Consumers are increasingly expecting negative returns

We saw in February that a record number of consumers were expecting stocks to rise, which hasn't been a great sign in the past, and wasn't again. Their attitude changed drastically according to surveys that are starting to include the March freefall.

The latest release from the University of Michigan showed a record one-month decline in the percentage of consumers looking for a rally. The March survey from the Conference Board also showed a sharp drop.

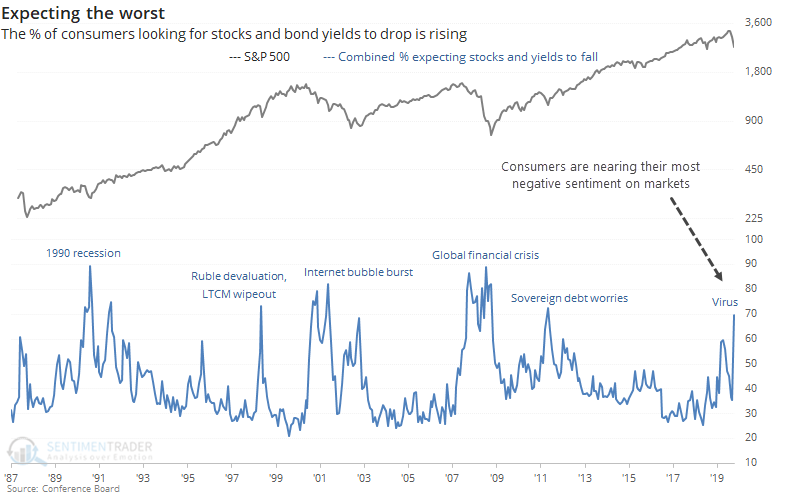

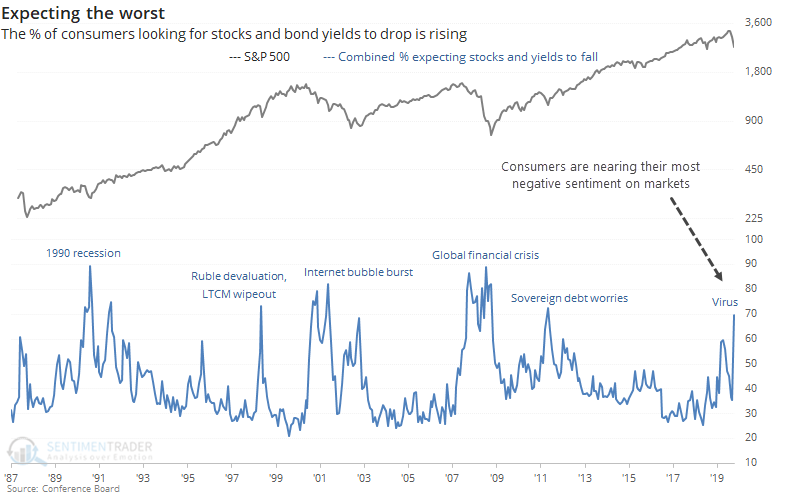

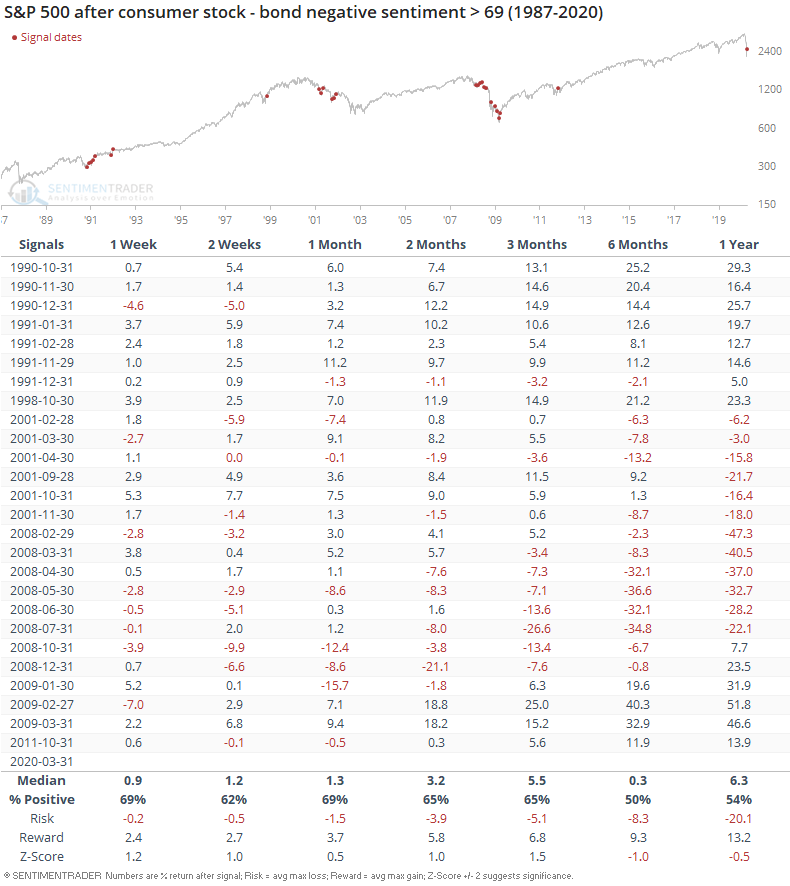

Not only are consumers now expecting stocks to fall, they're also looking for declining bond yields. We looked at the survey in this way last September and it has been a decent sign for stocks going forward. Not surprisingly, now it's even more extreme than it was then.

