Did Tech Just Give Another Buy Signal?

In the past decade, the technology sector has been the place to be, especially in the last 2-3 years. Looking forward, half of the pundits seem to think that the tech sector is wildly overvalued and due for a severe whack, while the other half sees nothing but blue skies as the pace of technological advancement continues to accelerate.

Interestingly, one reliable breadth indicator just gave a bullish signal for tech stocks, while one seasonal tendency is currently flashing a short-term warning sign.

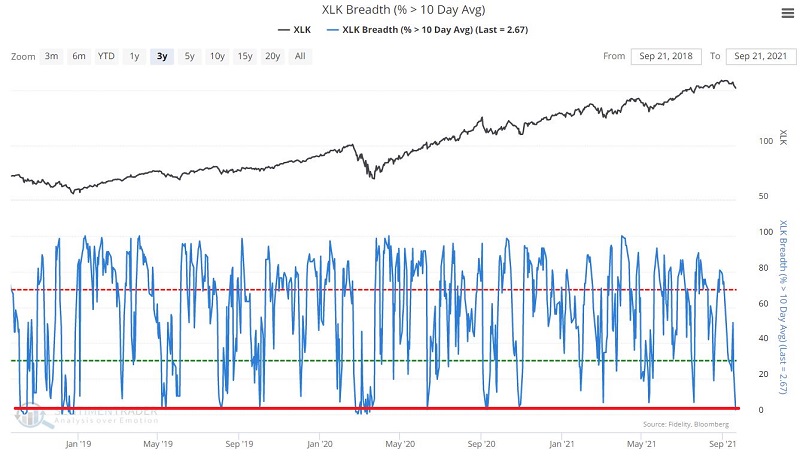

XLK Breadth (% > 10-day Avg)

As the name implies, the XLK Breadth (% > 10-day Avg) indicator notes the percentage of ticker XLK (Technology Select Sector SPDR Fund) component stocks currently above their respective 10-day moving average. The chart below displays the indicator along with the price action for ticker XLK for the last three years.

Note that only rarely does the indicator value drop below 3%.

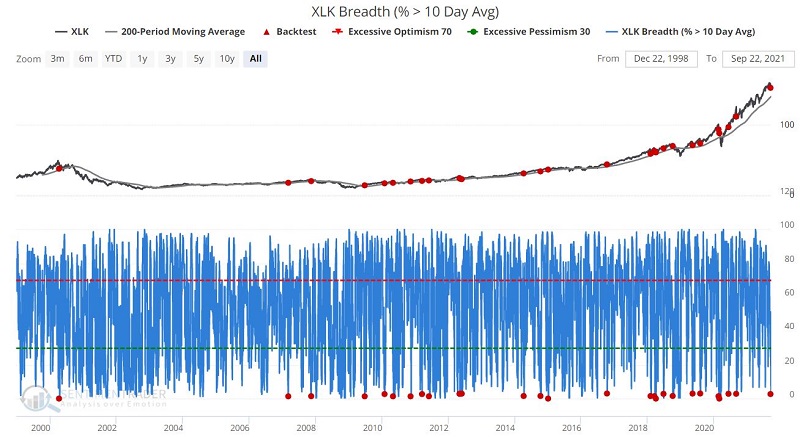

Now let's set up a test using our Backtest Engine (you can run this test by clicking here). For this test, we will look for those times during all of XLK's history when:

- XLK was above its 200-day moving average (i.e., we want to look for signals only when XLK is already in a quantifiable uptrend)

- The % of XLK components above their 10-day moving average drops below 3%

- For the first time in 5 days

All previous signals are noted with a red dot in the chart below.

The table below displays the historical results.

Things to Note:

- A high percentage of winning trades across the board (except for 2-weeks)

- Progressively higher Median Returns across each subsequent time frame

- A new signal occurred on 9/20/2021

Does this new signal mean everything is "All Clear" for the technology sector and that tech stocks are about to embark on another great run to the upside? Not necessarily. Note that the signals in April 2000 and November 2007 were followed by subsequent 12-month XLK declines of -47% and -39%, respectively.

