Days after turning negative, Nasdaq breadth surges

Leave it to this market to be as perverse as possible.

Just days after it became apparent that underlying momentum in the Nasdaq wasn't just deteriorating but was turning negative, it has one of the most broadly positive days in months.

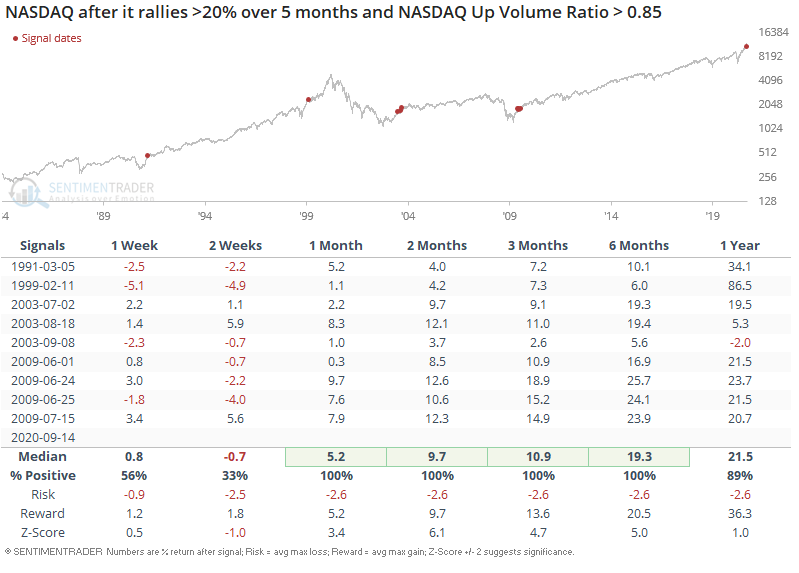

I'm going to borrow a table from Troy's premium note showing how the Nasdaq has responded after a surge in positive breadth after it had already rallied strongly over the past 5 months.

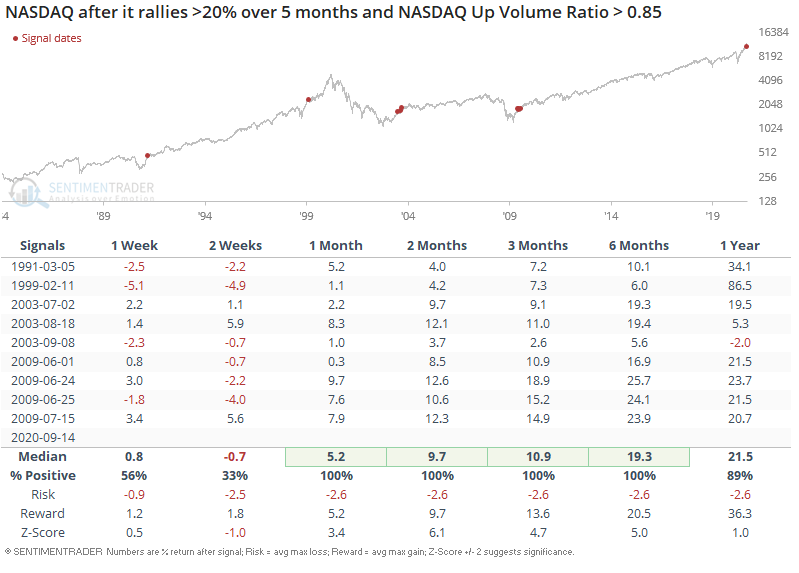

Monday's broad rally was enough to push the 10-day average of the Up Volume Ratio above 50% again, albeit barely. The Nasdaq Composite's annualized returns when this is above 50% are much better than when it's below. Another point in the bulls' favor.

