Chinese tech stocks suddenly become re-investable

Key points:

- For the first time in almost a year, more than 15% of Chinese tech stocks are above their 200-day moving averages

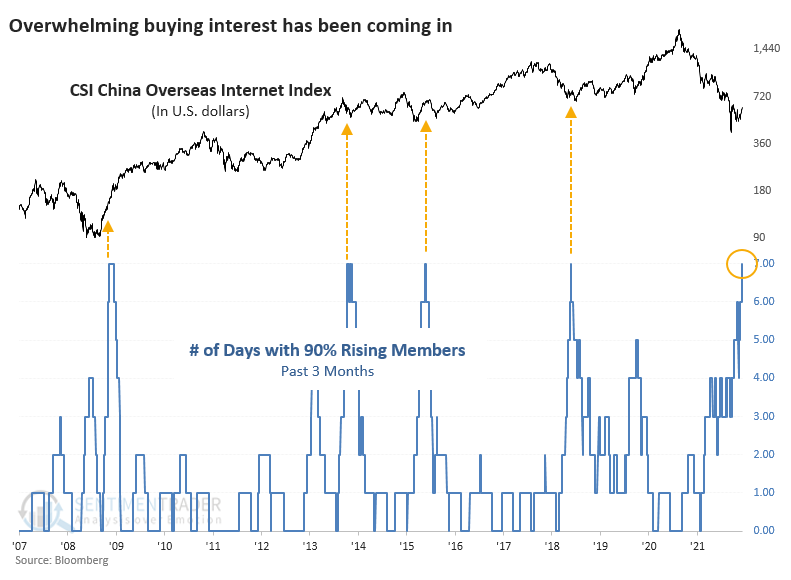

- A record surge of days with overwhelming buying interest has fueled the recovery

- Both factors have preceded further long-term gains in the sector

The most hated sector is finally trying to turn a corner

Maybe the long nightmare has finally ended for Chinese tech.

The shift in mood among investors and the media is pronounced. Not that long ago, the stocks were believed to be uninvestable (the same thing they said about energy two years ago). These are all mainstream media headlines from mid-March to early April:

Now it's starting to thaw as the media focus on policy changes and rising stock prices. More and more, we see impressive buying interest in these stocks. There have been other false starts over the past six months, but none came from such a spectacular crash as we looked at in mid-March.

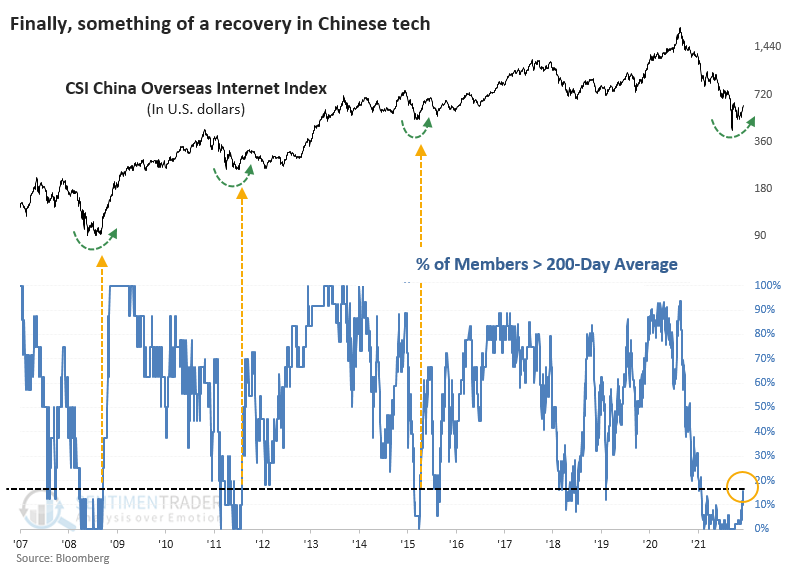

For the first time in what seems like forever, "more than zero" stocks have climbed above their 200-day moving averages.