Still, at least until XLK shows some serious sign of breaking down (a drop below the 200-day moving average, perhaps?), tech sector traders might consider giving the bullish case the benefit of the doubt for the time being - with one near-term caveat.

ONE CAVEAT

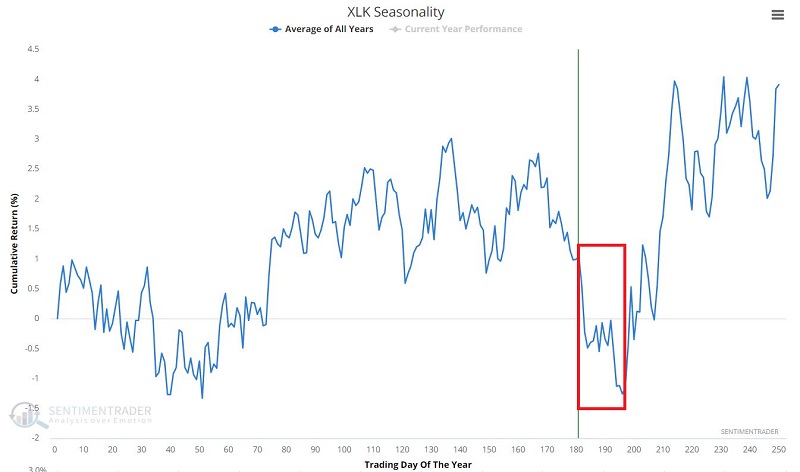

The Annual Seasonal Trend chart for XLK suggests that tech stock traders might be wise to exhibit patience in the near term.

As you can see in the chart above, XLK is entering a period of seasonal weakness.

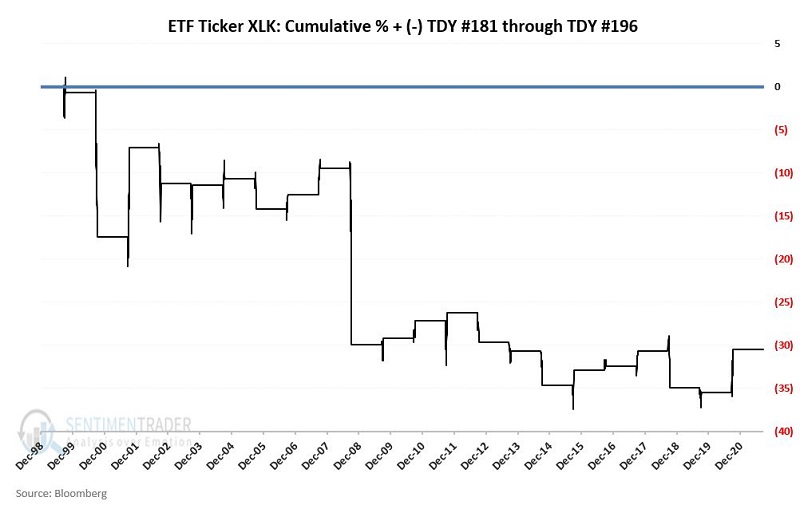

The chart below displays the cumulative percentage price performance for XLK from the current Trading Day of the Year through TDY #196.

Things to Note:

- # of times UP = 11

- # of times DOWN = 11

- Average UP % = +3.4%

- Average DOWN % = (-6.3%)

Another pullback by XLK as it nears the seasonal low around Trading Day of the Year #196 - combined with the breadth signal above - could serve as a buying opportunity for tech stock traders.

TO SAVE TO FAVORITES

To save the scan discussed above:

- Click "Add to Favorites"

- Enter a Name (ex., "XLK Breath (% > 10-day Avg) crosses below 3%")

- Click "Save"