Despite losses, investors borrow more against stocks

Investors have become pretty willing to borrow against the value of their brokerage accounts.

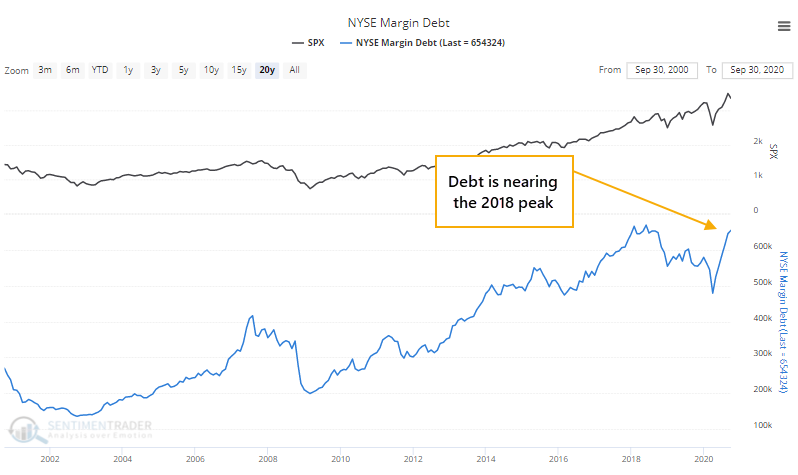

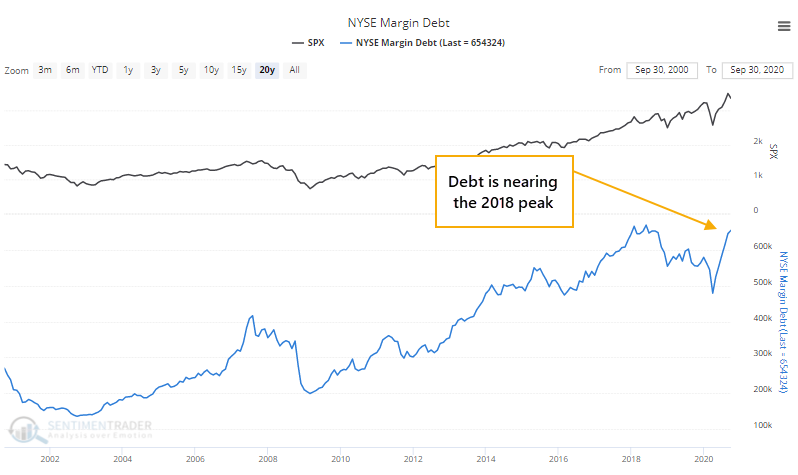

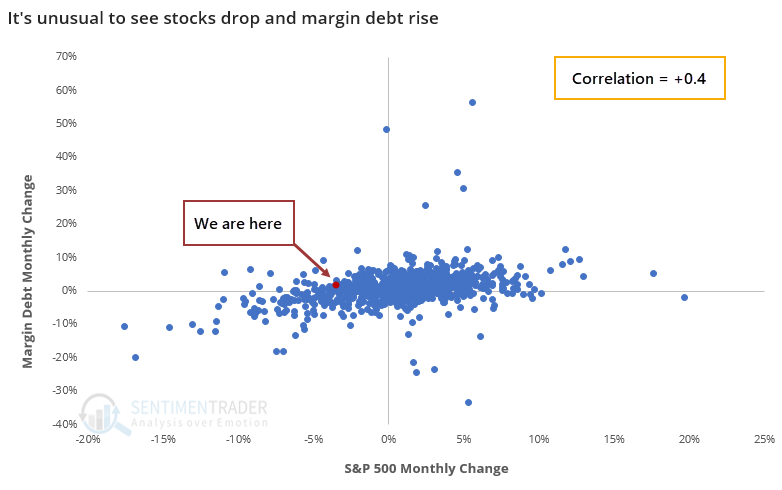

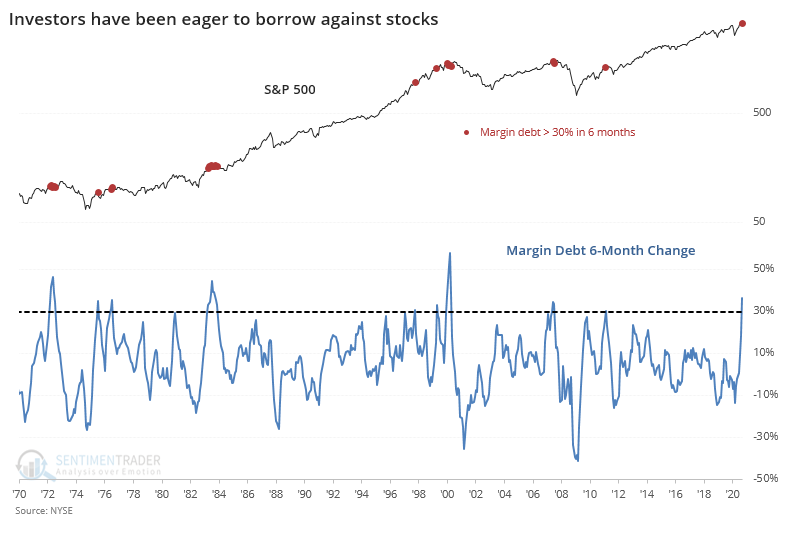

The latest margin debt figures show that investors have pledged more than $650 billion against their stock holdings as of September. That's up more than 35% from the low in March and is nearing a record high.

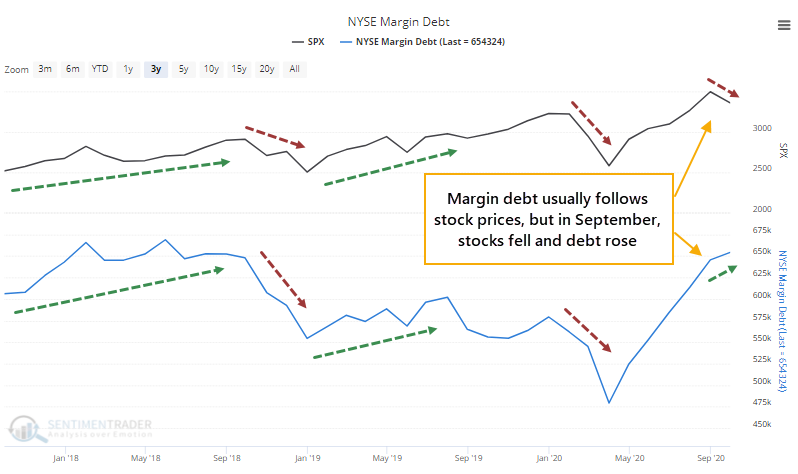

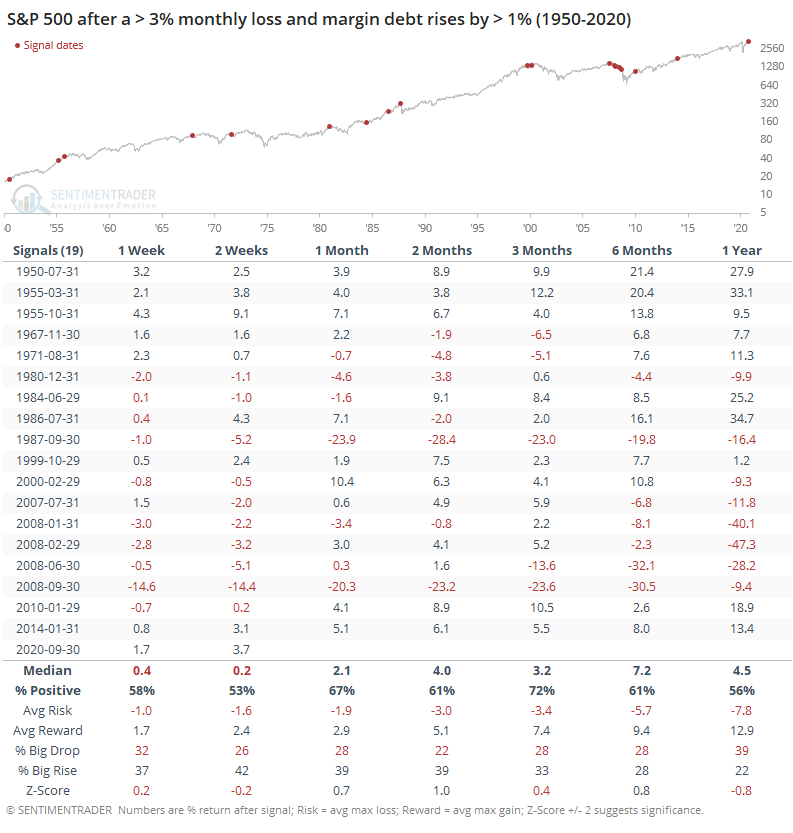

This is unusual because in September stocks fell and yet borrowings against those holdings increased.

Over the past 70 years, it has been unusual to see the monthly percentage change in the S&P 500 differ much from the change in margin debt. There's a fairly high positive correlation between the two, which September violated.

A knee-jerk contrarian would assume this is a bad thing. It suggests that investors are complacent, too willing to increase their leverage despite a market that's not going their way. But it hasn't really proven out that way.

Clearly, there were some trouble spots - most notably in 1987, 2000, and 2007, when longer-term returns suffered greatly. Those were also times when debt had jumped by a large amount, and quickly.

Over the past 6 months, margin debt has jumped by more than 35%, one of the largest rates-of-change since 1950.

