Headlines

|

|

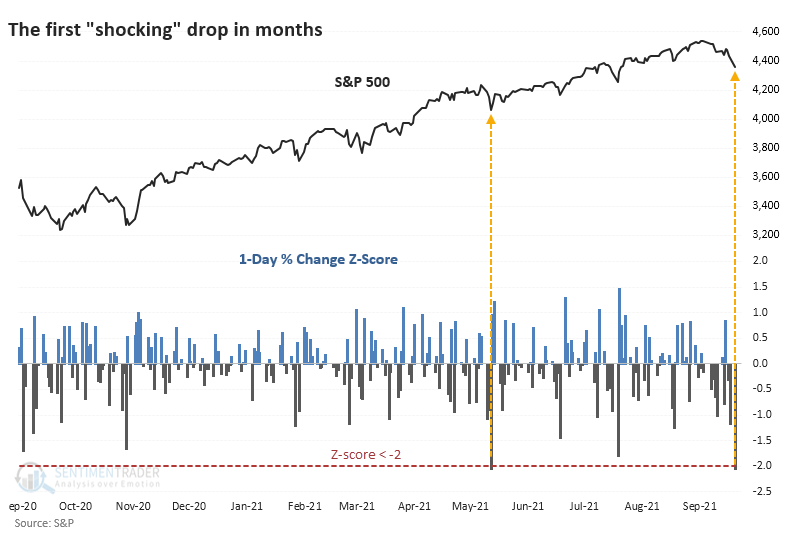

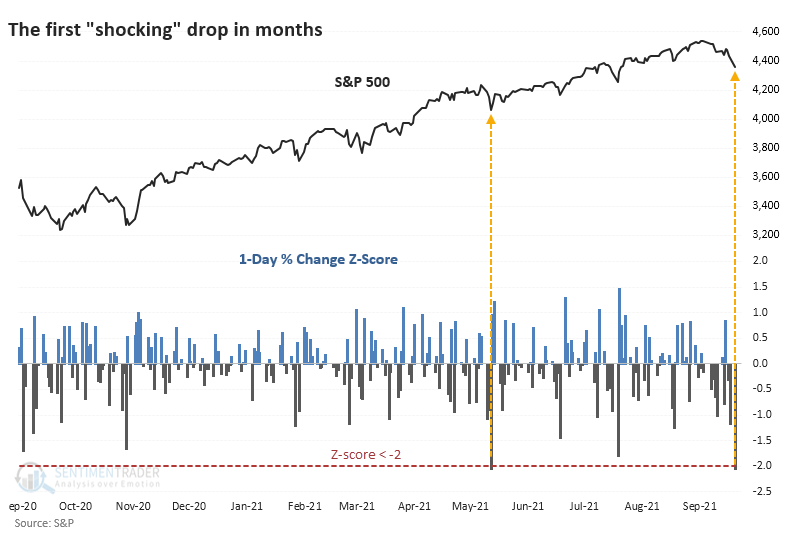

The First Shocking Decline in Months:

For the first time in more than four months, the S&P 500 suffered a shocking decline. Its drop on Monday was more than 2 standard deviations from the average return during the past year. Most of the others tended to lead to rebounds in the month(s) ahead.

Bottom Line:

STOCKS: Hold

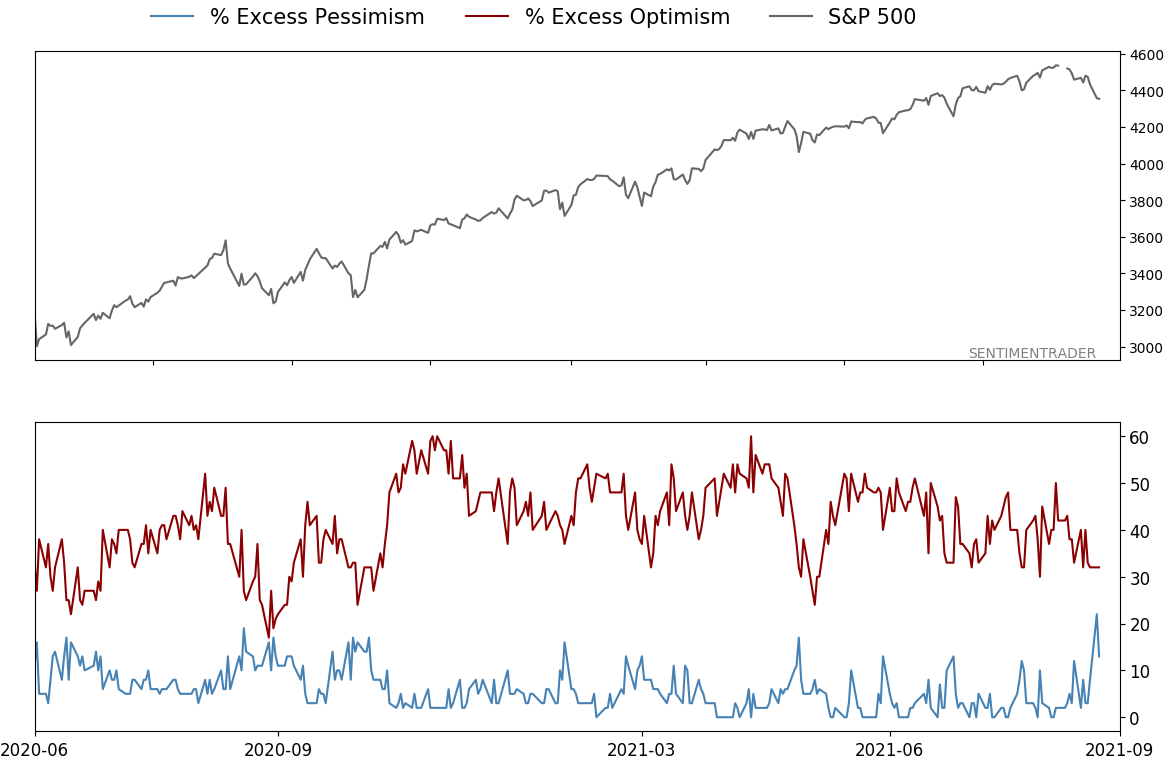

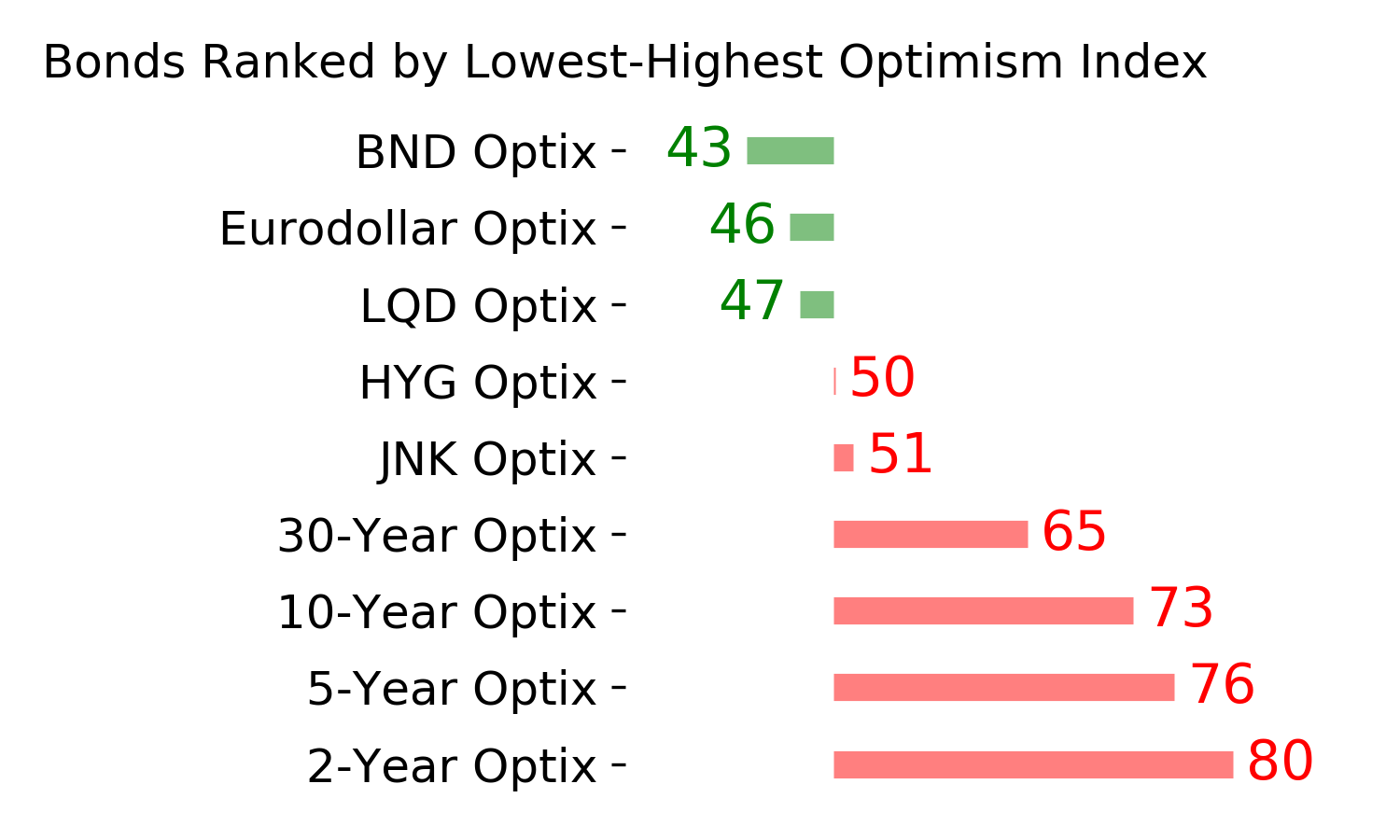

Sentiment continues to decline from the speculative February peak. With deteriorating breadth, this raises the risk of poor short- to medium-term returns until optimism and better breadth returns. See the Outlook & Allocations page for more. BONDS: Hold

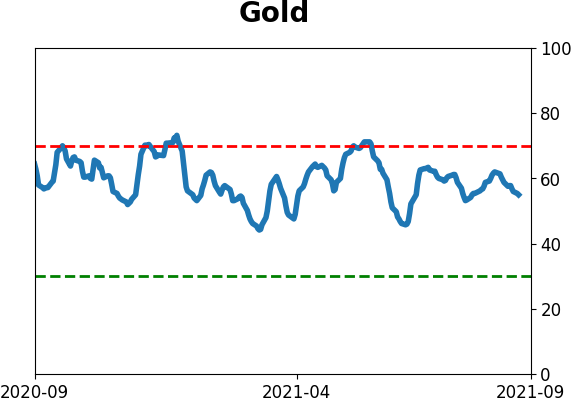

Various parts of the market got hit in March, with the lowest Bond Optimism Index we usually see during healthy environments. Bond prices have modest recovered and there is no edge among the data we follow. GOLD: Hold

Gold and miners were rejected after trying to recover above their 200-day averages in May. Lately, some medium-term (not long-term) oversold extremes in breadth measures among miners have triggered.

