Consumer Staples Underperformance

On Tuesday, I shared a study that showed that only 30% of S&P 500 members are outperforming the Index on a rolling 21-day basis as of 6/28/21. That level ranks in the 2nd percentile when compared to all other instances since 1927. I also highlighted the percentages for individual sectors within the Index. The consumer staples sector was one of three sectors with a percentile rank of zero. i.e., one of the lowest readings in history.

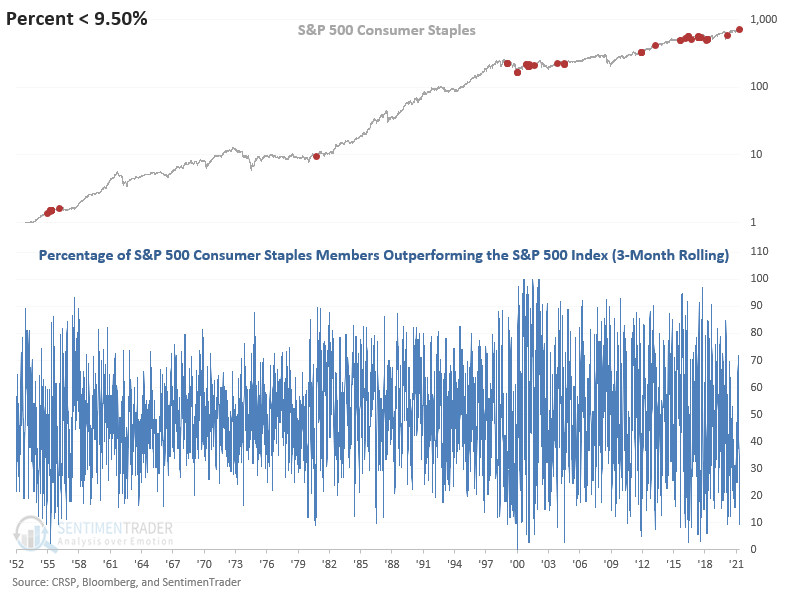

The team at SentimenTrader also keeps track of the percentage of members outperforming the S&P 500 index on a rolling 63-day basis. That measure for the consumer staples sector has also fallen to one of the lowest absolute levels in history. As of 6/29/21, it showed that 9.38% of consumer staples stocks are outperforming the S&P 500 index.

Let's conduct a study to assess the forward return outlook for the consumer staples sector when the percentage of members outperforming the S&P 500 on a rolling 63-day basis cross below 9.5%. I will include a reset condition cross back above 60% to screen out duplicate signals.

HISTORICAL CHART

The historical chart for the percentage of consumer staples members outperforming the S&P 500 highlights the change in character for the sector. Before 2000, the group performed like a more traditional growth sector, especially during the 1980s and early 1990s. Since 2000, it's one of the go-to groups for defensive growth in times of high volatility.

