Change in sentiment

Sentiment was extremely pessimistic in March and is now bouncing back - various sentiment indicators are back to neutral.

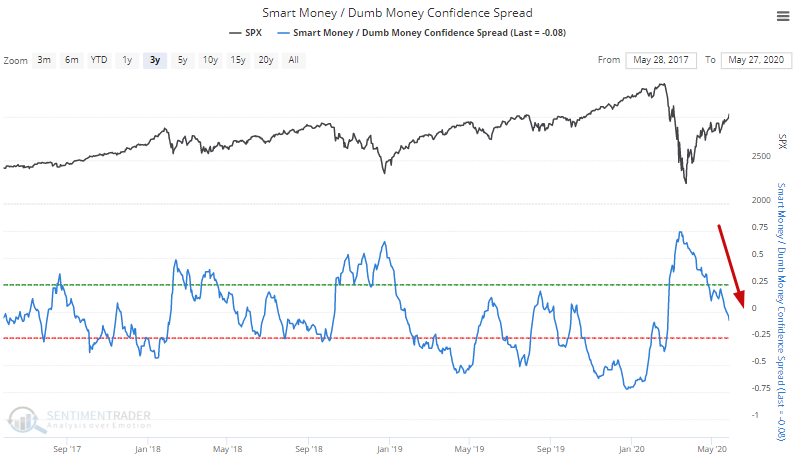

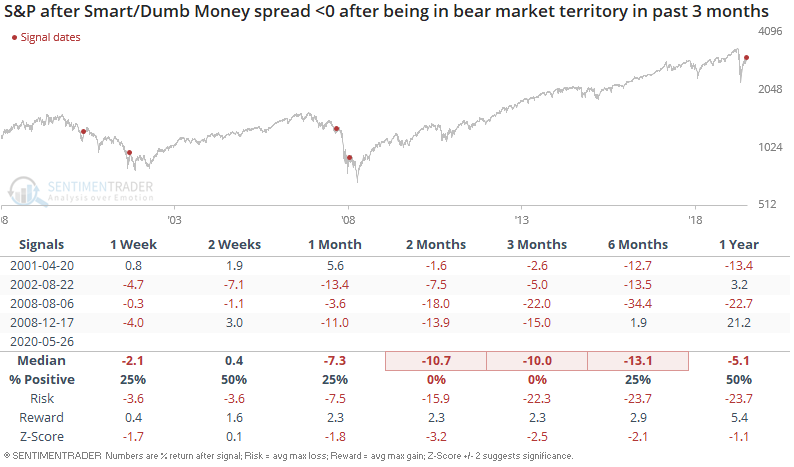

For example, the Smart Money/ Dumb Money Confidence Spread has crossed below 0:

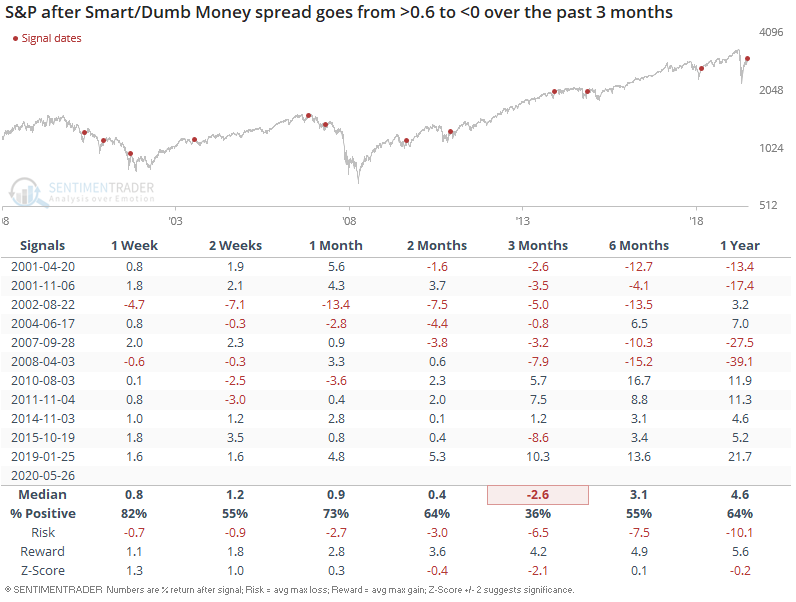

When it cycled from extreme pessimism to neutral over a 3 month period, the S&P 500's returns over the next 3 months were more bearish than random. Granted, most of the bearish cases occurred when the market was still in a bear market, and in a bull market this wasn't bearish:

So if we only look at the cases when this occurred after the S&P was recently in bear market territory, the S&P was consistently bearish over the next 2-3 months:

