Demise of the U.S. Dollar

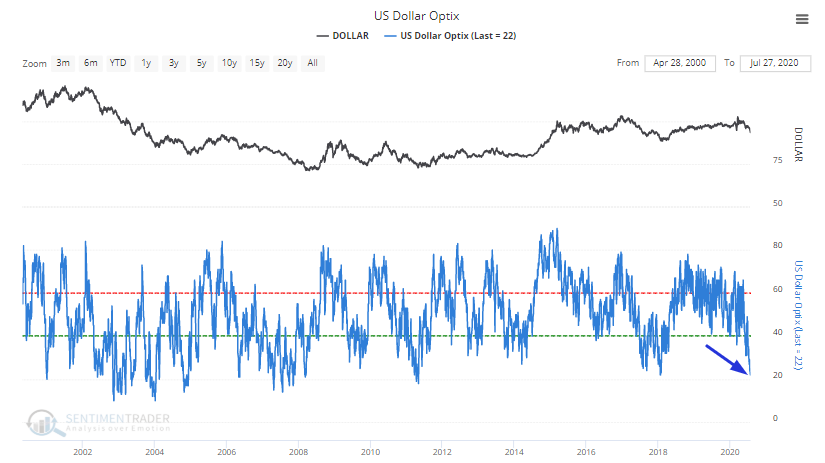

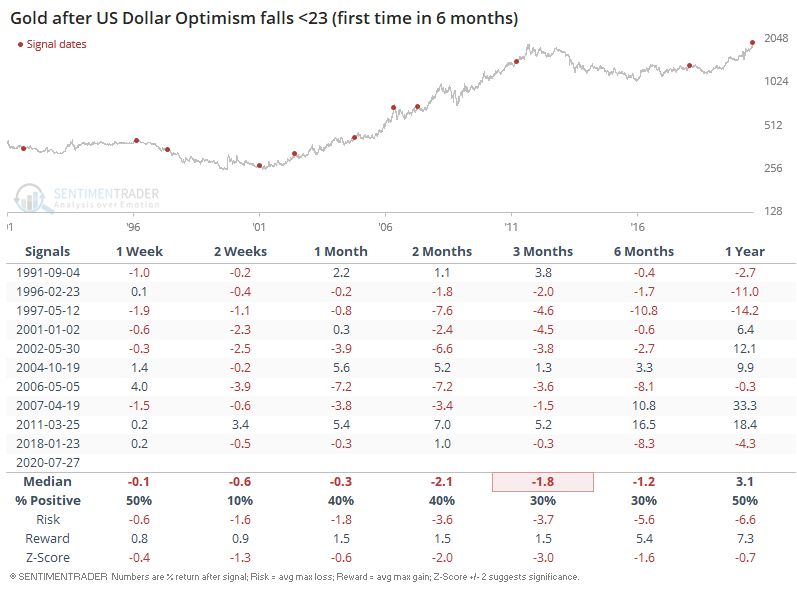

The plunging U.S. Dollar pushed the US Dollar Optix to fall to one of the lowest levels in years. Traders have been swarming towards safe haven assets as a hedge.

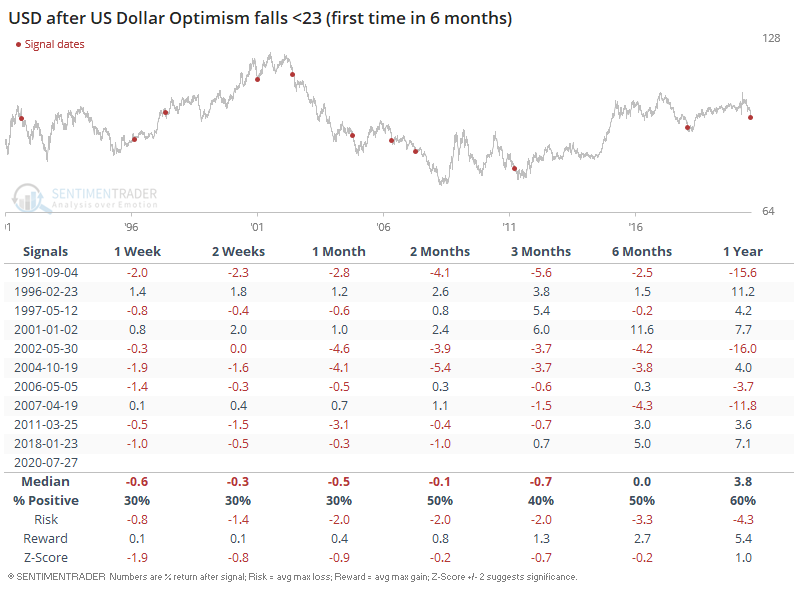

Historically when UD Dollar Optix fell below 23, the short term (1 week - 1 month) returns were grim for the U.S. Dollar and the 2 months - 1 year returns were mixed.