|

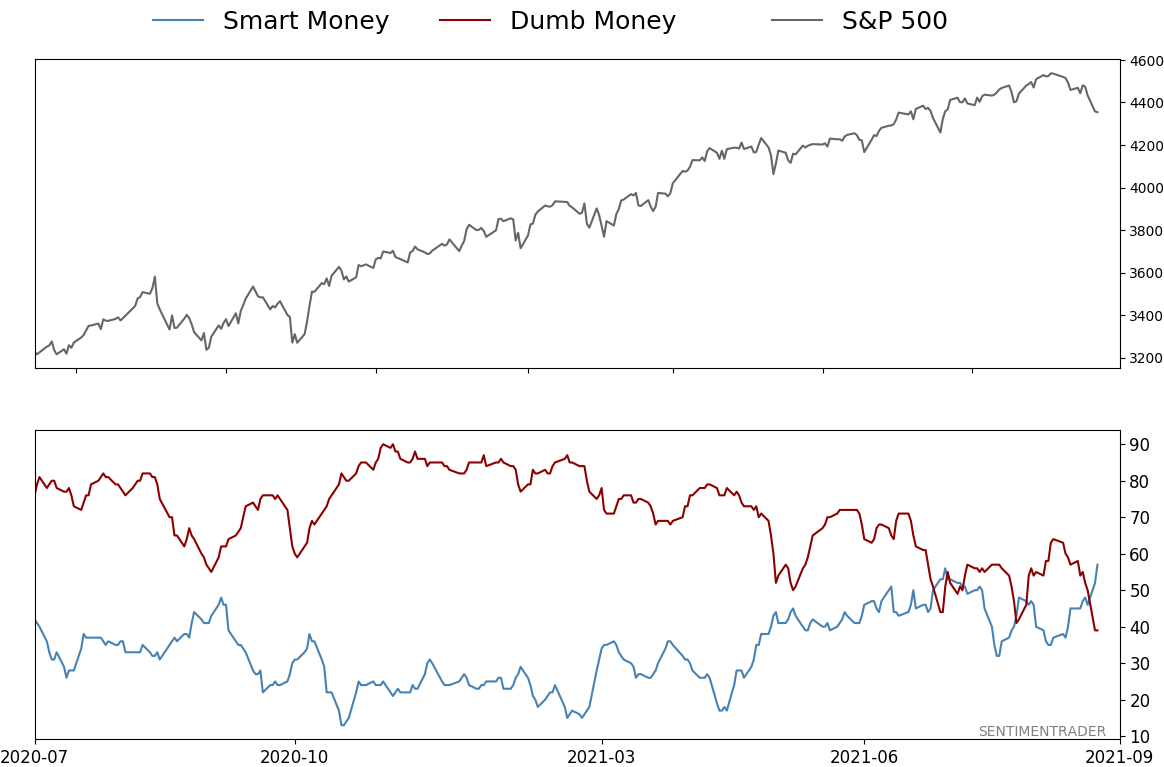

Smart / Dumb Money Confidence

|

Smart Money Confidence: 57%

Dumb Money Confidence: 39%

|

|

Risk Levels

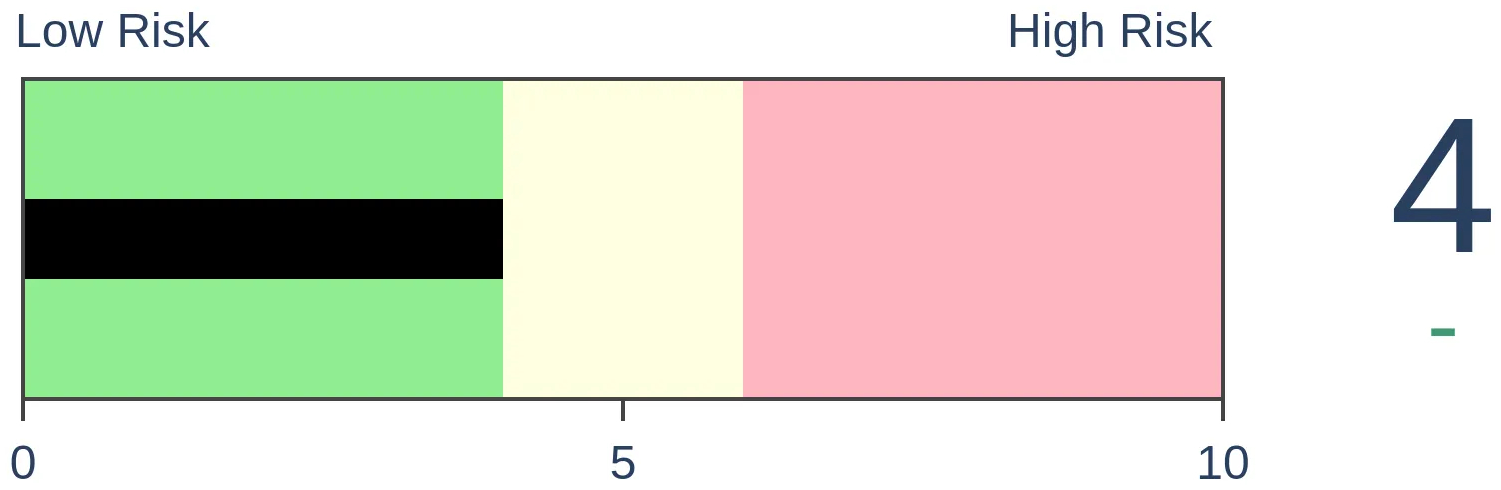

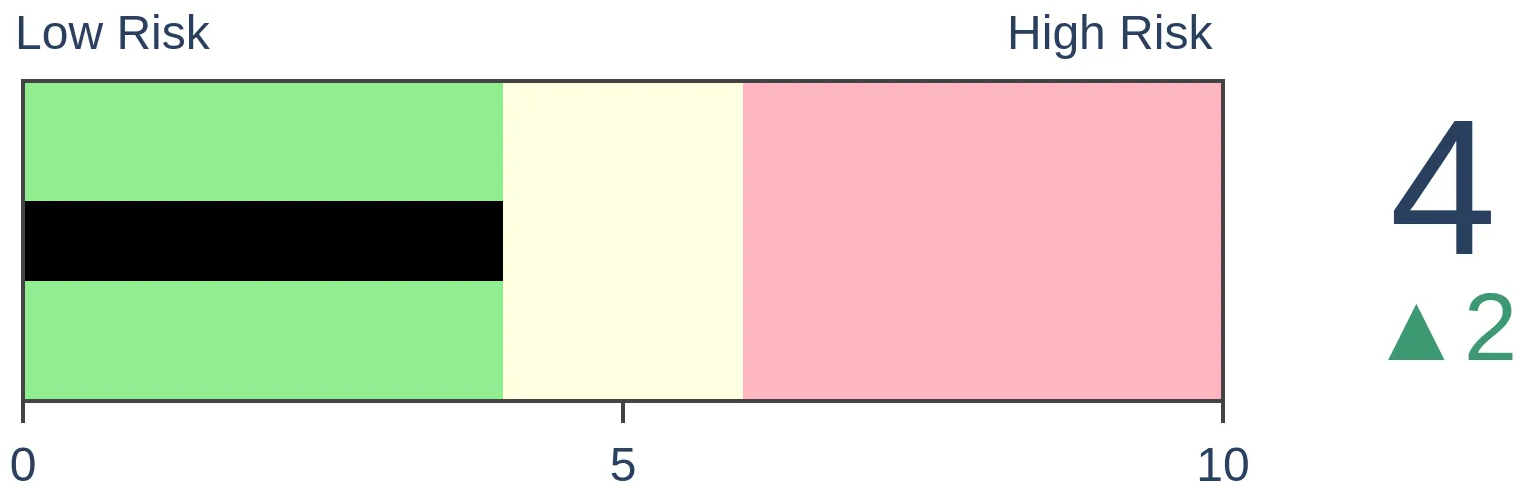

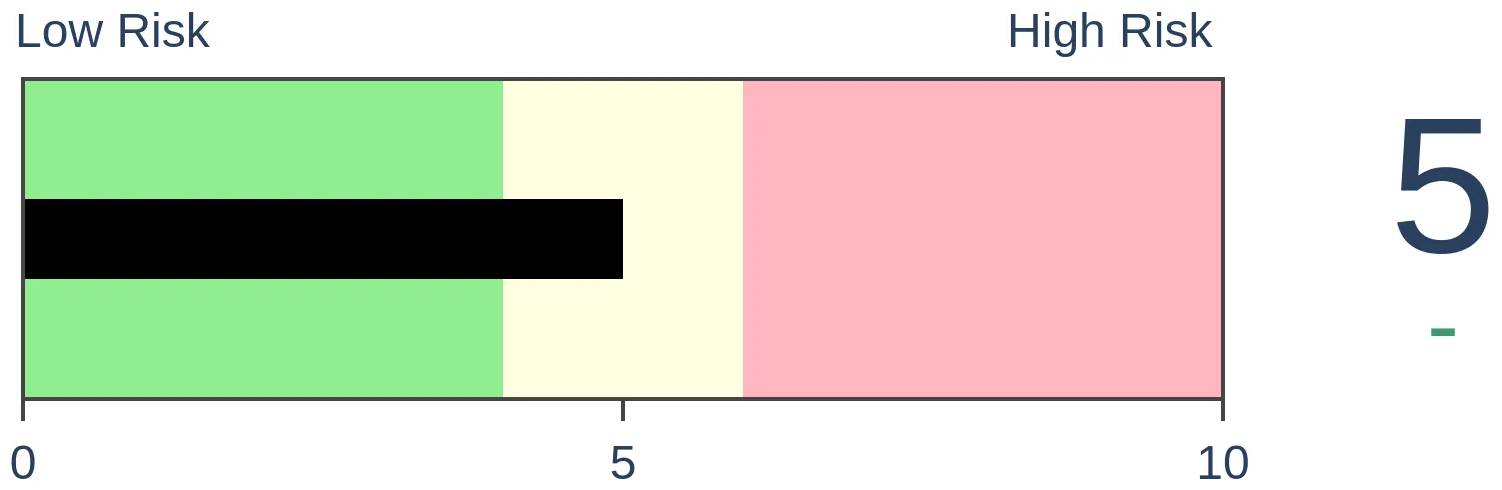

Stocks Short-Term

|

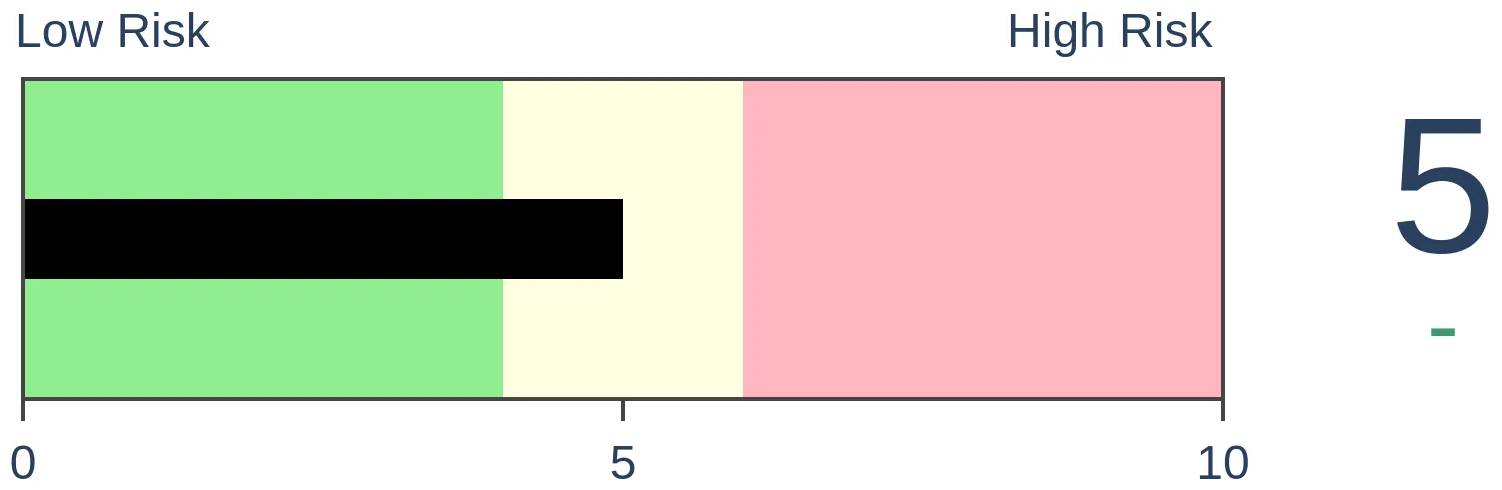

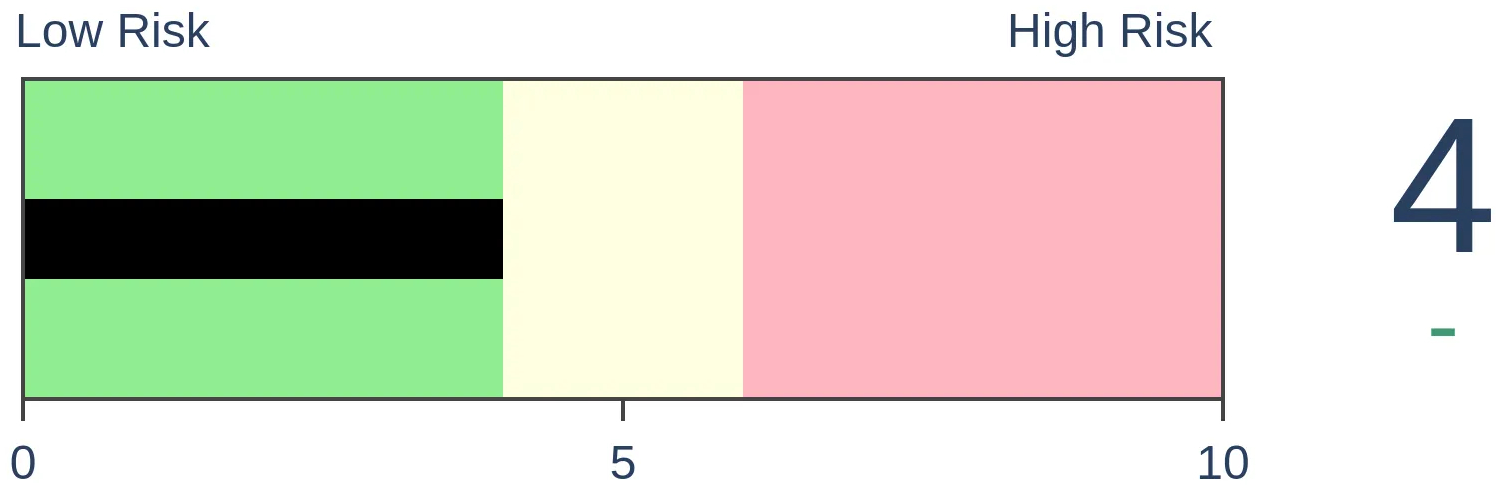

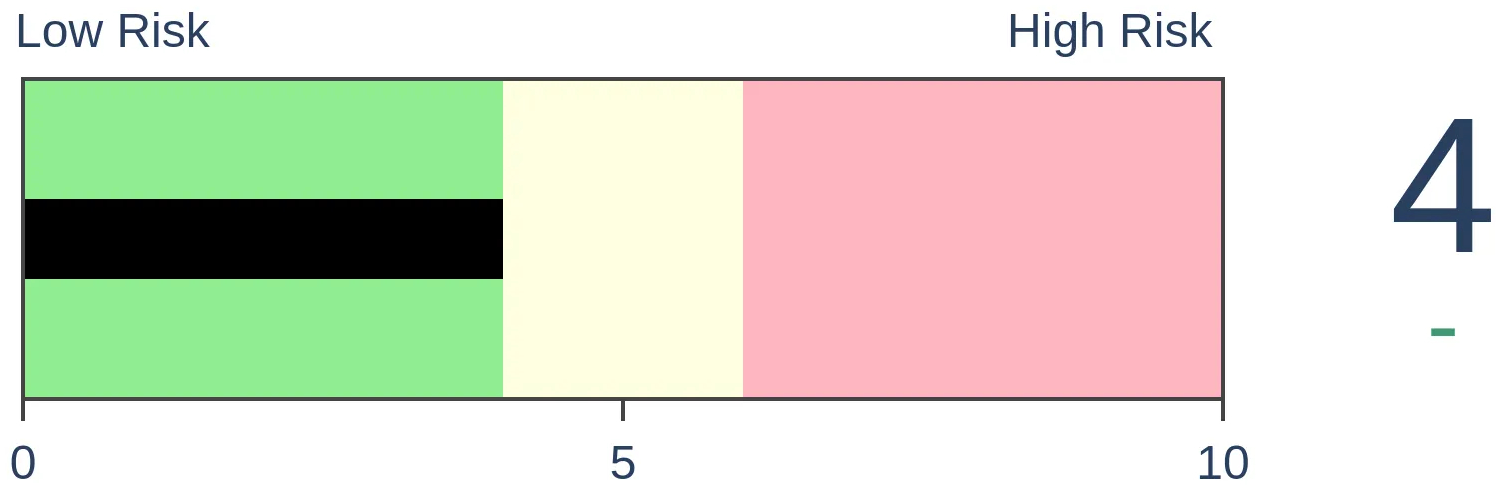

Stocks Medium-Term

|

|

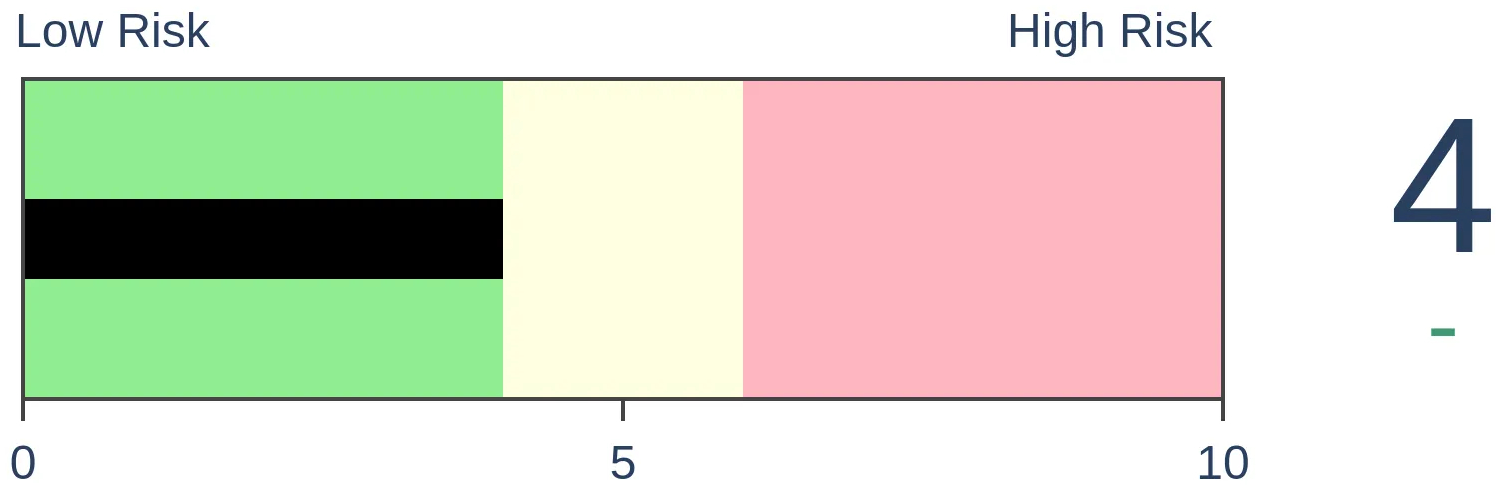

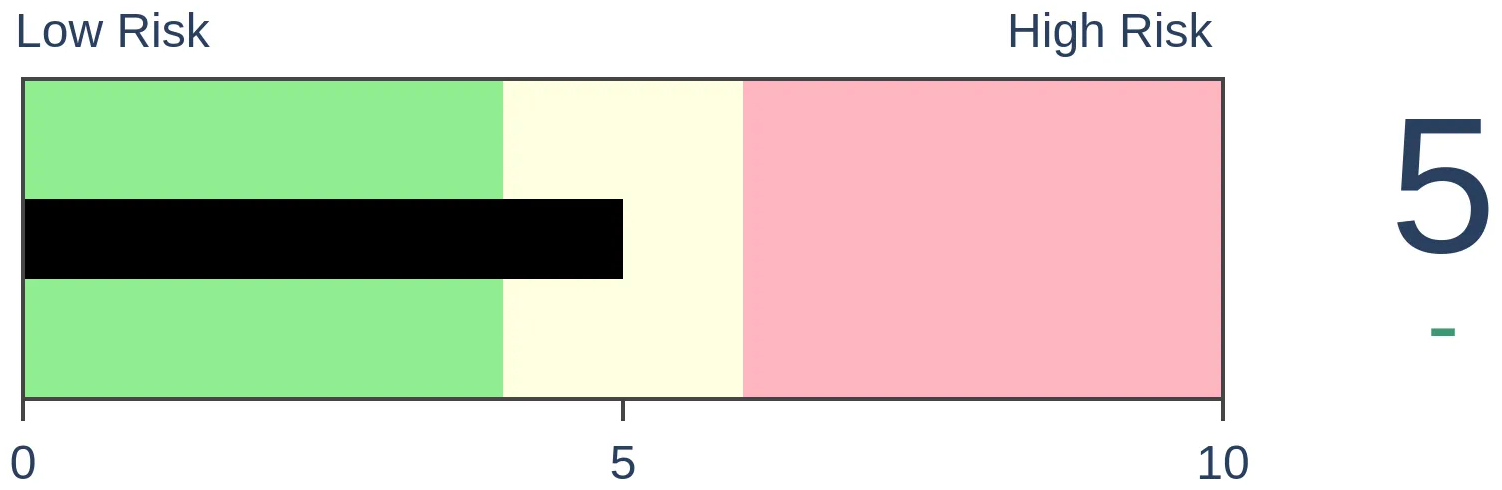

Bonds

|

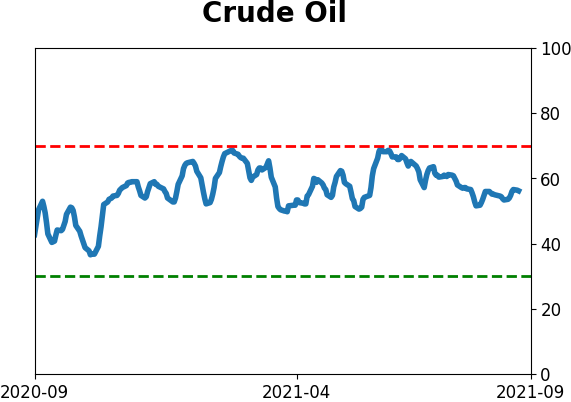

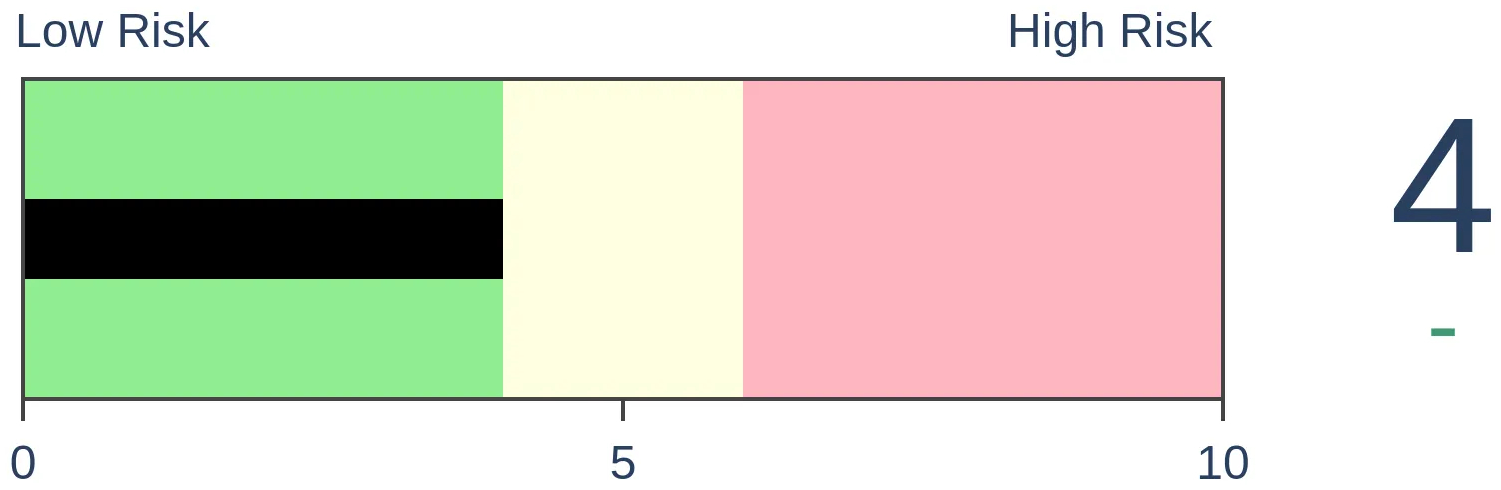

Crude Oil

|

|

Gold

|

Agriculture

|

|

Research

By Jason Goepfert

BOTTOM LINE

For the first time in more than four months, the S&P 500 suffered a shocking decline. Its drop on Monday was more than 2 standard deviations from the average return during the past year. Most of the others tended to lead to rebounds in the month(s) ahead.

FORECAST / TIMEFRAME

None

|

It's no secret that investors had become accustomed to a historic level of calm. We've been looking at this since the spring, it usually doesn't last, and yet it did for months.

Even with a late-day recovery on Monday, the loss in the most widely-benchmarked index in the world was a rude awakening to those who believe that stocks only travel in one direction. Monday's session was more than two standard deviations from the average daily change over the past year. The only other day with a -2 z-score over the past year was May 12, which marked the bottom for that pullback.

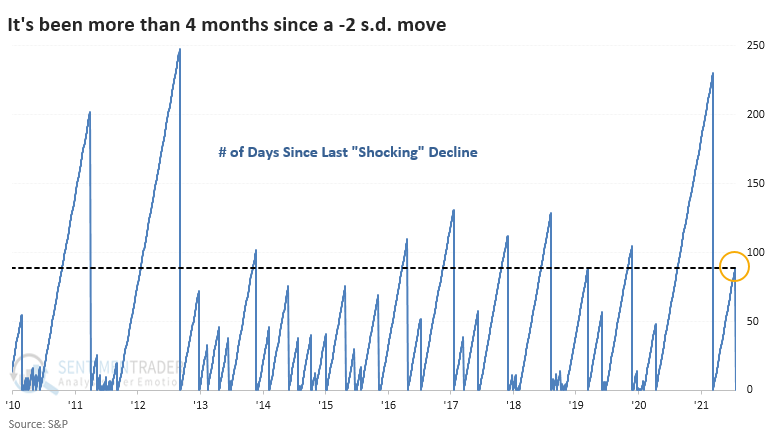

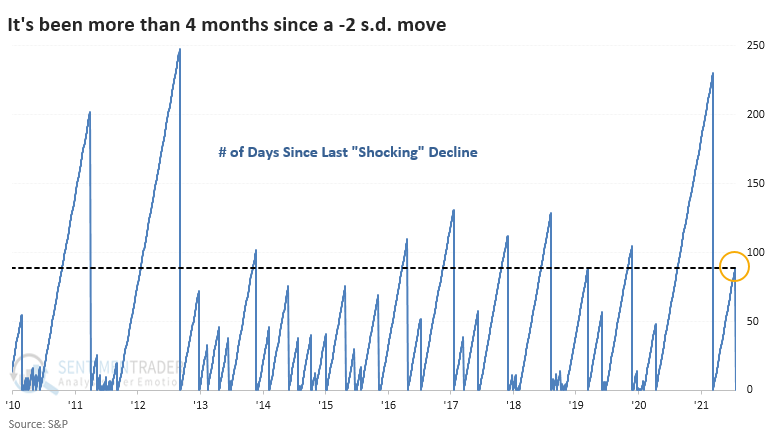

It had been nearly 90 days since that "shocking" decline in May, which is a relatively long time. Over the past decade, this ranked as the 10th-longest stretch between shocking drops.

USUALLY A QUICK BOTTOM

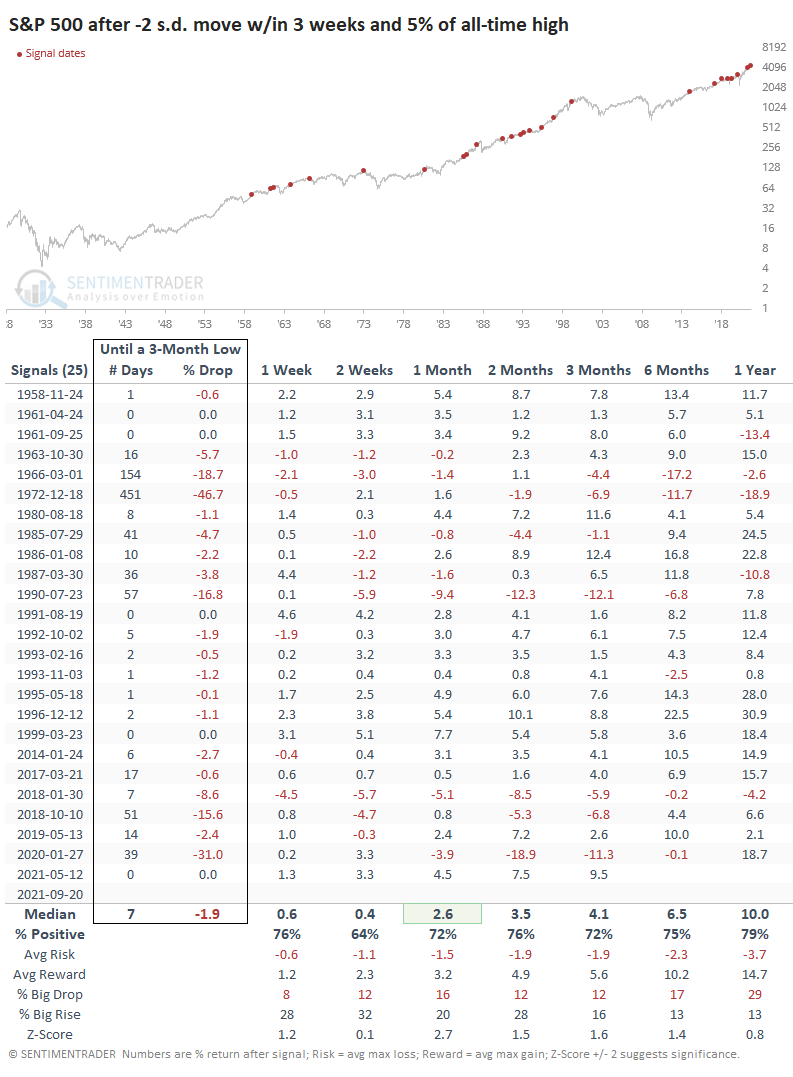

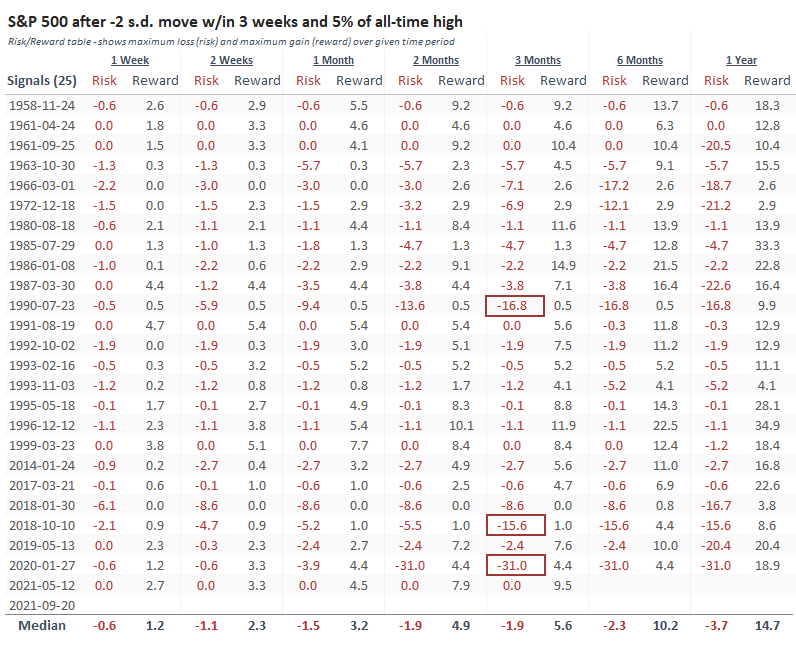

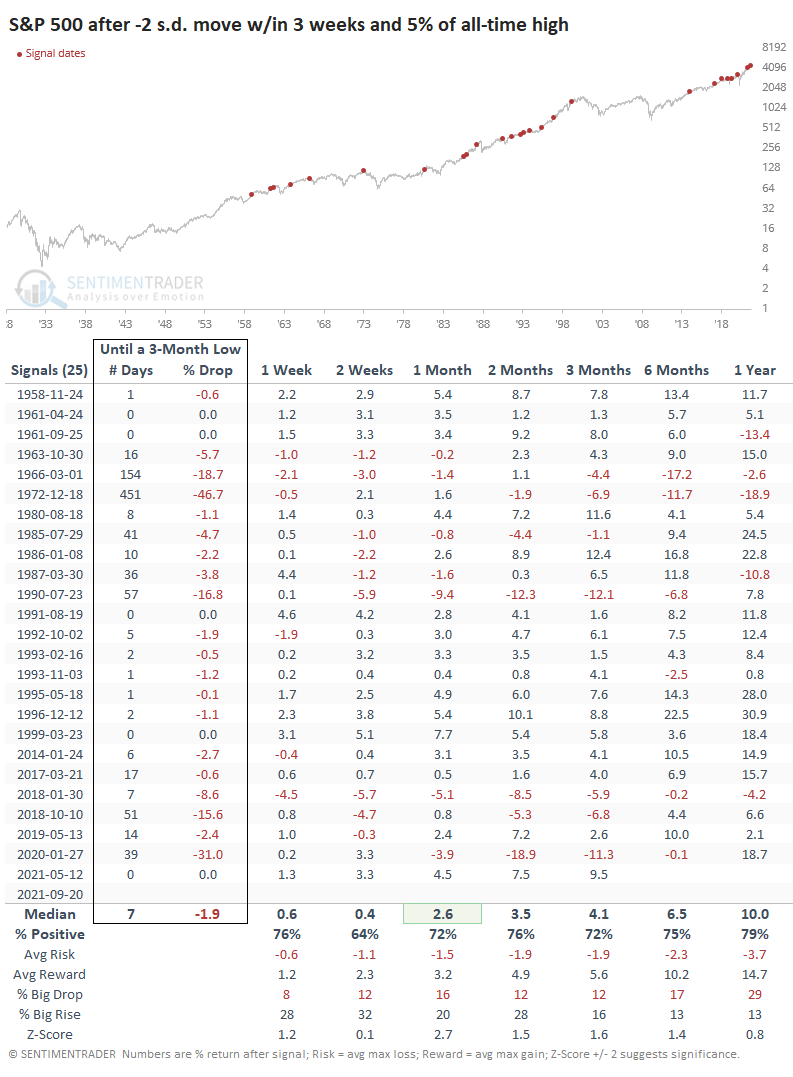

Most of us are concerned with the question of "so what?" To help give a clue, the table below shows every time since 1928 when the S&P 500 was within 5% and no more than three weeks removed from a multi-year high, then suffered its first -2 standard deviation move in at least four months. These show the times when reality paid investors an unwelcome visit.

For the most part, these were buying opportunities. Investors love the idea of a bargain, and these declines often provided just that. Instead of paying up after persistent rallies, the quick drops presented them with substantially lower prices, and they usually took advantage.

The S&P's forward returns were above average on all time frames, with the most impressive performance over the next month.

MOSTLY A LOW-RISK SETUP

The risk/reward was positively skewed, with minimal risk even up to a year later. It took a median of 7 trading days until the S&P bottomed, meaning it closed at its lowest price for at least the next three months. It took an average of a further 1.9% drop to get there.

Out of the 25 signals, 5 bottomed that very day, 18 took less than a month to bottom, and 20 suffered less than a 10% decline.