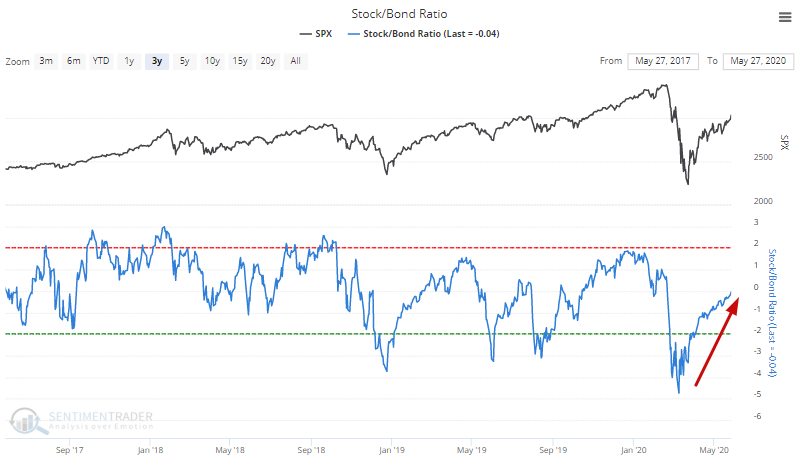

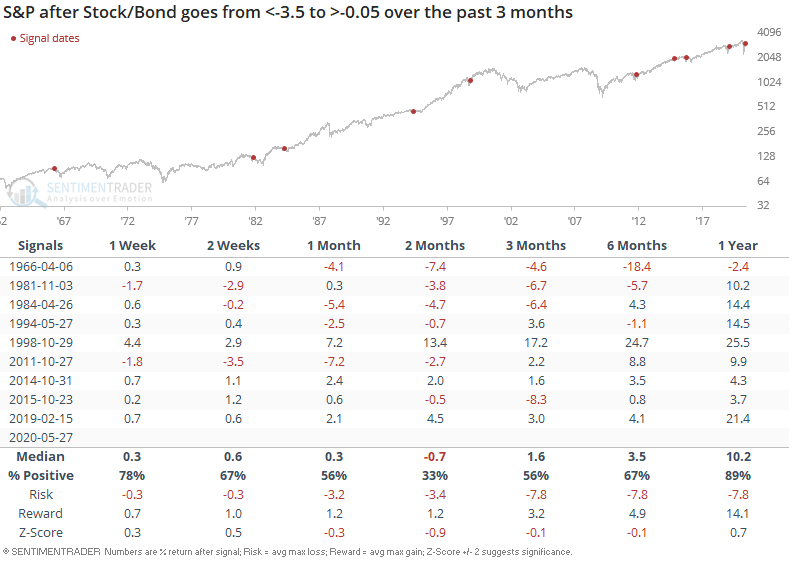

Similarly, the Stock/Bond ratio has cycled back from extreme pessimism to almost crossing above 0 (neutral):

When this happened in the past, the S&P's returns over the next 2 months were more bearish than random, even if this mostly led to gains over the next year:

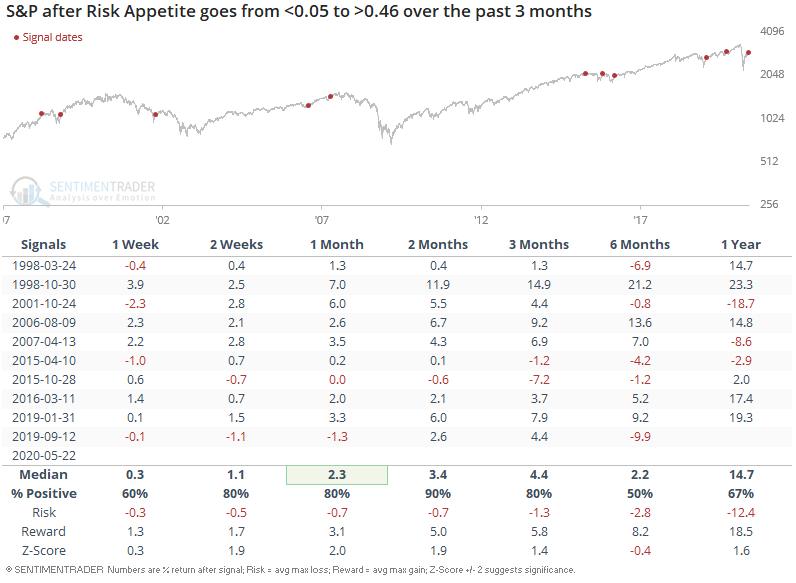

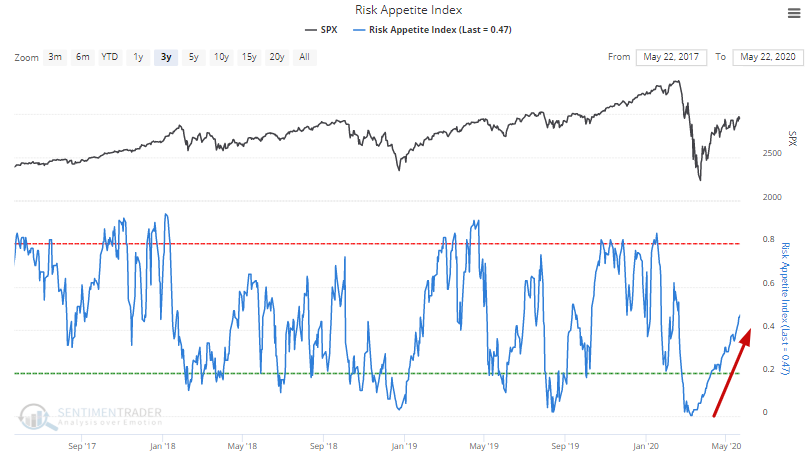

The Risk Appetite Index, which combines the Citigroup Macro Risk Index + Westpac Risk Aversion Index + UBS G10 Cary Risk Index, is also cycling back from extreme pessimism to neutral territory:

When this happened in the past, the S&P's returns over the next 6 months were more bearish than random, but other than that it wasn't a bearish factor for stocks on any time frame.