Coronavirus craters consumers' confidence

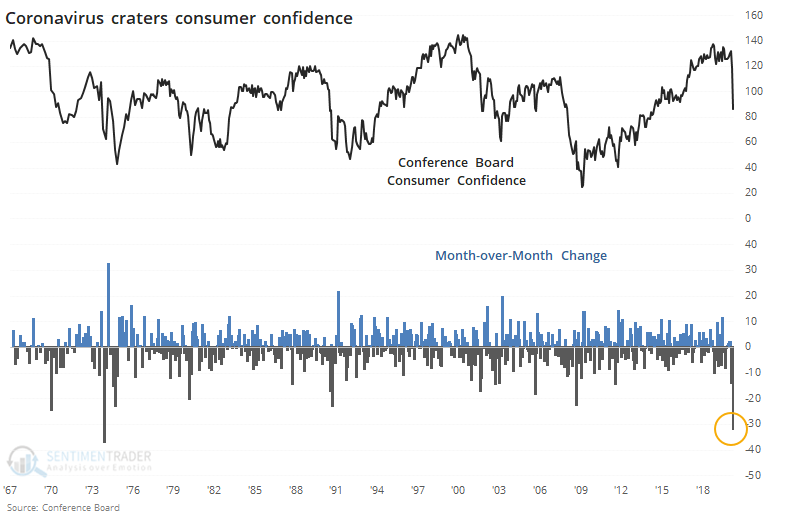

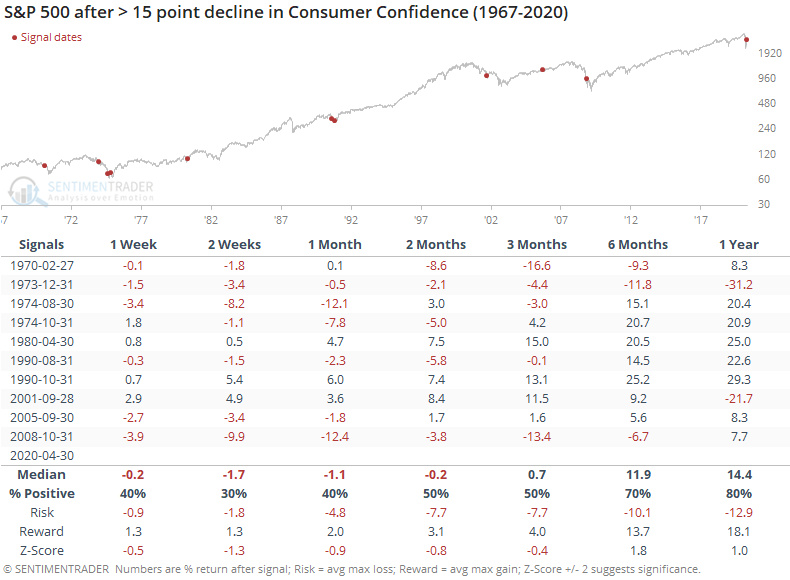

The latest release of Consumer Confidence from the Conference Board shows that attitudes flipped in a major way in April. From a near-record level, Confidence dropped more than 30 points in a single month.

That's the 2nd-largest monthly decline since 1967. The only month with a larger decline was December 1973 when OPEC doubled the price of crude oil and terrorists had commandeered a plane in Italy.

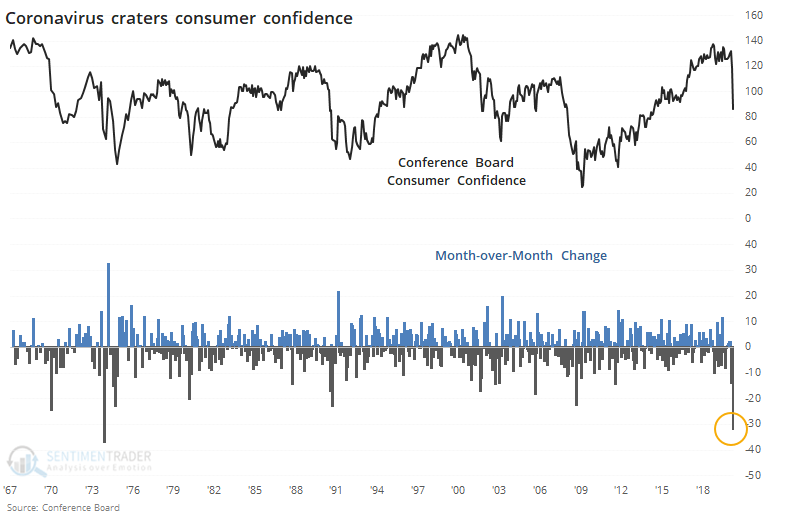

Big declines in confidence have come during rough markets, and they didn't usually turn on a dime. In the weeks following the largest monthly declines, stocks tended to fall.