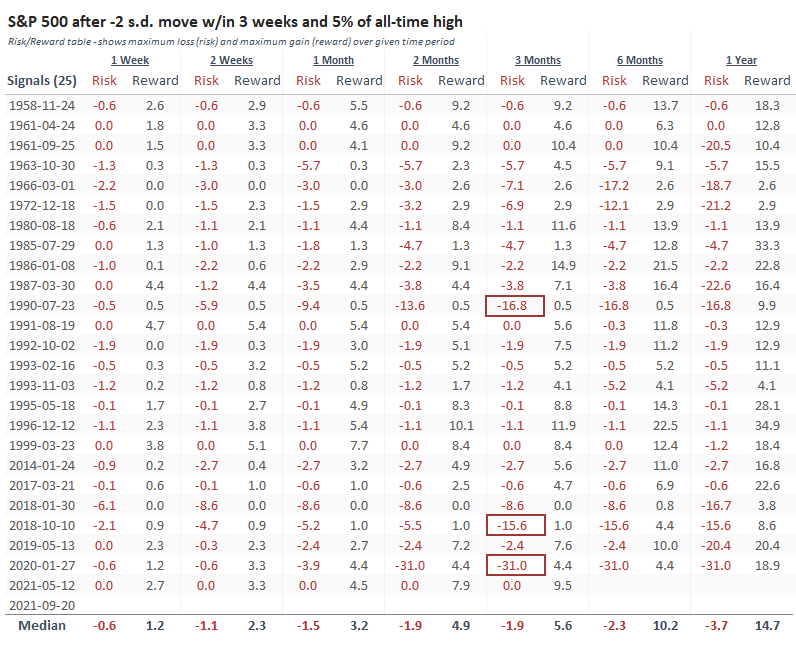

The Risk/Reward Table below shows the maximum decline (risk) and maximum rally (reward) across every time frame. Out of 25 signals, 17 of them offered more reward than risk over the next three months. The dates when the S&P fell more than a further 10% at any point during the next three months have a red box around them - there were only three.

To be fair, only four of the signals preceded a gain of more than +10% during the next three months. A few of them saw further gains in the months after that, but most investors are more concerned with risk, especially over a multi-month time frame. In that sense, there was little risk of significant and sustained declines resulting immediately from these "shocking" declines.

There are now some ugly-looking charts out there, and trend-followers have their first real test of the year. We're not really seeing a bevy of oversold conditions or anything other than isolated signs of excessive pessimism. It was a quick, hard panic and that's about it. However, a quick, hard panic is about all it took for buyers to step in within similar market environments. Based on the precedents above, anything more than about a 2% decline from yesterday's close should have bulls getting anxious that this time is finally different.

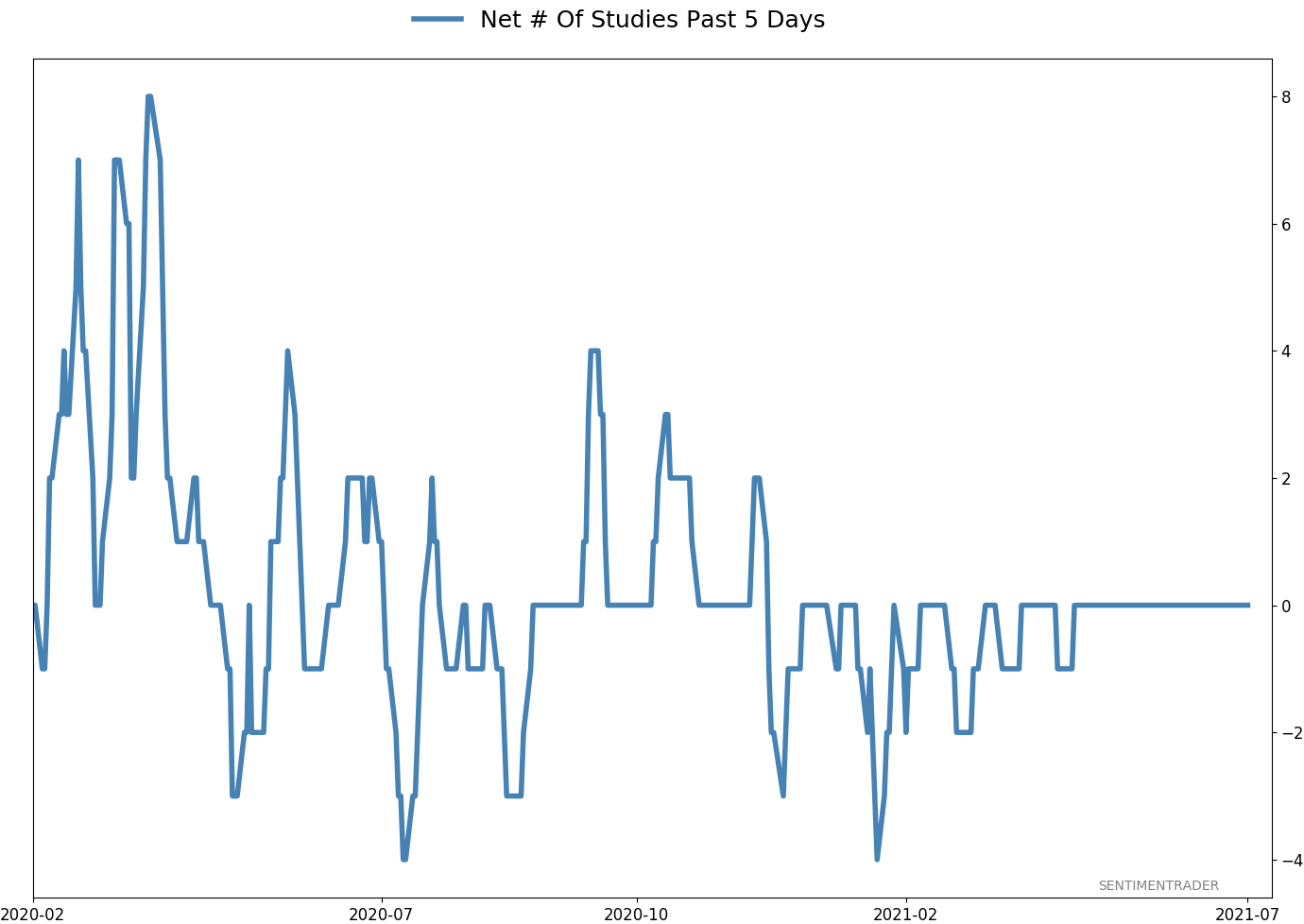

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 6 | | Medium-Term | 6 | 3 | | Long-Term | 11 | 5 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 4.1 | Added 4.1% | 2021-05-19 | | Bonds | 23.9% BND, 6.9% SCHP | 30.7 | Reduced 7.1% | 2021-05-19 | | Commodities | GCC | 2.6 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 5.6 | Reduced 4.2% | 2021-05-19 | | Special Situations | 4.3% XLE, 2.2% PSCE | 7.6 | Reduced 5.6% | 2021-04-22 | | Cash | | 49.4 | | |

|

Updates (Changes made today are underlined)

Much of our momentum and trend work has remained positive for several months, with some scattered exceptions. Almost all sentiment-related work has shown a poor risk/reward ratio for stocks, especially as speculation drove to record highs in exuberance in February. Much of that has worn off, and most of our models are back toward neutral levels. There isn't much to be excited about here. The same goes for bonds and even gold. Gold has been performing well lately and is back above long-term trend lines. The issue is that it has a poor record of holding onto gains when attempting a long-term trend change like this, so we'll take a wait-and-see approach. RETURN YTD: 8.1% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

