Chinese tech stocks are back on the path to uninvestable

Key points:

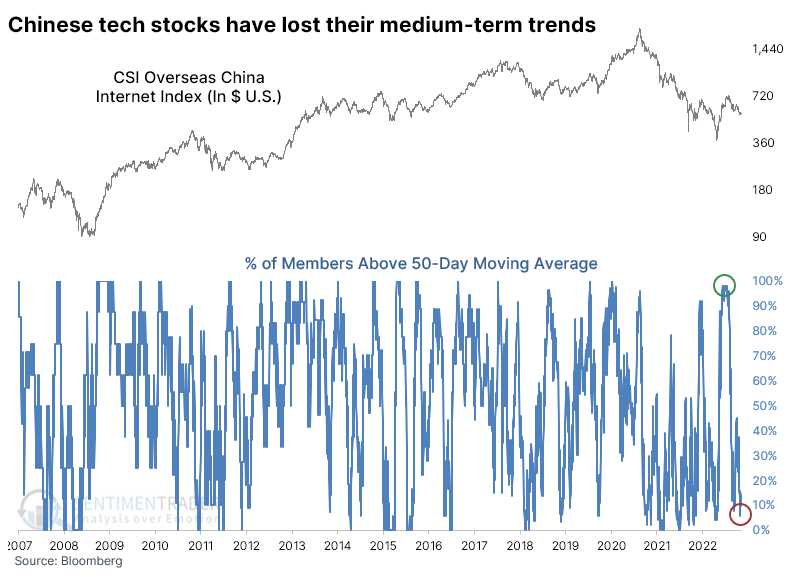

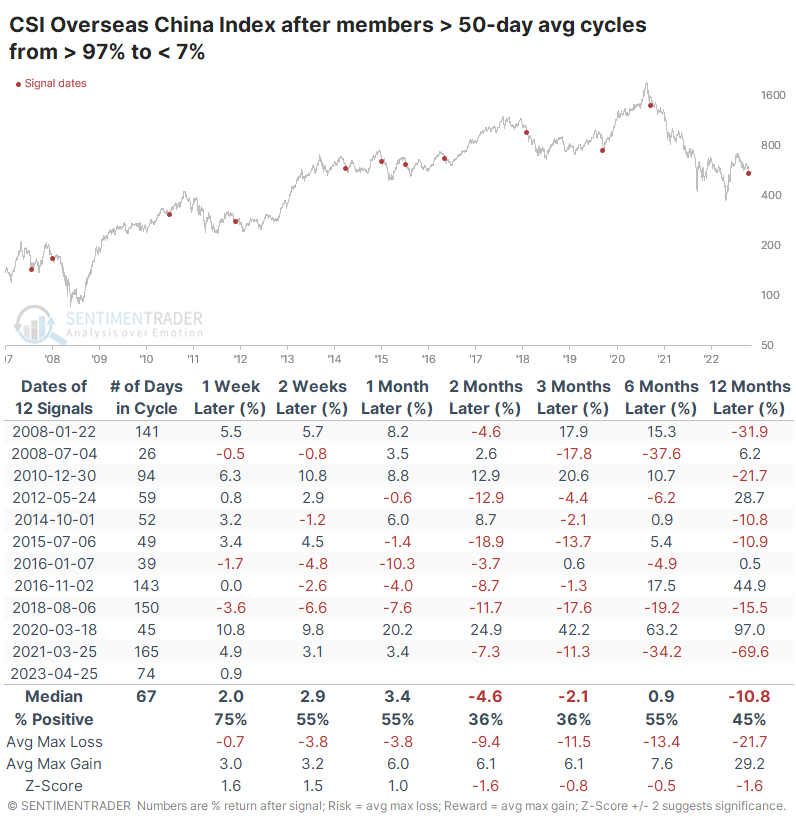

- Breadth among Chinese technology stocks soared in January and has since pulled back

- Medium- and long-term measures are nearing oversold levels

- Similar cycles preceded mostly poor returns, highlighting the difficulty with a boom-and-bust sector

From uninvestable to investible and back again

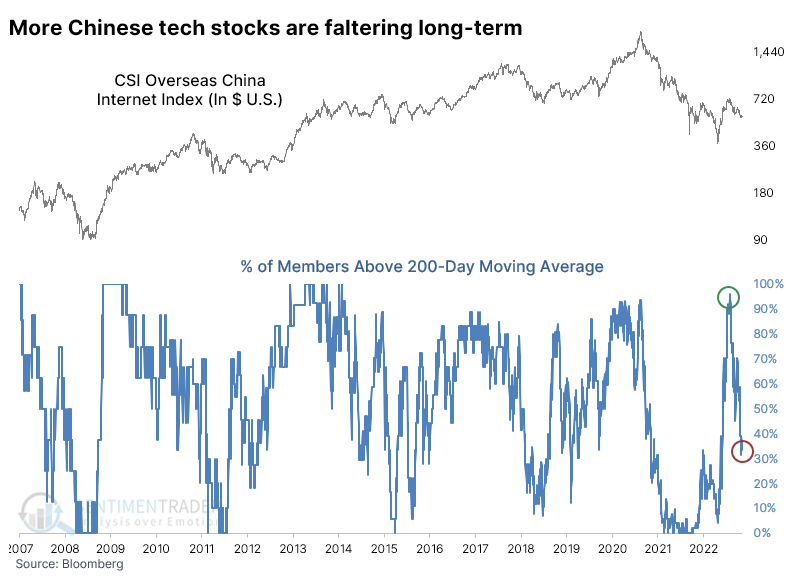

Talk about a boom-and-bust market. Chinese technology stocks went from the latter to the former and now back to the latter again.

A storm of geopolitical controversy hounded the Chinese tech sector for much of 2022, and the stocks suffered one of their largest declines ever. They rebounded for a while, then plunged anew last October, once again triggering compelling extremes and earning the reliable buy signal of being uninvestable.

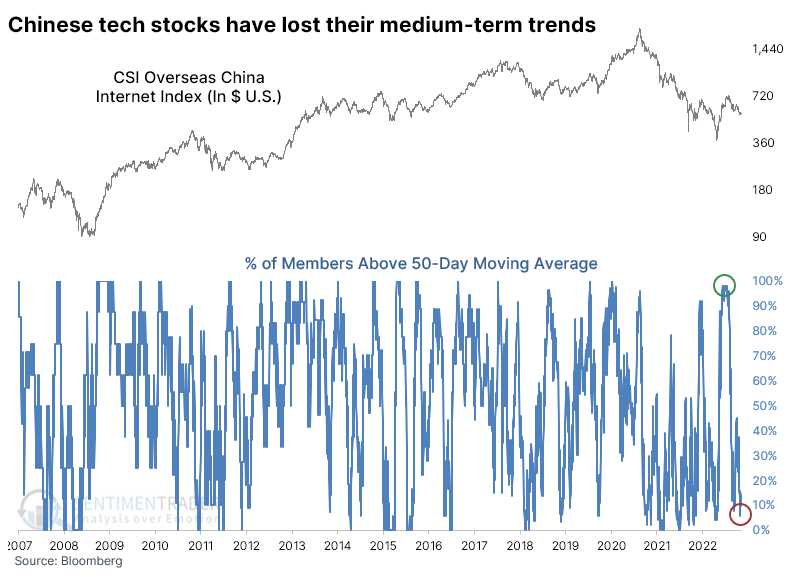

A furious rally into last December made the media and major investment banks jump on the recovery bandwagon, which is always a worry. When we looked at the recovery at the time, the few precedents appeared bullish in the short-term, bearish in the medium-term, and bullish again in the very long-term.

So far, it has mostly played out that way, but the decline has gone deeper than we might have reasonably suspected. Since late January, the stocks haven't enjoyed much respite from the selling pressure. At the time, nearly every one of the stocks was above its 50-day moving average, but by late last month, that fell to fewer than 7%.

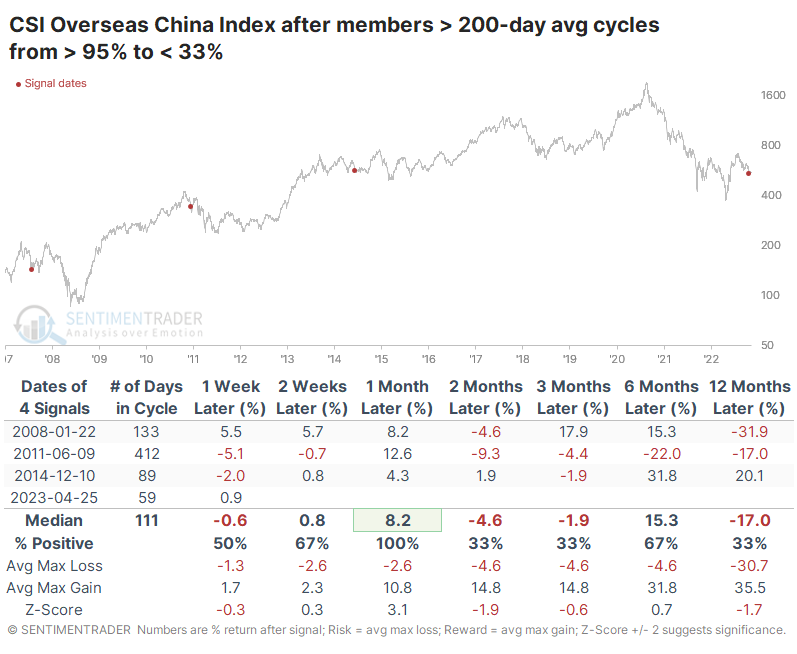

Similar cycles have not typically been kind to the CSI Overseas China Internet Index, the index behind the popular KWEB fund in the U.S. The fund struggled to rebound consistently over the next 2-3 months and suffered a double-digit median loss over the next year.

We can see a similar situation with longer-term trends. By late January, more than 95% of the stocks had recovered above their 200-day moving average; a couple of weeks ago, that fell to fewer than 33% of stocks holding above their average.

Because we have only about 15 years of history for this sector and the boom-and-bust nature of the extremes, there are few precedents. But the few times the sector underwent similar cycles, it rebounded over the next month each time, then saw great six-month returns twice and a horrid loss once.

What the research tells us...

When we started looking at Chinese tech stocks a little over a year ago, we saw a sector suffering some of the worst losses not only in its limited history but some of the worst of any we'd ever seen in any sector ever. Perhaps the worst. When more than 90% of a broad sector's stocks hit a 52-week low on the same day, well, we'd never seen anything like that before. The recovery into January was impressive, but the sector has not had a good history of sustaining that kind of upside momentum, and it hasn't this time.

The stocks have suffered bad selling pressure, but it hasn't reached the extreme that would suggest a high likelihood of an imminent rebound. The biggest trouble is that we're mostly flying blind here as far as historical precedents go because the only somewhat similar historical periods are 2008-09 and 2011-12. The most compelling thing we've seen with the sector is the long-term (2-3 year) implications of the kind of selling pressure witnessed last year, and the current volatility is the likely price a long-term investor would have to pay to stick with a potential recovery from an "uninvestable" asset.