Such negative sentiment led to mostly higher returns for stocks, but it was awfully early in 2001 and 2008, depending on the time frame.

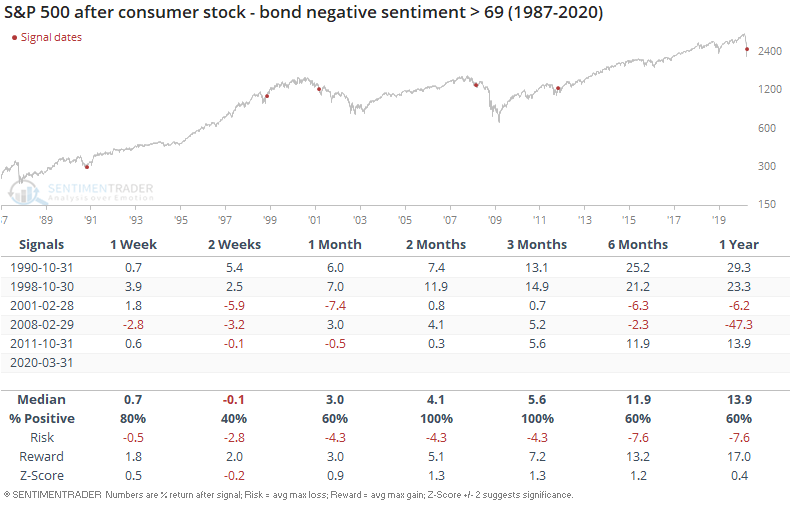

If we only look at the first signal in at least a year, then returns improve over the medium-term. That first stab lower in sentiment proved to be a temporary drop before at least a multi-month reprieve.

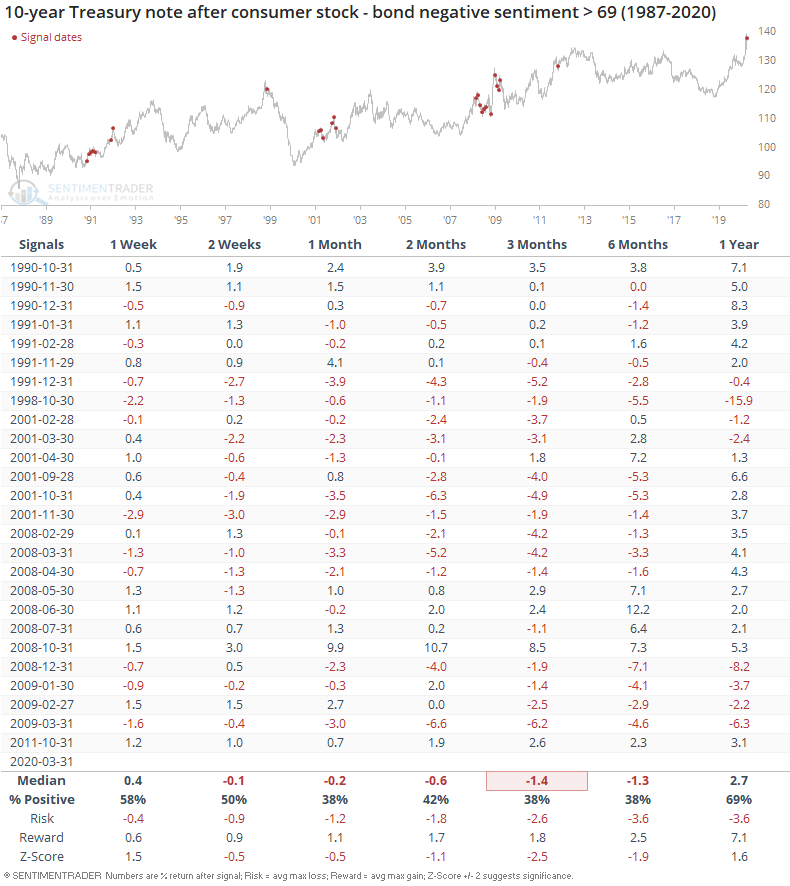

For bonds, it wasn't such a great sign.

Sentiment indicators, especially those that are survey-based, don't change on a dime. The wicked market in March served to make folks think hard about what had been record or near-record optimism, but most haven't had time to fully absorb the losses that were compressed in only a few weeks' time. Unless we see a strong rebound in April, many of these indicators (especially the surveys) will likely see pessimism on par with the largest declines in 30 years.