That was most definitely not a good sign in 2000 and 2007, but as we've discussed multiple times in recent years, that was coming from a higher base, and the growth in debt was far ahead of the growth rate in stocks. Neither is the case this time around.

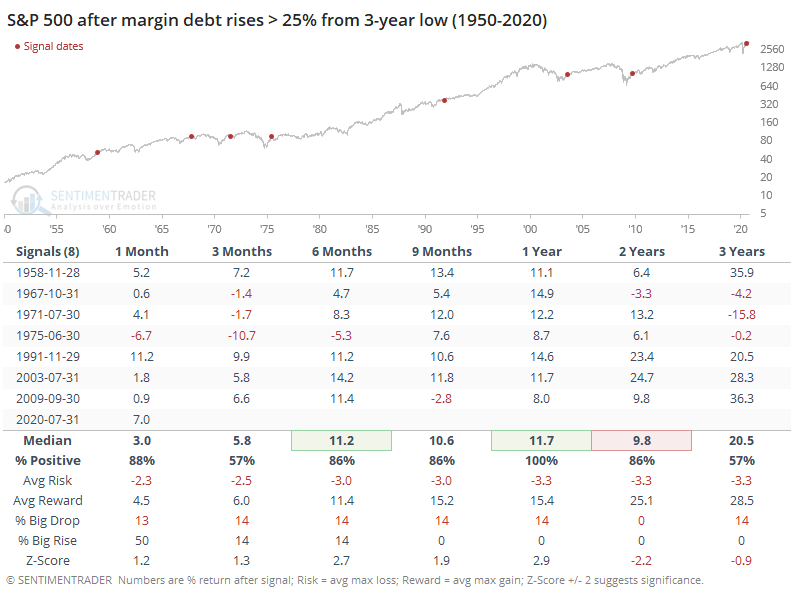

Below, we can see the S&P's future returns when debt jumped by more than 25% when it was coming off at least a 3-year low.

This context is important, as it more accurately reflects investor sentiment at the time. In these cases, stocks had a strong tendency to rally over the next 6-12 months, with no large failures. The risk/reward was skewed impressively to the "reward" side, though there was not a strong bias toward seeing an abnormally large rise versus fall across most time frames.

We'd be more inclined to consider the latest margin debt data as a positive for stocks going forward, but because the rate of change has been so high, and it's so near the prior record level, there are enough concerns that it likely shouldn't be included in the Active Studies.