Corporate insiders favor S&P 500 stocks, not Nasdaq 100, as trends diverge

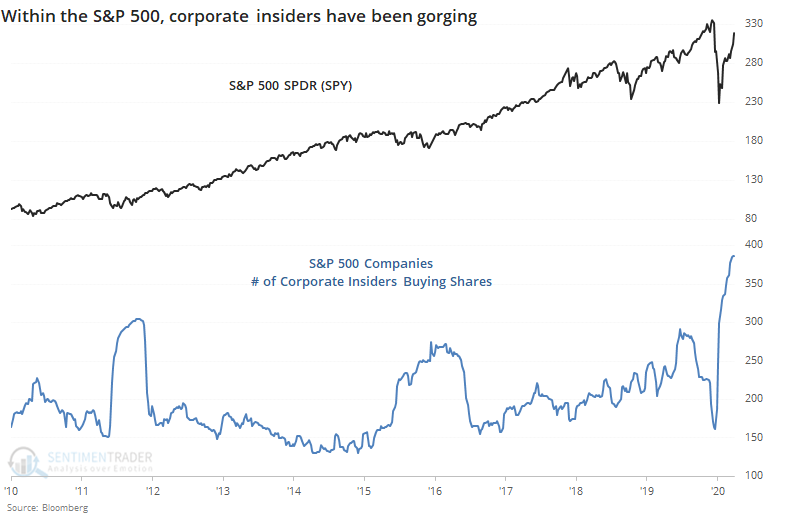

As stocks climbed incessantly higher to start the year, corporate insiders became hesitant. Among S&P 500 companies, there was a multi-year low in the number of insiders buying their firm's shares on the open market.

The pandemic changed all that. As other investors panicked, insiders picked up shares on the cheap. They're still going. The number of insiders that have bought shares in S&P 500 companies within the past six months has soared to a decade high.

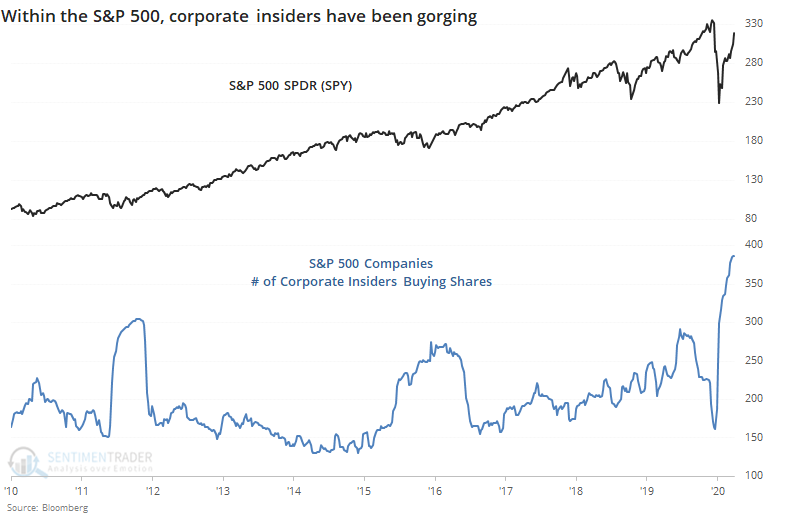

They're maybe not seeing quite the same values in big tech stocks. Insider buying among Nasdaq 100 companies has been tepid.

