Corporate Bonds Suffer As Small Caps Shrug Off Economic Reports

This is an abridged version of our Daily Report.

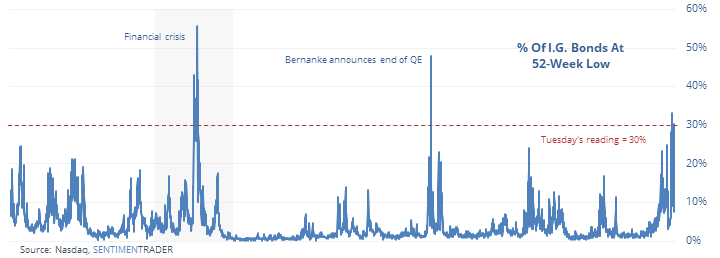

Bloodbath in bonds

Corporate bonds have been hammered, with Tuesday seeing the worst breadth readings since 2008 and 2013. Those two crises (the financial meltdown and the end of QE) were the only ones that matched Tuesday’s carnage.

Forward returns were excellent after other times the market suffered panic-level selling pressure.

Small-cap investors shrug off disappointing economy

Small-cap stocks have reached record highs even as the Citi Economic Surprise Index (CESI) hits a multi-month low. The Russell 2000 is the most highly correlated index to the CESI so this is relatively unusual. Similar behavior led to further gains for the Russell, but the S&P 500 did even better.

Oil enthusiasm

The Optimism Index on crude oil is back above 70. Since 1991, that has led to gains in oil over the next month 44% of the time, averaging a loss of 0.7%, according to the Backtest Engine

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |