Sector Surge, MLP Rebound

This is an abridged version of our Daily Report.

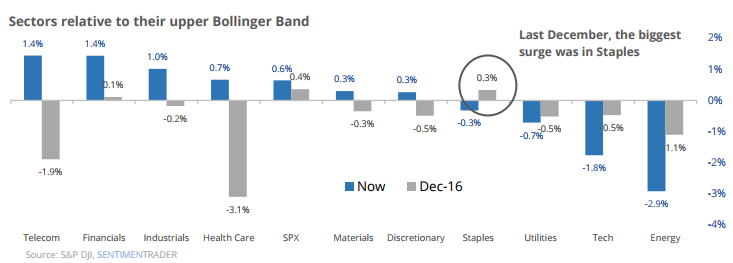

Sectors surging along with the S&P 500.

The S&P has been above its upper Bollinger Band for 3 days. Among sectors, Telecom and Financials are also surging. That’s different from what we saw last December, when it was Staples stocks that were surging above their own Bollinger Bands.

In the past, those two sectors were the least useful in predicting further gains for the broader market.

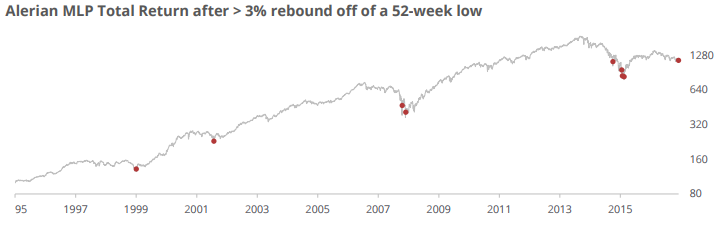

Big rebound in MLPs.

Master limited partnerships saw major buying interest on Thursday. The Alerian MLP Total Return index enjoyed a gain of more than 4%. Coming off of a 52-week low, one-day jumps of more than 3% have been a good sign for further gains, with an average return of more than 25% over the next six months.

Most financials hit a high.

More than half of the financial stocks in the S&P 500 have hit a 52-week high on both Wednesday and Thursday. That’s a high reading that has led to a short-term breather but long-term gains (see inside).

This is not a normal market.

The last time, before Thursday, that the S&P 500 rose more than 0.75% and closed at a new high, but the VIX “fear gauge” also rose at least 5%, was March 23, 2000.

This is not a normal market.

The S&P 500 rallied more than 0.75% on Thursday but emerging markets dropped more than -0.75%. That has led to gains over the next two weeks only 25% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.