Copper is hoping for a seasonal tailwind

Key Points:

- Copper has been stuck in a trading range for almost eleven months

- Copper tends to witness strength from late January into early March

Copper trapped in a range

The chart below displays a daily bar chart for a continuous copper futures contract (courtesy of StockCharts). As you can see, Copper has been mired in a trading range since late February 2021.

So the question on trader's lips is, "Which way will this break out?" The reality is that it could go either way. However, a seasonal tendency argues for a move to the upside.

A favorable seasonal period for Copper

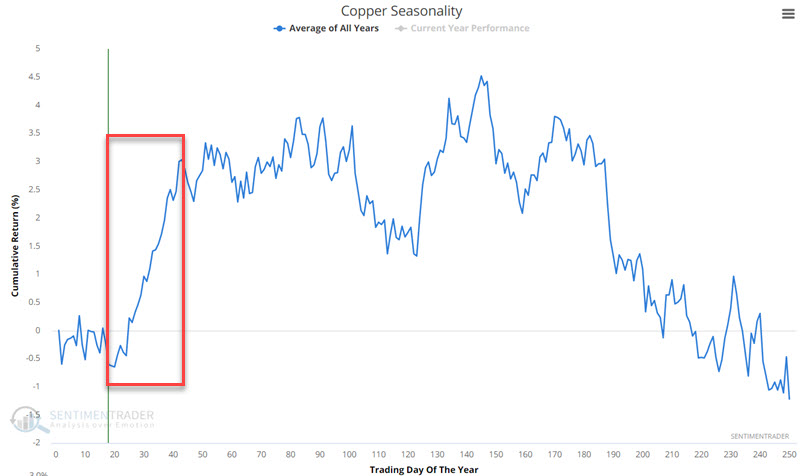

The chart below displays the annual seasonal trend for Copper. In the red box, you can see the tendency for Copper to show strength between late January and early March.

For 2022, this period extends from the close on January 31st through March 4th.

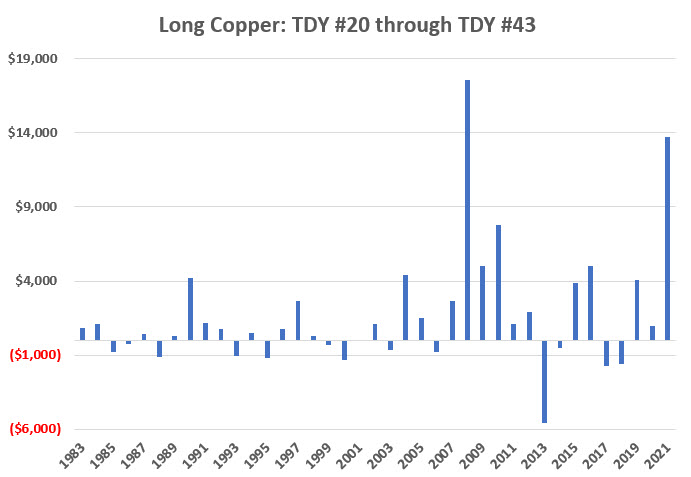

The chart below displays the hypothetical year by year $ +(-) achieved by holding long a copper futures contract ONLY during this seasonally favorable period.

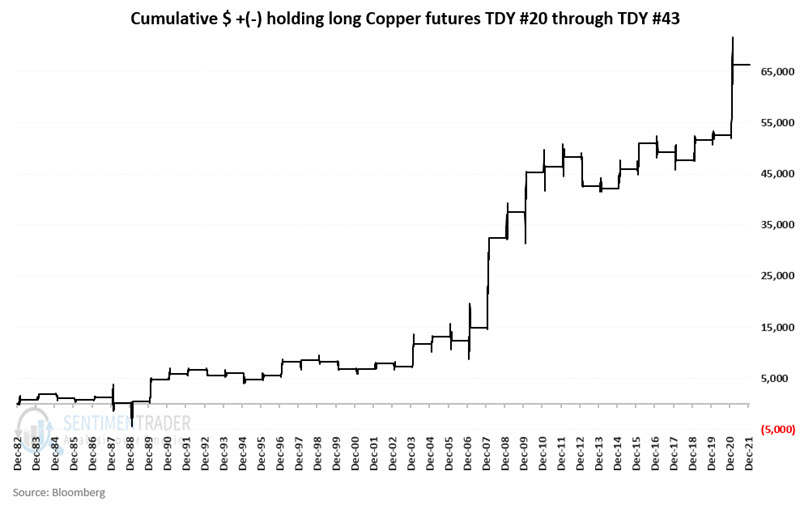

The chart below displays the hypothetical cumulative $ +(-) achieved by holding long a copper futures contract ONLY during this seasonally favorable period. In the chart above and below, we see a "tendency" for strength - but by no means a "certainty" on a year-by-year basis.

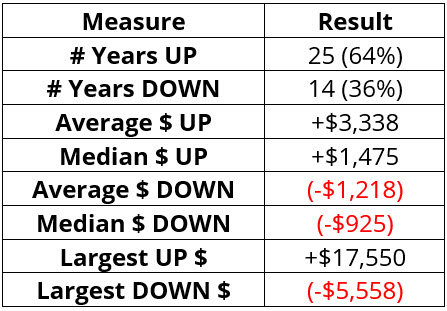

The table below displays a summary of annual results.

An ETF alternative

Traders who do not wish to trade futures contracts can participate in price movements of Copper using shares of CPER (United States Copper Index Fund, LP). CPER is an ETF designed to track the price movements of copper futures, which are traded like shares of stock. The chart of CPER below displays the same trading range affair as copper futures.

What the research tells us...

Copper has been dead money for almost a year. Many factors can influence the price of Copper, and seasonality is only one of them. If Copper does begin to exhibit strength in the days and weeks ahead, the positive seasonal influence suggests a greater possibility of some actual follow-through.

From a real-world trading perspective, the proper approach would be, a) to give the bullish case the benefit of the doubt, b) to carefully consider whether to enter a long position now or after some sign of actual price strength, and c) to assume an appropriate and acceptable amount of risk, in case 2022 is one of those years when seasonality does not work out as hoped.