Phase Table

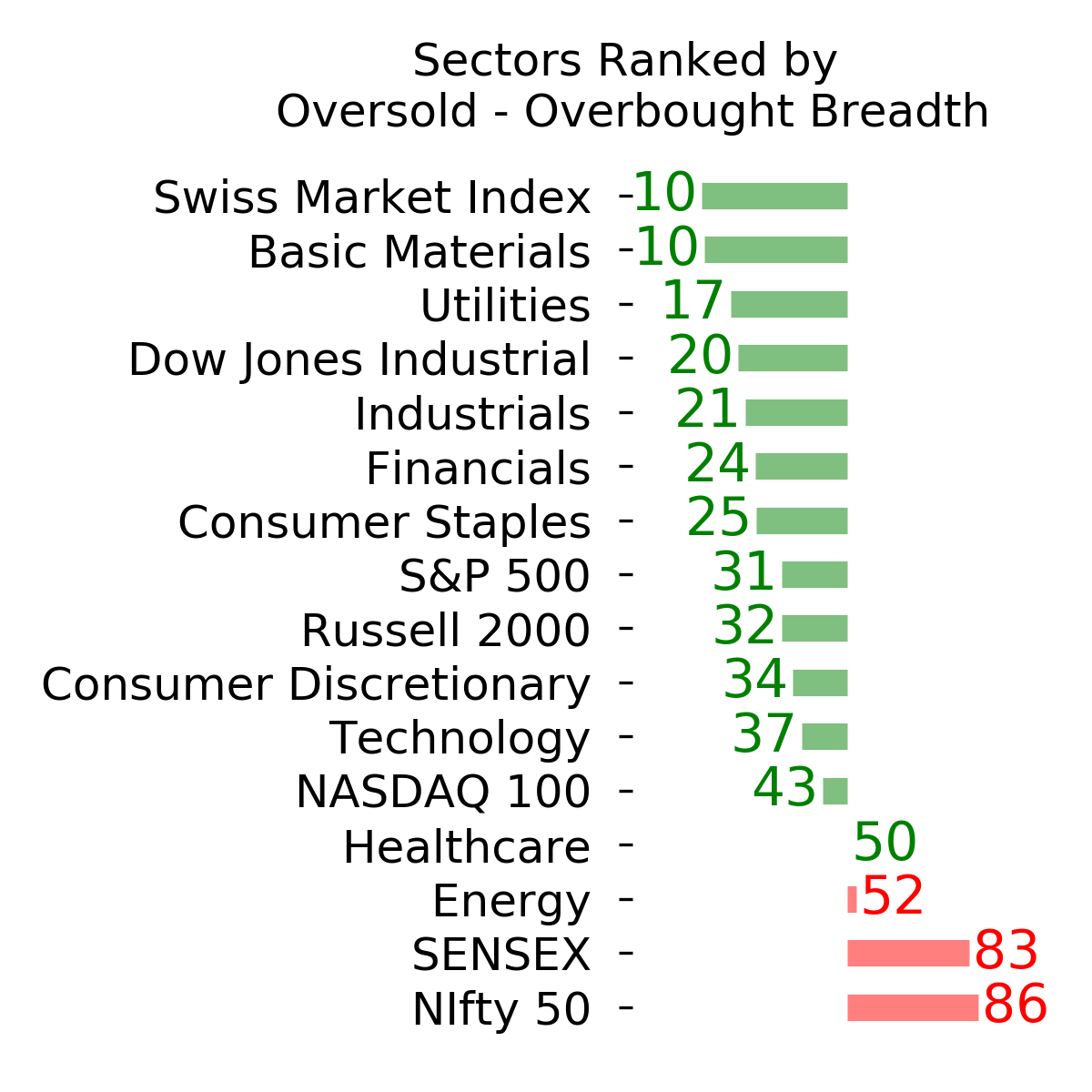

Ranks

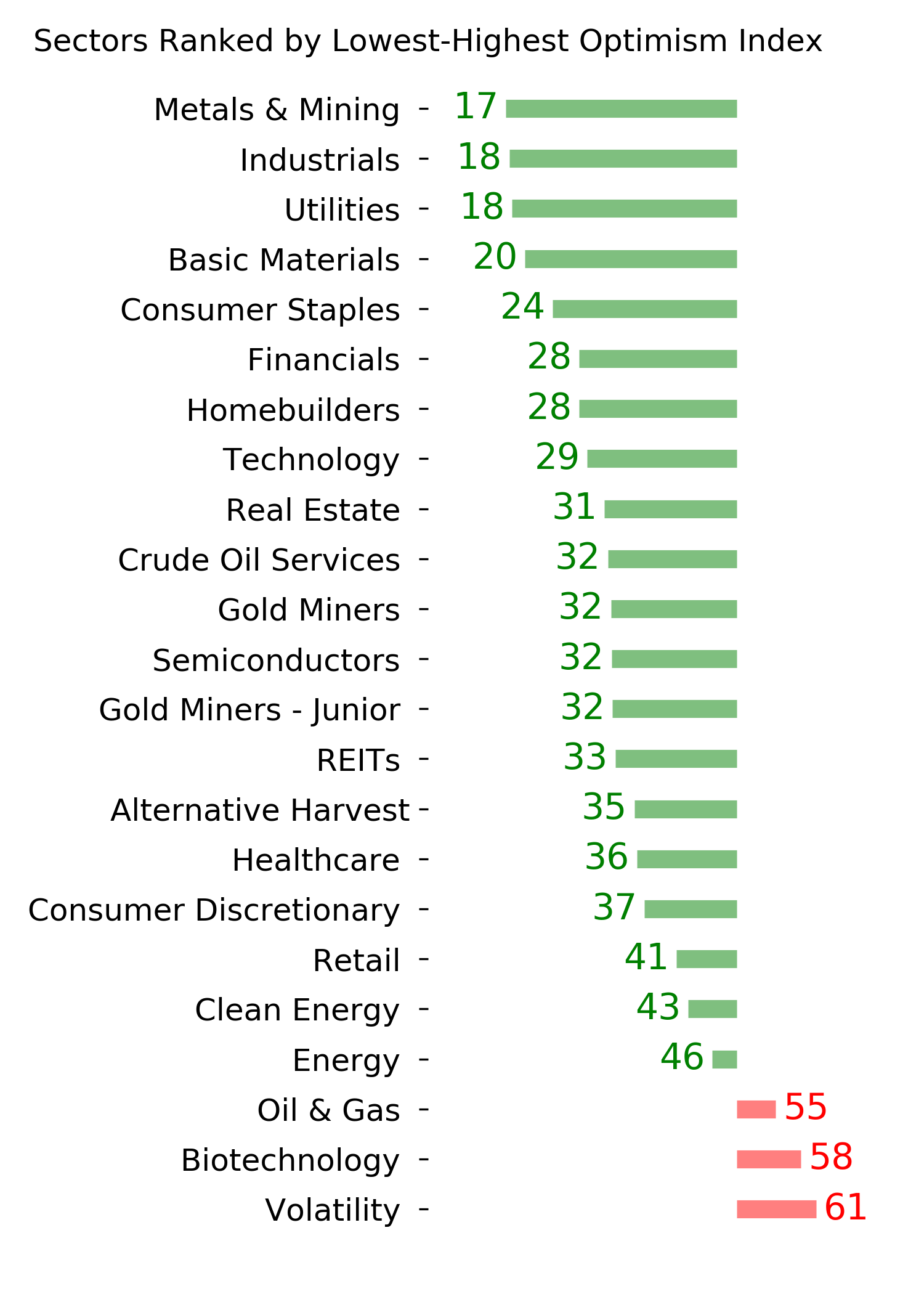

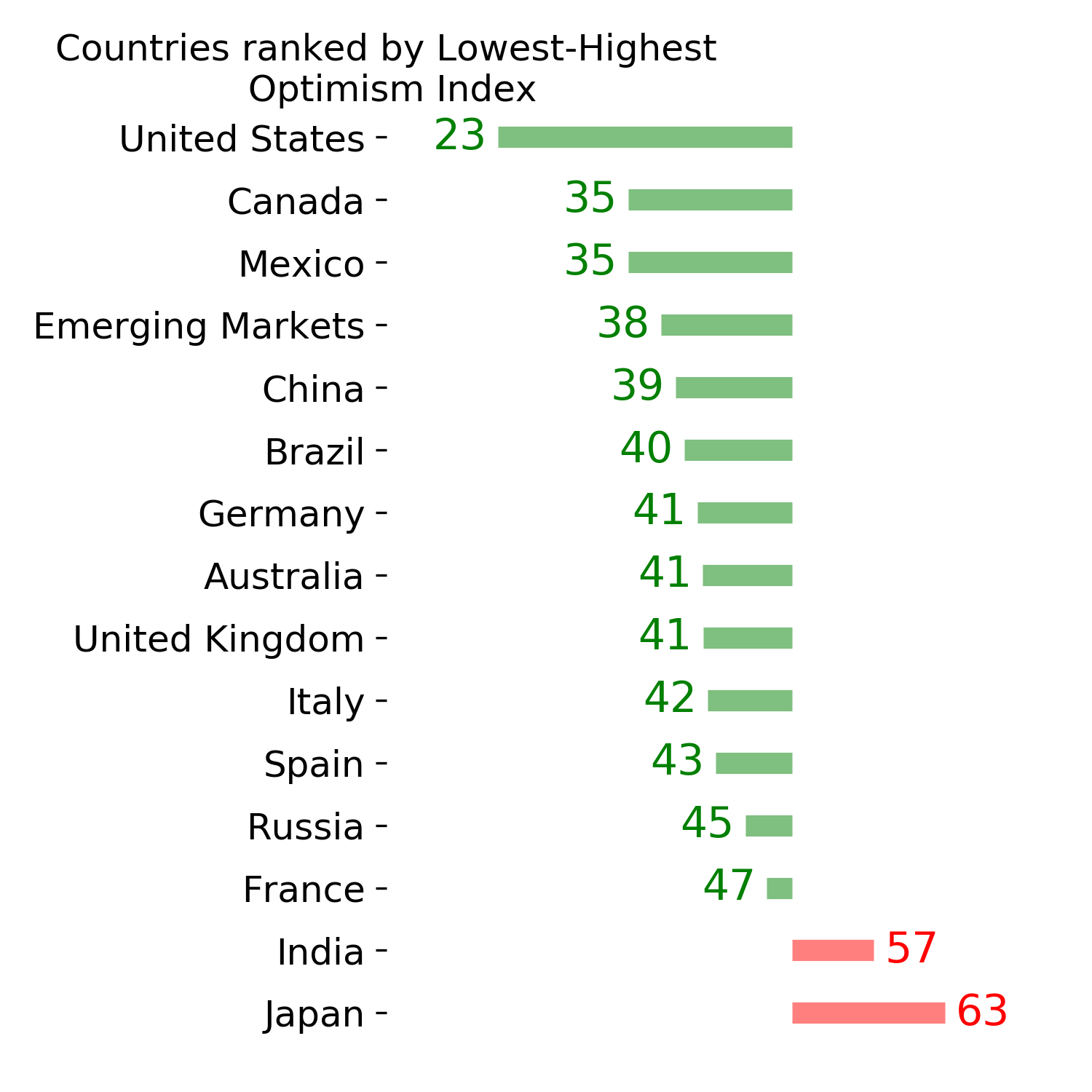

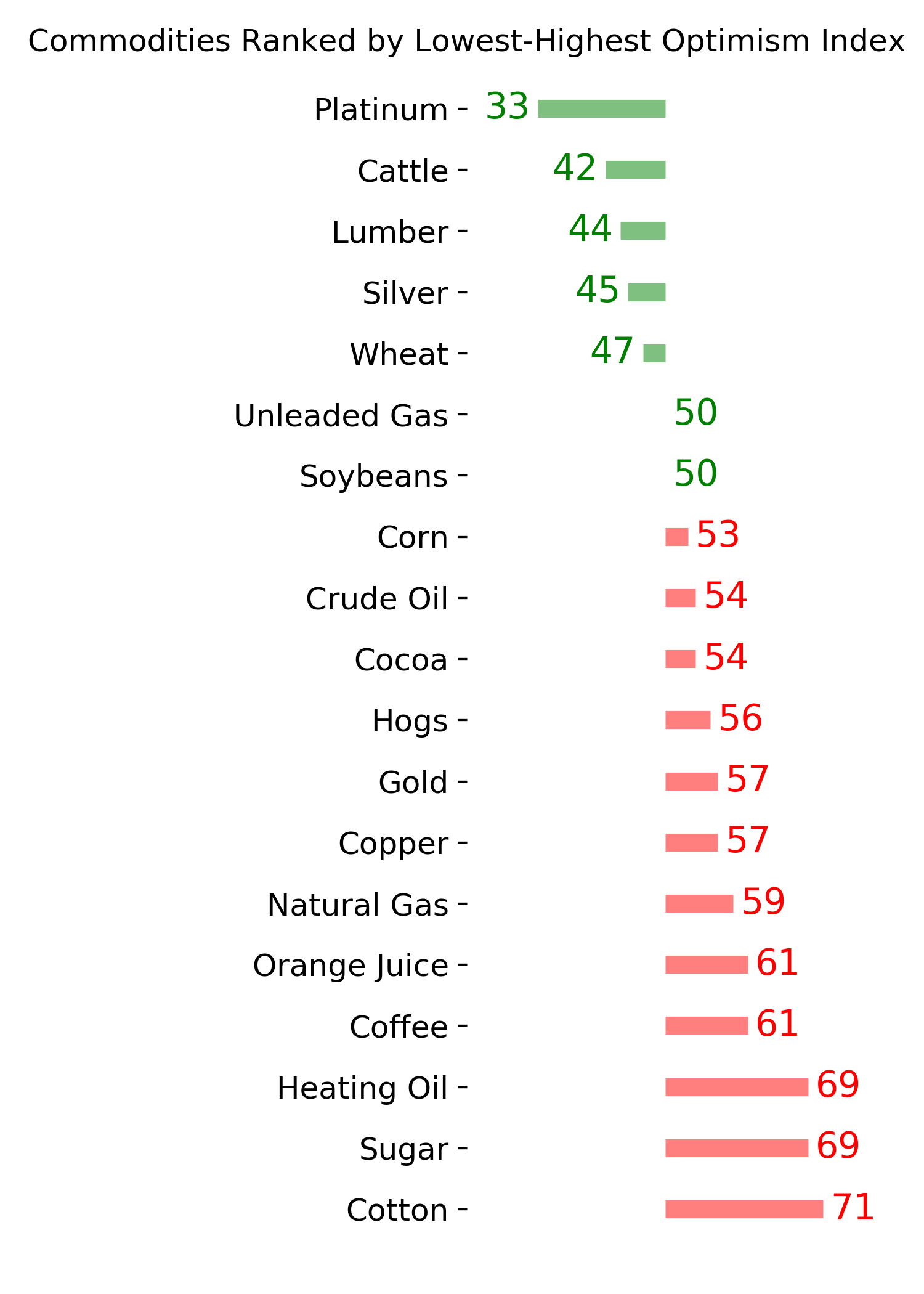

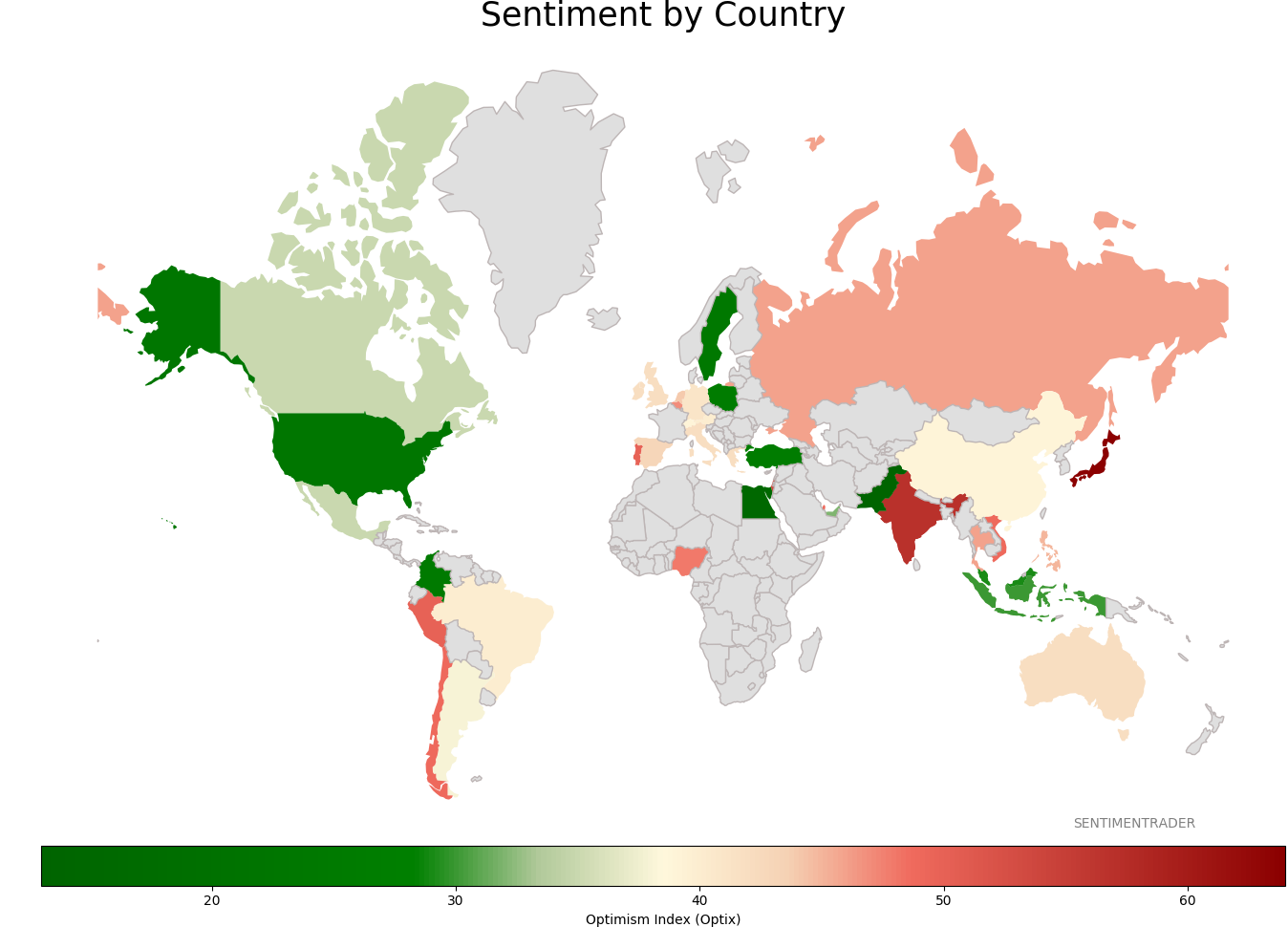

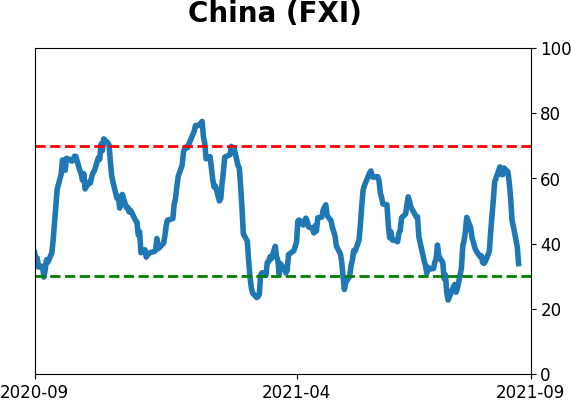

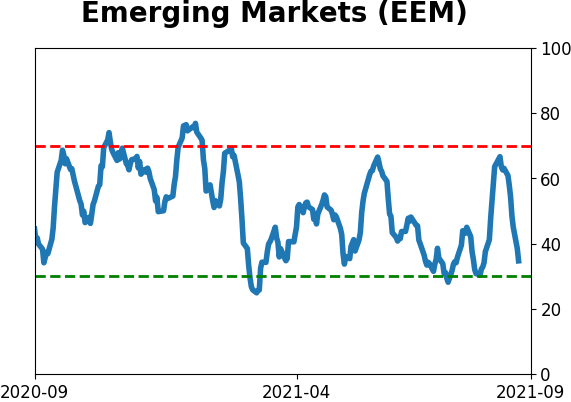

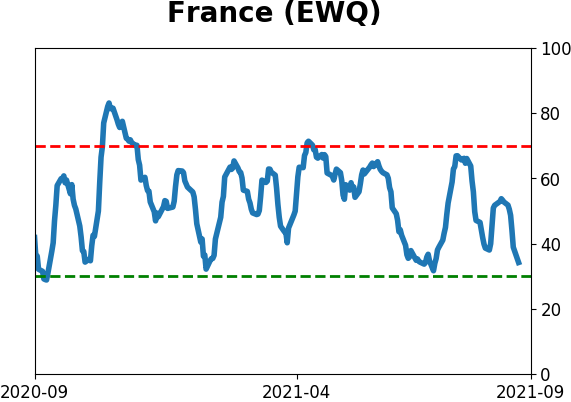

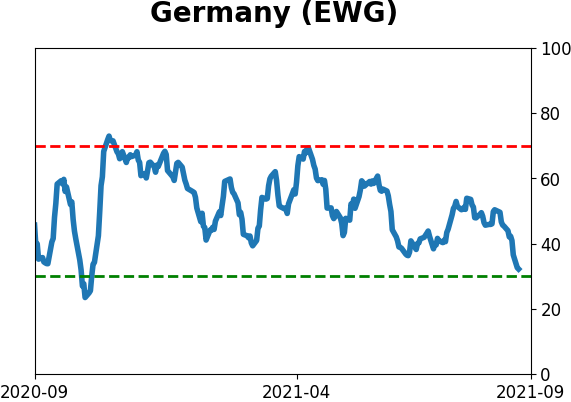

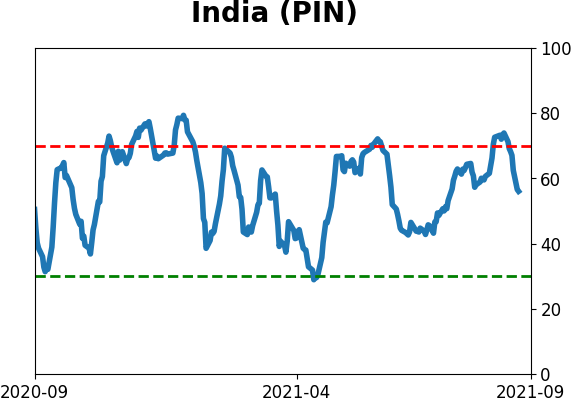

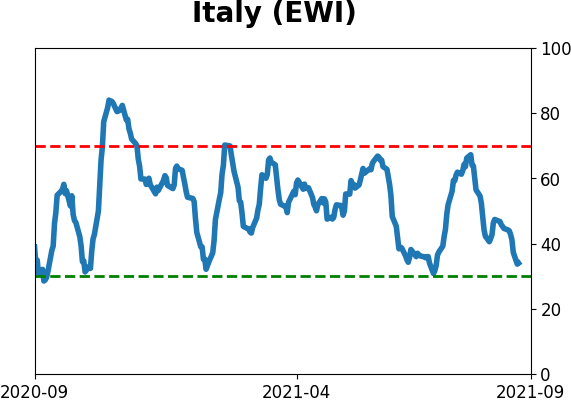

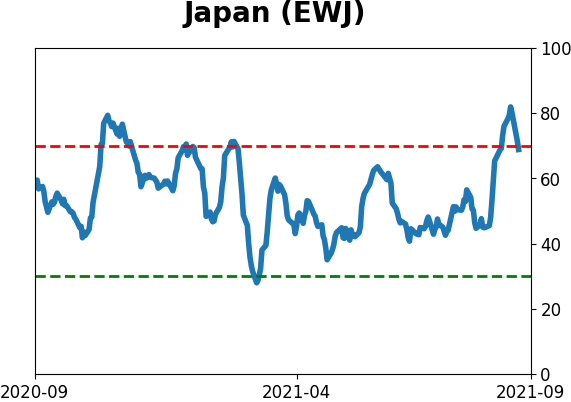

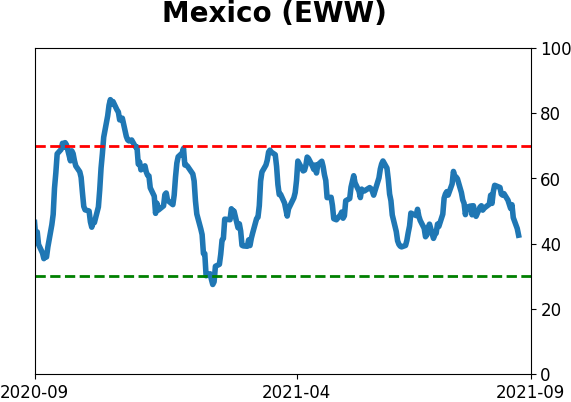

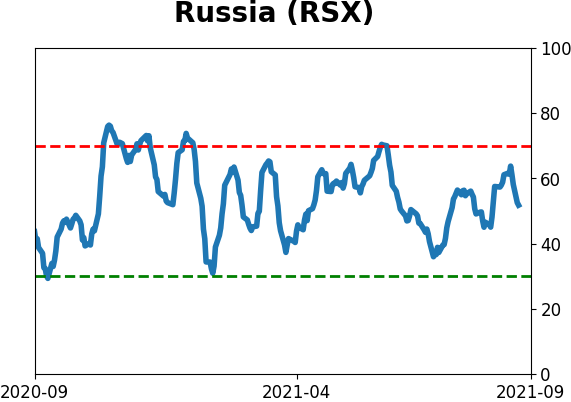

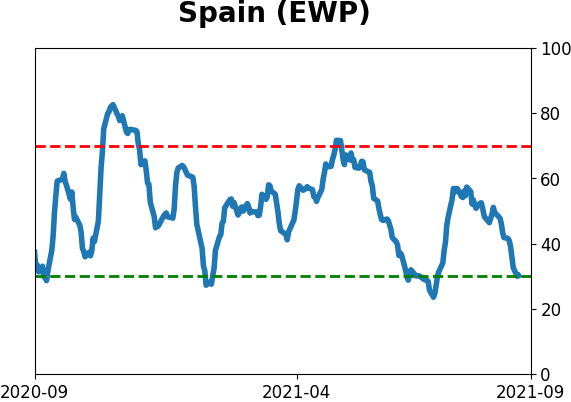

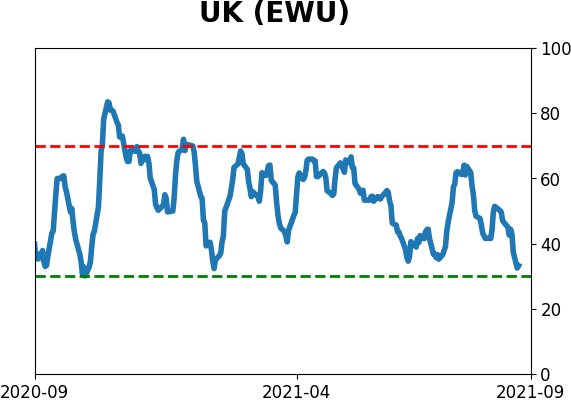

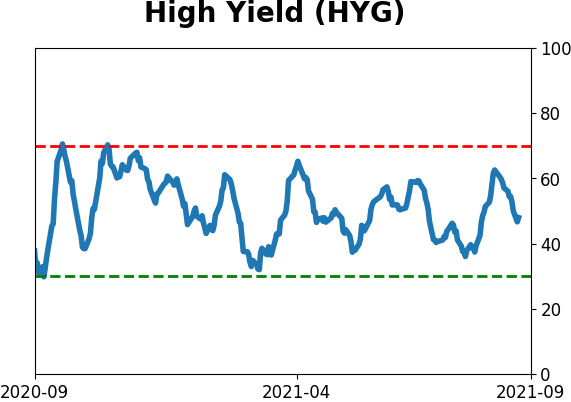

Sentiment Around The World

