Cheap speculation in silver update (and a lesson on position management)

Key Points

- The process of entering trades involves 1) spotting opportunity and 2) exploiting the opportunity

- However, trade selection is only one part of the equation

- The other critical parts of the equation are 1) capital allocation and 2) position management

- On January 10, I highlighted an example trade using options on iShares Silver ETF (SLV)

- This article is an update on that earlier example

The state of SLV

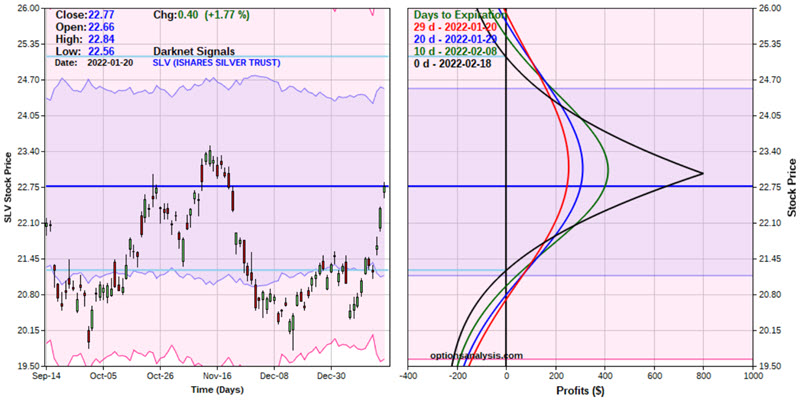

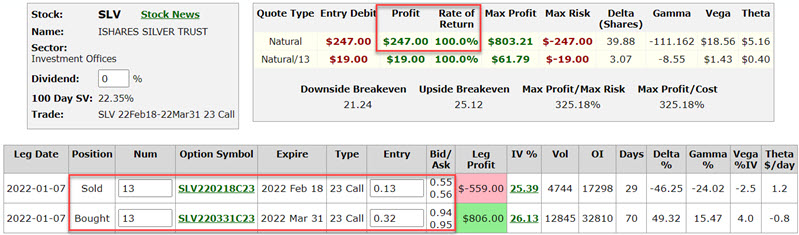

On 1/7, SLV was trading at $20.62. I highlighted the following example of a call calendar spread:

- Buying 13 SLV Mar18 2018 23 calls @ $0.32

- Selling 13 SLV Feb18 2018 23 calls @ $0.13

The cost to enter this trade was $247. At the time, I highlighted the following position management "plan:"

- Close the entire position if SLV drops below $19.50 before Feb. expiration

- Close (or adjust) the position if SLV approaches $23 a share

- Exit the day before or the day of option expiration if neither of the above occurs

On 1/20, SLV reached a price of $22.77 a share, or 10.4% higher than its price on 1/7. If a trader had purchased 100 shares of SLV on 1/7, they would have a gain of $215 on their investment of $2,062.

The updated call calendar spread status late in the day on 1/20 appears in the figures below (courtesy of Optionsanalysis).

As you can see in the figure above, the options trader in this example would have an open profit of $247 on their investment of $247, or a 100% gain on capital committed. This example illustrates the potential leverage available using options instead of shares. Of course, not every trade works out this well.

Now what?

One of the great dangers of garnering a substantial quick profit is the temptation to throw your trading plan out the window and to come up with a new plan "on the fly." This action is always a mistake - even if it ultimately works in your favor "this time around." The reason is that this kind of arbitrary action can lead you to become an undisciplined trader and to second-guess your initial plan again and again. The reason for developing a trading plan in the first place is to avoid emotional and arbitrary decision-making "in the heat of battle."

So, given that our initial trading plan indicated that the entire trade should be exited if SLV shares approached $23 a share, the proper course of action would be to exit the whole position, book a profit, and move on to the next trade.

What the research tells us...

Analyzing market trends and identifying potential opportunities is only part of trading success. Interestingly, given that there are many different ways to trade, some would argue that it is not even the most crucial piece of the puzzle. Regardless of what criteria you use to select trading opportunities, your success or failure will ultimately be decided by how wisely you allocate capital and how disciplined you are in managing your trades.