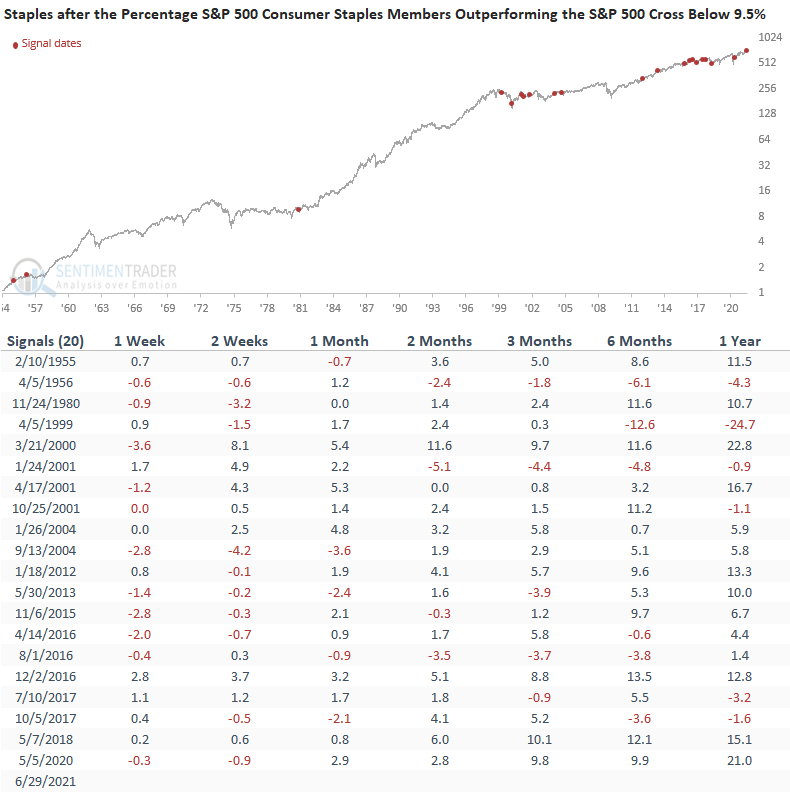

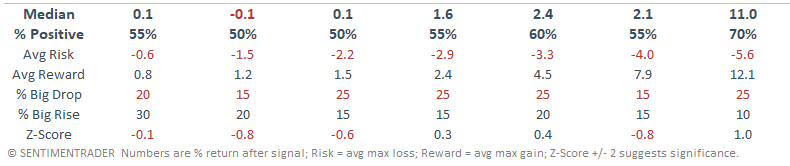

HOW THE SIGNALS PERFORMED - CONSUMER STAPLES

The 1-2 week results look underwhelming. However, the 1-6 month outlook looks constructive.

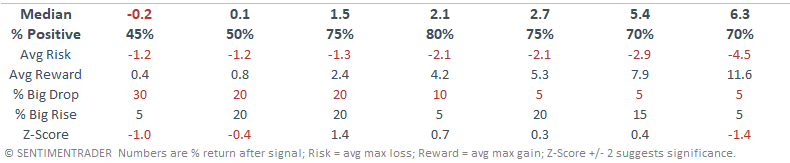

Let's apply the same signals to the S&P 500 index.

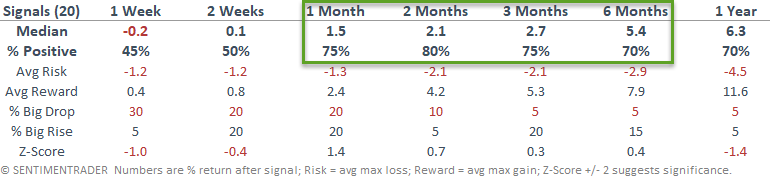

HOW THE SIGNALS PERFORMED - S&P 500

Interestingly, the results look underwhelming across almost all timeframes.

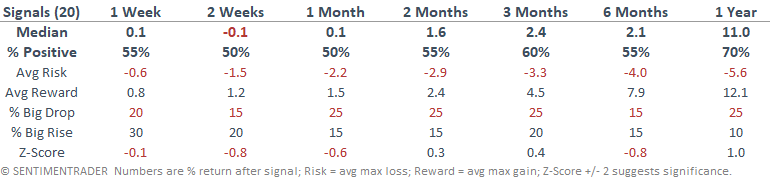

SUMMARY COMPARISON

The 1-6 month results look more compelling for the Consumer Staples sector.