As for gold, this led to more bearish returns on almost all time frames.

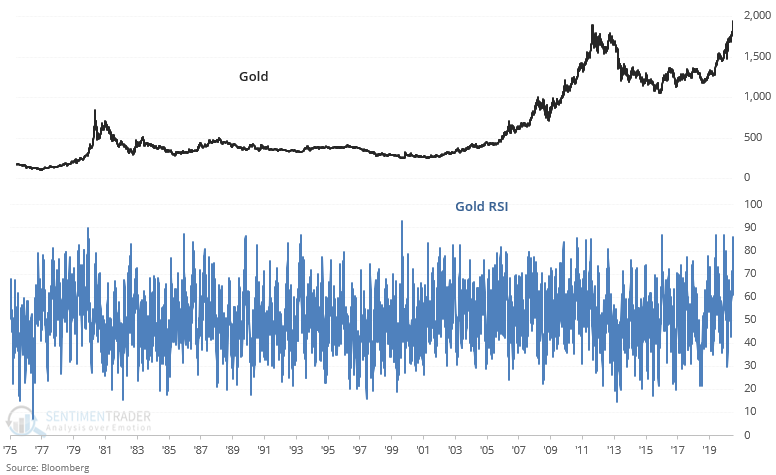

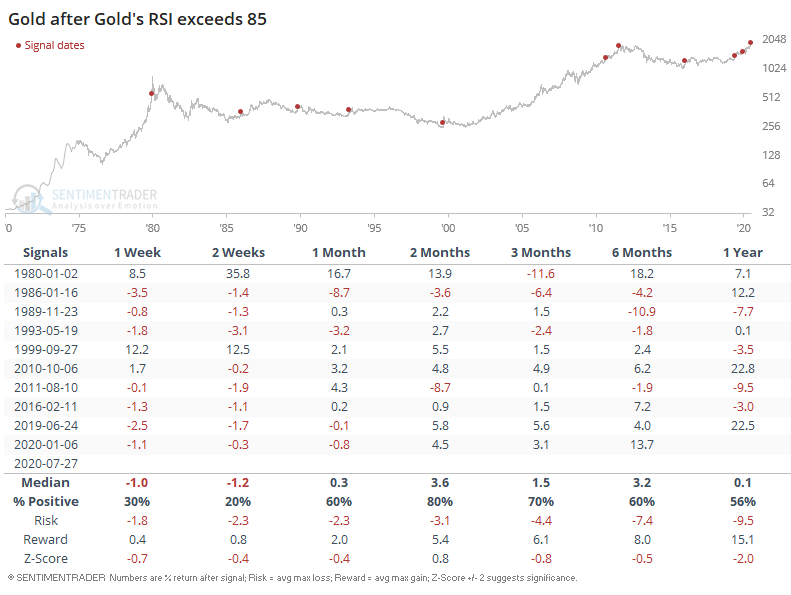

Gold's strong momentum pushed its RSI to an extremely high level:

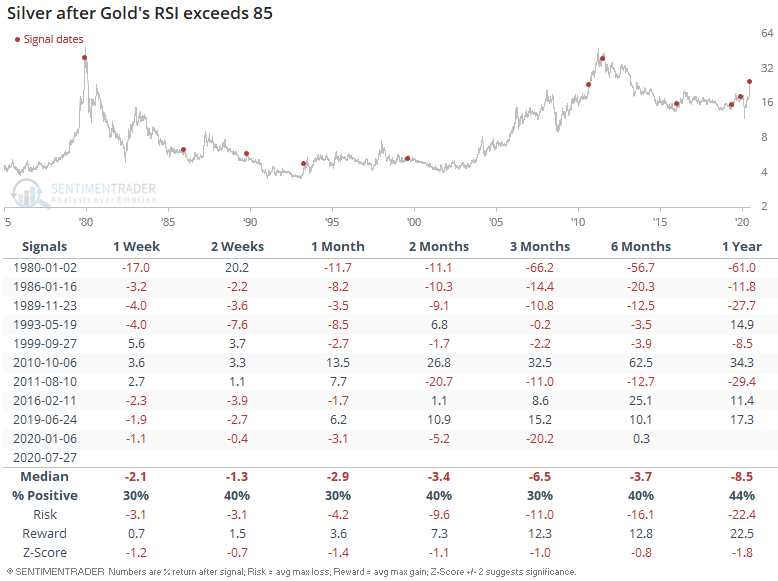

When Gold's RSI exceeded 85 in the past, it usually led to more bearish returns over the next 1-2 weeks and mixed (but more bullish than random) returns over the next 1 month - 1 year.

And as for silver, this was a bearish sign on all time frames.