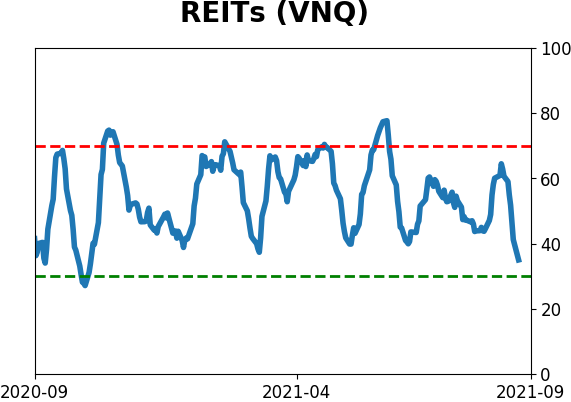

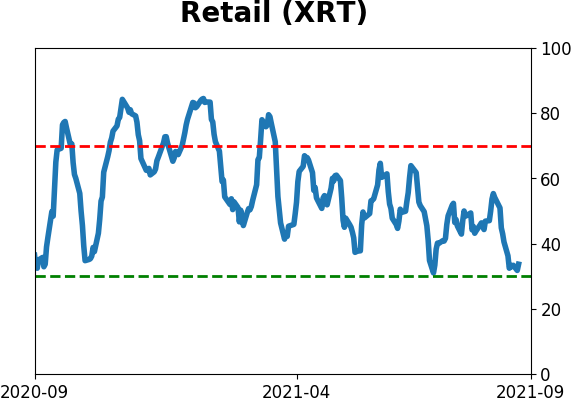

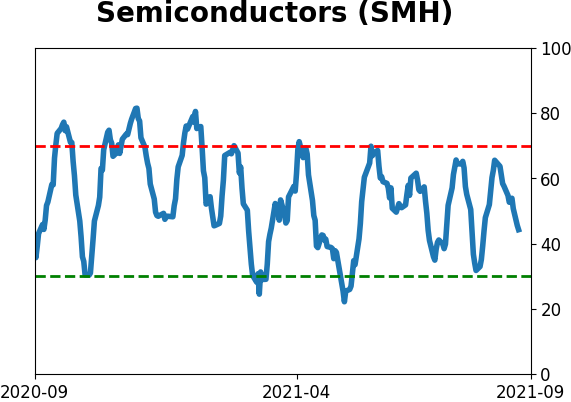

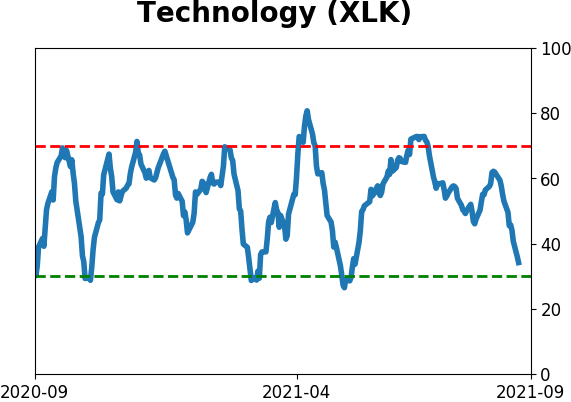

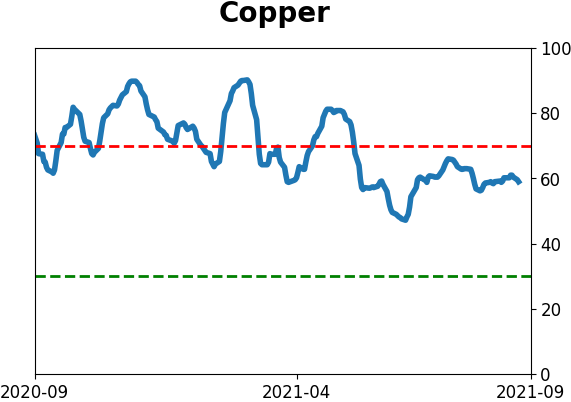

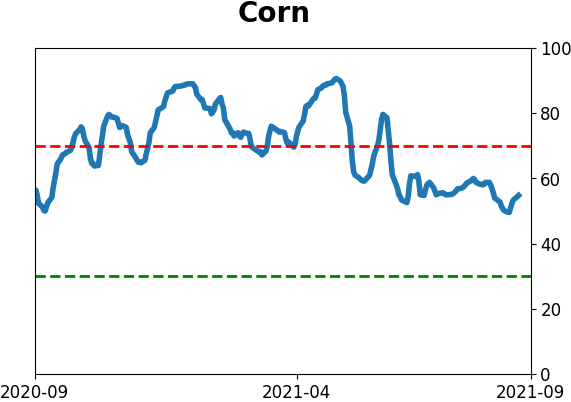

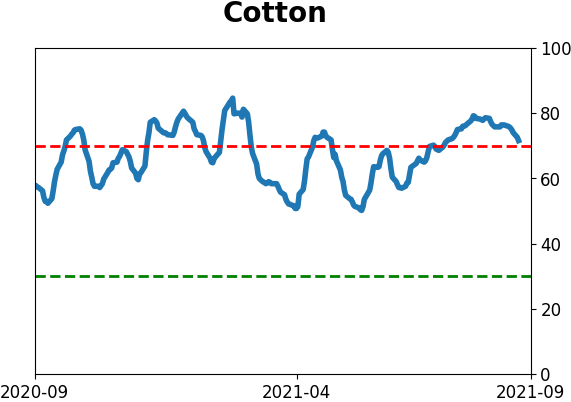

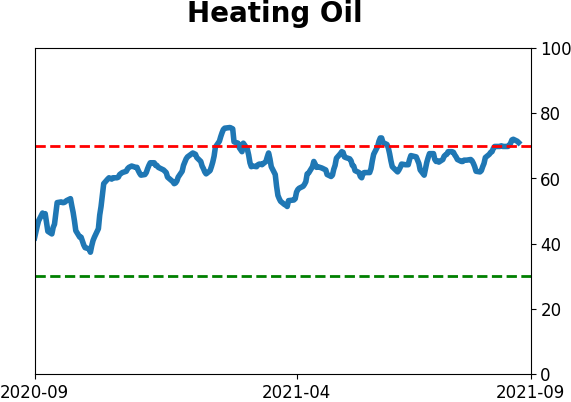

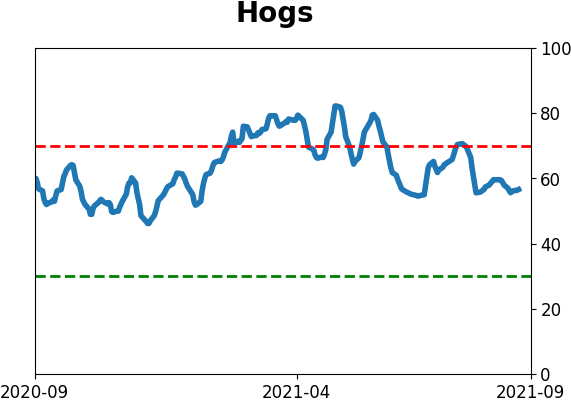

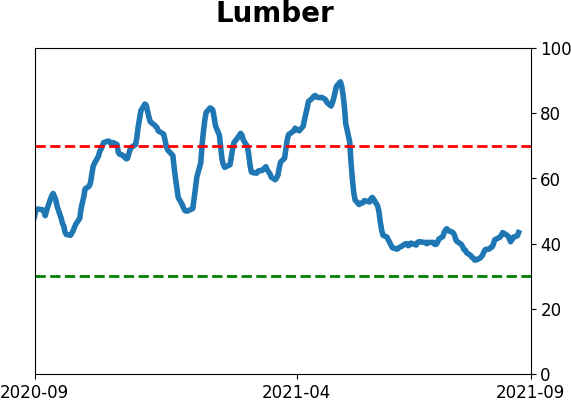

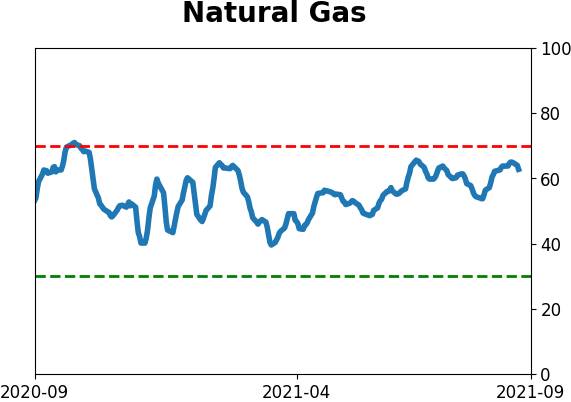

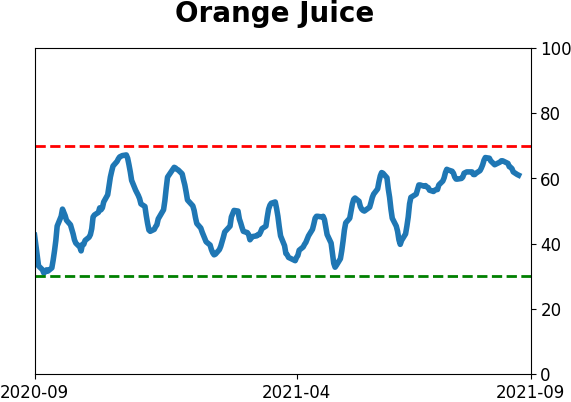

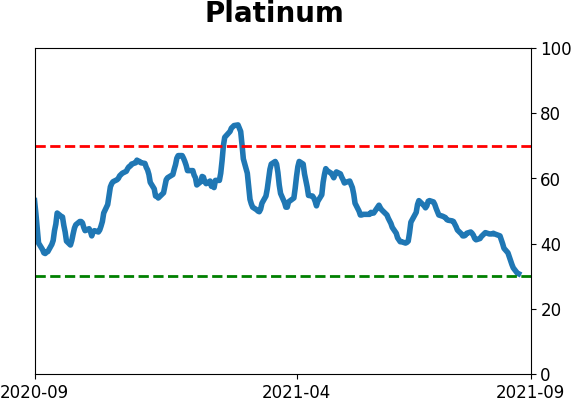

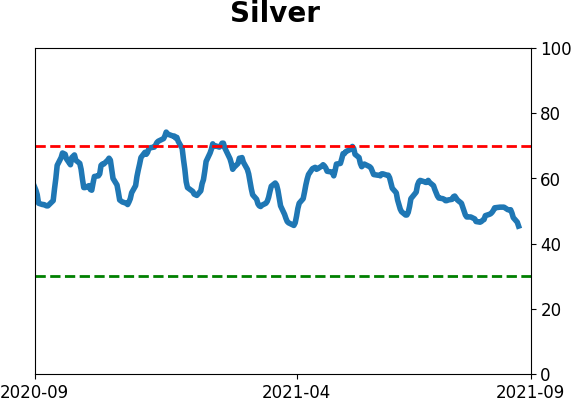

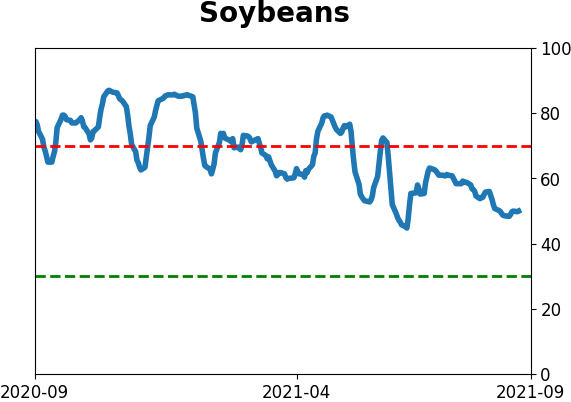

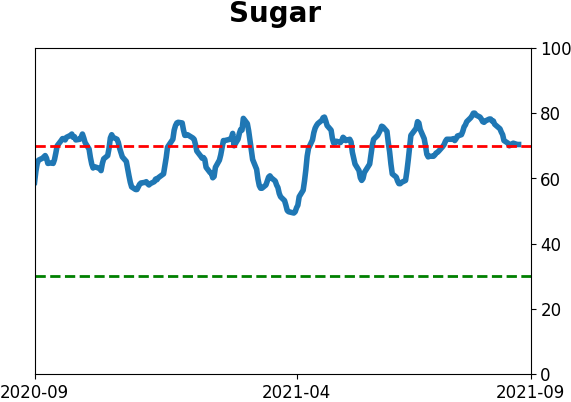

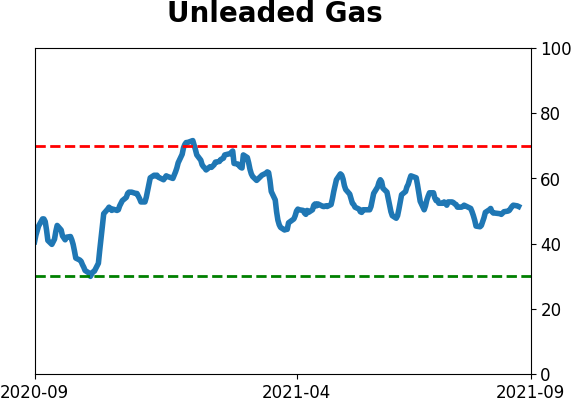

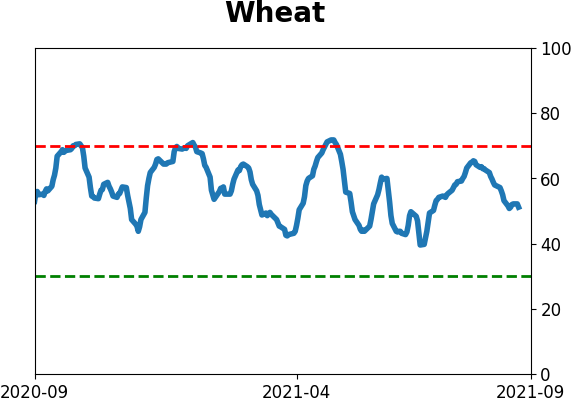