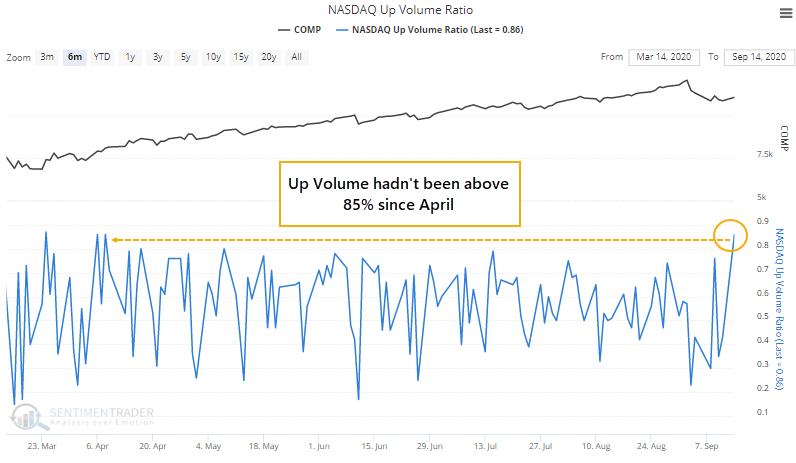

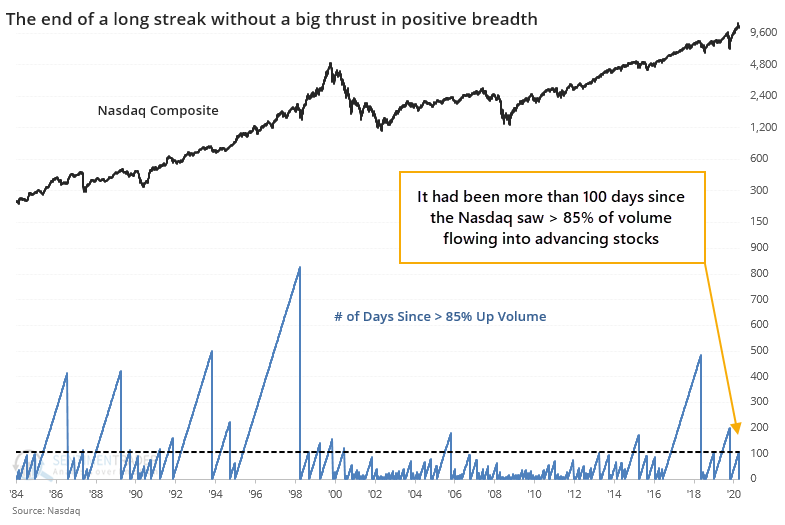

Remarkably, it had been more than 100 days since more than 85% of any day's volume flowed into advancing stocks.

This is one of the longer streaks dating back to 1984.

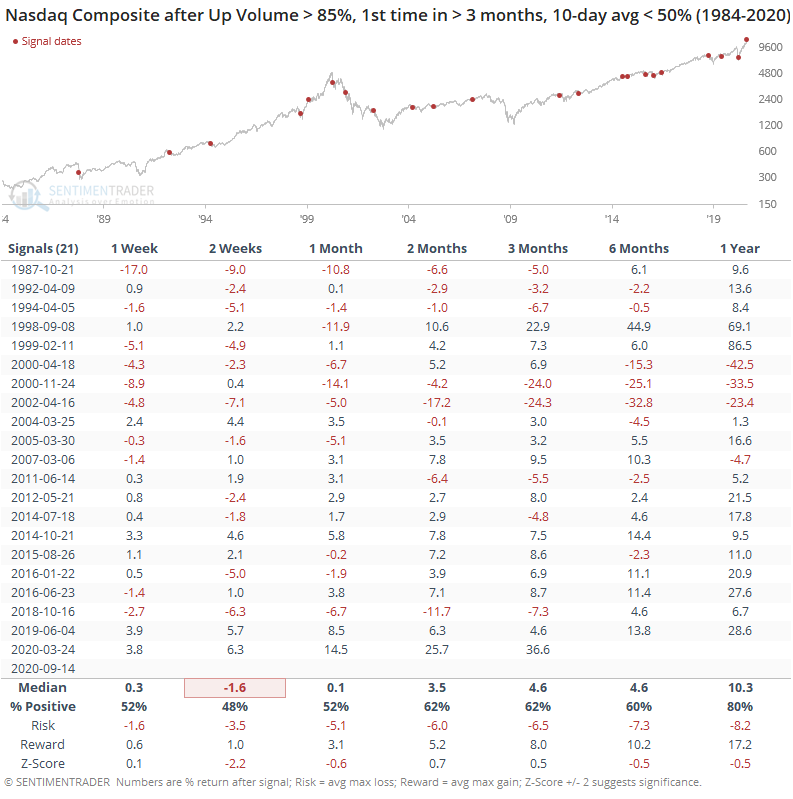

The table below shows how the Composite performed after its first 85% Up Volume day in several months when the 10-day average of that ratio had been below 50%.

While not as extreme as Troy's study, thanks to a larger sample size, the overall pattern was the same - shorter-term weakness, medium- to long-term strength.

One of the primary reasons that the risk/reward for stocks appeared positive in March-June was the historic number and magnitude of positive breadth thrusts. Perhaps those are still exerting their influences - certainly, they have run over any and all sentiment extremes since then.

The worry over the past couple of months has been that breadth was turning questionable, with a huge number of extremely odd readings, and those have historically not turned out well. Combined with signs of astounding speculation and a neutral-at-best market environment, the risk/reward outlook was poor. If we start to see continued thrusts in some of these breadth figures, it would offset a lot of those oddities from August and make the idea of sustained gains more palatable.