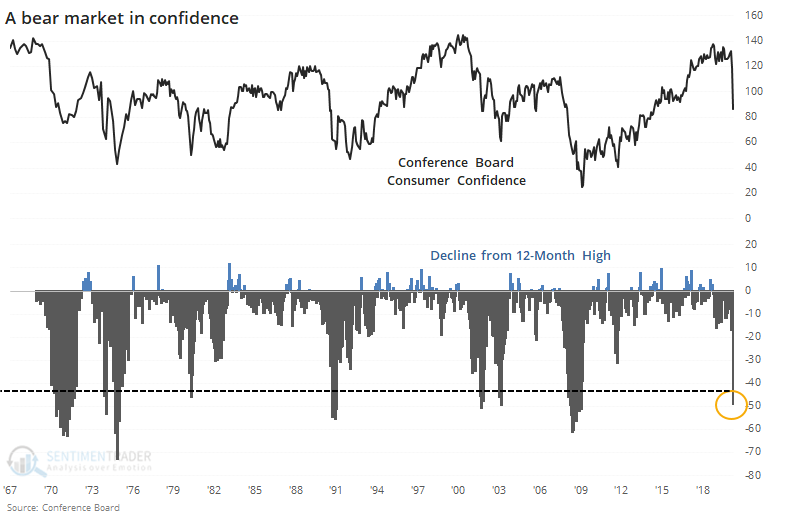

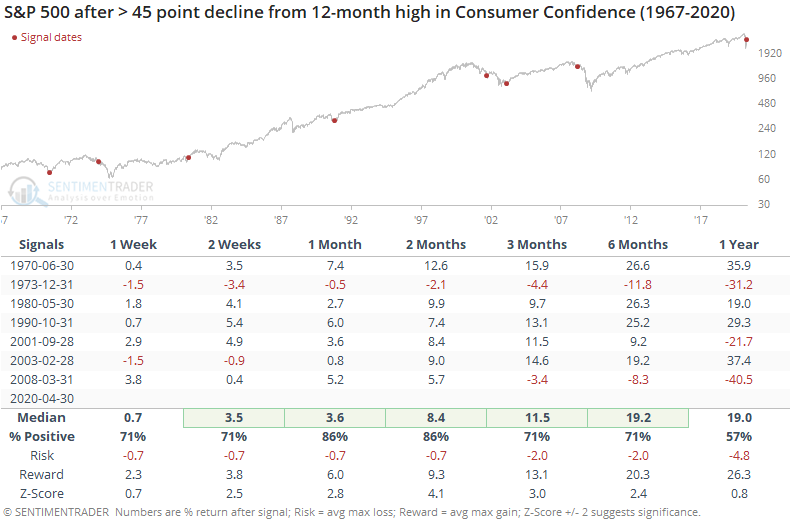

What makes this change stand out is its sheer magnitude. Already, Consumer Confidence is down more than 45 points from the peak over the past year.

When put into this context, returns were significantly better.

That drop in 1973 is still in the table, and it's the only one that showed a loss over the next 1-2 months, which cascaded into an even larger drop over the next year.

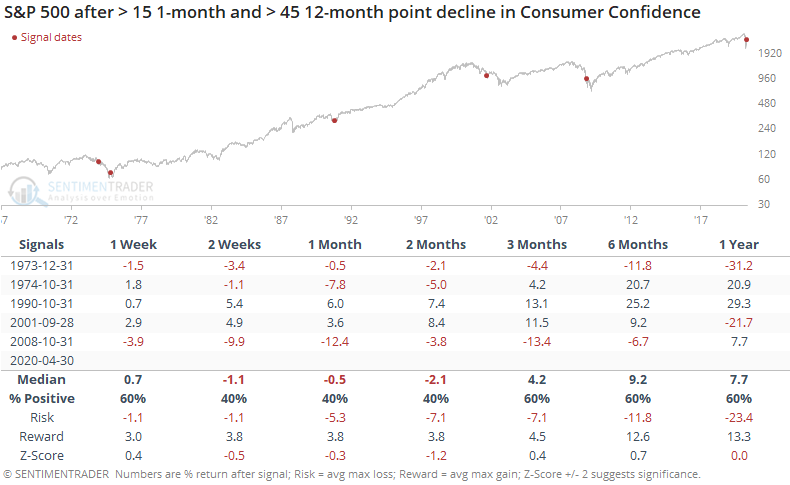

If we combine the large one-month drops in Confidence and the largest drawdowns from the highest Confidence level over the past year, then we get the following signals.

These massive drops in Consumer Confidence came near bear market lows in 1974 and 1990. But it was woefully early in 1973 and 2008, and served to be only a medium-term inflection point in 2001.

Both bulls and bears could point to something there, which isn't very helpful. Probably the biggest takeaway is that it should be a positive going forward, but if prices start to show a pattern of lower lows, then the precedents are decidedly negative.