Optimism Index Thumbnails

|

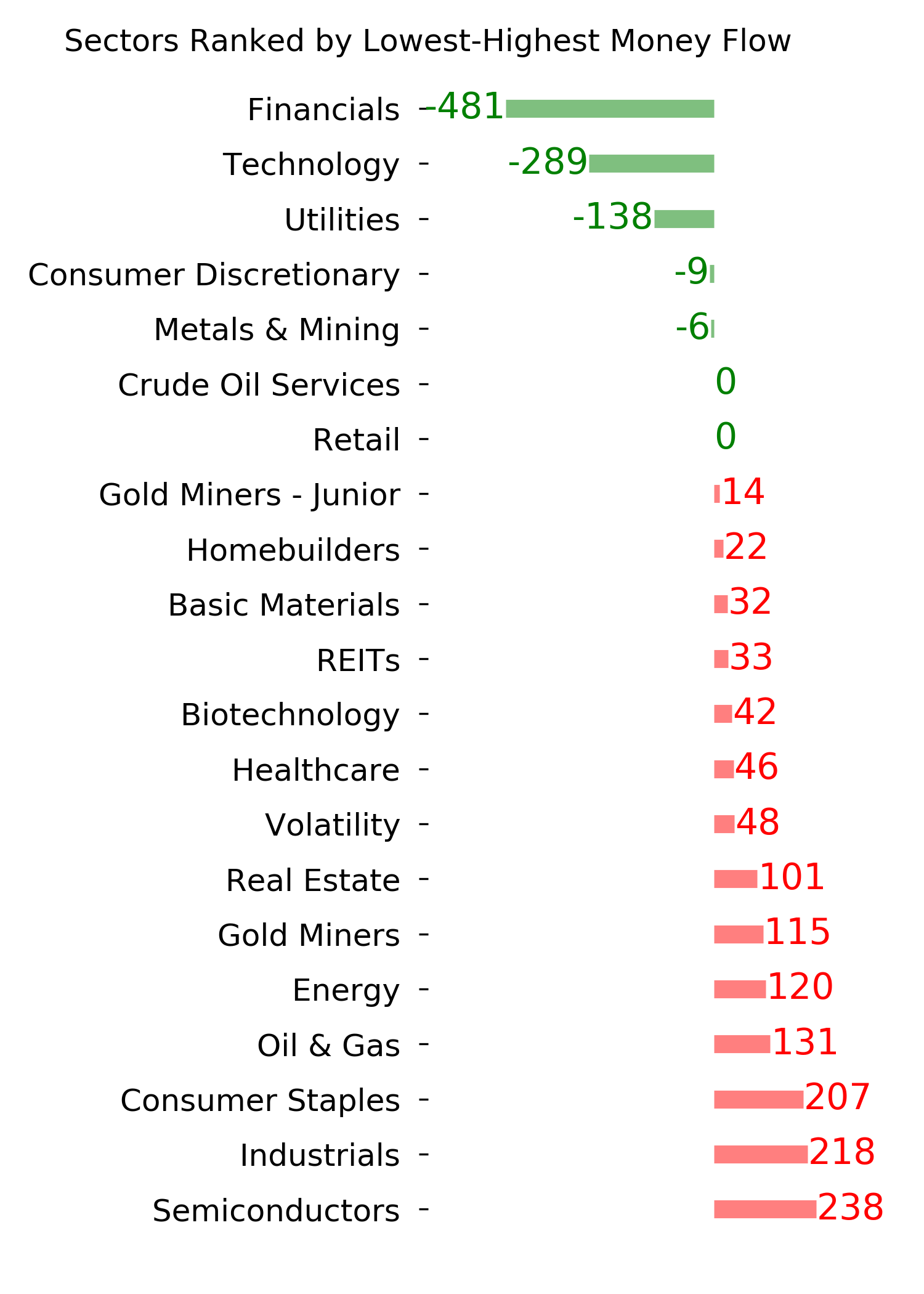

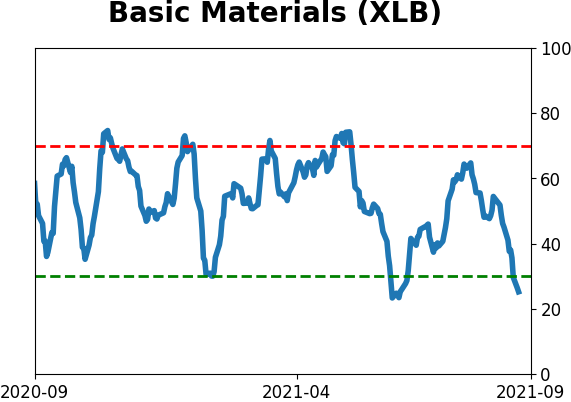

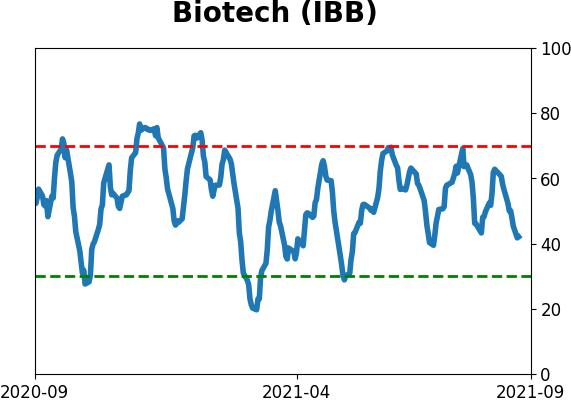

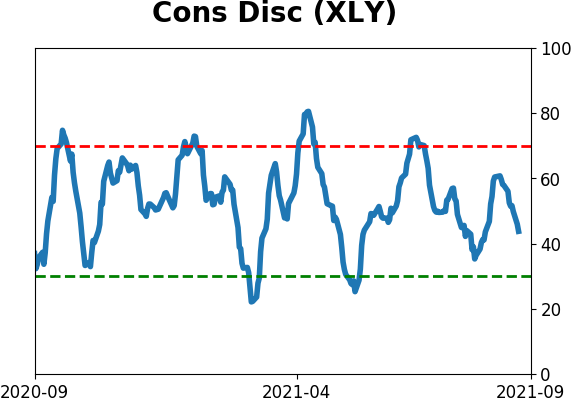

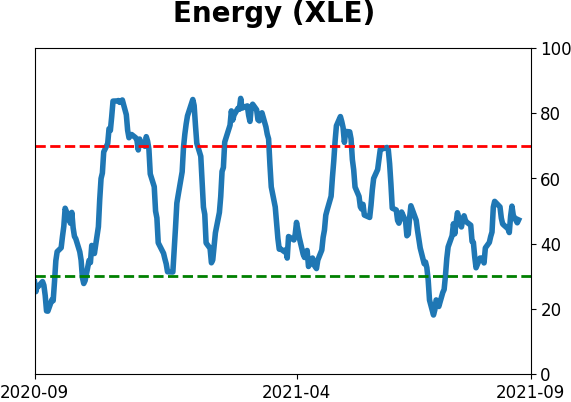

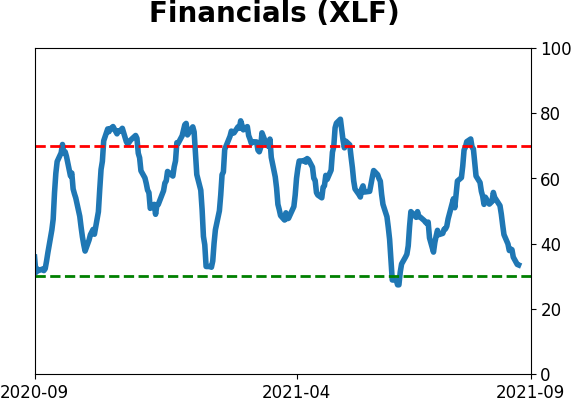

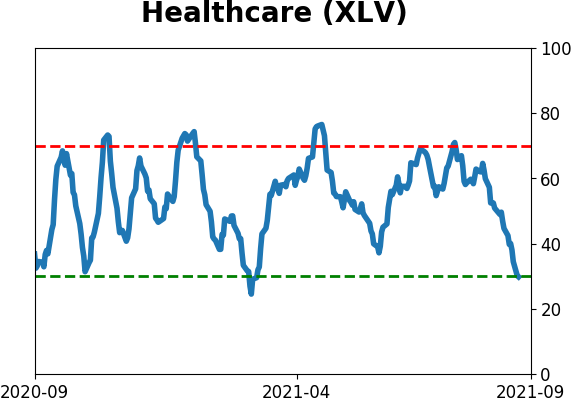

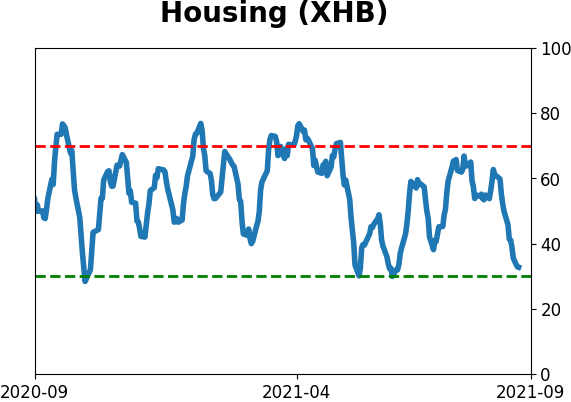

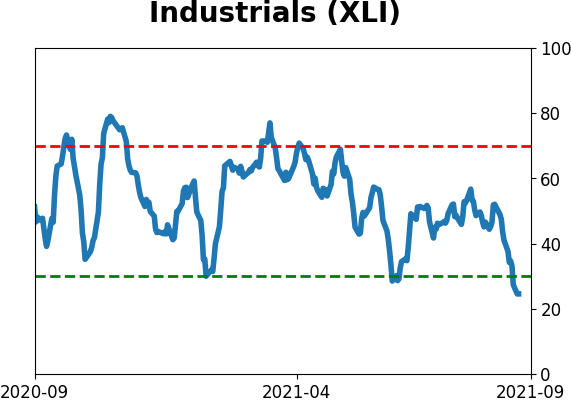

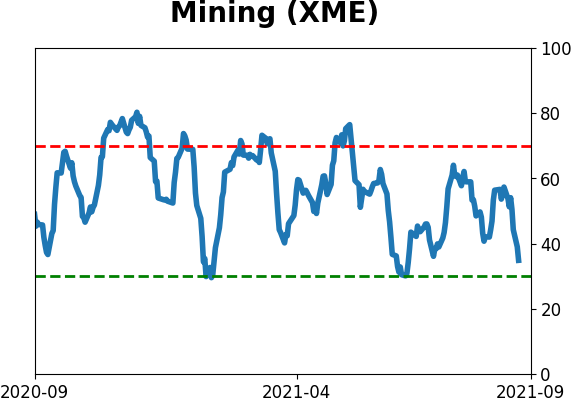

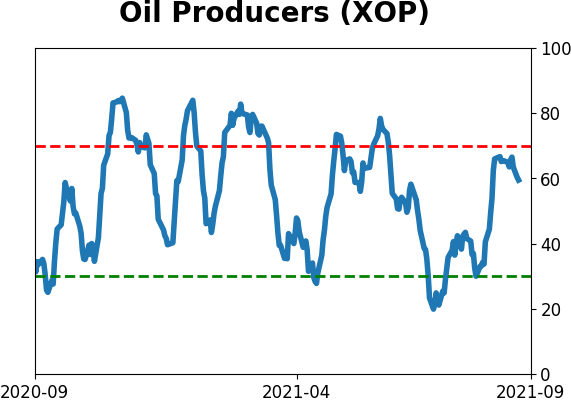

Sector ETF's - 10-Day Moving Average

|

|

|

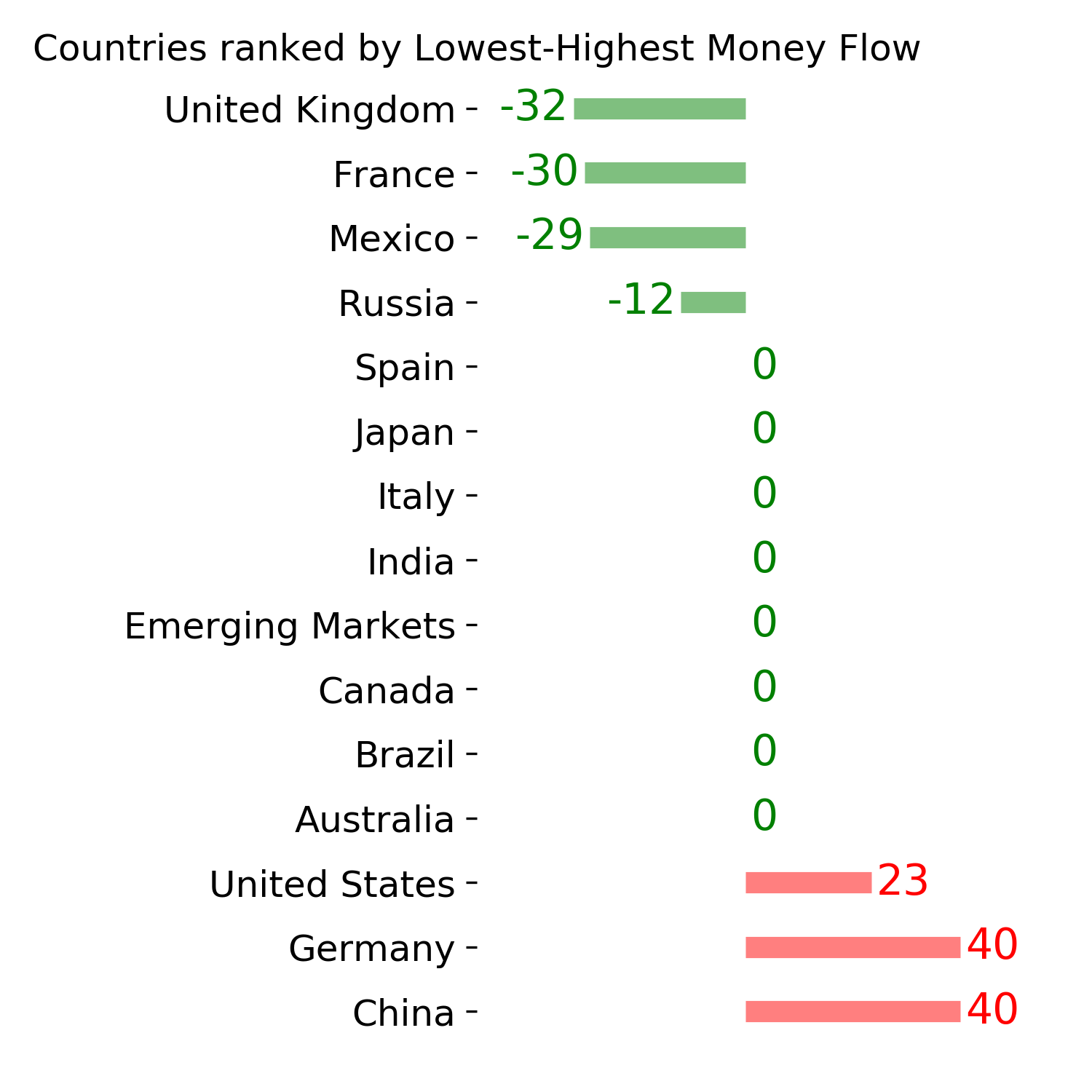

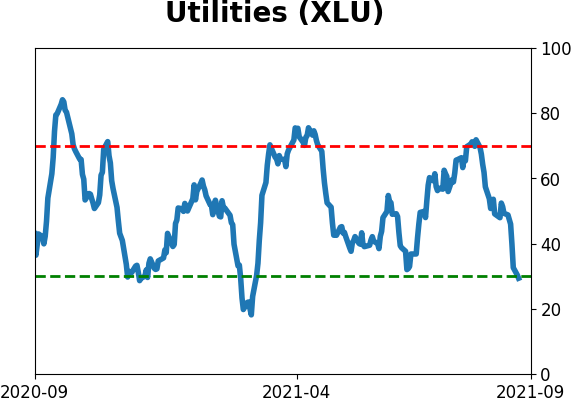

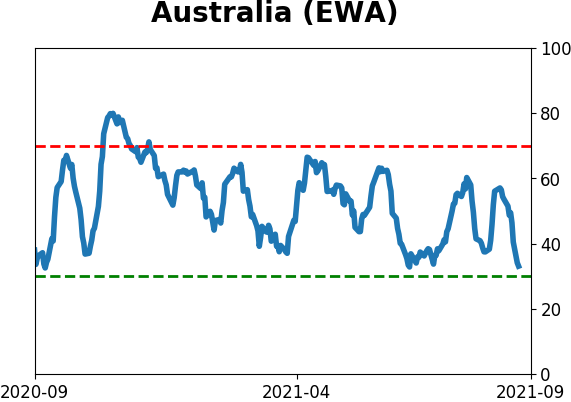

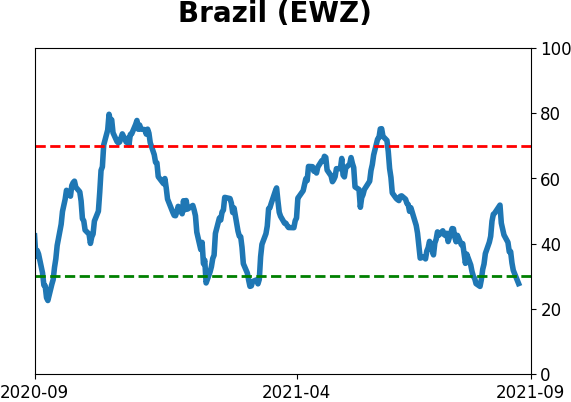

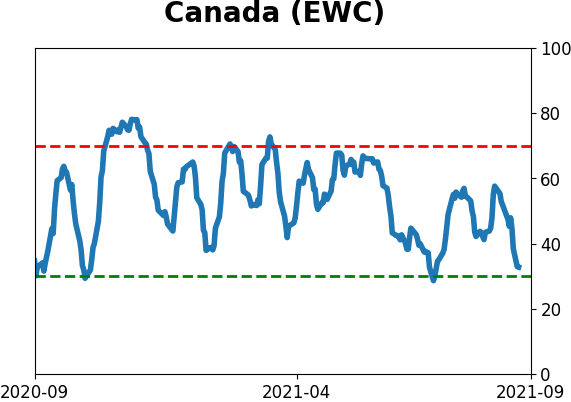