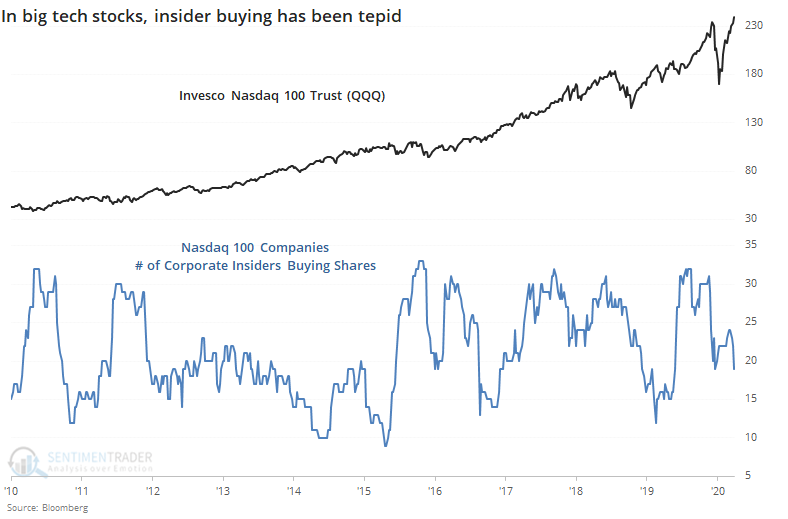

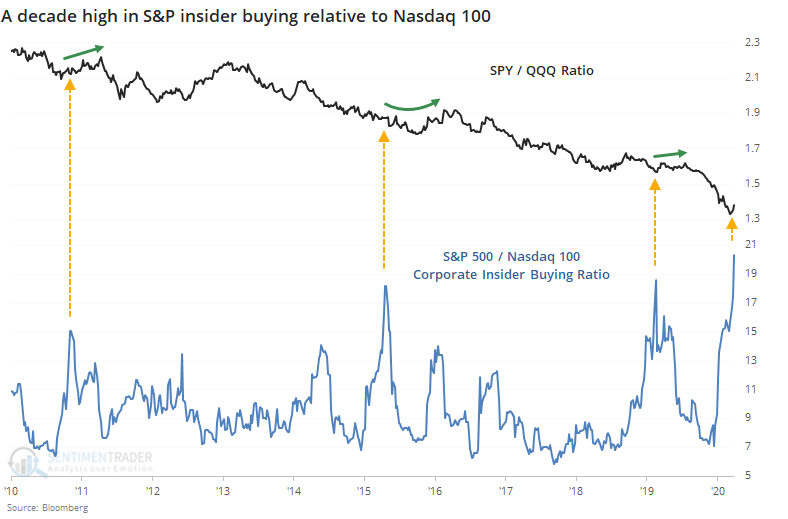

Insider buying is now 20 times greater in S&P 500 stocks than Nasdaq 100 stocks. While we should expect the ratio to be high simply because there are more stocks, this is still the highest ratio since at least 2010.

This wasn't a slam-dunk, but other times when insiders in S&P stocks were much more aggressive buyers than insiders of Nasdaq 100 stocks, the ratio between SPY and QQQ showed a modest tendency to rebound in the months ahead. Once the ratio of insider buying settled down, QQQ resumed its relative outperformance.

Insider appetite for their own shares in S&P stocks comes despite the Nasdaq's torrid trend (or perhaps because of it). In a premium note, Troy mentioned that the Nasdaq has levitated above its 20-day moving average for 46 days, a historically long stretch. That's the case for both the Nasdaq 100 and Nasdaq Composite.

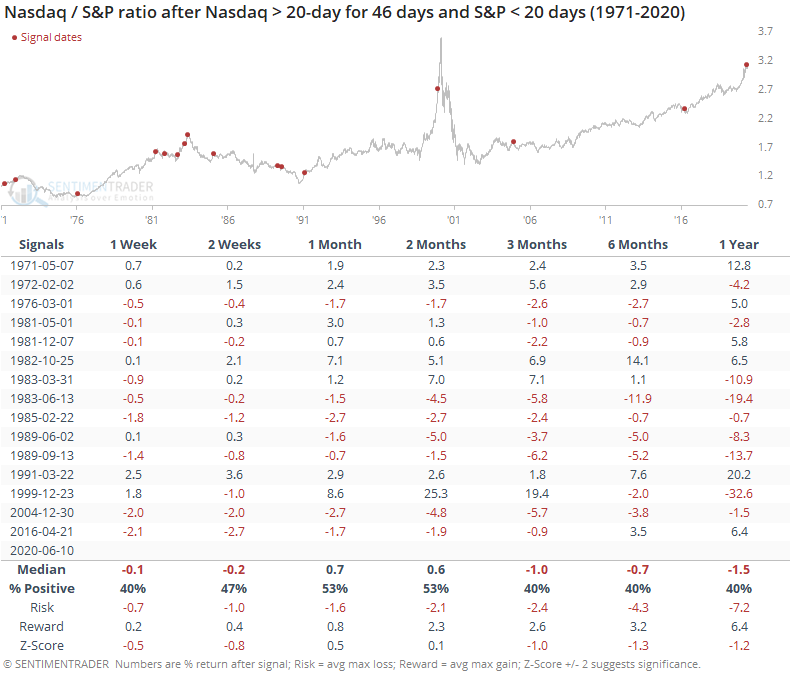

It's interesting to note that while the Nasdaq indexes have been on such a sustained trend, the S&P 500 has not. It hasn't spent even 20 days above its 20-day average.

When the Nasdaq's trend has been so much stronger than the S&P's, we typically saw mean reversion in the months ahead. The ratio between the Nasdaq Composite and S&P 500 showed a tendency to decline.

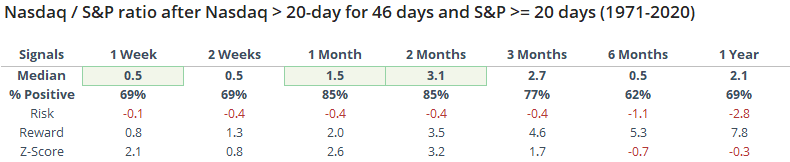

Contrast that to times when the S&P had enjoyed a sustained trend above its 20-day average along with the Nasdaq. Then, then Nasdaq showed more of a tendency to outperform.

Anytime the indexes enjoyed such a run above their 20-day average, shorter-term returns were generally poor but quite good in the medium- to long-term. We've seen that time and time again - bouts of extreme momentum often suffer mean-reversion in the short-term but are a sign of intense buying interest that doesn't die easily longer-term.

Given insider positioning and trend divergences, the likelihood is increasing that broader indexes like the S&P should start to do better relative to the hot Nasdaq.