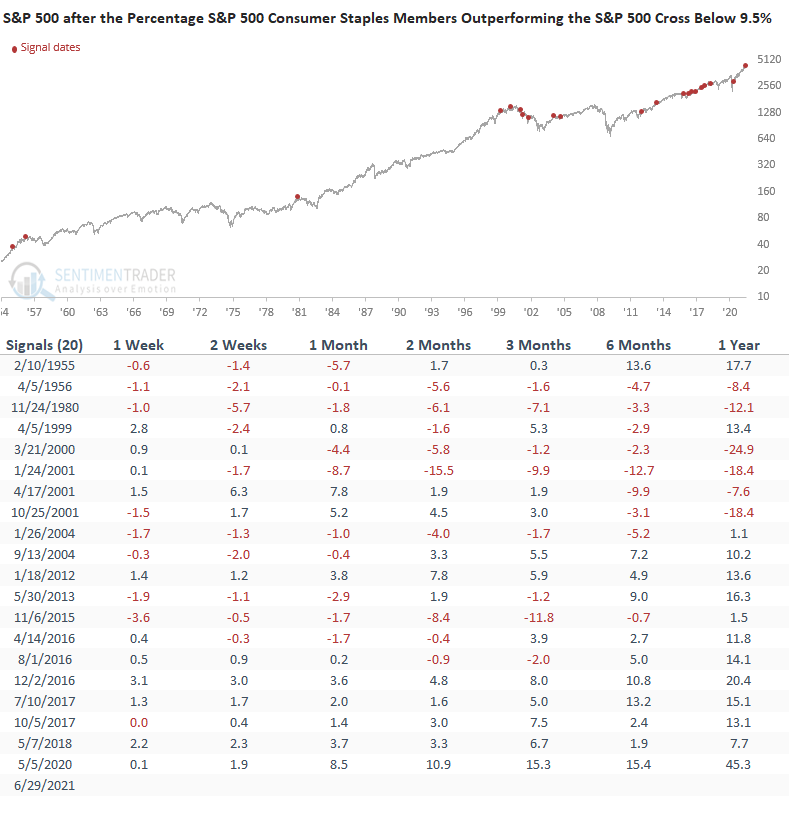

Consumer Staples

S&P 500

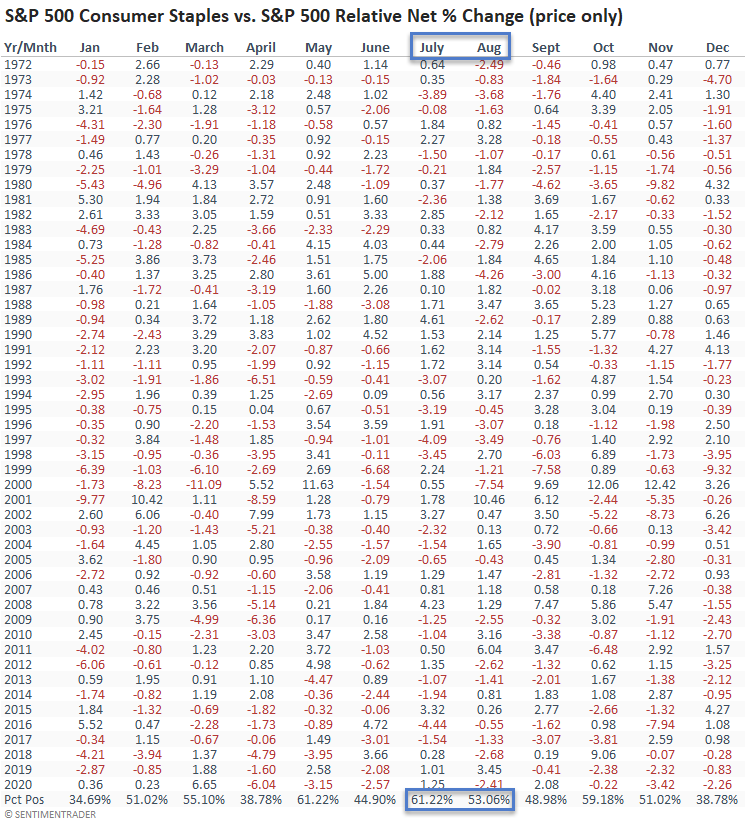

As we approach the seasonally weak period of the year, let's see how the consumer staples sector compares to the S&P 500 on a relative basis.

SEASONALITY

As the table shows, the consumer staples sector typically outperforms the S&P 500 in the month of July and August.

The case for an allocation to the consumer staples sector looks compelling, especially if one is worried about the weak breadth measures that Jason and I have highlighted of late. I would view the allocation as a summer rental that starts in mid-July.