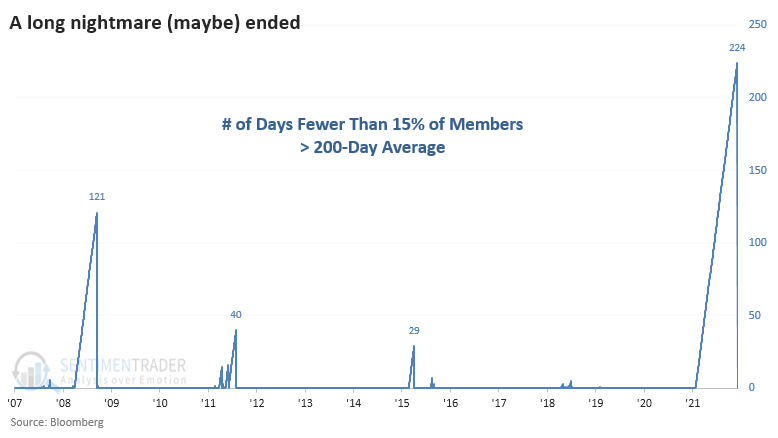

That's a little hyperbolic since every stock hasn't been pinned below its long-term average. But it's been close. This is the first time in nearly a year that even 15% of the stocks in the CSI China Overseas Internet Index have climbed above their averages, far beyond any of the other crashes these stocks have suffered.

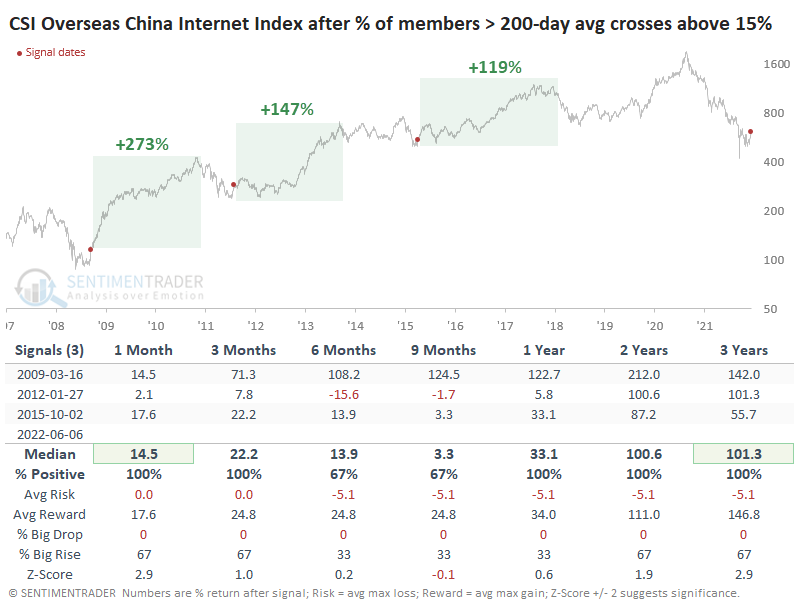

There isn't a lot of history here, only about 15 years. So, the sample size for pretty much any extreme will be tiny, and this is no exception. It's only the fourth time the stocks have recovered from a prolonged bout of selling pressure. All three of the others preceded double-digit gains over the next couple of months.

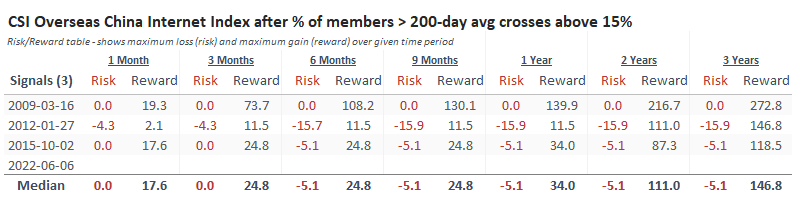

The Risk/Reward Table shows that while the 2012 signal saw a 15% drop within the next six months, all three signals ended up enjoying a double within the next three years.

The recovery has come in fits and starts, but the "starts" have been impressive. Over the past three months, there were seven days when more than 90% of member stocks advanced on the same day. This ties the record for overwhelming buying days, and it's something that had been missing during earlier parts of the decline.

What the research tells us...

Chinese tech stocks tried to bottom last fall and failed miserably. That makes it harder to trust the latest attempt. Still, two main factors help the case: 1) It's coming from one of the most remarkable plunges we've ever seen in any market, and 2) Buying interest in recent weeks has been impressive and is a change from prior attempts. This should prove to be a further tailwind for what has been one of the most hated sectors we've ever witnessed.