Country ETF's - 10-Day Moving Average

|

|

|

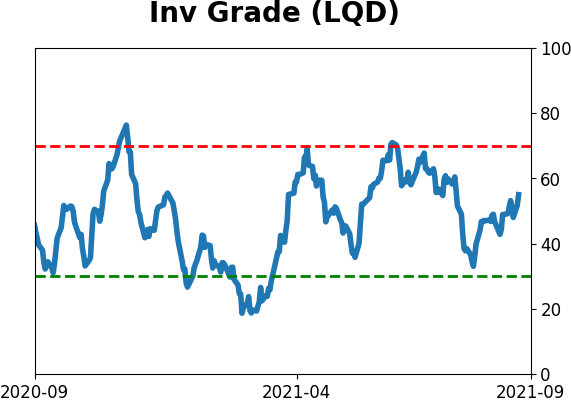

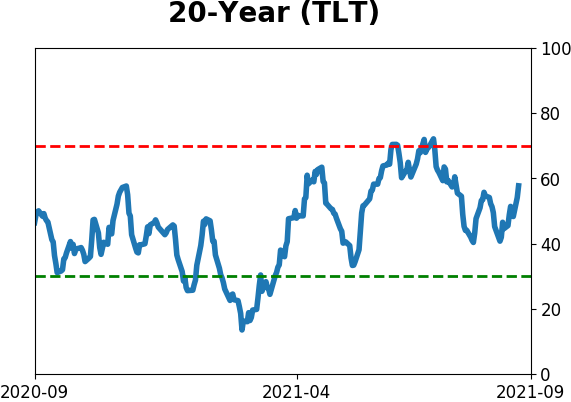

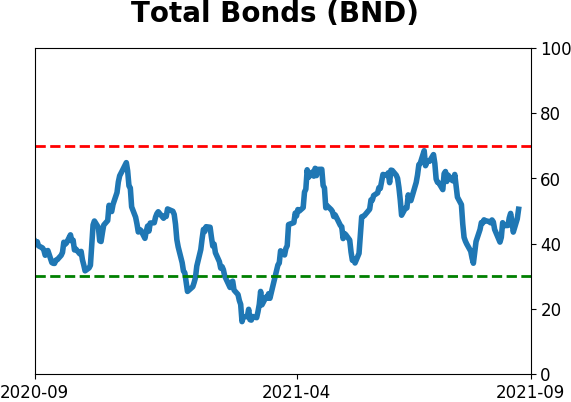

Bond ETF's - 10-Day Moving Average

|

|

|

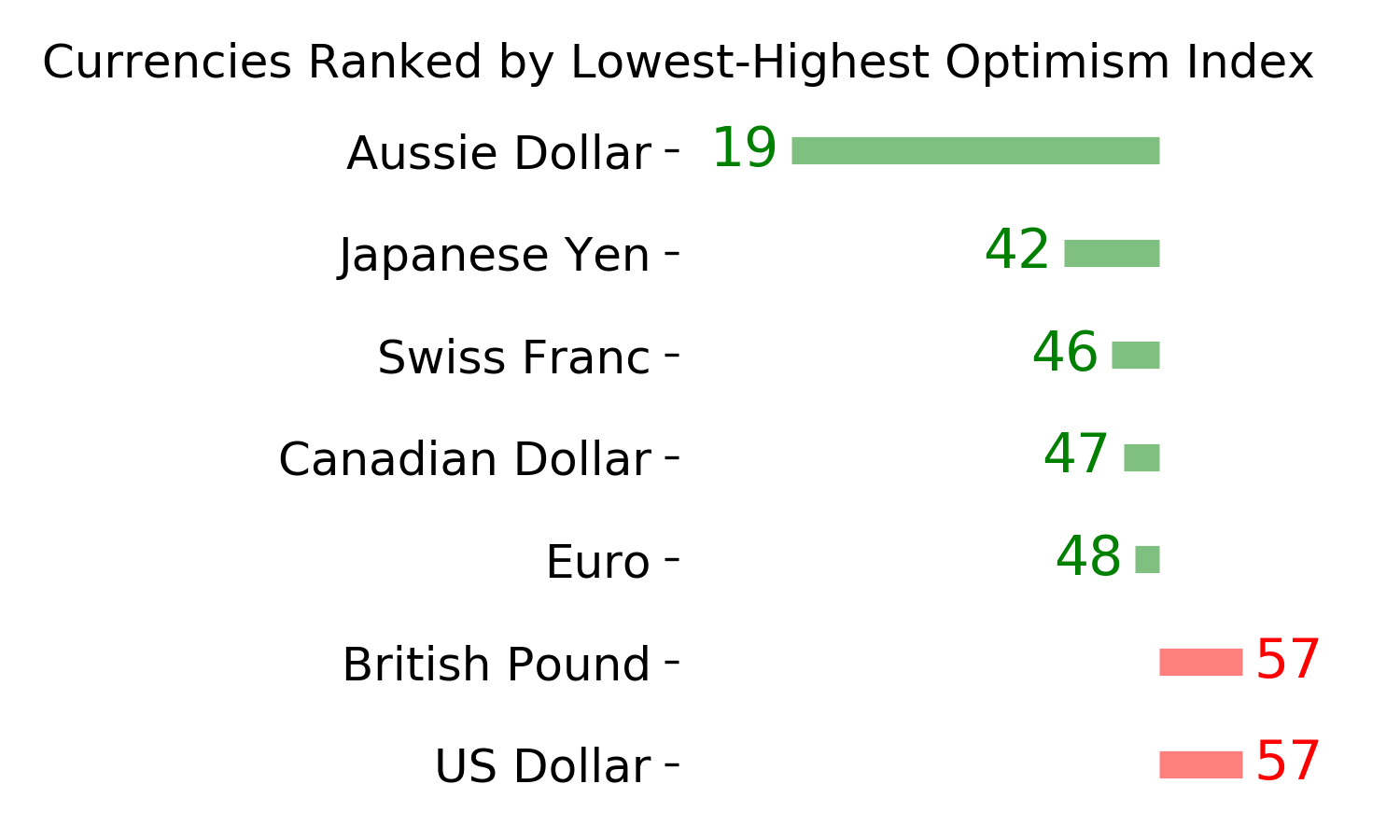

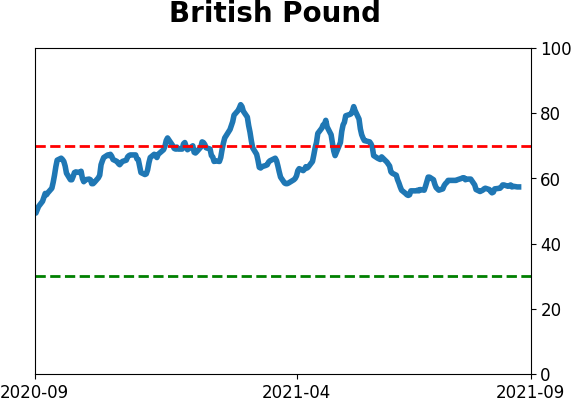

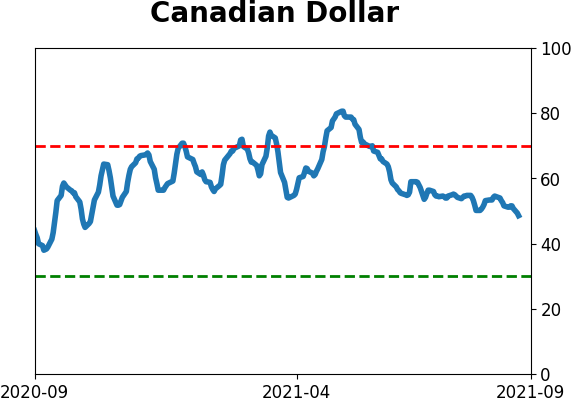

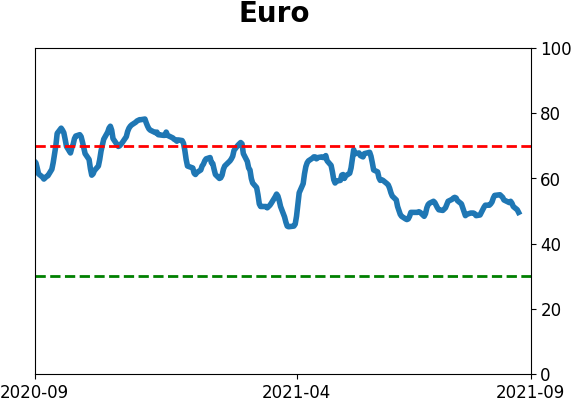

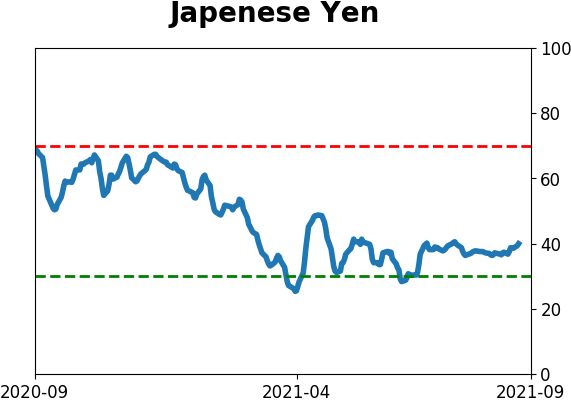

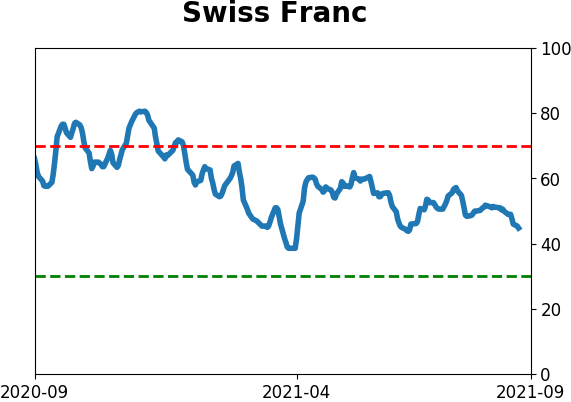

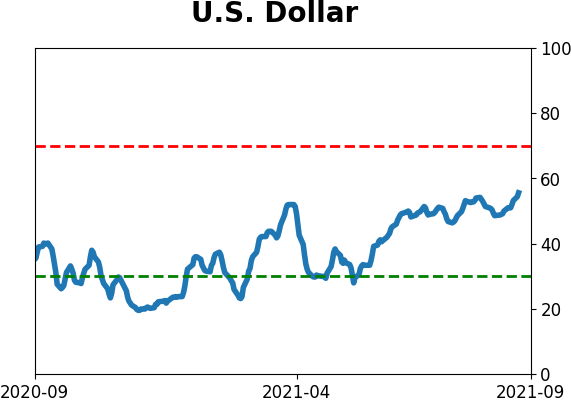

Currency ETF's - 5-Day Moving Average

|

|

|

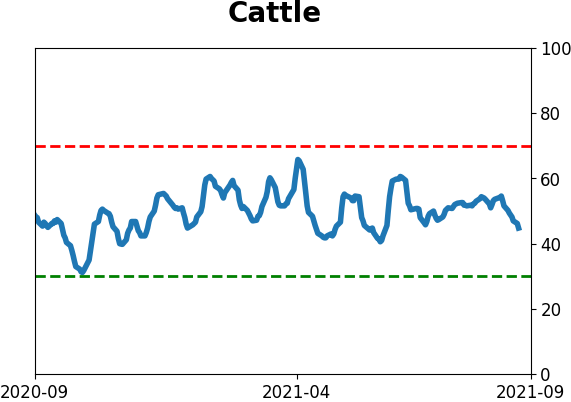

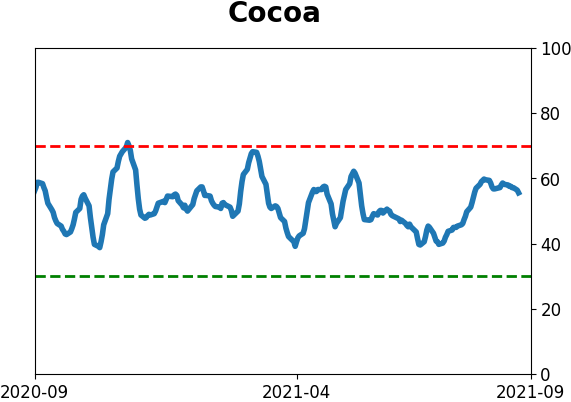

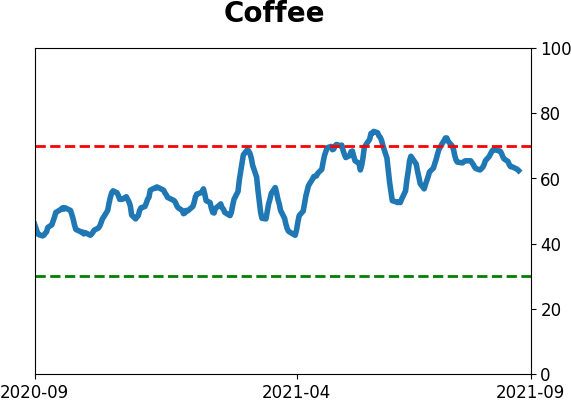

Commodity ETF's - 5-Day Moving Average

|

|